- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

While geopolitics and inflation are driving sentiment:

- Will traders show any propensity to reduce EUR exposures into the two rounds of votes?

- What if France pulled off a Brexit-type scenario and Emmanuel Macron lost the second-round vote?

The election process

For background, the first round of voting takes place on Sunday 10 April and unless one candidate gets 50% of the votes, the two candidates (of 12) who get the highest number will face off for a final vote on Sunday 24 April.

While five candidates have polled over 10% of the votes in the polls (for the first round) for a while it would be a big shock if it wasn’t Emmanuel Macron vs Marine Le Pen going head-to-head in the second-round run-off on the 24 April, and for a re-run of the 2017 election.

Recall, in the 2017 run-off Macron picked up a sizeable 66% of the votes and easily beat Le Pen.

Macron’s approval rating has picked up throughout the Ukraine invasion, however, we should consider his ‘disapproval’ rating is still far too high (at 54%) to say he has strong public admiration - it’s possible for this very reason that he has put in a low effort campaign for fear of a communication mishap.

What’s more, recent polling has seen voting intentions towards Le Pen climbing higher, with at least three recent polls suggest a second-round vote (between Le Pen and Macron) would be far closer than the 2017 result, with Macron ahead by just five to six percentage points and within the margin of error. To some this makes the ‘what if’ a genuine event risk and the markets may start to become gradually more anxious after the first round of voting (10 April).

We can see that Le Pen also seems to be getting some tailwinds from support from far-left voters and many on the right of politics who may see Eric Zemmour as perhaps too extreme. We should also consider that voter turnout could play a pivotal role, although it would need Macron’s voter base to really go missing to promote a genuine shock.

There are important implications from the presidential elections on the parliamentary (legislative) elections that take place on 12 and 19 June – currently, the French govt holds a 60% majority, but this strong standing is expected to fall, and the president needs a majority in the lower house to efficiently implement domestic reforms.

Markets are incredibly calm on the issue of politics

With around 50bp of hikes priced into European rates markets for this year, taking the ECB’s policy rate into positive territory, the French election is clearly not on the radar as a major risk event.

We can look at FX forward volatility pricing and see markets pricing a 0.5% move in EURUSD on the day for both the first and second rounds of presidential voting (10 April and 24 April). So, there is no demand to buy EUR volatility as a hedge, and the markets, rightly or wrongly, do not see either round of voting as a volatility event.

We can also see the French CAC 40 is performing in line with the EU Stoxx and French 10yr bond yields are moving in a tight range with German 10yr bunds – so no signs of election stress here.

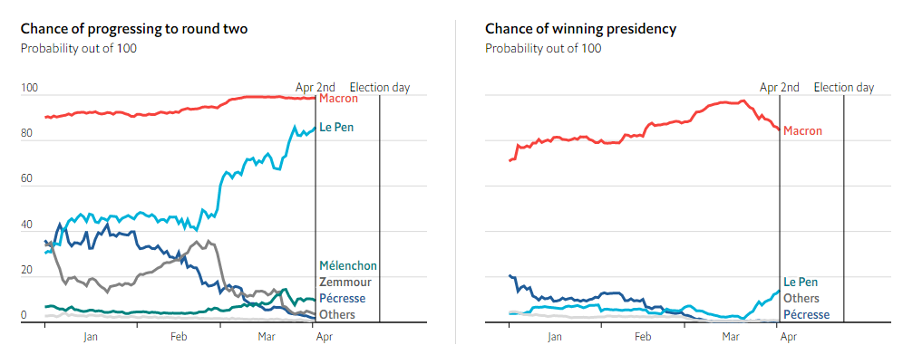

The Economists election model

(Source: The Economist - Past performance is not indicative of future performance.)

We can look at the betting odds and see Macron holding an 86% chance of winning the presidency, with right-wing candidate Marine Le Pen someway behind with 12%. The Economist’s own modelling sees an 85% chance we see Macron and Le Pen progressing into the second round for a re-run of the 2017 Presidential match up, with an 84% chance that Macron subsequently takes that battle to remain in power.

Potential market reaction

Given the current market dynamics and reflect betting market expectations, if Macron and Le Pen both progress it shouldn’t result in too much of a move on the Monday 25th open – that is unless Le Pen’s share of the votes is significantly higher than the 21% currently portrayed in the polls. I would expect EURUSD to open 0.7% to 1% lower in this situation.

If we see Macron facing off against Jean-Luc Melancon or Eric Zemmour I would see small EUR/FRA40 upside, as the prospect of a sizeable Macron victory in the run-off would increase.

Moving to the second round (24 April), a Le Pen victory in the base case head-to-head battle (vs Macron) would be a huge shock and likely cause a strong gap lower on the Monday 25 April open – with EURUSD down potentially 2-3% with the FRA40 finding one-way selling flow – it would have traders questioning France’s current relationship with the EU, as well as its growth trajectory and deficit.

That said, for a full EU asset de-risking Le Pen would need to get enough votes to gain a simple majority, which again seems unlikely. This would result in the formation of a coalition, limiting her ability to get her full agenda through and limiting the EUR and FRA40 downside.

So, currently this election has been in the shadows of geopolitical and macro issues and rightly so, given the recent polling for the second-round votes, it’s time to get an understanding of this potential vol event.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.