The Daily Fix: Brexit deadline set for Wednesday with US fiscal in play

Dr Fauci suggested the middle of January in the US could get “really bad”. There's been some focus on US-China trade given US sanctions placed on 14 members of China’s NPC who have been targeted with asset-freezes and travel bans. We can throw in our friend Brexit, but this is a stretch to think this is having an impact on sentiment outside of the UK.

On any other day we could've had this news flow and still push higher in risk, so this selective mindset is just the market sitting on its hands waiting for the next shoe to drop. The fact is when we look across markets the negative stance is hardly that pronounced.

Gold and Silver are the two standouts when it comes to movement, with the USD only 0.1% higher and both nominal and real Treasury yields lower by a few basis points, which is supporting both metals. The fact Gold has reclaimed 1848 and the former range low, subsequently moving into 1868 has also been in play, with sellers into the 50% fibo of the 1965 to 1764 move.

At the time of writing we're waiting to hear more on fiscal with an announcement due from Senate leader Mitch McConnell. The market seems to have discounted the $908b stimulus (relief bill) as passing through Congress, although there's thoughts the Senate leader has a personal preference for stimulus closer to $600b. We are expecting to hear more shortly and there'll be a focus on the breakdown of the agreement and specifically, if we see Republicans agree to the DEMs push for another $1200 in stimulus checks.

We’ll wait for the announcement and whether it does move the dial of the markets.

In terms of market moves, EU equities closed modestly lower with the CAC40 the worst performer with a drop of 0.6%. In the US we’re seeing modest weakness in the S&P 500 (-0.3%), with the Dow -0.5% while good buying in tech has seen the NAS100 push +0.5% higher. Volumes through the cash markets were sanguine, with turnover through the S&P 500 15% below the 30-day average. 830k S&P 500 futures traded is pathetic though.

There's just been very little movement in US equity indices with the S&P 500 trading in a 17-handle range through US cash trade, with a somewhat defensive bias within the sectors – energy has been the standout here with a fall of 2.2%, with crude down a modest 1.3% in reflection to the COVID news.

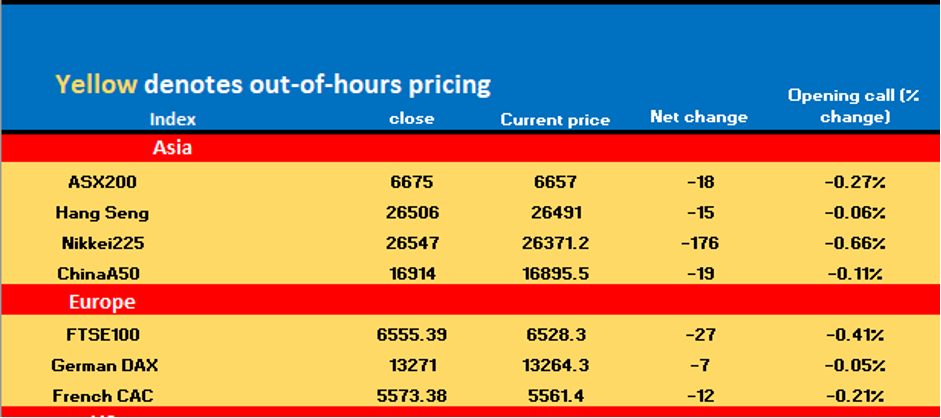

Our calls for Asia equity indices are modest lower at this stage.

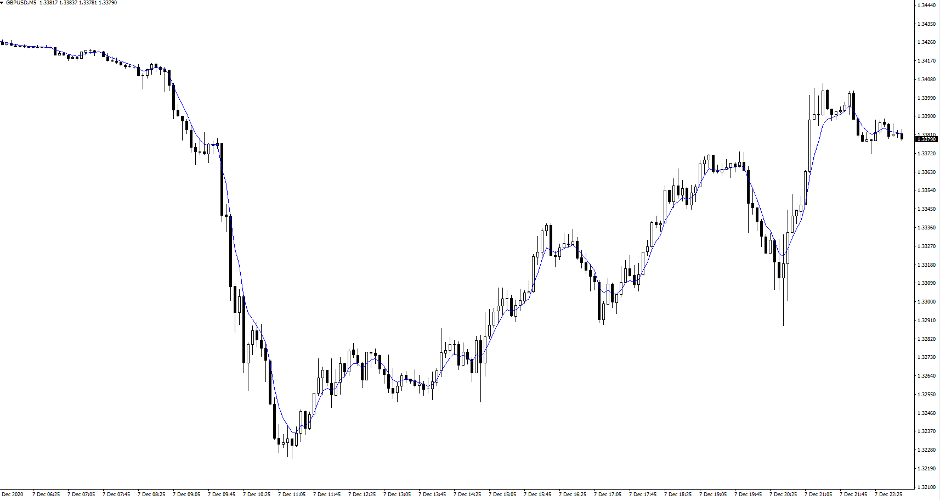

In the FX markets we’ve seen good flow in GBP, which won't surprise as traders are magnetised to movement and with GBPUSD 1-week implied volatility pushing to 16% the implied movement resembles that of the BRL. We’ve seen a solid move off 1.3225 to current levels with some excitement that Boris Johnson is headed to Brussels to meet with the EC president Ursula von der Leyen.

The thought process is Boris isn't going to Brussels to come back without a deal, but to do this we need both sides to make concessions and that'll likely (in my view) mean the EU compromise on fishing rights, while the UK concede on the level playing field consideration and perhaps of the ongoing dispute resolution process too. There must be a joint concession to sell back to their respective publics and portray that they’ve both fought a tough battle, or at least made it look like that is the case.

(GBPUSD 5min chart)

A hard deadline has been set for Wednesday and ahead of the EU Council, so a failure to agree anything past Wednesday and GBP could face some tough times with GBPUSD likely trading into 1.3000. I’m quietly confident though we get something tangible to work off at this meeting, which could cause some of the short covering of the no-deal hedges.

While Brexit and US fiscal get a good run, the event risk through the coming session shouldn’t promote too much in the way off vol. Japan final GDP is not expected to change on revision, while Japan’s October current data will not move the JPY and we see USDJPY hovering around the 104-handle, with good support into 103.60. Aussie NAB business confidence (due 11:30 AEDT) will get some focus from economists but it shouldn’t impact the AUDUSD which is moving as a risk proxy and aligned with S&P 500 futures.

EU ZEW survey expectations (released 21:00 AEDT) may get some attention and could impact the DAX if the index falls sharply from last month, but most eyes are focused on Thursday’s ECB meeting. EURUSD has traded a range of 1.2079 to 1.2166 and sits at the 40th percentile of the day's range.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.