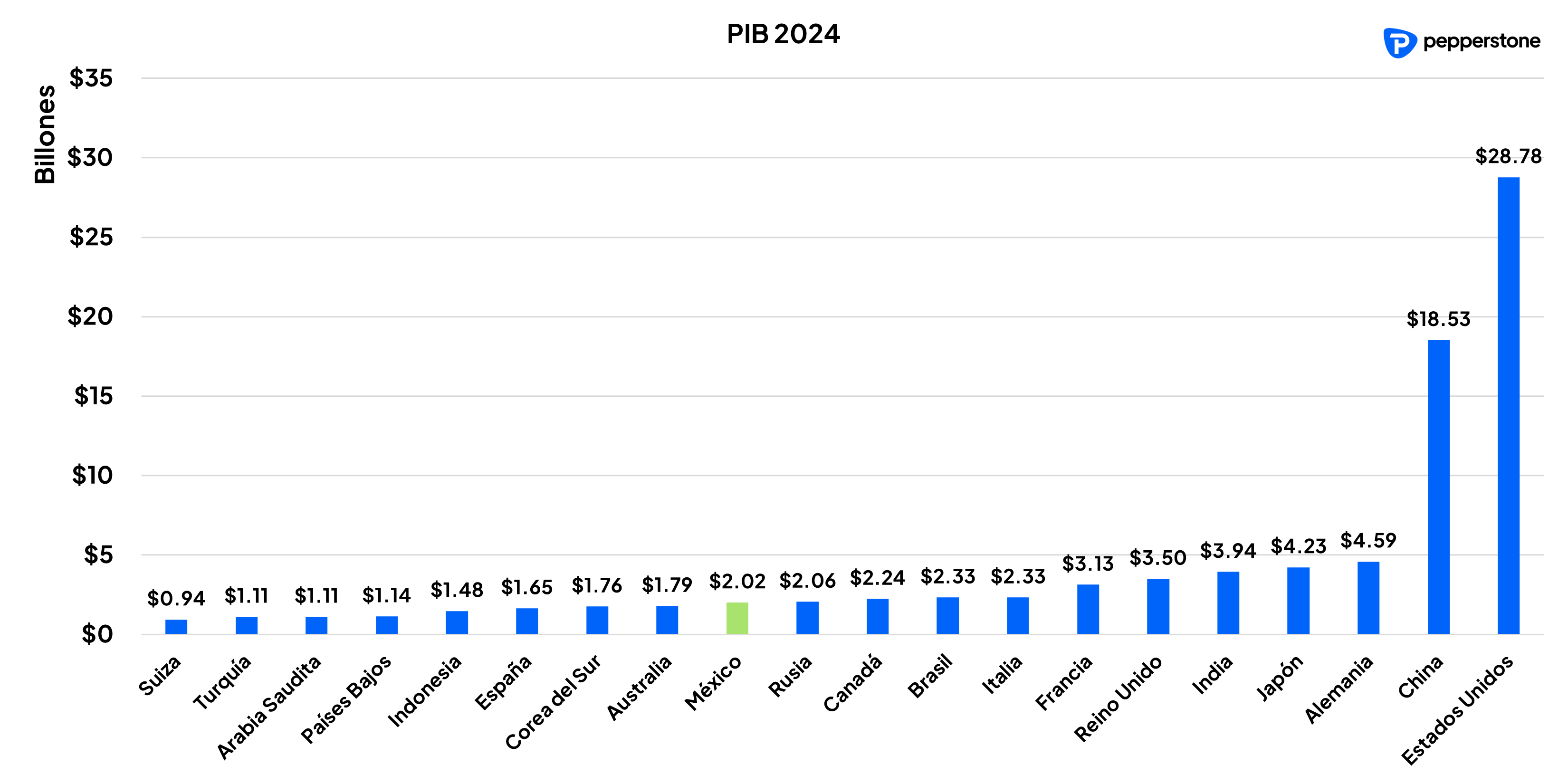

GDP 2024 (Projected)

What is the Mexican Peso?

The Mexican Peso (symbol: $; code: MXN) is the official currency of Mexico and is quite significant in the forex market. Besides representing one of the major global economies, it is preferred by traders as a proxy for exposure to the thematic of emerging markets. Its history dates back to colonial times, but it was not until 1821, when Mexico gained independence, that the Mexican Peso was officially established as the country’s currency. The Mexican Peso is issued by the Bank of Mexico, the institution responsible for the country's monetary policy and economic stability.

Why Trade the Mexican Peso?

- Volatility and Opportunities: The MXN tends to be more volatile than other major currencies, which can translate into higher profit opportunities (and risks) for traders.

- Diversification: Including MXN in your portfolio can help diversify trading operations and reduce exposure to other major currencies.

- Correlations: The Mexican Peso often shows correlations with commodities, opening up the possibility for interesting trading strategies.

- Carry Trade: Emerging markets often implement monetary policies that result in higher interest rates compared to major currencies. This makes the Mexican Peso (MXN) an attractive option for carry trade strategies, allowing investors to benefit from wider interest differentials when market conditions allow it.

- Expanded Access in Pepperstone: Now, at Pepperstone, you can trade MXN not only against the US Dollar (USD) but also against the Euro (EUR), British Pound (GBP), Canadian Dollar (CAD), and Japanese Yen (JPY). This gives you even more flexibility to take advantage of market movements!

Factors Influencing the Mexican Peso

The value of MXN is affected by a variety of factors, including:

- Monetary Policy: Decisions by the Bank of Mexico regarding interest rates.

- Global Economy: Global economic growth and commodity prices (Mexico is a major oil producer).

- Relationship with the United States: Given the close trade relationship between the two countries, US policies and economy significantly impact the peso.

- Investment Flows: The inflow and outflow of foreign capital in Mexico.

- Recently, this aspect has gained more relevance as Mexico has become one of the main beneficiaries of global fragmentation and trends such as "friendshoring" and "nearshoring."

- Political Events: Both domestic and international political events can cause volatility in the MXN.

Pepperstone Reduces Spreads on MXN Pairs

Good news for LATAM traders! Pepperstone has reduced spreads on all currency pairs that include the Mexican Peso. This means you can trade MXN at a lower cost, improving operational conditions for the peso.

Take Advantage of This Opportunity

If you are looking to diversify your trading operations and explore new opportunities in the forex market, the Mexican Peso can be an excellent option. With Pepperstone's reduced spreads, there has never been a better time to start trading MXN!

Start today! Open an account at Pepperstone and discover the advantages of trading the Mexican Peso.

做好交易准备了吗?

只需少量入金便可随时开始交易。我们简单的申请流程仅需几分钟便可完成申请。

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。