- English

NAS100 volatility alert: three tech giants reporting July 30

Add in the rest of the companies reporting this day (including Comcast and vaccine hopeful Gilead Sciences) and they total a 36% weighting. We’ll focus on the three tech behemoths though, which together make a significant concentration risk, dominating almost a third of the NAS100.

Apple, Amazon, and Google are all reporting after market next Thursday, which makes the big session the following day: Friday the 31st. The implied moves for each stock are: Apple 4.9%, Amazon 7.73%, and Alphabet (Google) 5.51%.

The implied move on the NAS100 for the day is a cool 2%.

With Pepperstone, you can trade these individual shares and the NAS100 index in the after-hours market. This lets you take a position in real time, giving you an edge ahead of the next day’s open.

So a clean sweep of favourable reporting where results beat expectations, and we could see the NAS100 a tidier 2% higher on the day. Underperformance across the board could take the index as much as 2% lower.

But we all know it’s unlikely the three tech giants move in the same direction on reporting day. Last quarter alone, Apple outperformed consensus expectations while Amazon and Alphabet underperformed.

For 2020 Q2, consensus expectations predict a lower earnings per share (EPS) than the previous quarter for all three tech giants, a fair assumption considering pandemic lockdowns and mass job losses. Despite the low expectations, valuations compared to earnings are at the highest since the dotcom era. The big question is… have markets priced these considerations correctly?

EPS expectations for the three tech giants next Wednesday, as well as last quarter results, are below:

| NAS100-listed company | 20Q2 Expected EPS (GAAP+ Consensus) | 20Q1 Reported EPS (vs. expected) |

| Alphabet (GOOGL.O) | 8.26 | 9.87 (vs 10.35 expected) |

| Amazon (AMZN.O) | 1.39 | 5.01 (vs 6.27 expected) |

| Apple (APPL.O) | 2.03 | 2.55 (vs 2.25 expected) |

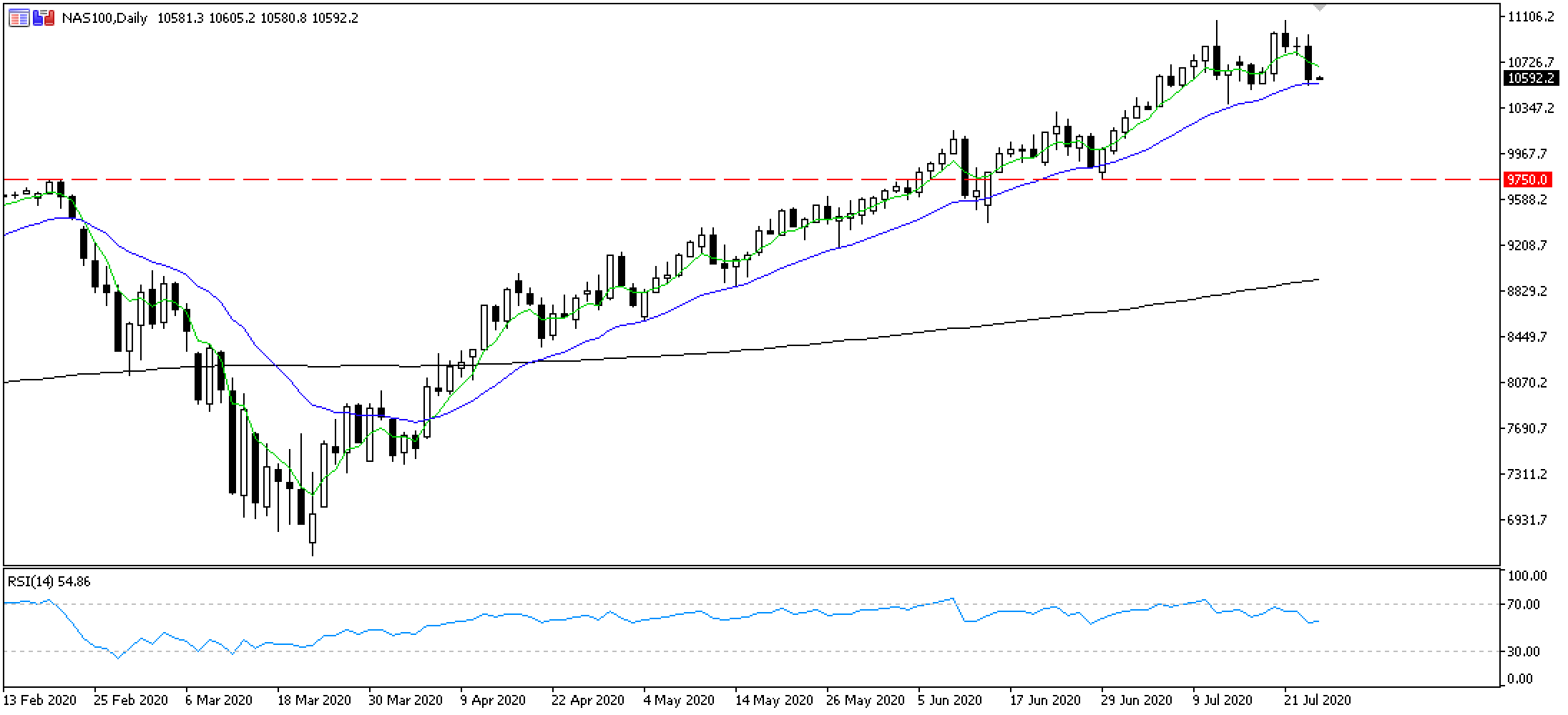

If we look at the daily chart since February, the NAS100 seems unstoppable. The aggressive growth index has left the pandemic far behind, boosted by the success of stay-at-home stocks like Netflix and Amazon. Investor hunger for the aggressive growth stocks has also helped. It took less than four months for the NAS100 to resume posting regular record highs, while the S&P 500 and the Dow Jones are yet to reclaim covid-19 losses.

Investor appetite for growth stock is increasing the lower rates go. The NAS100 is behaving as a bond-proxy, similar to gold, whereby the lower US treasury yields fall, the more capital seems to flow into the aggressive growth index.

Daily chart: NAS100. Chart source data: Metaquotes MT5.

The index fell 2.7% on Thursday, driven by a fall in Microsoft stock. The tech giant did exceed consensus expectations but the bulls were left wanting more. Perhaps it's a knee-jerk reaction, but Microsoft's considerable weighting on the NAS was a large contribution to the 2.7% fall.

Treasury real yields rising at the shorter end of the curve didn’t help either and the index has fallen to its 20-day EMA (blue line), a level that has supported fairly well since early April. So will yesterday’s sell-off bring sellers into the market eyeing a bargain, or could the 20-EMA finally give way?

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.