Los CFDs son instrumentos complejos y conllevan un alto riesgo de perder dinero rápidamente debido al apalancamiento. El 80% de las cuentas de inversores minoristas pierden dinero al operar CFDs con este proveedor. Debes considerar si comprendes cómo funcionan los CFDs y si puedes permitirte asumir el alto riesgo de perder tu dinero.

- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

The Daily Fix: USDCNH leads the FX markets as we turn to the FOMC meet

The US500 (closed +0.5%) for example and had another look above 3400. However, there was little conviction to hold the figure as yet another stimulus bill was rejected in the House. This time by the Democrats, causing some tension in markets and the idea many once had of US personal income rising to say 15% by October, after getting a boost from fiscal checks, is becoming a pipe dream. This is more likely to be closer to 3% by December.

At one point the NAS100 fell 1.1% from the session high, but buyers came back in as we headed in the last hour and the index settled +1.2%. Some focus on the prospects for Oracle’s (closed +2.5%) bid for Tiktok, given the offer doesn’t include the payment Trump was demanding. Names like Tesla +7.1% and Netflix +4.1% have worked well and the interesting aspect about these names is the call open interest has not spiked, so the Robinhood/Softbank OTM call buying set are not as active at this point and I guess that can be skewed both positive and negative.

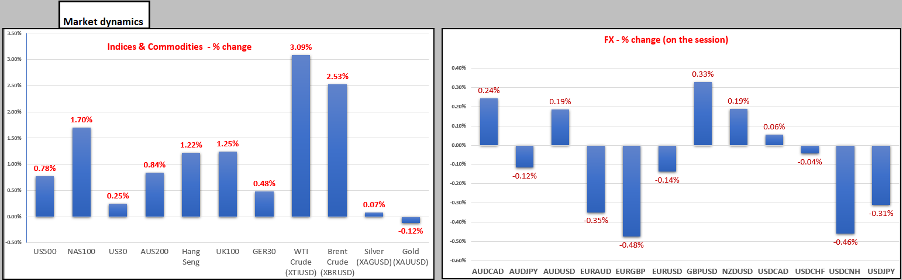

(Price moves - server close to present)

Generally, economic data was better. With China’s higher frequency data all looking good (industrial production +5.6%), the German ZEW survey was strong (‘Expectations’ 77.4 vs 69.5 eyed, and ‘Current Situation’ -66.2 vs -72). The NY manufacturing print came in at 17 vs 6.9, although US industrial production was a touch weaker at 0.4%. The bulls will take this improvement, although there was no real lift in inflation expectations and the US bond market was remarkably quiet, despite a 3% rally in crude. I guess it's all about the Fed and its meeting tomorrow morning at 4 am AEST and traders managing exposures accordingly.

After writing a punky piece on the US election yesterday I thought it interesting that Michigan state Senate passed a bill to count mail-in votes the day prior to the election. Who knows, if other states adopt this practice then it could dramatically increase the speed at which we know the result, with many fearing the idea that it could be days and weeks before we get a result, especially if the notion is contested.

In FX markets the USDX is largely unchanged and it won’t surprise to see gold also unmoved on the day. Although, we did see some vol around 00:00 AEST, with the metal dropping from 1966 to 1950, with the USD finding buyers and risk coming out the market on the House fiscal news. There have been no real trends to speak of, with GBPUSD finding shorts covering, taking the pair into 1.2926. Although, it came back below the figure and AUDUSD has also retreated from the session high of 0.7343.

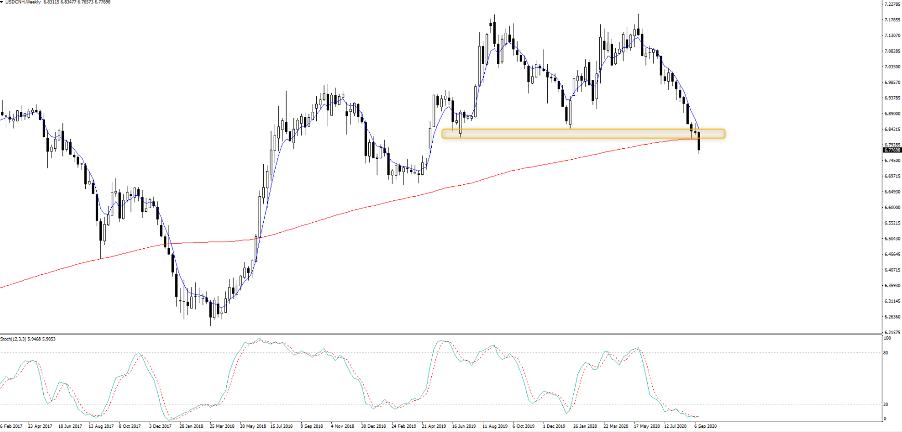

USDCNH was all the talk yesterday, with price taking out the 200-week MA and smashing the 6.8000 level - the effects here were felt across G10 and EM FX, with USD finding sellers across the spectrum as the yuan rallied. When you see the sell-off in China’s bond market and the fact 10-year bonds trade with a 243bp premium to USTs we can argue this reflects a relative economic divergence, but it also encourages yield seekers and capital will hunt this out every day. The real question isn't to celebrate China allowing the yuan to strengthen but whether it should be far stronger than current levels.

Top – USDCNH (inverted)

Lower – China 10yr govt bond yield – UST10s

(Source: Bloomberg)

So, all eyes on the Fed statement (4am AEST) and the Jay Powell presser (04:30 AEST). While I have suggested in prior notes that the Fed should go hard, as credibility is everything, I do question if politics will be a factor. Will they hold off from really rolling out the big guns and giving us full definition until December? It’s not out the realms of possibility. Either way, regardless of what I think, FX implied vols hardly scream of a market expecting massive price moves and I will update Telegram later in the day on expected movement when the options markets get some action.

We watch for the Fed’s new economic projections, any clues on a potential shift in QE purchases to longer-dated durations, the lowering of the long-term dot projection (from 2.5% to 2%), new forward guidance and to not lift PCE inflation until it reaches 2% on a sustained basis. Let’s see, but the USD will be key and depending on the reaction in inflation expectations (breakevens) will determine moves in ‘real’ Treasury yields and this is where the NAS100, the USD, gold etc will take its direction.

Related articles

Artículos más leídos

¿Listo para operar?

Comenzar es fácil y rápido – incluso con un depósito pequeño. Aplique en minutos con nuestro simple proceso de solicitud.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.