- ไทย

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- Español

- Português

- لغة عربية

การวิเคราะห์

It is for this reason that the continued bear steepening of the curve – where long-end yields rise faster than their counterparts at the front-end – should be attracting more attention than it currently appears to be getting.

While that view of the curve in its entirety shows the bear steepening in question, zooming in to a segment of it makes things clearer still. Take, for instance, the 3m10y spread below.

Of course, the most important thing among all this is what the bear steepening may actually mean, and its potential implications. On this note, we must dive down into the rabbit hole that is financial plumbing, and liquidity.

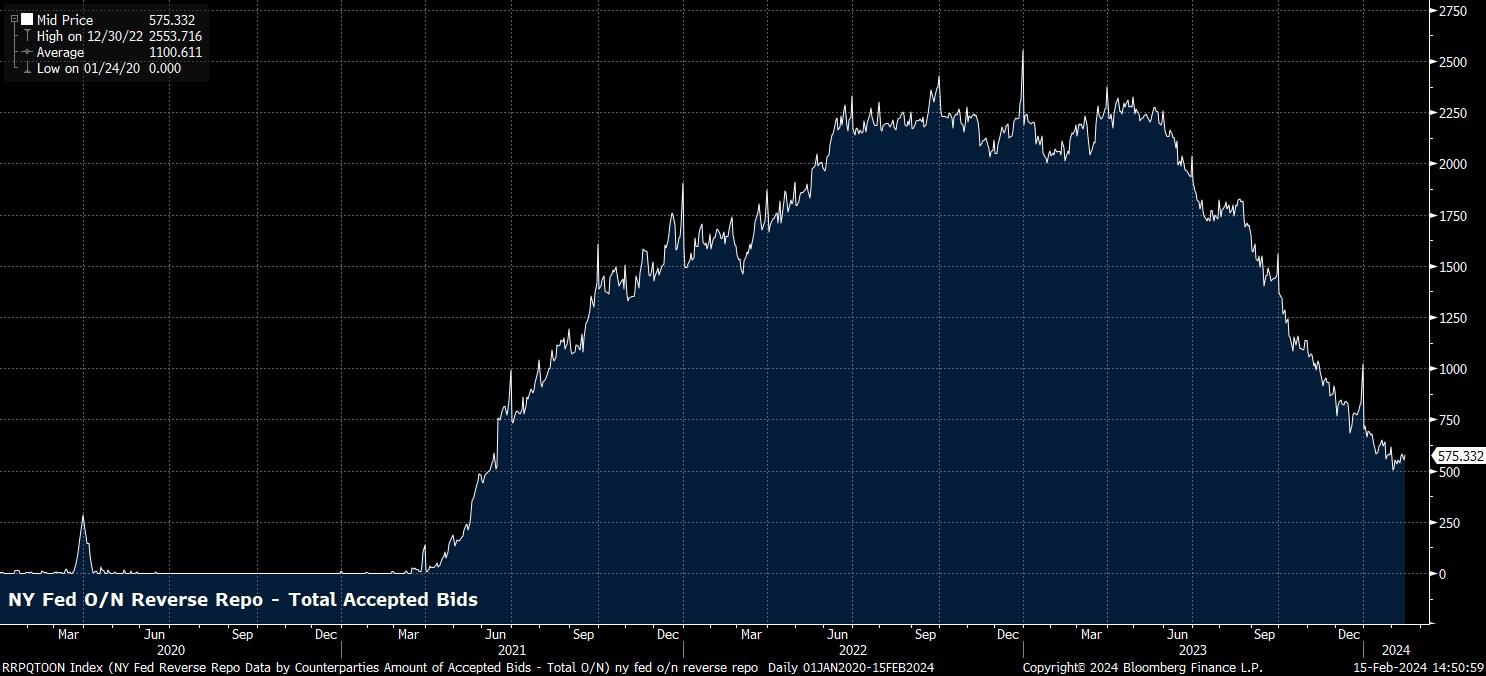

In layman’s terms, were the bear steepening to continue, as one may expect with front-end rates anchored by the Fed’s policy stance, and rate cuts unlikely until the spring, this should continue to increase the relative attractiveness of short-term debt (e.g. bills), particularly for money market funds, in turn likely resulting in a faster rundown of the Fed’s overnight reverse repo facility, usage of which has already fallen to a quarter of its peak level.

This, overall, amounts to liquidity being drained from the market. This reduction in liquidity leads to two conclusions – firstly, an increase in the chances of potential financial instability, particularly as the impact of prior hikes this cycle continues to be felt; and, secondly, being a potential headwind for riskier assets to battle, with the link between equity performance and liquidity remaining a close one, as the below chart shows.

However, while these near-term considerations are important, there are some longer-run factors that should also be borne in mind, particularly with the FOMC set to begin more formal discussions over the process of balance sheet rundown, and quantitative tightening (QT), at the March meeting.

The focus for policymakers remains ensuring that reserves remain above what has been termed the “LCLoR” – the lowest comfortable level of reserves, in plain English. While such a level is hard, perhaps impossible, to measure, it’s important to note that a more rapid pace of RRP rundown is likely to result in a higher level of bank reserves. In turn, this may lead to the Fed enacting QT for longer, allowing the current weaker liquidity backdrop to continue, and potentially posing a headwind to risk as a result.

Related articles

เนื้อหาที่ให้ไว้ในที่นี้ไม่ได้จัดทำขึ้นตามข้อกำหนดทางกฎหมายที่ออกแบบมาเพื่อส่งเสริมความเป็นอิสระของการวิจัยการลงทุน และด้วยเหตุนี้จึงถือเป็นการสื่อสารทางการตลาด แม้ว่าจะไม่อยู่ภายใต้ข้อห้ามใดๆ ในการจัดการก่อนการเผยแพร่การวิจัยการลงทุน แต่เราจะไม่แสวงหาผลประโยชน์ใดๆ ก่อนที่จะส่งมอบให้กับลูกค้าของเรา