April 2024 ECB Review: Cuts Coming Next Time Around

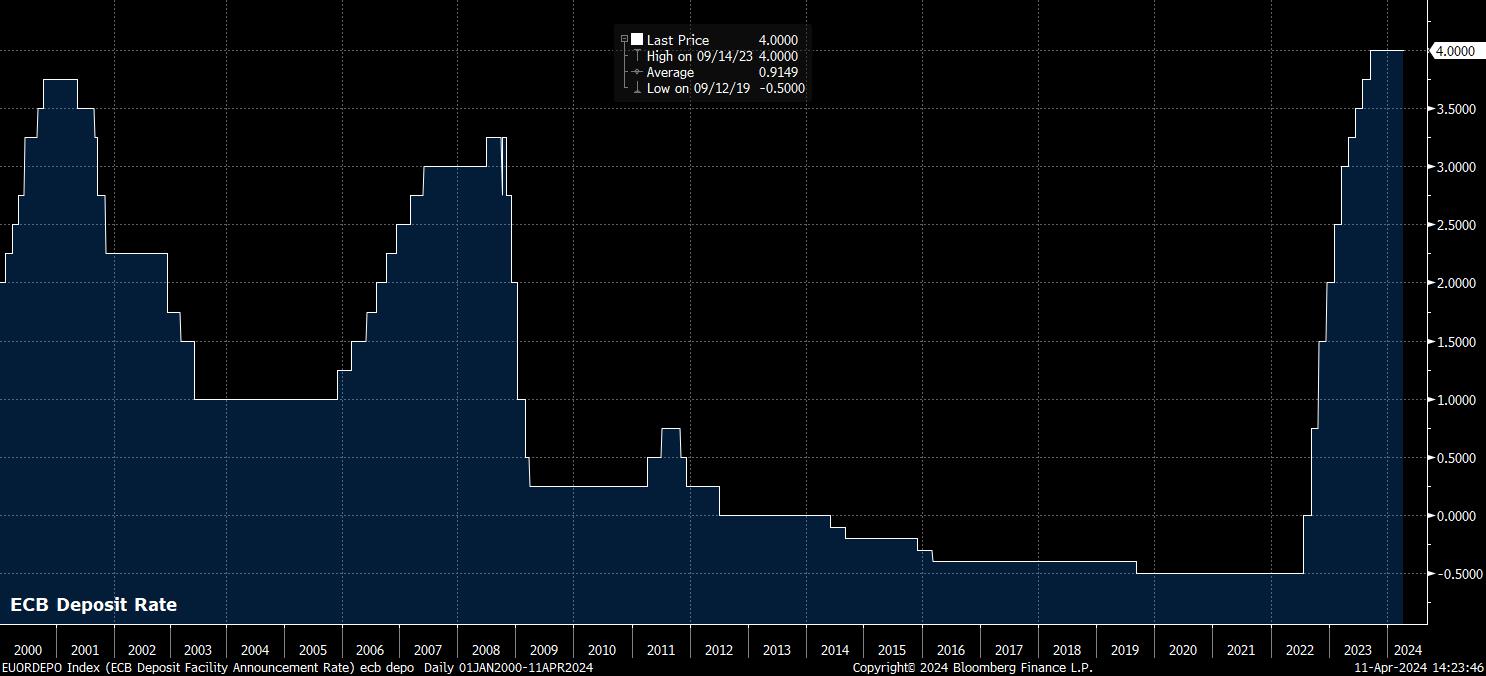

Unsurprisingly, the ECB kept all policy settings unchanged at the conclusion of the April meeting, thereby maintaining the deposit rate at 4.00%, a record high, and the level at which it has been since last September. It may go without saying, however such an outcome had been fully priced by the EUR OIS curve, and was bang in line with consensus expectations.

Nevertheless, heading into the April decision, focus had not been on the policy decision, but instead on the guidance that would accompany it. This is particularly the case with the ECB, in March, having effectively pre-committed to a June cut, after President Lagarde noted that policymakers would know “a little more by April, and a lot more by June”.

On this note, while the policy statement reiterated that the Governing Council plan to keep policy “sufficiently restrictive for as long as necessary”, the statement did indeed allude to the possibility of cuts. While policymakers noted that they are not “pre-committing” to a particular rate path, and kept up the pretence of adopting a meeting-by-meeting approach, the statement did include reference to the possibility that rates “may” fall, if there is sufficient confidence in inflation returning to 2%.

This guidance, while perhaps not as explicit in hinting at a June cut as some of the GC’s doves would’ve liked, was the only change to the statement from that issued in March – hence, is a significant addition. Said addition helped to cement market expectations for a cut in June, which is priced as around an 80% probability, with the EUR OIS curve implying quarterly cuts from then onwards, until the end of the year.

President Lagarde expanded on this guidance at the post-meeting press conference, noting three conditions that would need to be met before a rate reduction – namely, the updated assessment of the inflation outlook, dynamics of underlying inflation, and the strength of policy transmission – all of which would need to increase policymakers’ confidence that inflation is converging towards the target.

Despite this, “a few” policymakers on the Governing Council were of the view that a cut at today’s meeting would be appropriate, even if a “very large majority” preferred waiting until June, at which the ECB will have “a lot more data” – a line that Lagarde repeated from the March meeting.

Sticking with the press conference, Lagarde’s view of the economy was broadly unchanged, with activity having remained ‘weak’ in the first quarter, and risks to the growth outlook remaining ‘tilted to the downside’. Furthermore, Lagarde reiterated her expectation that inflation will decline to target, albeit ‘fluctuating’ before doing so.

Sadly, further information or insight than this was rather thin on the ground, owing to journalists’ rather peculiar obsession with continually asking President Lagarde about how developments in the US, and Fed policy, have a bearing on what the ECB may or may not do.

In any case, markets displayed a relatively muted reaction to the ECB statement, and presser, which perhaps shouldn’t come as a surprise, given that the April decision served simply as a placeholder, as policymakers continue to bide their time before a June cut.

Despite that, the path of least resistance for the common currency should continue to lead lower, at least against the greenback, as risks to the ECB outlook tilt in an increasingly dovish direction, and risks to the FOMC outlook become increasingly hawkish, especially after the hotter-than-expected CPI figures yesterday. A continued grind lower in EUR/USD over coming quarters seems a reasonable expectation.

_eur_spot_2024-04-11_14-24-19.jpg)

To conclude, we frankly learned little from the April ECB meeting. While some policymakers were prepared to cut today, it is clear that the Governing Council on the whole continue to wait for “a lot more data” before the June meeting, at which a much greater majority should have confidence in inflation returning to target, and the policy normalisation cycle should begin with the first 25bp cut. Focus now should shift to the pace, and magnitude, of easing that is likely to come this cycle, though any clarity on this seems relatively unlikely, until the next meeting in eight weeks’ time.

Related articles

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。