What is the definition of hedging

Taking a hedge can mean different strategies in trading. One is based around money management; the others are used by trading correlated products. The main objective of a hedge is to limit the potential downside of a trade or portfolio.

Hedging can be simplistic or an advanced strategy that requires an algorithm to execute the separate legs.

Figure 1 Hedging. Not to be mistaken for a hedge

A simple Hedging Strategy – the direct hedge

Let us look at an example:

You have taken a long (Buy) position in EURUSD as your medium-term analysis highlights that the bias is bullish or positive for the major currency pair. You are 5 units long.

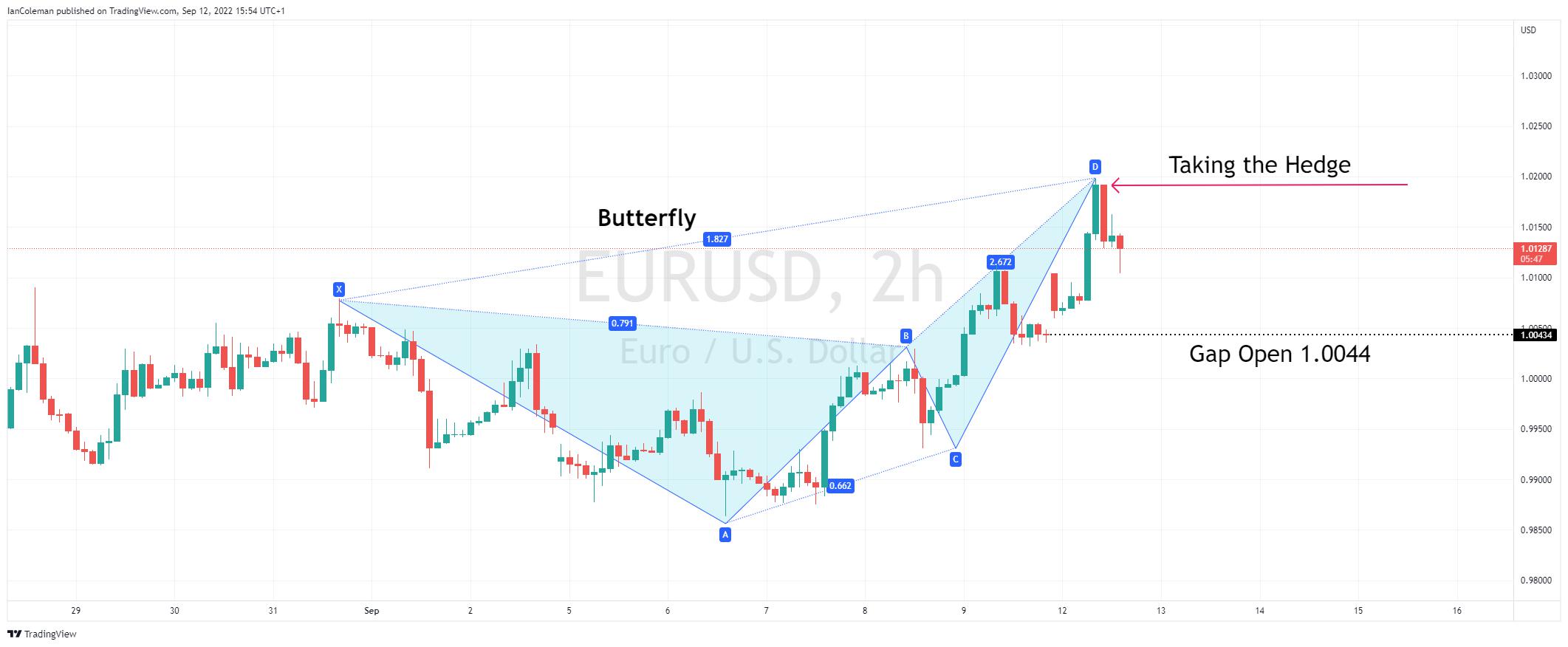

A ‘gap open’ happened this morning and you are conscious that gaps or windows normally get closed. You can also see a short-term reversal pattern called a Butterfly. You don’t want to close your position but are wary of a correction to the downside.

You sell 3 units at 1.0175 with a target level of 1.0045, the gap closed. You have hedged 3 units and now have an overall net long position of 2 units.

You look to take the hedge off at 1.0045. This will result in a profitable hedge trade (3 units x 130 pips). It will also result in the full 5-unit long position coming back into play.

What happens if your hedge is incorrect?

Your hedge trade does not move to your desired level. What next?

- You can place a stop loss on your hedge position resulting in a loss being taken

- You can keep both long and short positions open knowing that you are net long 2 units. You aim for the original target (limit) closing both positions at the same time.

Figure 2 Hedging. EURUSD scenario

Hedging using options

The holder of a currency option has the right, but not the obligation, to exchange a currency pair at a certain price at the expiry date.

It can sound complicated, but it is worth the time and effort to investigate further. The important part of the last sentence is the right but not the obligation. You don’t have to take the ‘option’!

Let us look at another example using the EURUSD scenario above:

You have taken a long position in 5 units. Instead of taking the direct hedge you take a PUT OPTION at 1.0045.

If the downside move extends lower, you will lose on your spot FX EURUSD long position but can execute your option to sell EURUSD at 1.0045.

Complicated Hedging Techniques

Some hedging techniques are highly complex. They may even extend to the point of arbitrage*. They may involve multiple correlated currency pairs or correlated products like the Canadian Dollar (CAD) and Oil.

Can I hedge at Pepperstone

Yes, Pepperstone offers the ability to hedge.

*Arbitrage is the technique of taking multiple trades at the same time to lock in a profit.

Related articles

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。