Giao dịch CFD là gì và hoạt động như thế nào?

CFD mang đến một cách linh hoạt để đầu cơ trên các thị trường tài chính hoặc phòng hộ danh mục hiện có. Tìm hiểu cách chúng hoạt động, ưu điểm và rủi ro, điểm khác biệt so với đầu tư truyền thống và cách bạn có thể bắt đầu giao dịch.

Giao dịch CFD là gì?

CFD (Contract for Difference — Hợp đồng chênh lệch) là thỏa thuận giữa nhà môi giới và nhà giao dịch nhằm thanh toán phần chênh lệch giá trị của một tài sản từ thời điểm mở lệnh đến khi đóng lệnh.

Vì giao dịch CFD được thực hiện giữa hai bên và ngoài các sở giao dịch chính thức, CFD là một dạng phái sinh tài chính OTC (phi tập trung), có giá trị dựa trên hay “phát sinh” từ một tài sản như tiền tệ, cổ phiếu hoặc hàng hóa. Với các sản phẩm phái sinh, bạn có thể đầu cơ biến động tăng hoặc giảm của tài sản mà không cần sở hữu tài sản cơ sở.

Khi bạn quyết định đóng và thoát lệnh CFD, chênh lệch giữa giá mở và giá đóng sẽ là lợi nhuận hoặc thua lỗ của bạn. Thị trường càng đi đúng kỳ vọng, lợi nhuận càng lớn; ngược lại, nếu đi ngược kỳ vọng, mức lỗ sẽ tăng.

Giao dịch CFD hoạt động như thế nào?

CFD mô phỏng hành vi của các thị trường tài chính, cho phép bạn mua/bán tương tự như đối với tài sản cơ sở mà chúng đại diện.

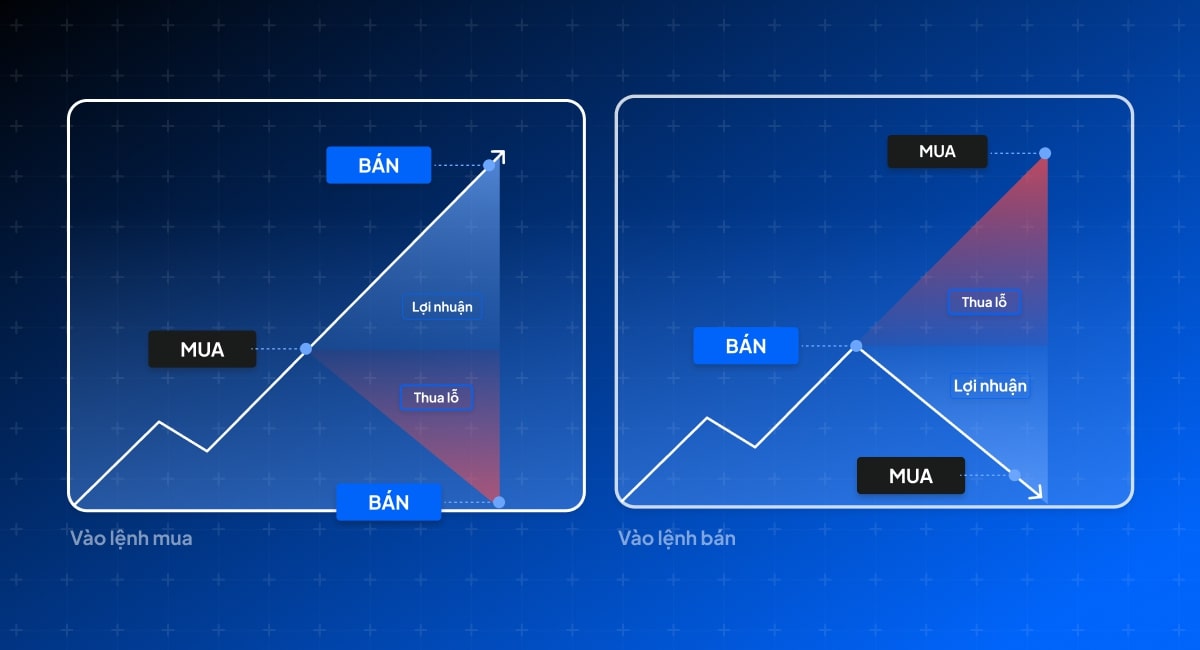

Một lợi thế lớn của CFD là sự linh hoạt khi đầu cơ theo cả hai chiều giá — mua (long) hoặc bán (short). Giao dịch hai chiều giúp bạn tận dụng biến động tăng và giảm của thị trường trong mọi điều kiện.

Vào lệnh mua (Long)

Nếu dự đoán giá tài sản sẽ tăng, bạn có thể vào lệnh mua (long) với kỳ vọng bán lại ở mức giá cao hơn. Giá tăng sẽ mang lại lợi nhuận là phần chênh lệch; ngược lại, nếu giá giảm, bạn chịu lỗ và thanh toán phần chênh lệch đó cho nhà môi giới.

Vào lệnh bán (Short)

Ngược lại, nếu bạn tin rằng giá tài sản sẽ giảm, bạn có thể vào lệnh bán (short). Nếu giá giảm như dự đoán, bạn có lãi; nếu giá tăng ngoài kỳ vọng, bạn sẽ thua lỗ.

Ví dụ

Giả sử bạn nghĩ cổ phiếu X sẽ tăng giá. Bạn có thể tiếp cận theo cách truyền thống bằng cách mua đứt 100 cổ phiếu, thanh toán toàn bộ và sở hữu. Hoặc bạn có thể giao dịch 100 CFD trên cổ phiếu X để có mức tiếp xúc tương tự chỉ với khoản đặt cọc ban đầu nhỏ. Cùng xem kịch bản sau:

Một nhà giao dịch mua 100 CFD cổ phiếu X, giá $2,00 mỗi đơn vị. Tổng giá trị vị thế là $200 (100 × $2,00), nhưng anh ấy không đặt cọc toàn bộ. CFD là sản phẩm có đòn bẩy, nên chỉ cần ký quỹ một phần nhỏ giá trị giao dịch. Đây gọi là ký quỹ (margin), sẽ được trình bày sau.

Sau đó, giả sử giá cổ phiếu tăng lên $2,50. Nhà giao dịch bán 100 CFD ở mức giá cao hơn, lãi $0,50 mỗi CFD. Tổng lợi nhuận là $50 (100 × $0,50 = $50).

Ngược lại, nếu giá giảm xuống $1,50, nhà giao dịch bán ra ở mức giá thấp này, lỗ $0,50 mỗi CFD, tổng lỗ $50 (100 × $0,50 = $50).

Trong cả hai trường hợp, mức lãi/lỗ phụ thuộc vào mức độ biến động giá tài sản so với dự đoán của nhà giao dịch.

CFD được định giá như thế nào?

CFD được định giá dựa trên giá trị tài sản cơ sở, kèm điều chỉnh để phản ánh chi phí giao dịch như chênh lệch giá mua/bán (spread), hoa hồng (commission) và phí qua đêm. Cụ thể như sau:

Spread là gì?

Spread là chênh lệch giữa giá mua (ask) và giá bán (bid). Đây là khoản phí nhà môi giới thu để thực hiện giao dịch. Ví dụ, nếu cổ phiếu giao dịch ở $175,25 (bid) và $175,75 (ask), giá CFD sẽ tương tự, có điều chỉnh nhẹ cho spread. Nếu giá CFD là $175,00 (bid) và $176,00 (ask), spread là $1,00.

Spread càng hẹp thường càng có lợi cho nhà giao dịch vì giảm chi phí vào/ra lệnh. Mức spread thay đổi tùy vào độ biến động và thanh khoản của công cụ tài chính.

Commission (hoa hồng) là gì?

Trong giao dịch CFD, hoa hồng là phí nhà môi giới thu khi bạn mở và đóng lệnh, thường là tỷ lệ nhỏ trên quy mô giao dịch. Ví dụ, phí 0,1% cho giao dịch cổ phiếu CFD trị giá $10.000 tương đương $10.

Tùy loại tài khoản, một số nhà môi giới có thể thu hoa hồng hoặc thay bằng spread rộng hơn. Hãy kiểm tra chi tiết tài khoản để hiểu rõ các loại phí áp dụng.

Phí qua đêm (overnight funding) là gì?

Giữ vị thế CFD tiền mặt/spot qua đêm sẽ phát sinh phí, gọi là phí hoán đổi (swap) hay phí qua đêm. Lý do: nhà môi giới tài trợ phần đòn bẩy trong giao dịch của bạn — tức là cho bạn “vay” để kiểm soát vị thế lớn hơn — và thu phí cho việc duy trì “khoản vay” này sau giờ đóng cửa thị trường. Nếu giao dịch CFD kỳ hạn (forward), bạn không trả phí swap vì đã được gộp vào spread rộng hơn.

Hiểu cách CFD được định giá giúp bạn đánh giá chi phí và đưa ra quyết định giao dịch sáng suốt. Để xem đầy đủ các loại phí liên quan đến CFD, hãy truy cập trang “Chi phí và Phí”.

Đòn bẩy trong giao dịch CFD

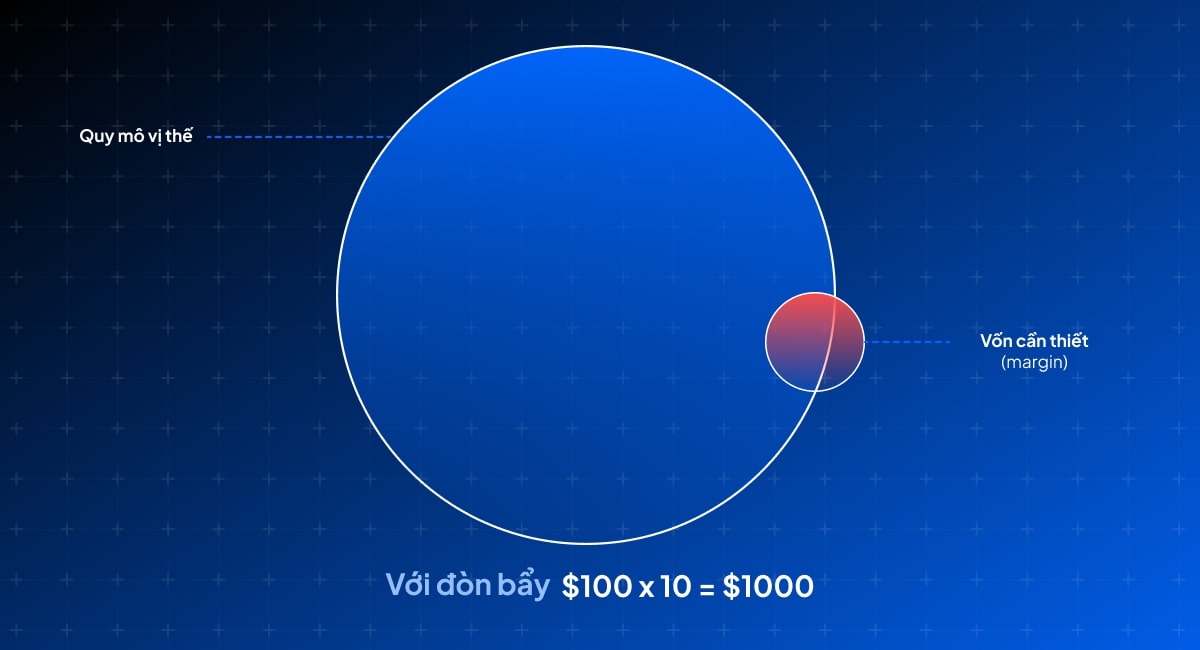

Một đặc điểm nổi bật của CFD là sử dụng đòn bẩy.

Đòn bẩy cho phép bạn kiểm soát vị thế lớn với số vốn nhỏ (ký quỹ), tức có thể giao dịch quy mô lớn hơn nhiều so với vốn ban đầu. Ví dụ, với tỷ lệ 10:1, bạn có thể kiểm soát vị thế $10.000 chỉ với $1.000 vốn tự có.

Ví dụ: nhà giao dịch muốn đầu tư $1.000 vào dầu Brent, nhà môi giới yêu cầu ký quỹ 10%. Khi đó, chỉ cần nạp $100 để bắt đầu giao dịch.

Mặc dù đòn bẩy có thể khuếch đại lợi nhuận khi thị trường thuận lợi, nó cũng gia tăng mức độ rủi ro và thua lỗ tiềm ẩn.

Đòn bẩy vừa mạnh mẽ vừa tiềm ẩn rủi ro, cần được cân nhắc thận trọng khi giao dịch.

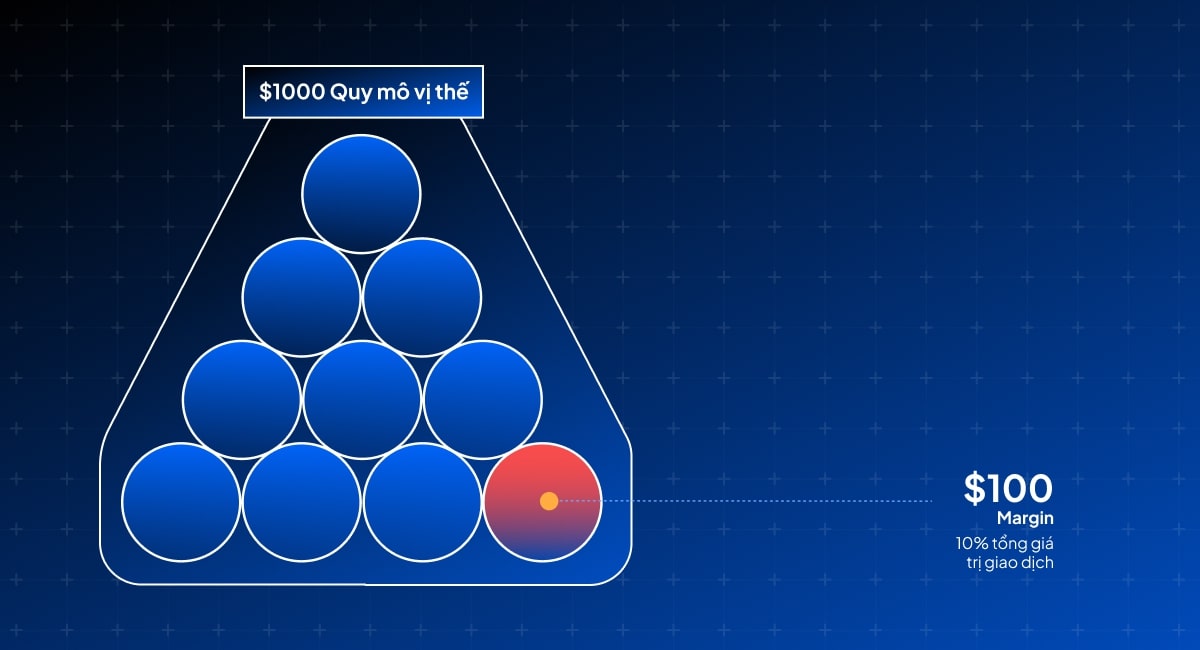

Ký quỹ (Margin)

Ký quỹ là số tiền bạn cần có trong tài khoản để mở và duy trì một vị thế có đòn bẩy. Thường được biểu thị theo phần trăm quy mô giao dịch và thay đổi theo từng thị trường.

Có hai loại ký quỹ chính. Cả hai phụ thuộc vào vốn chủ sở hữu tài khoản — chênh lệch giữa số tiền đã nạp và lãi/lỗ từ các lệnh đang mở:

• Ký quỹ ban đầu (Initial margin): Để mở vị thế mới, vốn khả dụng phải lớn hơn mức ký quỹ ban đầu yêu cầu.

• Ký quỹ duy trì (Maintenance margin): Để giữ vị thế, vốn khả dụng luôn phải cao hơn mức ký quỹ duy trì. Nếu giảm xuống dưới ngưỡng này, bạn sẽ nhận margin call yêu cầu nạp thêm tiền hoặc đóng bớt vị thế để giảm mức tiếp xúc và yêu cầu ký quỹ. Nếu bỏ qua hoặc vốn tiếp tục giảm, vị thế có thể bị đóng tự động.

Lưu ý quan trọng: lãi/lỗ được tính trên toàn bộ giá trị vị thế, không chỉ trên số tiền ký quỹ bạn đã đặt.

Các loại tài sản có thể giao dịch dưới dạng CFD

• Các cặp Forex như EUR/USD, GBP/JPY và AUD/USD.

• Cổ phiếu của các công ty lớn tại Mỹ, Anh, EU, Hồng Kông và Úc.

• Chỉ số bao gồm S&P 500, NASDAQ và FTSE 100.

• Hàng hóa như vàng, bạc, dầu thô và khí tự nhiên.

• Tiền điện tử như Bitcoin, Ethereum, Ripple.

• ETF theo các ngành và quốc gia khác nhau, ví dụ SPDR S&P 500 ETF Trust (SPY).

Pepperstone cung cấp hơn 1.350 sản phẩm CFD với mức giá cạnh tranh cao.

Quy mô hợp đồng trong giao dịch CFD

Tất cả CFD được giao dịch bằng hợp đồng tiêu chuẩn (lot). Quy mô hợp đồng phụ thuộc vào từng loại tài sản, phản ánh cách thức giao dịch trên thị trường cơ sở.

• Forex CFD được giao dịch theo standard lot (100.000 đơn vị), mini lot (10.000) hoặc micro lot (1.000). Trong Forex, 1 standard lot tương đương 100.000 đơn vị đồng tiền yết giá. Ví dụ, giao dịch 1 lot EUR/USD là bạn đang đầu cơ trên biến động giá của €100.000 giá trị cặp tiền đó.

• Cổ phiếu CFD thường theo tỷ lệ 1:1, tức 1 CFD tương đương 1 cổ phiếu. Giao dịch 100 CFD cổ phiếu Apple nghĩa là bạn đầu cơ trên biến động giá của 100 cổ phiếu Apple.

• CFD hàng hóa đại diện cho lượng cụ thể của hàng hóa cơ sở, ví dụ 1.000 thùng dầu thô hoặc 100 ounce troy vàng. Giao dịch 1 lot dầu thô CFD là bạn kiểm soát 1.000 thùng dầu. Nhiều nhà cung cấp còn hỗ trợ mini lot (0,10) và micro lot (0,01) cho hàng hóa để bạn kiểm soát mức tiếp xúc tốt hơn.

• CFD chỉ số được định giá theo giá trị mỗi điểm, tùy theo hợp đồng. Ví dụ với chỉ số S&P 500, mỗi hợp đồng có thể tương ứng $10 mỗi điểm biến động (tùy nhà môi giới).

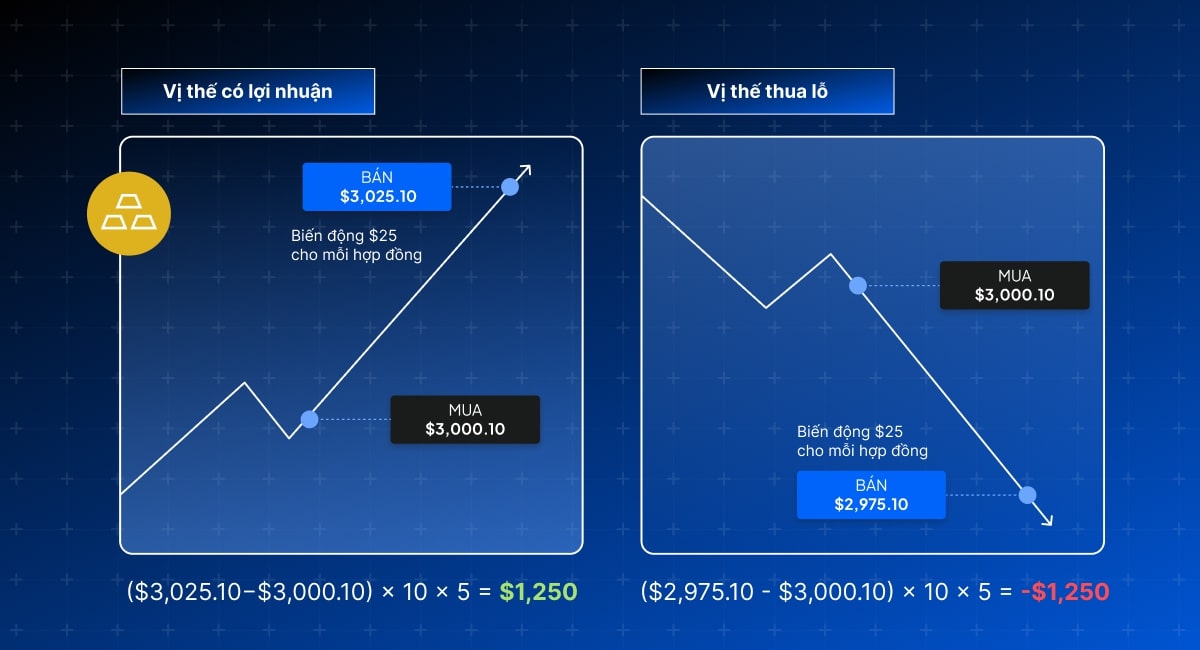

Ví dụ giao dịch CFD: Vàng

Giả sử nhà giao dịch cho rằng bất ổn địa chính trị sẽ khuyến khích dòng tiền vào vàng. Nhà môi giới báo giá vàng $3.000,00 - $3.000,10 và nhà giao dịch tin rằng giá có thể tăng.

Anh ấy quyết định mua 5 mini lot (0,10 lot, tương đương 10 ounce troy) CFD vàng spot ở giá mua $3.000,10. Tổng giá trị vị thế là $150.005 (10 ounce troy × $3.000,10 × 5).

Vài ngày sau, giá vàng có xu hướng tăng, báo giá cập nhật $3.025,10 - $3.025,20. Nhà giao dịch quyết định đóng vị thế bằng cách bán ở giá bid $3.025,10.

Kết quả

Để tính lợi nhuận, xét mức biến động giá và quy mô hợp đồng. Giá tăng từ $3.000,10 lên $3.025,10, tức tăng $25.

Với mức tiếp xúc là 5 micro lot, tổng lợi nhuận là (10 ounce troy × 5 × 25) = $1.250,00.

Nếu thị trường đi ngược 25 điểm, mức lỗ sẽ là $1.250,00.

Ưu điểm của giao dịch CFD

• Bán khống: CFD linh hoạt cho phép bạn vào lệnh bán để có thể kiếm lợi khi giá giảm.

• Chi phí ban đầu thấp: Yêu cầu ký quỹ ban đầu tương đối nhỏ để tiếp cận nhiều thị trường như cổ phiếu, forex, hàng hóa…

• Không cần giao/nhận hay lưu trữ: Bạn chỉ đầu cơ theo hướng giá nên không cần nhận tài sản vật chất như vàng hay dầu.

• Dễ dàng phòng hộ: CFD có thể phòng hộ rủi ro cho cả danh mục có hoặc không dùng đòn bẩy bằng cách mở vị thế ngược chiều để bảo vệ trước các đợt suy giảm tạm thời.

• Vốn có đòn bẩy: CFD cho phép dùng đòn bẩy, chỉ cần ký quỹ một phần giá trị giao dịch — có thể làm tăng cả lợi nhuận lẫn thua lỗ.

Rủi ro của giao dịch CFD

CFD vốn dĩ rủi ro cao; cần cân nhắc các yếu tố sau trước khi giao dịch:

• Đòn bẩy: Có thể khuếch đại lợi nhuận khi thuận lợi nhưng cũng dễ làm thua lỗ phình to khi thị trường đi ngược.

• Giao dịch quá mức: Dễ vào lệnh nhờ ký quỹ thấp có thể khiến mức độ rủi ro quá lớn và chi phí giao dịch tích lũy cao theo thời gian.

• Cảm xúc chi phối: Đòn bẩy khuếch đại “cảm xúc” lời/lỗ; biến động đột ngột có thể gây căng thẳng dẫn đến quyết định bốc đồng.

• Phí qua đêm (swap): Giữ vị thế spot/cash qua đêm phát sinh phí tài trợ; mức phí này thể hiện trên nền tảng Pepperstone và cần tính đến trước khi giao dịch.

Quản trị rủi ro khi giao dịch CFD

Khi giao dịch CFD, việc áp dụng chiến lược và công cụ quản trị rủi ro là rất quan trọng:

• Lệnh chốt lời (Take profit/Limit): Tự động đóng vị thế khi chạm mức đã định để khóa lợi nhuận.

• Lệnh cắt lỗ (Stop loss): Tự động đóng vị thế tại mức giá chỉ định nhằm hạn chế thua lỗ. Lưu ý: mức cắt lỗ/chốt lời không được đảm bảo, có thể trượt khi thị trường biến động mạnh hoặc có gap.

• Dừng kéo theo (Trailing stop): Tự động dịch chuyển theo hướng có lợi, giữ khoảng cách cố định so với giá hiện tại; giúp khóa lợi nhuận khi giá đi tiếp và bảo vệ khi đảo chiều.

• Cảnh báo giá: Một số nhà cung cấp như Pepperstone cho phép đặt cảnh báo tại các mức giá cụ thể để bạn chủ động ra quyết định khi thị trường chạm ngưỡng mong đợi.

• Theo dõi vị thế: Thường xuyên rà soát giao dịch để đảm bảo phù hợp với khẩu vị rủi ro và chiến lược; giúp bạn phản ứng kịp thời với thay đổi của thị trường.

• Đào tạo/kiến thức: Bổ sung kiến thức qua phân tích kỹ thuật, cơ bản, quản trị rủi ro và tâm lý thị trường. Pepperstone cung cấp nhiều tài liệu học tập cho mọi cấp độ.

Nền tảng giao dịch CFD

Pepperstone cung cấp bộ 5 nền tảng hiện đại, phù hợp nhiều phong cách giao dịch. Có thể truy cập miễn phí trên di động, máy tính bảng và máy tính để bàn.

TradingView

Bạn có thể liên kết trực tiếp tài khoản Pepperstone với TradingView. Nền tảng này cung cấp biểu đồ nâng cao và cập nhật tin tức giúp theo kịp diễn biến quan trọng của thị trường.

MetaTrader 5

Phiên bản nâng cấp của MT4 với hiệu năng và độ chính xác vượt trội. MT5 có tốc độ xử lý nhanh, hỗ trợ phòng hộ vị thế, cung cấp các tùy chọn lệnh chờ nâng cao cùng nhiều công cụ và chỉ báo để tối ưu chiến lược giao dịch.

MetaTrader 4

Nền tảng FX phổ biến nhất thế giới với báo giá thời gian thực, biểu đồ trực tiếp, tin tức tổng hợp và phân tích chuyên sâu. MT4 có nhiều công cụ quản lý lệnh, chỉ báo kỹ thuật và EA, phù hợp cho mọi cấp độ nhà giao dịch.

cTrader

cTrader có giao diện trực quan, hỗ trợ thiết lập tùy biến và tách rời biểu đồ, mang lại trải nghiệm thân thiện. Hỗ trợ các tính năng khớp lệnh nâng cao và cho phép lập trình bằng ngôn ngữ C#.

Nền tảng Pepperstone

Nền tảng và ứng dụng chủ lực của chúng tôi mang lại trải nghiệm giao dịch an toàn, mượt mà mọi lúc mọi nơi. Ứng dụng Pepperstone cho phép bạn tiếp cận thị trường toàn cầu và thực hiện giao dịch CFD theo thời gian thực trên FX, cổ phiếu, chỉ số, ETF, hàng hóa và tiền điện tử.

Cách bắt đầu giao dịch CFD

1. Mở tài khoản giao dịch CFD

Bạn thường có thể mở tài khoản Pepperstone trong vài phút theo quy trình đăng ký 4 bước.

2. Chọn thị trường

Pepperstone mang đến cơ hội giao dịch hàng nghìn sản phẩm trên FX, chỉ số, hàng hóa, cổ phiếu và nhiều hơn nữa.

3. Mở vị thế

Trong vé lệnh Pepperstone, bạn có thể đặt quy mô hợp đồng, áp dụng lệnh dừng/giới hạn và xem các loại phí trước khi mua hoặc bán.

4. Theo dõi giao dịch CFD

Theo dõi toàn bộ lệnh mở theo thời gian thực hoặc sử dụng tự động hóa với bộ công nghệ hàng đầu. Bạn có thể đóng lệnh bất cứ lúc nào.

Quan tâm giao dịch CFD tại Pepperstone? Hãy mở tài khoản ngay hôm nay.

Câu hỏi thường gặp về CFD

Tôi dùng CFD để phòng hộ như thế nào?

CFD có thể là phương pháp phòng hộ hiệu quả vì cho phép bạn mở cả vị thế mua và bán, giúp bù trừ biến động bất lợi ở giao dịch này bằng kết quả tích cực ở giao dịch khác.

Nếu một nhà giao dịch nắm $5.000 cổ phiếu Tesla nhưng dự đoán giá sẽ giảm, họ có thể dùng CFD để bảo vệ khỏi thua lỗ tiềm ẩn. Bằng cách bán khống lượng tương đương Tesla qua CFD, họ có thể có lãi khi giá Tesla giảm. Lợi nhuận từ CFD giúp bù đắp phần lỗ của cổ phiếu nắm giữ, giảm tác động tài chính tổng thể mà không cần bán cổ phiếu thực.

Khác biệt giữa giao dịch CFD và đầu tư cổ phiếu truyền thống là gì?

Khi so sánh CFD với đầu tư cổ phiếu truyền thống, quyền sở hữu và đòn bẩy là hai khác biệt cốt lõi.

Trong CFD, nhà giao dịch không sở hữu cổ phiếu cơ sở mà chỉ dự đoán biến động giá. Thị trường thuận lợi thì có lãi, đi ngược thì thua lỗ. Ngược lại, đầu tư cổ phiếu truyền thống là mua và sở hữu hợp pháp, kèm quyền lợi như cổ tức và quyền biểu quyết.

CFD hoạt động với đòn bẩy, chỉ cần ký quỹ một phần giá trị giao dịch, làm khuếch đại cả lãi và lỗ. Trong khi đó, mua cổ phiếu truyền thống cần thanh toán đủ ngay từ đầu.

CFD mang lại sự linh hoạt và cơ hội đầu cơ; đầu tư cổ phiếu truyền thống mang lại quyền sở hữu thực và tham gia trực tiếp vào vốn chủ sở hữu doanh nghiệp.

Nhà cung cấp CFD kiếm tiền như thế nào?

Nhà cung cấp CFD chủ yếu thu lợi qua:

Spread: Chênh lệch giữa giá mua (ask) và giá bán (bid). Nhà giao dịch trả spread khi vào/ra lệnh.

Hoa hồng (Commission): Với một số tài sản, có thể thu phí hoa hồng cho mỗi giao dịch, tùy nhà cung cấp và loại tài khoản.

Phí qua đêm: Phí khi giữ các vị thế có đòn bẩy qua đêm.

Tôi có thể giao dịch trên những thị trường nào?

Pepperstone cung cấp 1.350+ sản phẩm CFD trên FX, chỉ số, cổ phiếu, hàng hóa, ETF và tiền điện tử.

Tài liệu này không được chuẩn bị theo các yêu cầu pháp lý nhằm thúc đẩy tính độc lập của nghiên cứu đầu tư và do đó được coi là thông tin tiếp thị. Mặc dù không bị cấm giao dịch trước khi phổ biến nghiên cứu đầu tư, chúng tôi sẽ không tìm cách tận dụng lợi thế trước khi cung cấp cho khách hàng.

Pepperstone không cam kết tài liệu này là chính xác, cập nhật hoặc đầy đủ, do đó không nên được dựa vào như vậy. Dù thông tin từ bên thứ ba hay không, đây không phải là khuyến nghị; không phải là đề nghị mua/bán; không phải lời mời chào mua/bán bất kỳ chứng khoán, sản phẩm tài chính hay công cụ nào; hoặc tham gia chiến lược giao dịch cụ thể. Nội dung này không tính đến tình hình tài chính hay mục tiêu đầu tư của người đọc. Chúng tôi khuyến nghị người đọc tự tìm kiếm tư vấn phù hợp. Không được sao chép hay phân phối lại nội dung này nếu không có sự chấp thuận của Pepperstone.