Assessing The Inflation Outlook: Not Yet Out Of The Woods

First things first, it’s important to recognise the progress that has been made across DM in restoring a level of price stability. Having peaked around, or north of, 10% in the second half of 2022, the most rapid policy tightening cycle in four decades, coupled with the fading of supply-driven price pressures due to pandemic-related distortions, has seen headline price measures more than half in the subsequent 18 months.

However, as is clear in the above chart, progress has somewhat stalled over the last quarter or so – longer Stateside – with headline inflation having begun to stabilise at still-elevated levels. While a substantial chunk of this is due to a recent resurgence in energy prices, allowing core (ex-food and energy) price measures to continue to decline, this lack of further disinflationary progress at the headline level is likely to be of increasing concern as time goes on.

Before examining where risks to the inflation outlook lie, it’s key to acknowledge that the progress made thus far in restoring price stability has been ‘immaculate’, i.e. not coming – as many, including I, had expected – at the cost of a sharp deterioration in economic growth, or a significant loosening in global labour markets.

In fact, it was notable how, at the January FOMC press conference, Chair Powell noted that stronger growth is no longer seen as a problem, and that the Fed are ‘not looking for a weaker labour market’. These comments were both in rather sharp contrast to Powell, and the FOMC’s, previous stance that a period of ‘below-trend growth’ would be needed in order to bring inflation towards target. As with the prior, pre-covid cycle, evidence would suggest that the Phillips curve remains essentially flat.

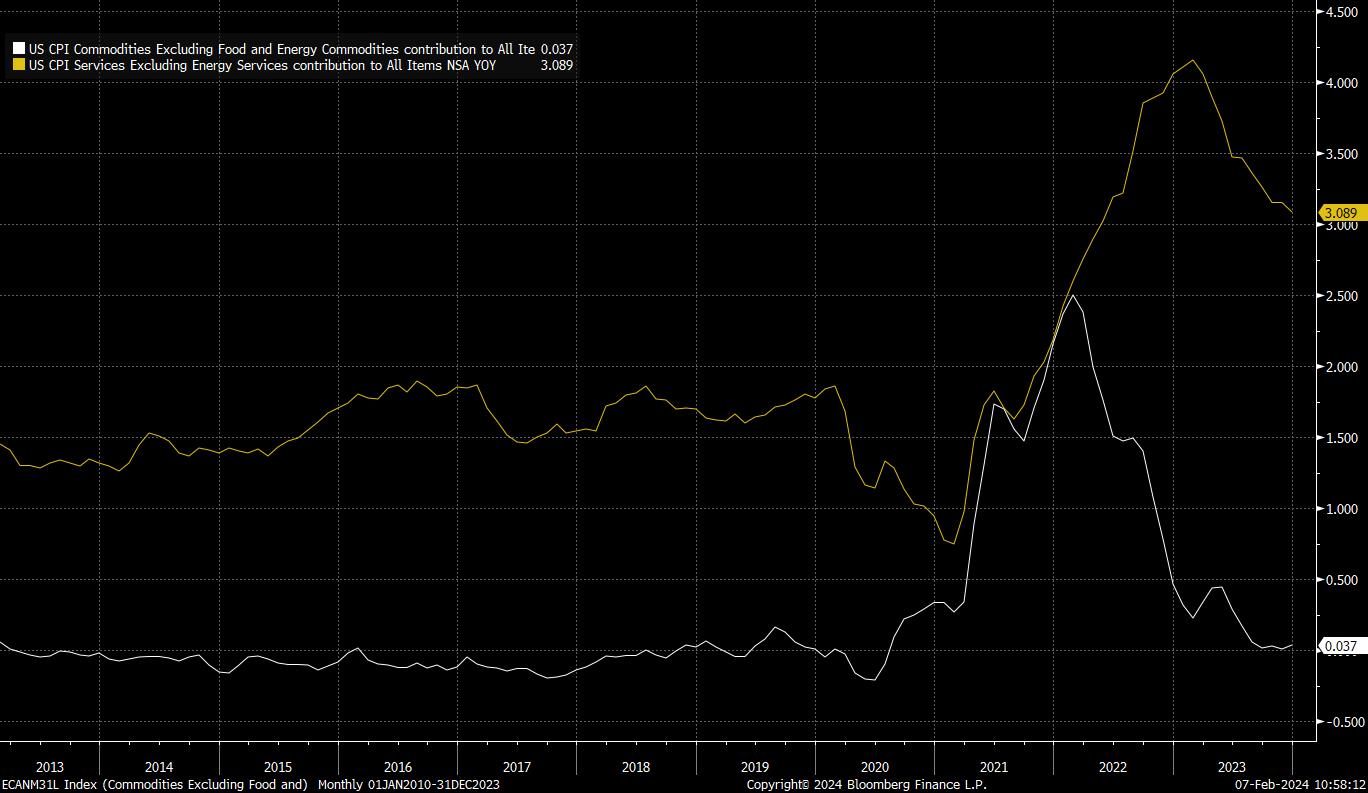

Despite all that, DM economies remain far from ‘out of the woods’ on the inflation front. While, as discussed, headline price gauges have made substantial progress towards target, it is important to recognise that much of this progress has come as a result of goods disinflation, as services prices have remained relatively ‘sticky’ at elevated levels.

This is true of the US.

While also being true of inflation here in the UK.

This points to an interesting dynamic over coming months. With economic momentum showing little sign of waning, particularly in the US, and labour markets set to remain tight, all signs point towards consumer spending remaining resilient. Such resilience should maintain upward pressure on services prices, particularly when considering that the lagged impacts of prior tightening appear less detrimental than had been feared, with effective mortgage rates in the US remaining below 4%, having risen just 50bp during the hiking cycle.

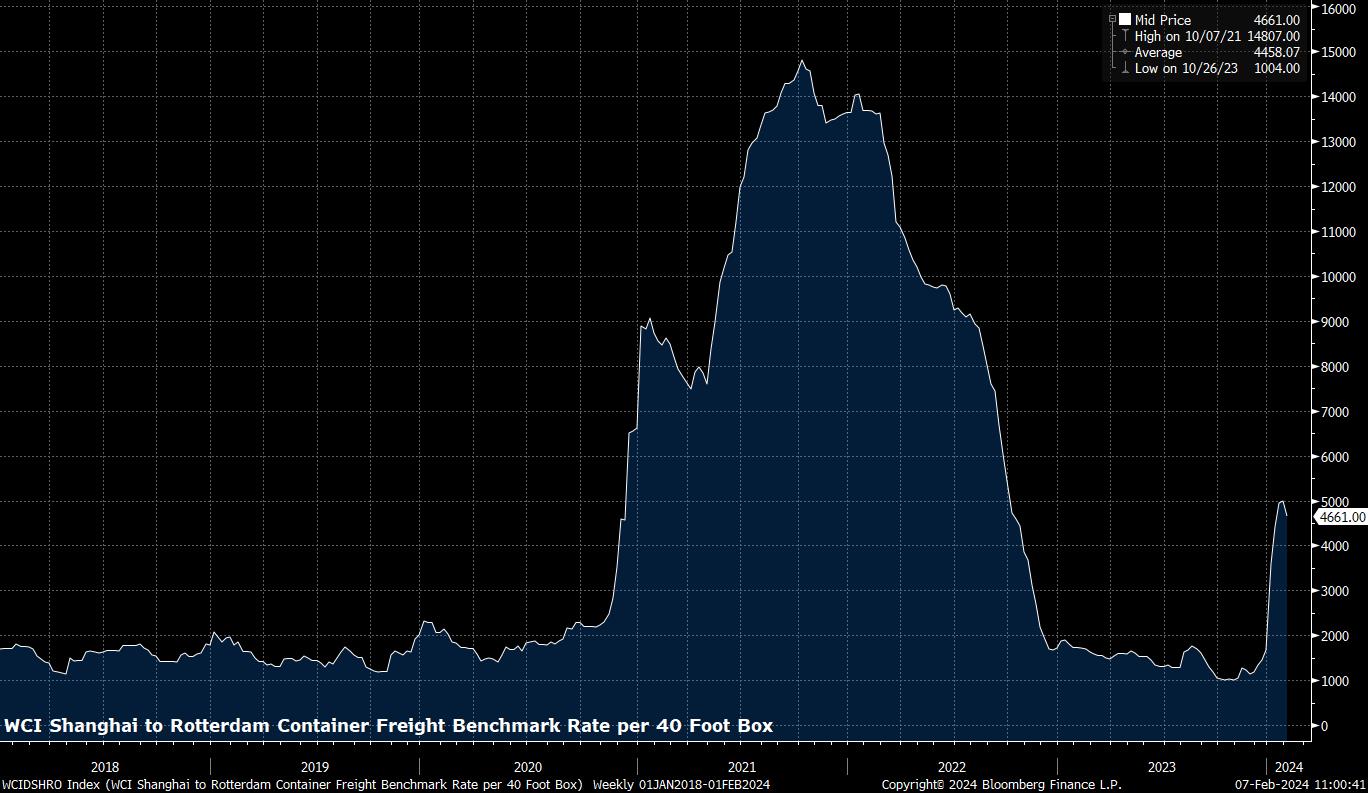

At the same time, the risks of a resurgence in goods inflation remain elevated, most notably as a result of continued, and escalating, geopolitical tensions in the Middle East, causing numerous shipping firms to avoid the Red Sea, resulting in a substantially longer – and more expensive – journey around the Cape of Good Hope. Benchmark container rates from China to Europe have already quadrupled since the turn of the year, a price rise that is likely to feed along the value chain, with question marks persisting over the ability of firms to absorb these costs.

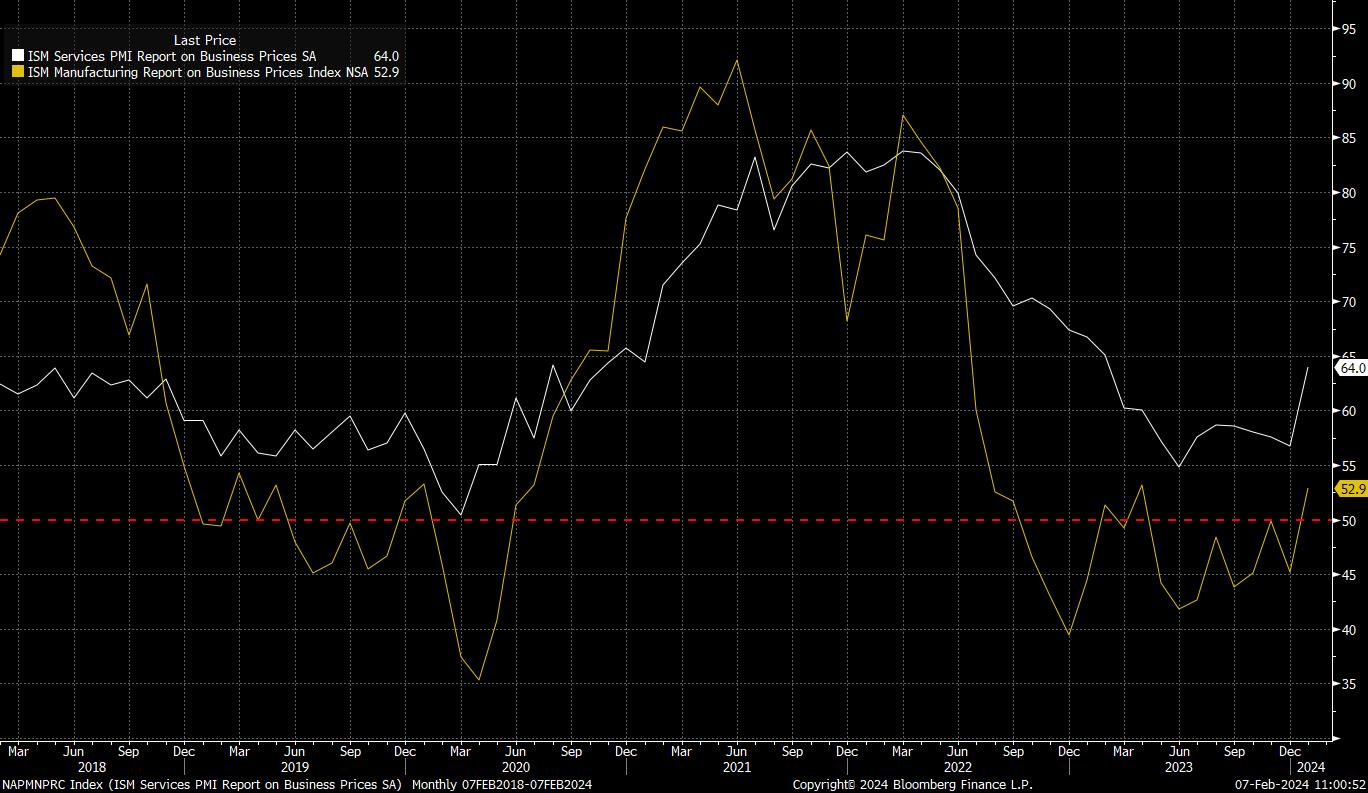

January’s ISM PMI surveys provided an important reminder that price pressures remain within the economy. For the manufacturing sector, the prices paid gauge printed north of the 50 mark – implying an MoM increase – for the first time in nine months, while the comparable services gauge rose to 64.0, its highest in almost a year.

The potential dynamic here is such that services inflation remains sticky, at the same time as goods inflation makes a resurgence due to a rise in shipping costs, thus exerting significant upward pressure on overall headline inflation. Of course, such a dynamic is unlikely to impact all DM economies equally, with the eurozone substantially more exposed than others; incidentally, posing a conundrum for the ECB, who are also grappling with an increasingly sick German economy, and anaemic economic growth.

More broadly, for policymakers, these upside inflation risks point to the easing cycle beginning later than markets currently foresee, even after the hawkish repricing that has been seen since the start of the year.

This is due to a likely desire to err on the side of caution, and maintaining restrictive policy for too long, as opposed to easing prematurely. Such a mentality seemingly stems from two sources. Firstly, continued scarring from the experience of dismissing price pressures as ‘transitory’ during 2021, and the subsequent erosion of credibility caused once forced into a rapid tightening cycle. And, secondly, a desire to avoid a ‘stop-start’ easing cycle, whereby it becomes necessary to hit pause on rate cuts for a period or, worse, re-tighten policy due to a resurgence in inflation.

For markets, this all points to the hawkish repricing of rate expectations continuing, posing a downside risk to fixed income in the process, particularly in locales – such as the US – where growth is also holding up substantially better than consensus expected. That dynamic should also see upside USD risks persist, particularly against G10s where earlier cuts are likely, namely the EUR, the CHF, and the NZD.

Related articles

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。