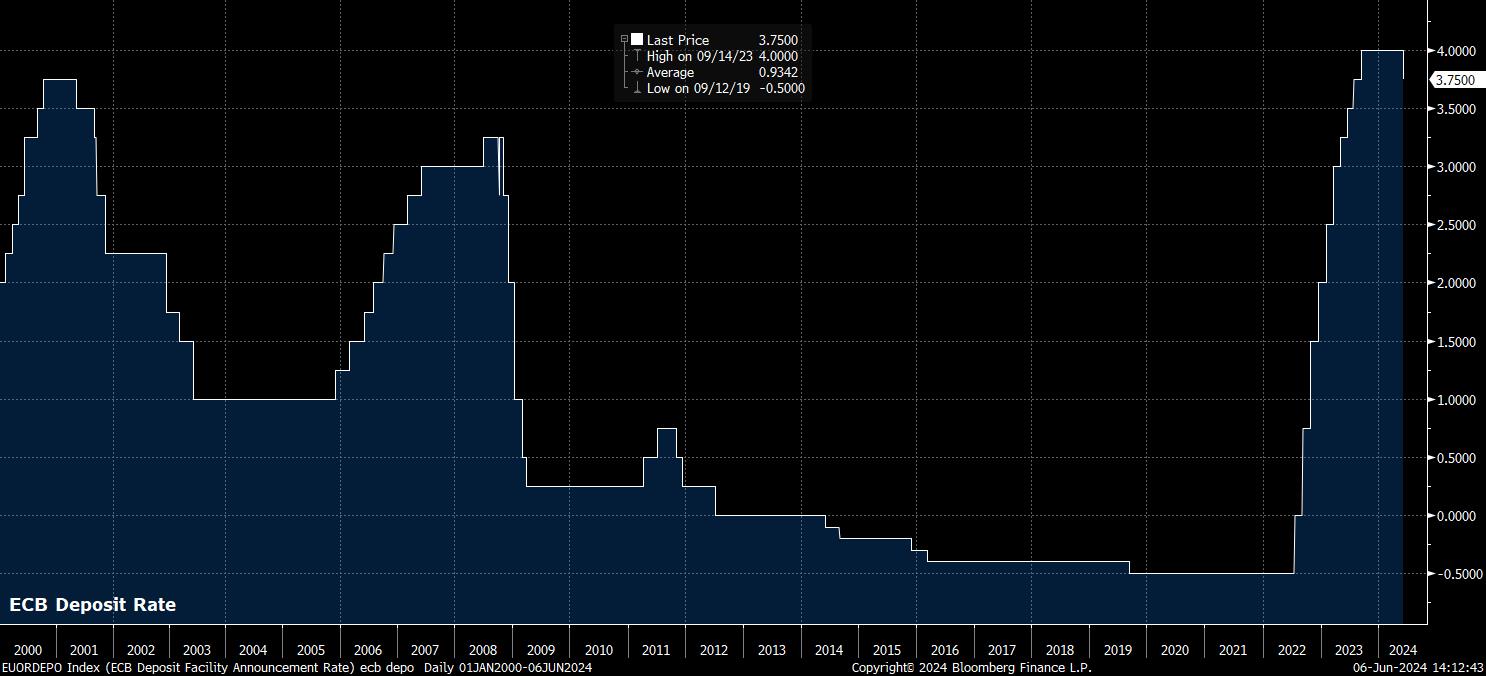

As had been fully expected, and discounted by financial markets, the ECB’s Governing Council delivered a 25bp cut at the conclusion of the June policy meeting, bringing the deposit rate to 3.75%. Such a move marks the first rate shift since the ‘insurance hike’ last September, and the first cut since back in 2019, when ‘Super’ Mario Draghi was still at the helm. With the ECB having delivered a rate cut, four G10 central banks have now embarked on easing cycles.

Given that such a rate cut had been extremely well-telegraphed, with policymakers having flagged the move as far back as March, focus naturally fell on the guidance accompanying the rate decision.

Firm guidance as to the timing of the next rate cut, however, was elusive, as policymakers attempt to maintain as much flexibility, and optionality, as possible. Guidance, by and large, was a repeat of that offered after the April meeting, with the statement noting that policy will be kept “sufficiently restrictive for as long as needed”, with policymakers to continue to follow a data-dependent, meeting-by-meeting approach. As if this wasn’t clear enough, the statement also included an explicit reference to how the ECB are not “pre-committing to any particular rate path”.

With this in mind, it was perhaps unsurprising to see little shift in market pricing for the ECB policy path, with around 40bp of easing by year-end still discounted.

In addition to updated policy guidance, the June ECB meeting also brought the release of the latest round of staff macroeconomic projections.

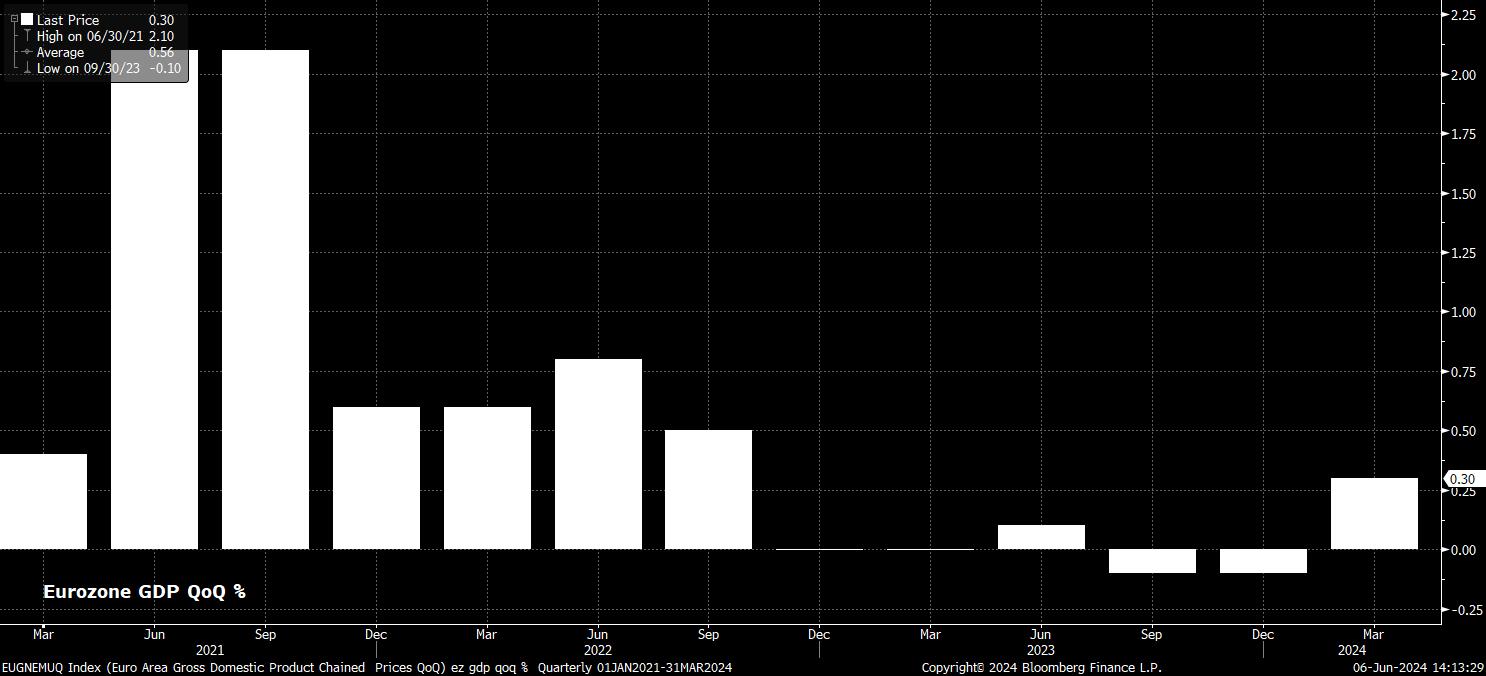

On growth, near-term downside risks to the outlook appear to be dissipating, with the 2024 GDP growth forecast receiving a chunky 0.3pp upward revision to 0.9%. While some of this likely represents growth from 2025 being pulled forward, hence the 0.1pp downward revision to an expected 1.4% pace of expansion next year, both this, and 2026’s unchanged 1.6% forecast, appear overly optimistic.

Meanwhile, on inflation, an upward revision to both this, and next, year’s HICP forecasts help to explain the lack of pre-commitment to any defined policy path, given the uncertainties that continue to surround the inflation outlook, particularly after the hotter-than-expected May HICP figures released last Friday.

The latest staff projections now see headline inflation at 2.5% this year, up from 2.3% in March, and at 2.2% in 2025, again 0.2pp higher than the March forecast, though the 2026 forecast remains unchanged at 1.9%.

Of course, President Lagarde’s post-meeting press conference was also closely watched for hints on the policy outlook, though again those hoping for explicit guidance were left sorely disappointed.

Lagarde, after rather pointlessly repeating the policy statement that had just been released, once again refused to pre-commit to a defined rate path, while also – perplexingly – noting that today’s decision to cut rates was based on the “reliability” of the staff projections. Projections, of course, which are typically more wrong than they are right.

Lagarde did, however, note that policymakers need to have “enough data” to make the relevant decision on when to further reduce the level of policy restriction. Furthermore, Lagarde noted that she was unable to confirm that the ECB have now entered the “dialling back” phase of monetary policy, while reaffirming that the speed and timing of further cuts will be determined by incoming data, as well as noting that the ECB has “more information” at projection meetings – a strong hint that it is at these quarterly occasions when cuts are more likely to be delivered.

In terms of market reaction, there really wasn’t anything of any particular significance, with the 25bp cut having been signalled far in advance, and guidance on the policy outlook thin on the ground. The EUR, briefly, popped around 30 pips or so, before paring gains entirely, while the 2-year Schatz and 10-year Bund both rose a modest 2.5bp over both the decision, and European equities by and large trod water.

_e_z_intra_2024-06-06_14-29-36.jpg)

Overall, the June ECB decision brought little by way of surprises. The headline 25bp cut had been well-telegraphed, albeit coming as a relatively hawkish one, being accompanied by an upward revision to short-term inflation projections. Another cut in July seems unlikely, though two more cuts by year-end – in September, and December – remains plausible, with quarterly cuts still the base case, providing incoming data continues to evolve in line with expectations.

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。