Was ist Goldhandel?

Gold wird nicht nur als Wertanlage, Industriemetall und Luxusgut geschätzt, sondern auch wegen seiner einzigartigen finanziellen Eigenschaften. Diese machen es zu einem wichtigen Vermögenswert, der von Händlern weltweit aufmerksam verfolgt wird.

Kurzüberblick: Goldhandel einfach erklärt

- Handelswege: Zur Auswahl stehen physisches Gold, Gold-Futures und Gold-ETFs; am flexibelsten sind Gold-CFDs, da sie ohne Lagerkosten, ohne feste Laufzeiten und in beide Richtungen handelbar sind.

- Gold gilt als sicherer Hafen, Inflationsschutz und Diversifikationsbaustein mit geringer Korrelation zu Aktien und Anleihen und wird weltweit hochliquide gehandelt.

- Marktentwicklung 2015–2025: Nach einem seitwärts geprägten Markt bis 2019 führten Pandemie, Geldpolitik, Inflation und geopolitische Risiken ab 2020 zu höherem Preisniveau und erhöhter Volatilität – ohne Garantie auf stetig steigende Kurse.

- Vorteile von Gold-CFDs bei Pepperstone: Handel nahezu rund um die Uhr, enge Spreads, Hebeleinsatz, verschiedene Basiswährungen (z. B. USD, JPY, CHF) und Unterstützung zahlreicher Strategien – von Trendfolge über Scalping bis Hedging.

- Gold reagiert besonders auf Zinsniveau und Geldpolitik, US-Dollar-Entwicklung, Inflationserwartungen, geopolitische Risiken, Zentralbankkäufe und Portfolioumschichtungen institutioneller Anleger.

- Erfolgreicher Goldhandel kombiniert makroökonomische Analyse mit technischer Analyse (Unterstützung/Widerstand, Trendlinien, Indikatoren, Volumen) sowie konsequentem Risikomanagement mit klaren Stop-Loss-Regeln.

Eine Einführung in den Goldhandel

Beim Goldhandel spekuliert man auf Preisbewegungen des Edelmetalls, um von Schwankungen im Goldpreis zu profitieren. In der Regel wird dabei kein physisches Gold gekauft oder verkauft. Stattdessen kommen Finanzinstrumente wie Gold-Futures, ETFs, Aktien von Goldunternehmen oder Derivate wie CFDs (Differenzkontrakte) und Optionen zum Einsatz. Diese ermöglichen es, auf steigende oder fallende Goldpreise zu setzen.

Trader können Long-Positionen eröffnen, wenn sie mit einem steigenden Goldpreis rechnen, oder Short-Positionen, wenn sie von einem Rückgang ausgehen. Das Risiko lässt sich dabei durch die Wahl der Positionsgröße sowie durch Stop-Loss- und Take-Profit-Orders steuern. Das Ziel besteht darin, Marktbewegungen in fundierte Handelsentscheidungen umzusetzen.

Warum spielt Gold an den Finanzmärkten eine so wichtige Rolle?

Eine einfache Analogie hilft: Ein Anlageportfolio ähnelt einer Flotte von Schiffen. Aktien und andere risikoreiche Anlagen sind die Segel, Anleihen bilden den stabilen Kiel und Gold fungiert als Rettungsboot. In Zeiten wirtschaftlicher Unsicherheit oder hoher Marktvolatilität steigt der Wert dieses „Rettungsbootes“ häufig. Darüber hinaus besitzt Gold vier zentrale Eigenschaften, die es für Händler und Anleger weltweit besonders attraktiv machen:

1. Stabiler Wert in unsicheren Zeiten – In Phasen geopolitischer Spannungen, wirtschaftlicher Unsicherheit oder hoher Marktvolatilität gilt Gold als sicherer Hafen. Kapitalströme verlagern sich in solchen Zeiten häufig in das Edelmetall, da es seinen Wert auch in Krisenzeiten bewahren kann.

2. Schutz vor Inflation und Kaufkraftverlust – Gold dient als natürliche Absicherung gegen Inflation. Aufgrund seiner begrenzten Verfügbarkeit bleibt es langfristig werthaltig und hilft, die Kaufkraft gegenüber einer Geldentwertung zu erhalten.

3. Diversifikation im Portfolio – Da Gold nur gering mit Aktien oder Anleihen korreliert, wird es häufig zur Risikostreuung eingesetzt. Die Beimischung von Gold kann die risikobereinigte Rendite eines Portfolios verbessern und als Schutz vor systemischen oder währungsbedingten Risiken dienen.

4. Hohe Liquidität und weltweite Handelsaktivität – Gold wird an globalen Märkten gehandelt – von Zentralbanken über institutionelle Anleger bis hin zu Privatanlegern und ETFs. Die breite Marktteilnahme, die langen Handelszeiten und die hohe Liquidität erleichtern den schnellen Ein- und Ausstieg und sorgen dafür, dass sich makroökonomische Entwicklungen unmittelbar im Preis widerspiegeln.

Entwicklung des Goldpreises von 2015 bis 2025

Zwischen 2015 und 2019 bewegte sich der Goldpreis überwiegend seitwärts mit leichtem Aufwärtstrend.

In den Jahren 2020 bis 2023, die durch die Pandemie, wirtschaftliche Unsicherheit und geldpolitische Anpassungen geprägt waren, blieb der Preis auf hohem Niveau und zeigte starke Schwankungen.

Seit 2024 befindet sich Gold in einer Phase struktureller Veränderungen: Eine lockere Geldpolitik, fiskalische Stimuli, anhaltende Inflationssorgen und geopolitische Risiken führen zu erhöhter Volatilität bei einem insgesamt steigenden Trend.

Aus der historischen Entwicklung lassen sich zwei wichtige Lehren ziehen:

- Erstens werden in Zeiten makroökonomischer Turbulenzen die Eigenschaften von Gold als sicherer Hafen und Wertspeicher verstärkt, wodurch die Preise sehr widerstandsfähig sind.

- Zweitens gibt es keine Garantie dafür, dass der Goldpreis kontinuierlich steigt. Er unterliegt weiterhin Schwankungen, sodass Handelsentscheidungen sowohl makroökonomische Erkenntnisse als auch technische Analysen berücksichtigen sollten.

Erste Schritte im Goldhandel

Wer in den Goldhandel einsteigen möchte, sollte zunächst die Handelsmethode wählen, die zur eigenen Strategie und Risikobereitschaft passt. Grundsätzlich lassen sich drei traditionelle Ansätze unterscheiden:

Physisches Gold (z. B. Barren oder Münzen)

Vorteile: Direkter Besitz ohne Kreditrisiko – ideal für Anleger, die Gold langfristig als Wertaufbewahrungsmittel halten möchten.

Nachteile: Die Lagerung, Versicherung und Sicherheit verursachen zusätzliche Kosten. Zudem ist der Handel weniger flexibel und meist mit größeren Spreads verbunden.

Gold-Futures

Vorteile: Hohe Liquidität und transparente Preisbildung machen sie besonders für Absicherungsstrategien und institutionelle Marktteilnehmer interessant.

Nachteile: Die Kontrakte laufen zu festen Terminen aus, was Rollover-Kosten verursacht. Außerdem sind sie für Einsteiger oft komplexer zu verstehen.

Gold-ETFs (z. B. SPDR Gold Trust – GLD, Gold Miners ETF – GDX)

Vorteile: Einfach über ein Standard-Brokerkonto handelbar, bilden den Goldpreis genau ab, sind kosteneffizient und eignen sich für die langfristige Portfolioaufteilung.

Nachteile: Die Handelszeiten sind an die Börsenöffnungszeiten gebunden, was weniger Flexibilität im Vergleich zum direkten Goldhandel bietet.

Goldhandel mit CFDs: Flexibel, effizient und zugänglich

Im Vergleich zu traditionellen Anlageformen bietet der Handel mit Gold-CFDs (Contracts for Difference) deutlich mehr Flexibilität und Effizienz. Mit CFDs partizipieren Trader an Goldpreisbewegungen, ohne das physische Edelmetall besitzen zu müssen. Dadurch entfallen Lager-, Versicherungs- und Lieferkosten. Gleichzeitig gibt es keine festen Laufzeiten wie bei Futures – Positionen können jederzeit an die eigene Handelsstrategie angepasst werden.

Vorteile von Gold-CFDs

- In beide Richtungen handelbar - Ein zentraler Vorteil von CFDs ist die Möglichkeit, in beide Richtungen zu handeln. Trader können Long-Positionen eröffnen, wenn sie von steigenden Kursen ausgehen, oder Short-Positionen, wenn sie fallende Preise erwarten. Diese Zwei-Wege-Struktur eignet sich besonders für kurzfristige Strategien wie Day- oder Swing-Trading.

- Einsatz von Leverage - Zudem erlauben CFDs den Einsatz von Hebelwirkung (Leverage) – so lässt sich mit vergleichsweise geringem Kapitaleinsatz eine größere Marktposition steuern. Das erhöht die Kapitaleffizienz, erfordert aber ein konsequentes Risikomanagement.

- Längere Handelszeiten - Gold-CFDs bei Pepperstone sind nahezu rund um die Uhr handelbar und zeichnen sich durch enge Spreads und geringe Handelskosten aus.

- Für diverse Trading-Strategien geeignet - Sie eignen sich für verschiedene Handelsansätze – von Trendfolge-Strategien über Swing- und Scalping-Strategien bis hin zu Hedging-Positionen, bei denen bestehende Anlagen abgesichert werden.

Diese Kombination aus Flexibilität, globaler Zugänglichkeit und wettbewerbsfähigen Konditionen macht Gold-CFDs zu einem der beliebtesten Märkte bei Pepperstone – sowohl für erfahrene Trader als auch für aktive Marktteilnehmer, die regelmäßig handeln.

Goldhandel mit Leverage und effektivem Risikomanagement

Der Einsatz von Hebel (Leverage) kann Gewinne, aber auch Verluste verstärken. Dabei haben unterschiedliche Broker eigene Spreads, Finanzierungskosten (Overnight-Fees) und Marginanforderungen. Daher ist ein konsequentes Risikomanagement entscheidend.

Vor jedem Trade sollte klar definiert sein, wie viel Risiko pro Position eingegangen wird. Durch festgelegte Positionsgrößen sowie Stop-Loss- und Take-Profit-Regeln bleibt das Verhältnis von Risiko zu Ertrag ausgewogen und kontrollierbar.

Wer den Handel mit Gold-CFDs beginnen möchte, kann sich an folgenden Schritten orientieren:

- Konto eröffnen - Wählen Sie einen regulierten und vertrauenswürdigen Broker wie Pepperstone.

- Konto aufladen und Plattform wählen - Tätigen Sie eine Einzahlung und wählen Sie Ihre bevorzugte Handelsplattform – etwa MetaTrader 4/5, cTrader oder TradingView –, um Zugriff auf Echtzeitkurse für Gold-CFDs zu erhalten.

- Mit einem Demokonto können Sie risikofrei üben und lernen, wie sich die Goldmärkte bewegen, bevor Sie mit echtem Kapital handeln.

- Regeln festlegen und live handeln - Entwickeln Sie einen klaren Handelsplan mit definierten Ein- und Ausstiegsregeln sowie Risikobegrenzungen, bevor Sie in den Live-Handel übergehen.

Vorteile des Goldhandels mit Pepperstone

Im Vergleich zu anderen globalen Brokern zeichnet sich Pepperstone beim Handel mit Gold-CFDs durch folgende Merkmale aus:

Breite Produktpalette

Neben Gold-CFDs bietet Pepperstone auch den Handel mit weiteren Edelmetallen, ETFs sowie CFDs auf Goldminenaktien an. Gold-CFDs sind nicht nur in USD, sondern auch gegenüber wichtigen G10-Währungen wie JPY und CHF sowie ausgewählten Schwellenländerwährungen handelbar – ideal, um Ihr Portfolio zu diversifizieren.

Beliebte Plattformen

Nutzen Sie die führenden Plattformen MT4, MT5, TradingView oder cTrader, um technische Analysen durchzuführen und Trades direkt auszuführen. Alles ist nahtlos integriert.

Nahezu 24-Stunden-Handel

Profitieren Sie von engen Spreads, hoher Liquidität und Schutz vor negativem Kontostand. Die langen Handelszeiten ermöglichen mehr Flexibilität und ein effektives Risikomanagement über verschiedene Marktsitzungen hinweg.

Risikomanagement-Tools

Setzen Sie auf integrierte Funktionen wie Stop-Loss, Trailing Stop und Take-Profit. Diese Tools unterstützen eine disziplinierte Strategieumsetzung und helfen dabei, Kapital zu sichern und Gewinne in volatilen Marktphasen zu schützen.

Zusammenfassend lässt sich sagen, dass der Handel mit Gold-CFDs bei Pepperstone die Flexibilität und Effizienz des modernen Handels mit robusten Risikomanagement-Tools vereint. Dadurch können Sie sich voll und ganz auf die Umsetzung Ihrer Strategie und die Nutzung von Chancen konzentrieren.

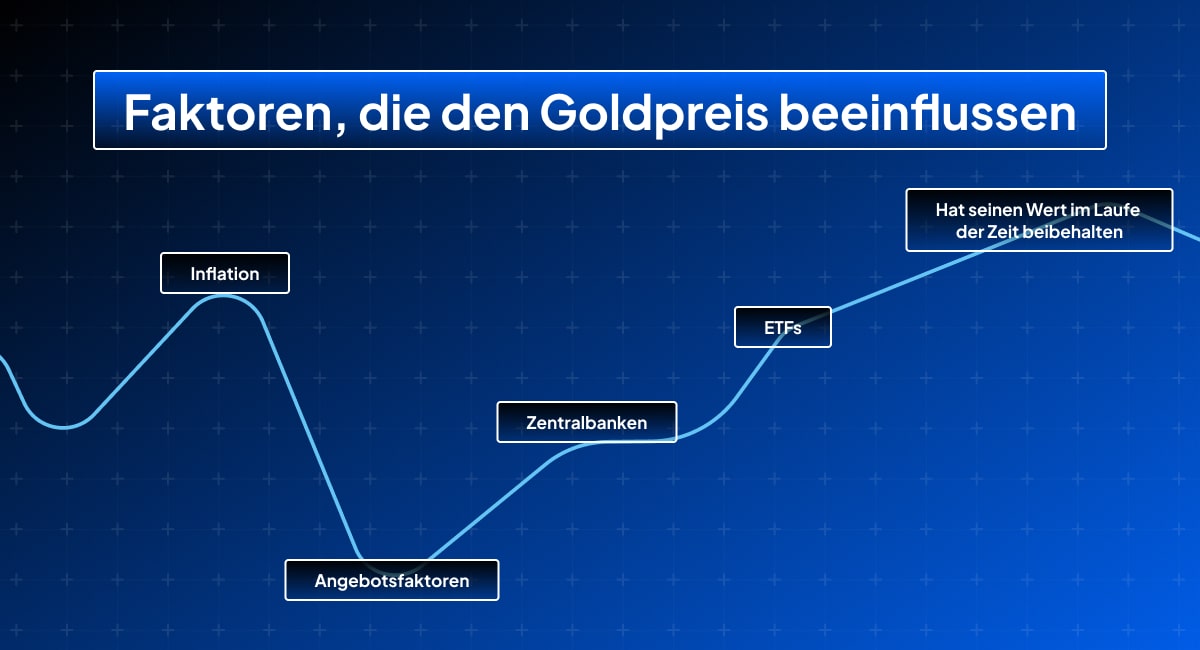

Welche Faktoren beeinflussen den Goldpreis?

Um fundierte Handelsentscheidungen zu treffen, ist es entscheidend, die treibenden Kräfte hinter der Goldpreisbewegung zu verstehen. Gold spielt an den Finanzmärkten eine besondere Rolle, da es gleichzeitig als sicherer Hafen, Inflationsschutz und Wertspeicher gilt. Sein Preis wird durch das Zusammenspiel makroökonomischer, geldpolitischer und marktspezifischer Faktoren bestimmt.

1. Zinsumfeld und Geldpolitik

Einer der wichtigsten Einflussfaktoren auf den Goldpreis ist das Zinsniveau. Besonders die Entscheidungen großer Zentralbanken – allen voran der US-Notenbank (Federal Reserve) – haben einen direkten Effekt auf die Goldnachfrage.

Steigen die Zinsen oder signalisiert die Geldpolitik eine straffere (hawkische) Haltung, erhöhen sich die Opportunitätskosten für das Halten von Gold, da es keine Zinsen oder Dividenden abwirft. In solchen Phasen kann der Goldpreis tendenziell fallen.

Sinken dagegen die Zinsen oder deuten Zentralbanken eine lockere (dovish) Haltung an, fließt Kapital häufig in Gold und andere wertstabile Anlagen. Dadurch steigt in der Regel die Nachfrage – und damit auch der Preis.

2. Der US-Dollar

Da Gold weltweit in US-Dollar notiert wird, besteht eine enge inverse Beziehung zwischen beiden. Ein schwächerer Dollar macht Gold für Anleger in anderen Währungen günstiger, was die Nachfrage und damit den Preis steigen lässt. Umgekehrt drückt ein stärkerer Dollar häufig auf den Goldpreis, da Gold für internationale Käufer teurer wird.

3. Inflationserwartungen

Inflation und Zinsen hängen eng miteinander zusammen. Steigen die Inflationserwartungen, gewinnt Gold an Attraktivität, da es langfristig vor Kaufkraftverlust schützt. In Zeiten, in denen Verbraucher und Unternehmen mit steigenden Preisen rechnen, fließt daher vermehrt Kapital in Gold.

4. Geopolitische Risiken und Marktstimmung

Kurzfristige Preisbewegungen im Goldmarkt entstehen häufig durch politische oder wirtschaftliche Unsicherheiten. Konflikte, Handelsstreitigkeiten oder Zweifel an der Stabilität von Zentralbanken führen dazu, dass Händler Gold als sicheren Hafen bevorzugen. Diese erhöhte Nachfrage treibt die Preise meist deutlich nach oben.

5. Nachfrage von Zentralbanken und institutionellen Investoren

Auch langfristige Trends werden durch Käufe von Zentralbanken und großen Finanzinstitutionen beeinflusst. Viele Schwellenländer haben in den letzten Jahren ihre Goldreserven aufgestockt, um ihre Abhängigkeit vom US-Dollar zu verringern. Diese strukturelle Nachfrage stützt die Preise und festigt die Rolle von Gold im globalen Währungssystem.

Ebenso bedeutend sind die Realzinsen, also die nominalen Zinsen abzüglich der Inflation. Steigende Realzinsen machen Gold weniger attraktiv, während fallende Realzinsen das Edelmetall als Anlageziel stärken und oft zu Preissteigerungen führen.

6. Portfoliodiversifizierung

Gold weist nur eine geringe Korrelation zu Aktien und Anleihen auf und ist daher ein wichtiges Instrument zur Risikostreuung. Fondsmanager und Anleger nutzen Gold, um die Volatilität in ihren Portfolios auszugleichen und systemische Risiken abzusichern – insbesondere in unsicheren Marktphasen.

7. Kapitalströme und Marktstrategien

Auch Handelsströme und strategische Positionierungen können Preistrends verstärken. Wenn systematische Händler – etwa CTAs (Commodity Trading Advisors) oder Momentum-Trader – stark in Gold investieren, kann sich ein bestehender Aufwärtstrend verlängern.

Zudem beeinflussen erwartungsgetriebene Marktbewegungen die Preisbildung. So führten im April 2025 Spekulationen über eine mögliche Goldsteuer unter der Regierung Trump in den USA zu starken Umschichtungen zwischen London und New York – und damit zu einem raschen Preisanstieg. Solche Beispiele verdeutlichen, wie stark Erwartung und Arbitrage den Goldpreis prägen können.

Der Goldpreis ergibt sich aus einem komplexen Zusammenspiel von makroökonomischen Daten, politischer Entwicklung und Marktverhalten. Um im Goldhandel erfolgreich zu sein, ist es wichtig, diese Einflussfaktoren zu verstehen und seine Analyse flexibel anzupassen, um globale Trends frühzeitig zu erkennen und Handelsentscheidungen auf einer fundierten Grundlage zu treffen.

Wie kann ich die wichtigsten Marktsignale im Blick behalten?

Um Goldpreisbewegungen richtig einordnen und frühzeitig reagieren zu können, ist es entscheidend, zentrale wirtschaftliche und politische Signale systematisch zu beobachten. Besonders die folgenden Bereiche bieten dabei wertvolle Orientierung:

1. Makroökonomische Daten und Risikoereignisse

Ein Wirtschaftskalender ist ein unverzichtbares Werkzeug, um relevante Veröffentlichungen aus G10- und Schwellenländern zu verfolgen, beispielsweise US-Arbeitsmarktdaten, Inflationsraten (VPI), BIP-Zahlen oder geldpolitische Entscheidungen.

Ebenso wichtig sind zentrale Risikoereignisse wie Zinsentscheidungen von Zentralbanken, das Auslaufen von Handelszöllen oder das jährliche Jackson-Hole-Symposium.

Wer Konsenserwartungen kennt, Marktschwerpunkte erkennt und Reaktionen antizipiert, kann fundierte Einschätzungen zu möglichen Goldpreisbewegungen treffen.

Der Wirtschaftskalender von Pepperstone bietet einen komfortablen Überblick über diese relevanten Daten und Termine.

2. Zinskurven und Inflationserwartungen

Realzinsen – also die nominalen Zinsen abzüglich der Inflation – gelten als zentraler Anker für die Goldpreisbildung. Besonders die langfristigen Renditen von Staatsanleihen (10 Jahre oder länger) sind hierfür ein wichtiger Indikator.

Ein deutlicher Rückgang dieser Renditen deutet oft auf steigende Goldpreise hin.

Mit Tools wie TradingView lassen sich diese Werte einfach analysieren, beispielsweise durch den Vergleich der Renditen zehnjähriger US-Staatsanleihen und inflationsgeschützter Anleihen (US10Y – T10YIE). So erhalten Trader einen klaren Überblick über die Entwicklung der Realrenditen.

3. Dollar- und Währungsentwicklung

Gold steht in enger Korrelation zum US-Dollar-Index (DXY). Ein schwächerer Dollar stärkt in der Regel den Goldpreis.

Neben dem gängigen XAU/USD-Paar können Trader bei Pepperstone auch die Paare XAUEUR, XAU/CHF und XAUC/CHF handeln. Das ist ideal, um von Währungsschwankungen zu profitieren und die Performance gezielt zu diversifizieren.

4. Zentralbankpolitik und Bilanzen

Zentralbanken haben einen erheblichen Einfluss auf die Goldmärkte. Änderungen in Zinsentscheidungen, Bilanzausweitungen oder geldpolitischen Strategien wirken sich unmittelbar auf den Goldpreis aus.

Es lohnt sich, die offiziellen Mitteilungen der Federal Reserve (Fed), der Europäischen Zentralbank (EZB) oder der Reserve Bank of Australia (RBA) – insbesondere Berichte, Protokolle und Pressekonferenzen – regelmäßig zu verfolgen.

5. Analysen und Marktkommentare von Experten

Das Analystenteam von Pepperstone unterstützt Trader mit fundierten Analysen, Marktupdates und Videokommentaren. Diese Inhalte helfen dabei, wirtschaftliche Daten einzuordnen und die möglichen Auswirkungen auf den Goldmarkt und andere Märkte zu verstehen.

Wie wende ich die technische Analyse im Goldhandel an?

Nachdem die grundlegenden Marktfaktoren und die allgemeine Richtung des Goldpreises bewertet wurden, spielt die technische Analyse eine entscheidende Rolle bei der Umsetzung konkreter Handelsentscheidungen.

Durch die Auswertung von Preisbewegungen, Chartmustern und Handelsvolumen lassen sich mögliche Einstiegs- und Ausstiegspunkte erkennen, egal, ob auf steigende oder fallende Kurse spekuliert wird.

Die technische Analyse kann auf verschiedenen Zeitebenen angewendet werden, von langfristigen Monatscharts bis zu Intraday-Charts im 15-Minuten-Takt. So lässt sich der richtige Zeitpunkt für den Markteintritt sowie für das Setzen von Stop-Loss- und Take-Profit-Niveaus besser bestimmen.

1. Unterstützung und Widerstand

Unterstützungsniveaus sind Preisbereiche, in denen ein Abwärtstrend häufig zum Stillstand kommt, da wieder Käufer in den Markt eintreten. Sie wirken wie ein „Boden“ im Chart.

Widerstandsniveaus markieren dagegen Preiszonen, in denen ein Aufwärtstrend ins Stocken gerät, weil Verkäufer Gewinne mitnehmen oder neue Short-Positionen eröffnen.

Das Beobachten dieser Schlüsselbereiche hilft dabei, Marktreaktionen vorherzusehen. Wiederholte Tiefpunkte können eine starke Unterstützung darstellen, während mehrfach getestete Hochpunkte als Widerstand fungieren. Auch psychologisch runde Kursmarken – etwa 2.000 USD pro Unze – spielen oft eine wichtige Rolle, da viele Trader ihre Orders an solchen Marken platzieren.

Viele Trader nutzen mehrere technische Indikatoren, um Unterstützungs- und Widerstandsniveaus zu bestätigen und ihre Analyse zu verfeinern.

Gleitende Durchschnitte (Moving Averages) dienen in Trendphasen häufig als dynamische Unterstützungs- oder Widerstandszonen, während Bollinger-Bänder Hinweise auf mögliche Trendwechsel oder Übertreibungen geben können.

Die Kombination dieser dynamischen Indikatoren mit historischen Kursbereichen und psychologisch wichtigen Preisniveaus kann die Treffsicherheit technischer Einschätzungen deutlich verbessern.

Das Handelsvolumen ist ein zentrales Bestätigungssignal in der technischen Analyse. Steigt das Volumen, während sich der Preis einem Unterstützungs- oder Widerstandsbereich nähert, spricht das für eine starke Marktüberzeugung in dieser Zone. Umgekehrt kann ein Ausbruch bei geringem Volumen darauf hindeuten, dass die Bewegung nicht nachhaltig ist und eine Kursumkehr wahrscheinlich wird.

Ein interessantes Phänomen der Marktstruktur ist der Wechsel der Rollen dieser Niveaus:

Wenn der Preis einen Widerstand erfolgreich durchbricht, wird dieses Niveau häufig zur neuen Unterstützung, die zukünftige Rücksetzer abfedert. Ebenso kann eine gebrochene Unterstützung zum neuen Widerstand werden, der Aufwärtsbewegungen begrenzt. Dieses Verhalten unterstreicht, wie wichtig es ist, frühere Preiszonen im Auge zu behalten, um künftige Reaktionen besser einschätzen zu können.

2. Trendlinien und Kurskanäle

Mithilfe von Trendlinien und Kurskanälen können Sie die vorherrschende Marktrichtung, den Rhythmus der Kursbewegungen sowie potenzielle Umkehr- oder Ausbruchsignale erkennen.

Eine Trendlinie wird in der Regel durch das Verbinden von zwei oder mehr signifikanten Hochs oder Tiefs gezogen. Eine aufsteigende Trendlinie verbindet zunehmend höhere Tiefs und steht für anhaltenden Kaufdruck. Eine absteigende Trendlinie verbindet dagegen zunehmend niedrigere Hochs und weist auf vorherrschenden Verkaufsdruck hin. Respektiert Gold wiederholt eine Trendlinie als Unterstützung oder Widerstand, zeugt dies von einer breiten Marktakzeptanz und verleiht der Linie Glaubwürdigkeit.

Händler verwenden häufig zwei parallele Trendlinien, um einen Kurskanal zu bilden. Dieser hilft dabei, Kursschwankungen innerhalb eines Trends zu visualisieren. Die obere Grenze dient dabei als Widerstand und die untere als Unterstützung. Wenn Gold innerhalb dieses Kanals gehandelt wird, können kurzfristig orientierte Händler Long-Positionen nahe der unteren Grenze eingehen und Gewinne nahe der oberen Grenze mitnehmen. Ein Ausbruch aus dem Kanal, insbesondere bei hohem Volumen, signalisiert häufig eine Trendbeschleunigung oder -umkehr.

_within_a_descending_channel_with_RSI_indicators_below.jpg)

Oszillatoren wie der 14-tägige RSI können die Trendanalyse ergänzen, indem sie überkaufte oder überverkaufte Bedingungen aufzeigen. Ein RSI über 70 deutet auf eine mögliche Überkaufsituation hin. Dies kann darauf hindeuten, dass sich die Aufwärtsdynamik abschwächt und es zu einem kurzfristigen Rückgang kommt. Ein RSI unter 30 deutet auf eine Überverkaufssituation hin, was auf eine mögliche Erholung hindeutet. In Kombination mit Trendlinien, Kanälen und Volumen ermöglicht der RSI eine umfassendere Einschätzung der Wahrscheinlichkeit einer Fortsetzung oder Umkehrung des Trends.

3. Candlestick-Muster

Kerzenformationen sind entscheidend für die Identifizierung potenzieller Trendumkehrungen oder -fortsetzungen. Einzelkerzenmuster wie „Der Hammer” oder „Der hängende Mann” treten häufig an Trend-Extremen auf und signalisieren einen nachlassenden Verkaufs- oder Kaufdruck. Mehrkerzenmuster wie das Engulfing-Muster deuten auf eine plötzliche Verschiebung des Gleichgewichts zwischen Angebot und Nachfrage hin.

Fortsetzungsmuster, wie beispielsweise drei aufeinanderfolgende bullische bzw. bärische Kerzen oder Flaggen und Rechtecke, deuten auf eine Beibehaltung der Dynamik nach einer kurzfristigen Konsolidierung hin. Um die Zuverlässigkeit zu erhöhen, können Sie Kerzenmuster mit Unterstützungs- und Widerstandslinien, Trendlinien oder dem Volumen kombinieren. So deutet beispielsweise ein bullisches Engulfing-Muster bei starkem Volumen auf eine höhere Wahrscheinlichkeit einer Umkehr hin, während Fortsetzungsmuster, die durch Kanalunterstützung verstärkt werden, die Wahrscheinlichkeit einer Trendfortsetzung erhöhen.

4. Fibonacci-Retracements und -Erweiterungen

Fibonacci-Tools werden häufig verwendet, um potenzielle Unterstützungs-, Widerstands- und Zielniveaus zu identifizieren. In der Regel wählen Trader einen markanten Trendschwung aus, markieren das Hoch und das Tief und berechnen die Retracement-Niveaus (z. B. 38,2 %, 61,8 %). Diese Niveaus entsprechen oft potenziellen Rückzugs- oder Konsolidierungszonen und helfen bei Entscheidungen zum Einstieg und zum Take Profit.

Fibonacci-Erweiterungen projizieren dagegen mögliche Ziele für eine Fortsetzung des Trends (z. B. 161,8 % oder 261,8 %) und können Ihnen dabei helfen, Gewinnziele festzulegen oder die Stärke eines Trends einzuschätzen.

5. Ausbrüche vs. falsche Ausbrüche

Um echte von falschen Ausbrüchen zu unterscheiden, müssen Sie zunächst beurteilen, ob der Kurs ein wichtiges technisches Niveau – wie beispielsweise ein vorheriges Hoch oder Tief – überzeugend überschreitet. Ein echter Ausbruch schließt in der Regel über diesem Niveau und nicht nur an einem einzigen Tag.

Das Volumen dient als wichtige Bestätigung. Echte Ausbrüche gehen oft mit einem deutlichen Anstieg des Volumens einher, was eine breite Marktbeteiligung widerspiegelt. Ausbrüche mit geringem Volumen sind dagegen eher falsche Bewegungen.

Auch die anschließende Kursentwicklung ist aufschlussreich. Bei einem echten Ausbruch wird das neue Unterstützungs- (oder Widerstandsniveau) oft erneut getestet, bevor der Trend fortgesetzt wird. Ein falscher Ausbruch kehrt dagegen schnell um.

Die Kombination aus Trendlinien, Kanälen und gleitenden Durchschnitten hilft zusätzlich bei der Bestätigung der Gültigkeit eines Ausbruchs. Überschreitet beispielsweise ein Kurs die obere Grenze eines Kanals oder den langfristigen gleitenden Durchschnitt ohne Unterstützung durch das Volumen und fällt dann wieder in den Kanal zurück, handelt es sich wahrscheinlich um einen falschen Ausbruch.

Zusammenfassend lässt sich sagen, dass die technische Analyse im Goldhandel „unscharfe Intuition” in umsetzbare Regeln umwandelt und klare Leitlinien für die Umsetzung von Strategien liefert. Mit zunehmender Erfahrung werden Sie feststellen, dass technische Instrumente weit über diese Grundlagen hinausgehen. Wichtig ist, dass der Goldhandel nicht nur die Identifizierung von Gewinnchancen, sondern auch die Festlegung einer strengen Stop-Loss-Logik zum Risikomanagement erfordert.

Beachten Sie auch, dass bestimmte Fundamentaldaten – wie beispielsweise Goldkäufe der Zentralbanken – im Gegensatz zu Aktien mit Verzögerung veröffentlicht werden. Wenn Sie sich ausschließlich auf Charts verlassen, können Sie möglicherweise nicht alle Marktinformationen sofort erfassen. Effektive Entscheidungen entstehen durch die Kombination von technischer Analyse und fundamentalen Erkenntnissen, um ein umfassendes Handelsframework zu bilden.

Wie kann ich einen Gold-Handelsrahmen aufbauen und wie unterstützt mich Pepperstone dabei?

Nachdem Sie die fundamentalen und technischen Faktoren, die den Goldpreis beeinflussen, berücksichtigt haben, können Sie einen umfassenden Handelsrahmen erstellen und einen standardisierten Vorbereitungsworkflow einrichten. Gehen Sie dazu wie folgt vor:

- Makroökonomische Bewertung - Beginnen Sie mit einer Analyse des aktuellen wirtschaftlichen Umfelds, der geldpolitischen Trends, der Inflationsaussichten und der allgemeinen Marktstimmung. Dies verdeutlicht die fundamentale Logik hinter den Goldpreisen und gibt die Richtung für die nachfolgenden Operationen vor.

- Strategieauswahl - Auf der Grundlage Ihrer makroökonomischen Bewertung und der Marktstruktur wählen Sie die geeignete Handelsstrategie aus: Long- oder Short-Positionen, mit dem Trend oder innerhalb einer Spanne mit Swing-Strategien.

- Technische Bestätigung - Identifizieren Sie wichtige technische Signale in den Charts, z. B. Trendlinienbrüche, Umkehrungen von Unterstützungs- bzw. Widerstandslinien oder bestimmte Kerzenmuster. Legen Sie anschließend Einstiegspunkte, Stop-Loss-Niveaus und Gewinnziele fest, um sicherzustellen, dass Ihre Entscheidungen durch klare Belege gestützt werden.

- Risikomanagement - Setzen Sie Stop-Loss-Limits und Positionsgrößen strikt durch. Berücksichtigen Sie dabei Ereignisrisiken oder sichern Sie sich mit verwandten Vermögenswerten ab. So stellen Sie sicher, dass potenzielle Verluste innerhalb akzeptabler Grenzen bleiben.

- Überprüfung nach dem Handel - Dokumentieren Sie die Gründe für jeden Handel, Abweichungen bei der Ausführung, emotionale Einflüsse, Gewinne und Verluste sowie Verbesserungspunkte, um Ihre zukünftige Entscheidungsfindung zu optimieren.

Beim erfolgreichen Goldhandel geht es im Wesentlichen nicht darum, den Markt perfekt vorherzusagen, sondern Ihre Analyse in einen wiederholbaren, ausführbaren und risikogesteuerten Prozess umzuwandeln. Nachhaltiger Handel lässt sich auf drei wesentliche Punkte reduzieren: genaue Wahrscheinlichkeitsbewertung, klare technische Bestätigung und strenge Risikokontrolle.

Während dieses gesamten Prozesses bieten die Plattformen und Tools von Pepperstone leistungsstarke Unterstützung. Sie können Gold-CFDs auf MT4/MT5, cTrader, TradingView oder der eigenen Plattform von Pepperstone handeln und integrierte technische Indikatoren und Charting-Tools für die Marktanalyse nutzen. Pepperstone unterstützt eine Vielzahl von Ordertypen, darunter Limit-Orders, Stop-Loss-Orders und Trailing Stops, und bietet Risikomanagement-Funktionen wie Margin-Warnungen und Schutz vor einem negativen Saldo. All dies hilft Ihnen, potenzielle Risiken zu kontrollieren und Strategien sicherer umzusetzen.

Sind Sie bereit, Ihre Reise in den Goldhandel zu beginnen? Eröffnen Sie noch heute ein Konto bei Pepperstone!

Goldhandel FAQs

Ist Gold-CFD eine gute Investition?

Ein Gold-CFD kann sinnvoll sein, wenn jemand:

- kurzfristig handeln möchte,

- sowohl auf steigende als auch auf fallende Preise spekulieren will,

- flexibel bleiben möchte und

- aktiv ein striktes Risikomanagement einsetzt.

Für einen langfristigen Vermögensaufbau eignen sich Gold-CFDs jedoch in der Regel nicht, da sie Finanzierungskosten verursachen und stark gehebelt sind.

Wann sollte man Gold traden?

Es gibt keinen universell „besten“ Zeitpunkt, aber viele Trader achten auf:

- hohe Marktvolatilität

- wichtige Makrodaten (z. B. US-Inflation, FOMC-Entscheidungen)

- geopolitische Ereignisse

- US-Dollar-Stärke oder -Schwäche

- technische Niveaus wie Unterstützungen, Widerstände oder Ausbrüche

Für CFDs gilt: Der Handel ist fast rund um die Uhr möglich – die aktivsten Phasen sind rund um die Überschneidungen der Handelszeiten in Europa und den USA.

Soll man noch Gold kaufen?

Ob eine Goldposition sinnvoll ist, hängt von mehreren Faktoren ab, die individuell unterschiedlich ausfallen können. Dazu gehören das persönliche Risikoprofil, der geplante Anlagehorizont und die Einschätzung zentraler Einflussgrößen wie Inflation, Entwicklung des US-Dollars und geopolitische Rahmenbedingungen.

Fest steht, dass Gold auch im Jahr 2025 stark gehandelt wurde und weiterhin als etablierter Baustein zur Wertaufbewahrung und Absicherung gilt. Ob ein Einstieg sinnvoll ist, lässt sich jedoch nur auf Basis der eigenen Ziele und Erwartungen beurteilen.

Worin besteht der Unterschied zwischen Gold-Futures und Gold-CFDs?

Der wichtigste Unterschied zwischen Gold-Futures und Gold-CFDs liegt in ihrer Struktur und ihrer Handelsumgebung. Gold-Futures werden an regulierten Terminbörsen wie der CME gehandelt und besitzen feste Laufzeiten, die zu einem bestimmten Verfallstag enden. Die Kontraktgrößen sind standardisiert und in der Regel deutlich größer, was höhere Marginanforderungen mit sich bringt. Futures sind daher stärker reguliert, komplexer aufgebaut und werden häufig für Hedging-Zwecke oder von institutionellen Marktteilnehmern genutzt.

Gold-CFDs hingegen werden außerbörslich über CFD-Broker gehandelt und haben keine festen Laufzeiten. Die Positionsgrößen können sehr flexibel gewählt werden, und die Marginanforderungen variieren je nach Broker. Aufgrund ihrer Struktur eignen sich CFDs vor allem für kurzfristiges Trading und sind in ihrer Handhabung weniger komplex als Futures.

Was ist der Unterschied zwischen Gold-ETF und Gold-CFD?

Ein Gold-ETF bildet den Goldpreis passiv ab und wird wie eine Aktie an der Börse gehandelt. Er eignet sich für mittel- bis langfristige Anlagen und unterliegt Börsenöffnungszeiten.

Ein Gold-CFD ist ein Derivat, mit dem Trader kurzfristig auf steigende oder fallende Goldpreise spekulieren. CFDs erlauben Leverage, Positionen können fast rund um die Uhr eröffnet oder geschlossen werden, und Gold muss nicht physisch hinterlegt sein.

Warum sind Gold-ETFs in Deutschland nicht zugelassen?

Gold-ETFs dürfen in Deutschland nicht als ETF zugelassen werden, weil UCITS-Regeln eine Diversifikation des Fondsvermögens vorschreiben. Ein Fonds, der ausschließlich physisches Gold hält, wäre nicht diversifiziert und entspricht damit nicht den EU-Regulierungsanforderungen für ETFs.

Deshalb gibt es in Deutschland stattdessen: Gold-ETCs (Exchange Traded Commodities), die rechtlich Schuldverschreibungen sind und besichert oder unbesichert vorliegen können. Diese sind funktional ähnlich, aber regulatorisch keine ETFs.

Wie funktioniert Handel mit CFD?

Beim CFD-Handel wird die Kursdifferenz zwischen Eröffnung und Schließung einer Position abgerechnet – nicht der Basiswert selbst gehandelt.

Grundprinzip:

- Trader eröffnen eine Long-Position, wenn sie einen steigenden Preis erwarten.

- Trader eröffnen eine Short-Position, wenn sie einen fallenden Preis erwarten.

- Der Broker verlangt eine Margin, also nur einen Bruchteil des Positionswerts.

- Gewinne oder Verluste ergeben sich aus der Preisbewegung und der Positionsgröße.

- Overnight-Gebühren fallen an, wenn Positionen über Nacht gehalten werden.

Welche Nachteile haben CFDs?

CFDs bringen mehrere Nachteile mit sich, die besonders für unerfahrene Trader relevant sind:

- Durch die Hebelwirkung können schon kleine Marktbewegungen zu überproportionalen Verlusten führen, was das Risiko im Vergleich zu ungehebelten Produkten deutlich erhöht.

- Zusätzlich fallen bei Positionen, die über Nacht gehalten werden, Finanzierungskosten wie Swap- oder Overnight-Gebühren an, was den Handel langfristig teurer machen kann.

- Für Einsteiger kann der CFD-Handel komplex sein, da schnelle Kursbewegungen – insbesondere in volatilen Märkten – zu emotionalen Entscheidungen und Fehltrades führen können.

- Zudem eignen sich CFDs nicht für langfristige Buy-and-Hold-Strategien, da sie primär für aktives, kurzfristiges Trading konzipiert sind und bei längerfristigen Positionen zusätzliche Kosten entstehen.

Das hier bereitgestellte Material wurde nicht in Übereinstimmung mit den gesetzlichen Anforderungen erstellt, die darauf abzielen, die Unabhängigkeit von Anlageforschung zu fördern, und wird daher als Marketingkommunikation betrachtet. Obwohl es keinerlei Handelsverbot vor der Verbreitung von Anlageforschung unterliegt, werden wir nicht versuchen, davon zu profitieren, bevor wir es unseren Kunden zur Verfügung stellen. Pepperstone stellt nicht dar, dass das hier bereitgestellte Material genau, aktuell oder vollständig ist, und sollte daher nicht als solches angesehen werden. Die Informationen, ob von einem Dritten oder nicht, sollten nicht als Empfehlung angesehen werden; oder als Angebot zum Kauf oder Verkauf; oder als Aufforderung zum Kauf oder Verkauf eines Wertpapiers, Finanzprodukts oder Instruments; oder zur Teilnahme an einer bestimmten Handelsstrategie. Es berücksichtigt nicht die finanzielle Situation oder Anlageziele der Leser. Wir raten allen Lesern dieses Inhalts, ihren eigenen Rat einzuholen. Ohne die Zustimmung von Pepperstone ist die Vervielfältigung oder Weitergabe dieser Informationen nicht gestattet.