- English

The Daily Fix: Turning cautious on NAS100 while USDX eyes 91.72

Tech has been sold reasonably aggressively, with Tesla and Moderna at the heart of the 2.2% NAS100 decline. The market reacted to a research note from JP Morgan who wrote that Tesla was “dramatically” overvalued. An odd reason to offer the stock as valuation has not mattered for some time, but apparently the market has now taken notice. Cyclicals and value have outperformed tech although the financial, materials and energy sectors are still modestly lower.

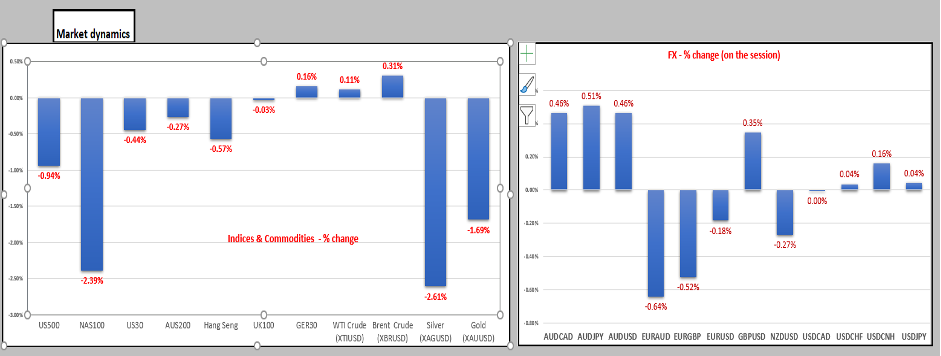

(Moves in core markets on the session)

While some have attributed the slight deterioration in sentiment to signs of gridlock on fiscal (in the US), I’m not so sure this justifies cyclicals outperforming tech and small selling in US Treasuries - so it feels like a position adjustment above anything else. I question if this could be the market calling it a year on their tech exposures, happy to run core cyclical positions into 2021.

We’ve seen the first close below the 5-day EMA since 23 November in NAS100, so the recent bull run has come to a halt. That said, at this juncture while it feels prudent to turn somewhat more cautious, I've limited conviction to run outright short NAS100 positions at this juncture. Even though the daily candle stands out as one that's meaningful. That said, the buyers will need to step in soon or the risk of a move into 12,000 accelerates.

Perhaps long US30 and short NAS100 as a pairs trade could be worth a look as a low beta tactical idea into year-end, although the ratio needs work.

(US30/NAS100 ratio)

(Source: Bloomberg)

Volumes are a touch higher than yesterday in the US cash markets, while 1.7 million S&P 500 futures contracts traded is a strong increase from yesterday. Volatility is bid, with the VIX +1.4 vols and NAS VIX +3.06 vols. We see S&P 500 1-month put volatility wearing an ever-greater premium to call vol and that's a bit of a red flag to me to turn cautious. There hasn’t really been much of a move in US Treasuries, with 10s and 30s both up 2bp, and hardly aligning with the equity risk-off vibe. The fixed income market will be watching moves in European sovereign bonds, with the ECB meeting in play at 23:45 AEDT.

Do the ECB overdeliver? Christine Lagarde is certainly no Mario Draghi when it comes to going above and beyond but she’s only been at the helm for a short period. She could channel her inner Draghi and take the PEPP asset purchase program into 2022, detailing that they discussed rate cuts and extending cheap loans to the banks (a.k.a TLTRO). Perhaps a bout of jawboning of recent EUR appreciation would help too. Whether we get these measures is yet to be seen, but these would constitute ‘over-delivering’ and would cause German bunds to go bid (yields lower) and push EURUSD through 1.2000.

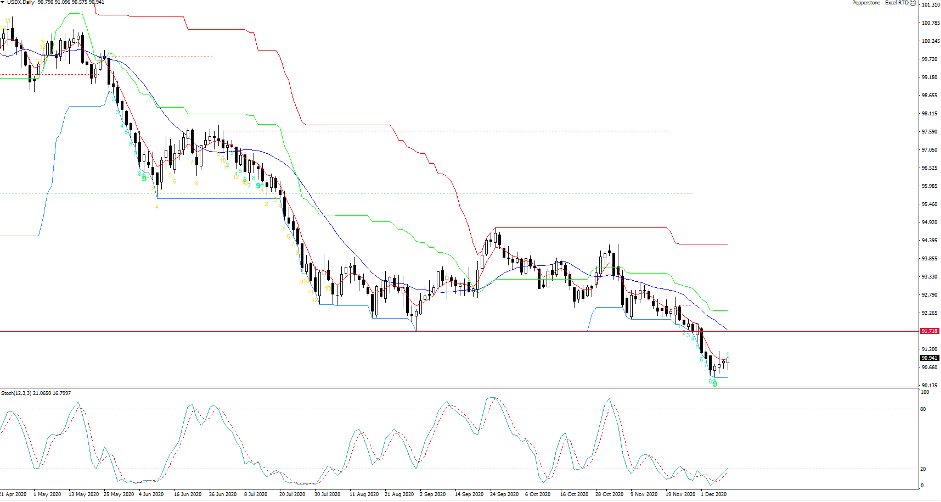

The market is certainly looking at its USD exposures and trimming and while the USDX is up just 0.08%, the moves vs NOK, MXN and RUB are somewhat more pronounced. The risk is the USDX can squeeze into 91.72 in the near-term, where I’d re-assess but to me this feels like a growing probability.

(USDX daily – do we target 91.72?)

AUD has been the strongest currency on the day, helped in part by the 4.1% gain in Westpac consumer confidence. However, iron ore is flying at the moment and we see iron ore futures (Dalian exchange) up 3.6%. Gold has not fared well in the stronger USD environment, but I am not sure it warrants a 1.7% sell-off in XAUUSD. Watching 1821 in XAUUSD and if this gives way then a move into and below 1800 should be in play.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.