Los CFDs son instrumentos complejos y conllevan un alto riesgo de perder dinero rápidamente debido al apalancamiento. El 80% de las cuentas de inversores minoristas pierden dinero al operar CFDs con este proveedor. Debes considerar si comprendes cómo funcionan los CFDs y si puedes permitirte asumir el alto riesgo de perder tu dinero.

- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

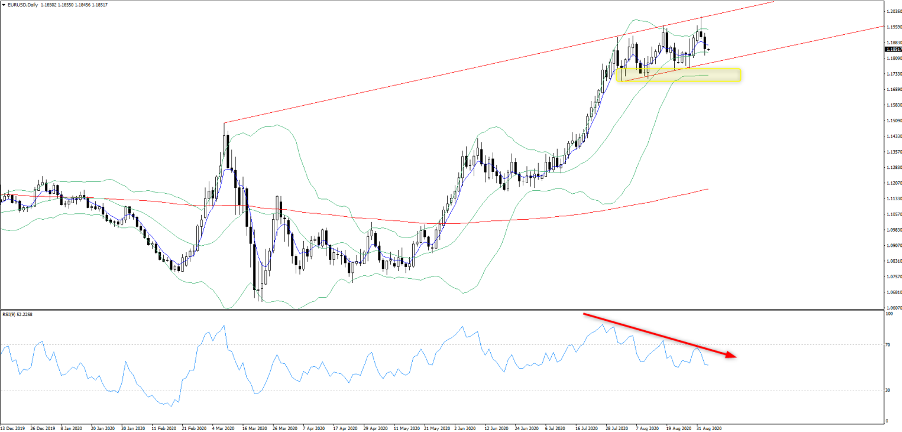

We now understand that holding EUR longs above 1.2000 comes with an increasing risk of ECB verbal intervention.

We therefore watch for communications from ECB president, Christine Lagarde. If she expresses a greater worry about the negative influence the EUR is having on inflation at next Thursdays ECB meeting and the market believes that they are prepared to do more, then it might just encourage real money accounts (think life insurance and pension funds) who have amassed a record EURUSD (futures) exposure, to reduce which could push EURUSD towards 1.1750/00.

The fact is the move into 1.2000 has largely been USD driven so there's not a whole lot the ECB can do structurally to alter that. Perhaps a dovish shift from the ECB would be best traded against the crosses, such as GBP or AUD. However, it does suggest that if EURUSD does move above 1.2000 then we expect the ECB to be ever more active in jawboning.

Let’s look at the upside playbook

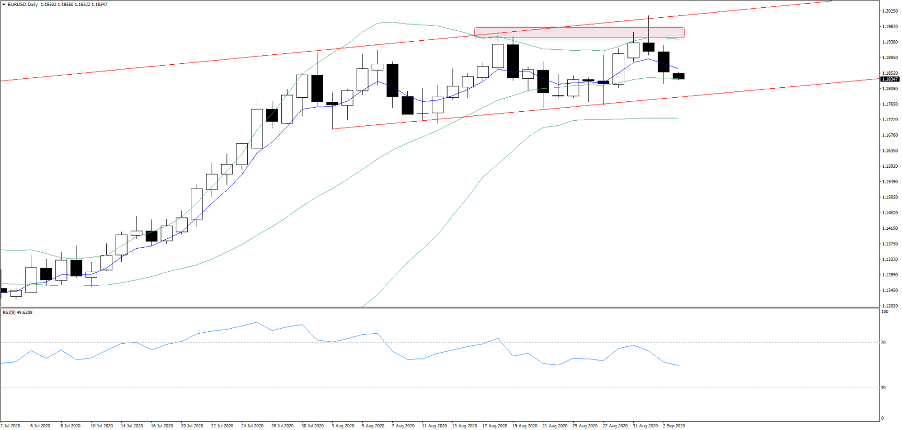

Resistance – 1.1966

As we see supply has come into the market into and above 1.1966 and we have a double top in place. A weekly close above 1.1966 would be the bullish signal for a renewed push above 1.2000 and into 1.2130/50.

Downside playbook

Support

1.1785 – Channel support

1.1763 – Last week’s low

1.1725 – Lower Bollinger Band

1.1695 – 3 August low

If you look at the current set-up on the daily chart, we can see the reversal off 1.2000 and this is in fitting with the bearish divergence seen between price and the RSI or momentum oscillators. That said, the 9-day RSI sits right at the mid-point with the 20-day MA moving sideways, so the set-up may appeal to range traders at this juncture. In this dynamic one could argue that the downside could be captured into the lower Bollinger Band at 1.1725. However, it would surprise to see a break here this week given the current level of implied volatility and the degree of movement expressed in options vol structures like the weekly straddle.

We also see EURUSD working in a channel, with channel support coming in at 1.1785. For the lower Bolly to come into play the EUR bears need to break this trend. We then look at last weeks low of 1.1763, where a weekly close below here would confirm a bearish outside week reversal and again offer evidence that the ownership structure has changed and the USD bulls are getting a greater say.

A move through the 3 August low (1.1695) and things get interesting, especially if the rate of change picks up. I would expect that to correspond with higher vol in equities and commodities would take a hit too.

The current set-up suggests quite a neutral bias, but the price levels are noted and the battle lines are drawn. I favour an eventual move through 1.2000, but if the market senses a dovish turn from the ECB next week it could encourage a market long of EURs to part liquidate and there are certainly increased risks with being long above 1.1900.

Artículos más leídos

¿Listo para operar?

Comenzar es fácil y rápido – incluso con un depósito pequeño. Aplique en minutos con nuestro simple proceso de solicitud.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.