MetaTrader4 (MT4)

MetaTrader4 (MT4)

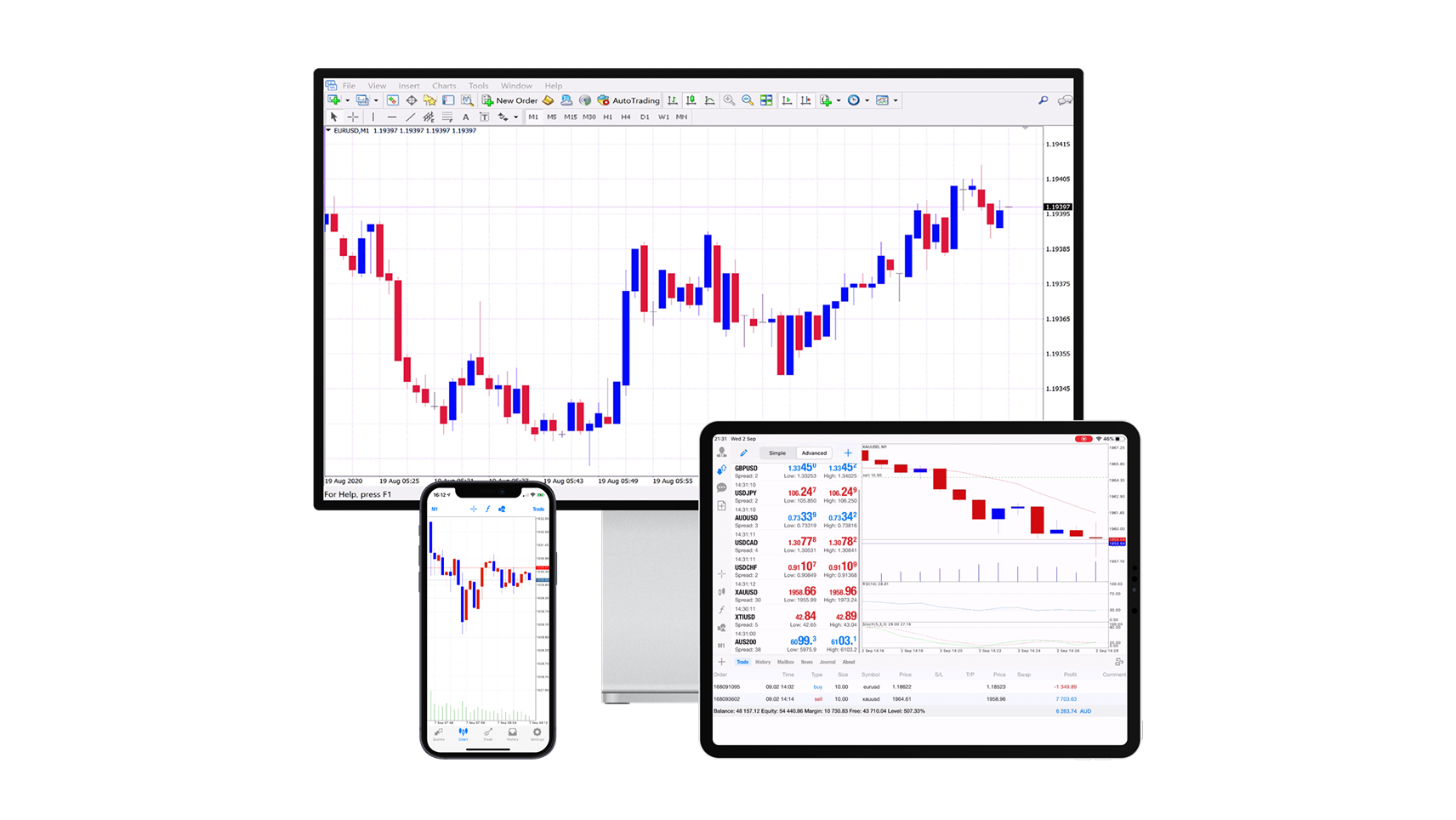

Automatisieren Sie ihren Handel mit fortgeschrittenen Indikatoren, Expert Advisors und Software zur Mustererkennung, unterstützt von der schnellen Orderausführung und den messerscharfen FX-Spreads von Pepperstone.

Warum MT4 wählen?

Smart Trader tool

Treffen Sie fundiertere Handelsentscheidungen, steuern Sie Risiken und automatisieren Sie Ihre Strategien, um wertvolle Handelszeit zu sparen.

Individualisierung

Erstellen Sie Ihre eigene Handelsumgebung durch die Kombination von Indikatoren und Skripten und entwickeln Sie so Ihr eigenes MQL4.

Eingebaute Indikatoren

Verbessern Sie Ihre Marktanalyse mit zahlreichen vorinstallierten Indikatoren sowie Tausenden kostenlosen, individuell anpassbaren Indikatoren.

Niedrige Mindestpositionsgrößen

Handeln Sie ab 0,01 Lots und behalten Sie so mehr Kontrolle über Ihr Risiko beim Handel mit hohen Volumina.

Vorteile von MT4 bei Pepperstone

Kleine Spreads

Ab 0,0 Pips bei Forex auf einem Razor-Konto und 0,1 Pips bei Gold.1

Schnelle, zuverlässige Ausführung

Ab 50 Millisekunden mit 99.59% Ausführungsrate ohne Handelsintervention.4

Dedizierter Support

Wir sind 24 Stunden am Tag von Mo-Fr und 18 Stunden am Wochenende für Sie da.

Weltweit anerkannte Marke

Wir haben 750.000 Kunden in 160 Ländern und 10 Standorte weltweit.3

Welches Pepperstone-Konto ist mit TradingView kompatibel?

CFD Standard

Sie erhalten eine ähnliche Exposure wie beim direkten Kauf des zugrundeliegenden Marktes, müssen aber nur einen Bruchteil des vollen Wertes Ihrer Position einsetzen.

Alle Gebühren, außer der Übernachtfinanzierung, sind im Spread enthalten ohne, dass weitere Kommissionen anfallen.

CFD Razor

Bietet die gleichen Handelskonditionen wie unser Standardkonto, jedoch mit provisionsbasierten Gebühren für Forex.

Raw FX-Spreads ab 0,0 Punkten 1 sowie feste, transparente Kommissionen ab USD 3,50 pro Lot und Seite.

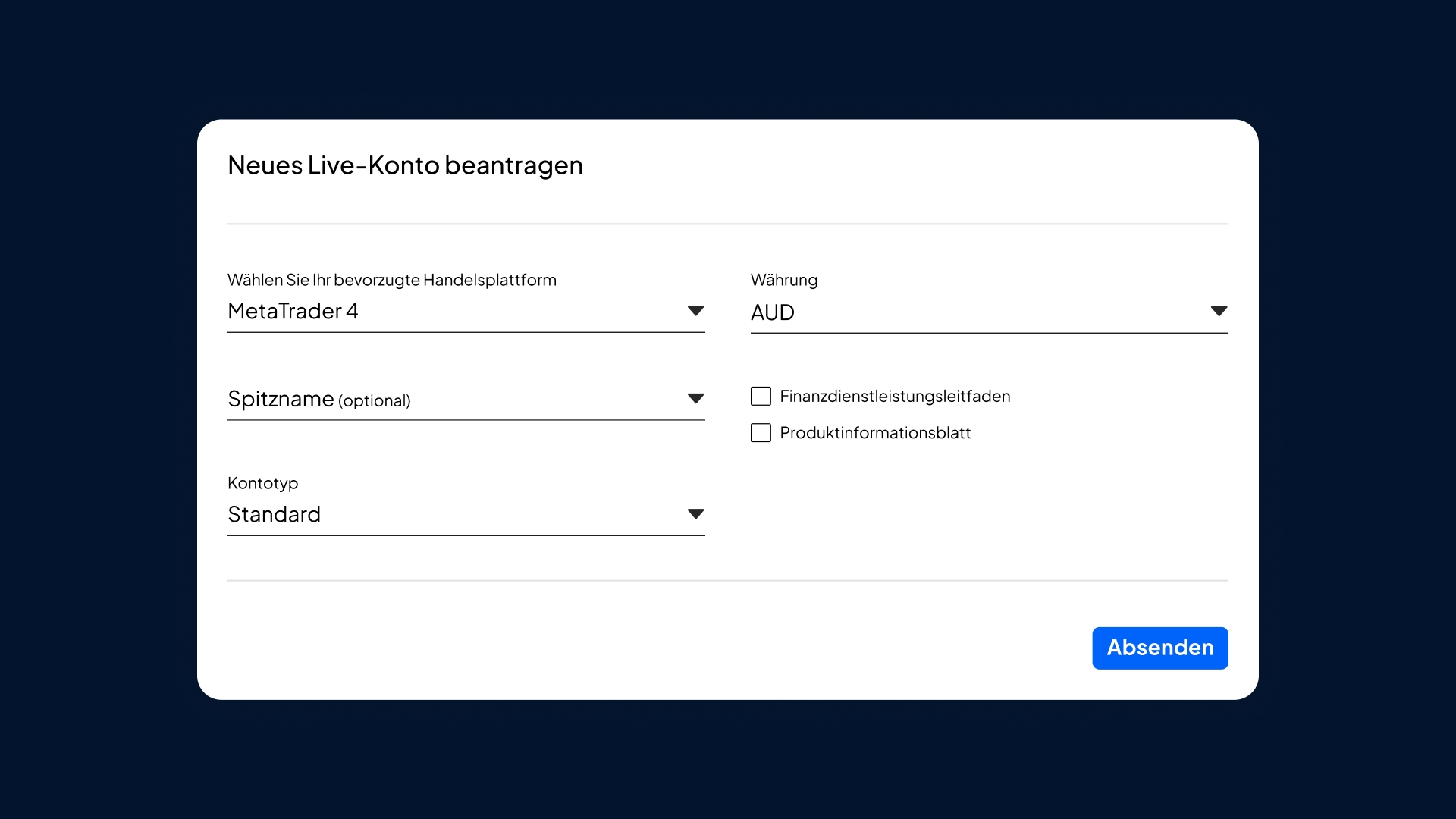

Bei MT4 und Pepperstone anmelden

Erstellen Sie ein Demo- oder ein Live-Konto bei Pepperstone und wählen Sie MT4 als ihre bevorzugte Plattform.

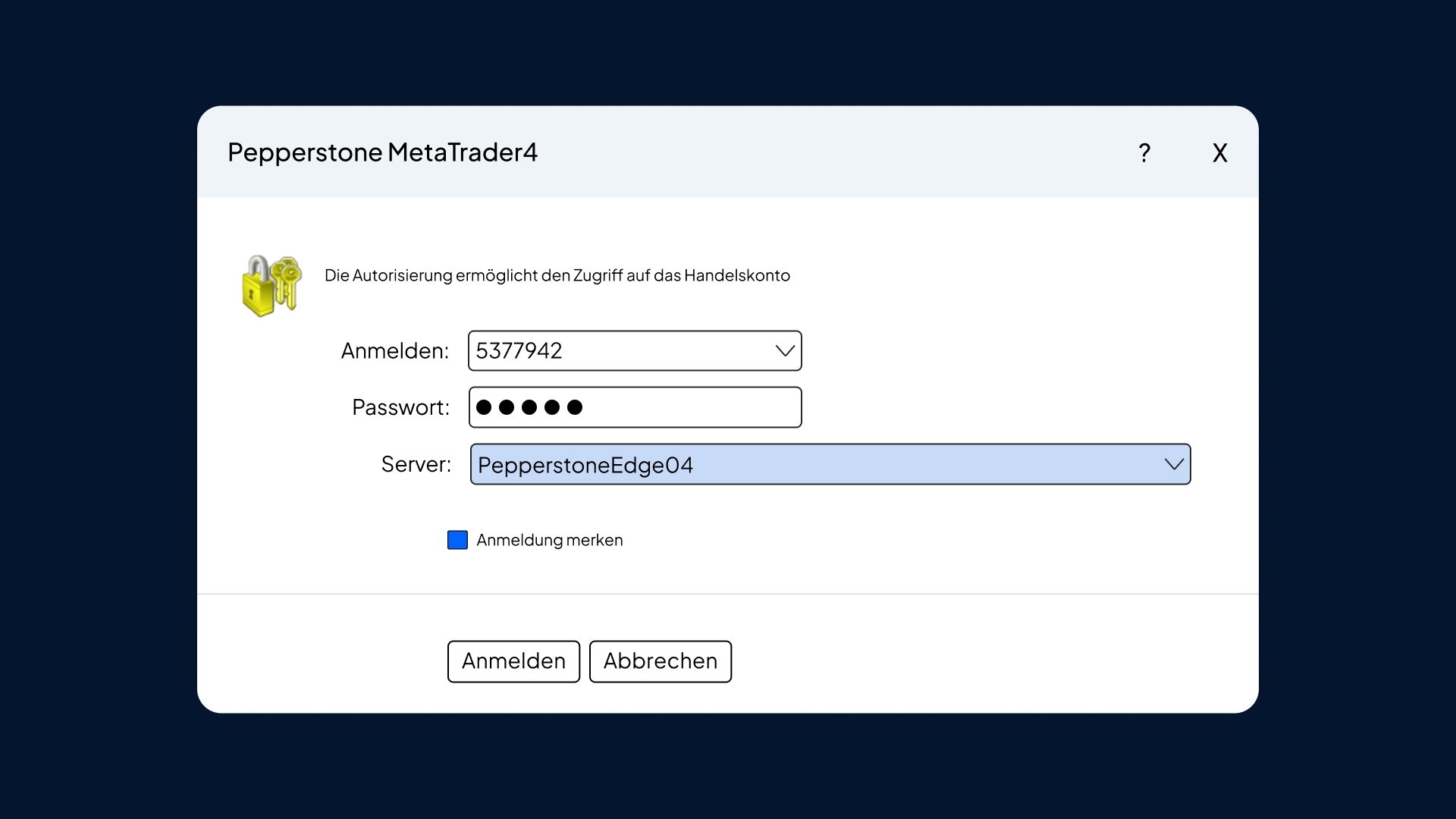

Öffnen Sie MT4 auf Ihrem gewählten Medium und melden Sie sich auf Ihrem Konto an.

Suchen Sie nach dem Pepperstone Server und melden Sie sich mit Ihren Pepperstone Daten an.

So starten Sie:

Gerne stellen wir Ihnen auch unsere Ressourcen als Starthilfe bei der Einrichtung der MT4 App zur Verfügung. Klicken Sie einfach auf einen der untenstehenden Links und schauen Sie in die jeweiligen Videos rein.

So melden Sie sich an und verbinden sich mit MT4

So führen Sie einen Trade aus.

So verwalten Sie Positionen und zeigen den Verlauf an.

So passen Sie Ihre Watchliste an.

So passen Sie Charts und Indikatoren an.

Laden Sie MT4 herunter

FAQs

Laden Sie zunächst MT4 herunter. Dazu melden Sie sich in Ihrem sicheren Kundenbereich an und navigieren zu Zugriff auf Handelsplattformen. Sie werden nun durch den Download-Prozess geleitet und werden am Ende nach ihrer Kontonummer, Passwort und dem Server Namen gefragt.

Sollten Probleme bei der Eingabe der Informationen aufkommen, empfehlen wir folgendes:

- Kopieren Sie ihr Passwort in das Feld, ohne Leerzeichen.

- Geben Sie ihre Server IP Adresse manuell ein.

- Löschen Sie den Server und geben Sie folgendes manuell ein ‘edge<server nummer>.pepperstone.com'. Zum Beispiel: edge03.pepperstone.com

Sollte das auch nicht helfen, gehen Sie zum Live Chat und wir helfen Ihnen gerne weiter.

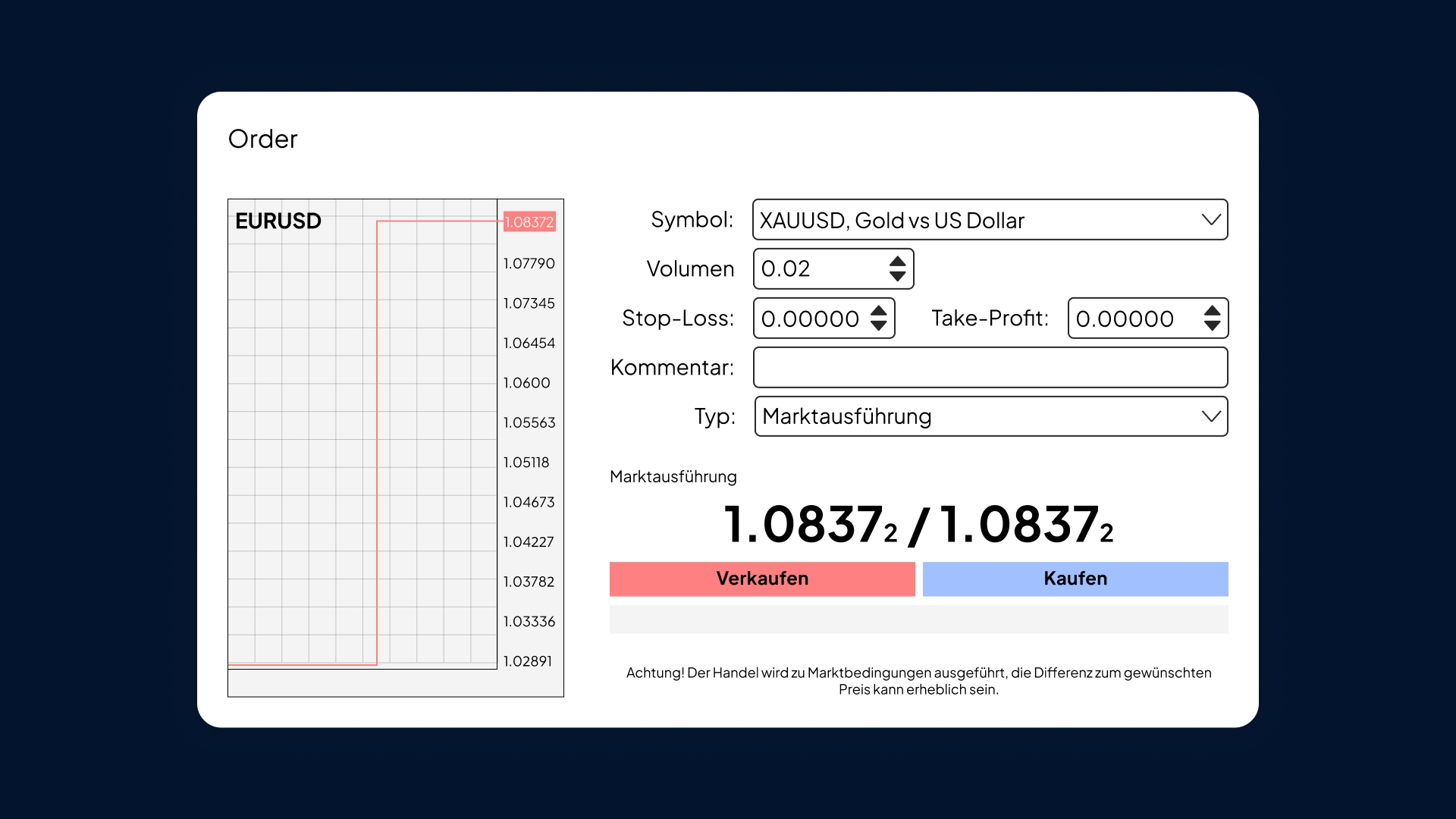

Um eine Order zu sehen:

- Öffnen Sie ein neues Fenster und wählen Sie ""Neue Order"" oder nutzen Sie einfach den Shortcut über die F9 Taste.

- Fügen Sie ihr Handelsvolumen ein, basierend auf dem FX Standardlot (USD 100.000 Exposure und USD 10 der Basiswährung pro Pip).

- Anschließend wälen Sie ihren Stop-Loss und ihr Take-Profit aus. Das können Sie vor oder auch nach der Orderaufgabe tun.

- Das Feld „Typ“ zeigt die Art der Order an, die Sie platzieren möchten. „Marktausführung“ ist eine Sofortorder, und mit „Pending Order“ können Sie den Preis festlegen, zu dem Sie handeln möchten."

Um eine Order zu ändern:

Klicken Sie mit der rechten Maustaste auf den Trade im Bereich 'Terminal – Trade' und wählen Sie 'Ändern 'oder 'Löschen'.

Sie können Stop-Loss- oder Take-Profit-Aufträge auf zwei Arten ändern:- Geben Sie den gewünschten Abstand vom aktuellen Kurs ein. Zum Beispiel 200 Punkte entsprechen einem Stop-Loss von 20 Pips vom aktuellen Marktkurs.

- Alternativ können Sie den genauen Kurs, zu dem Sie aussteigen möchten, in das Stop-Loss-Feld eingeben.

Es ist ganz einfach, den Expert Advisor (EA) oder Indikator zu laden.

- Laden Sie Ihren EA oder Ihre Indikatoren als Datei auf Ihren Computer herunter.

- Geben Sie 'MT4' ein und wählen Sie 'Datei'.

- Öffnen Sie den Ordner 'Daten'.

- Geben Sie MQL4 ein, wodurch Sie die Datei per Drag & Drop entweder in den Ordner 'Expert Advisors' oder 'Indikatoren' ziehen können.

- Starten Sie die MT4-Plattform neu, und Ihr Expert Advisor oder Indikator wird in Ihrer 'Navigator”-Liste angezeigt'.

Das Anpassen Ihrer Vorlagen ist eine gute Möglichkeit, Ihre MT4-Plattform individuell und benutzerfreundlicher zu gestalten. Mit Vorlagen können Sie steuern, wie Ihre MT4-Charts angezeigt werden, und sehen, welche Indikatoren in Ihren Charts enthalten sind.

Um eine Vorlage zu erstellen, müssen Sie:

- Fügen Sie alle Expert Advisors (EAs) oder Indikatoren hinzu, die Sie in Ihrem Chart haben möchten.

- Klicken Sie mit der rechten Maustaste auf Ihr Chart.

- Wählen Sie „Eigenschaften”, wo Sie Ihr Farbschema aktualisieren und allgemeine Einstellungen ändern können.

- Nachdem Sie Ihre individuellen Änderungen vorgenommen haben, klicken Sie mit der rechten Maustaste auf das Chart.

- Wählen Sie „Vorlagen” und benennen Sie die Datei, die Sie gerade bearbeitet haben. Sie können mehrere Vorlagen für verschiedene Strategien erstellen. "

Tipp: Benennen Sie diese Vorlage als „Standard“, damit alle Diagramme standardmäßig mit dieser Vorlage geöffnet werden.

MT4 und MT5 gehören zu den beliebtesten Handelsplattformen weltweit, unterscheiden sich jedoch im Umfang ihrer Funktionen. MT4 gilt als einfach zu bedienen, intuitiv und ist aufgrund ihrer vielseitigen Möglichkeiten sowohl für Einsteiger als auch für erfahrene Trader geeignet.

MT5 hingegen bringt erweiterte Funktionen mit, die den Handel auf ein neues Niveau heben. Die Plattform zeichnet sich durch eine große Auswahl an Zeitrahmen, umfangreiche Analysetools sowie eine Vielzahl an ausstehenden Ordertypen für Aktien, Rohstoffe, Indizes und weitere Märkte aus.

MT5 umfasst unter anderem:

- Erweiterte Zeitrahmen - Insgesamt 21 verschiedene Intervalle gegenüber 9 bei MT4. Dies ist besonders interessant für Scalper und erfahrene Trader, die den Markt detailliert analysieren möchten.

- Zusätzliche Ordertypen - Während MT4 hauptsächlich Stop- und Limit-Orders anbietet, ermöglicht MT5 zusätzlich die Nutzung von Stop-Limit-Orders. Damit lässt sich der Ausführungspreis gezielter steuern, um ungünstige Trades in volatilen Marktphasen zu vermeiden.

- Programmiersprache MQL5 - Obwohl für MT4 aufgrund seiner weiten Verbreitung nach wie vor umfangreiche Anleitungen und Ressourcen verfügbar sind, wechseln immer mehr Nutzer zu MQL5. Diese Sprache ist moderner, effizienter und einfacher zu handhaben, sodass sich Skripte leichter erstellen und anpassen lassen.

- Integrierter Wirtschaftskalender - Bietet Echtzeit-Updates zu makroökonomischen Ereignissen. Darüber hinaus verfügt MT5 über einen eingebauten MQL5-Community-Chat sowie ein internes E-Mail-System.

Fazit: MT4 ist eine unkomplizierte und effiziente Wahl für Einsteiger oder Trader, die sich auf den Forex-Handel konzentrieren. Wer hingegen eine leistungsfähigere Plattform mit einem größeren Funktionsumfang und erweiterten Analysemöglichkeiten bevorzugt, ist mit MT5 besser bedient. Für den 24-Stunden-Handel an fünf Tagen pro Woche mit führenden US-Aktien-CFDs³ ist MT5 besonders interessant.

Entdecken Sie die bessere Art des Tradings!

Starten Sie jetzt mit Pepperstone und werden Sie Teil unserer globalen Community mit über 750.000 Trader. ² Melden Sie sich in wenigen Munuten über unser einfaches Anmeldeverfahren an.

1

Registrieren

Melden Sie sich mit Ihrer E-Mail-Adresse an und erhalten Sie eine kostenlose Demo.

2

Fragen beantworten

Wir prüfen, ob unsere Produkte für Sie geeignet sind.

3

Verifizieren

Ihre Sicherheit hat für uns oberste Priorität.

4

Geld einzahlen

Das war's schon! Sie können jetzt mit dem Handel beginnen.

1 Es können weitere Gebühren und Kosten anfallen.

2Daten korrekt ab April 2025.

324-Stunden-Trading an 5 Tagen pro Woche für ausgewählte US-Aktien-CFDs. Die genauen Zeiten entnehmen Sie bitte den Instrumentenspezifikationen im Handelsterminal.

4 99,59 %. Die Ausführungsraten basieren auf allen Handelsdaten zwischen dem 01.07.2025 und dem 30.09.2025