The UK prompts something of a head-scratcher at the moment, which stems from the market’s, and the sell-side’s, view on how the UK economy is likely to evolve over the remainder of 2024.

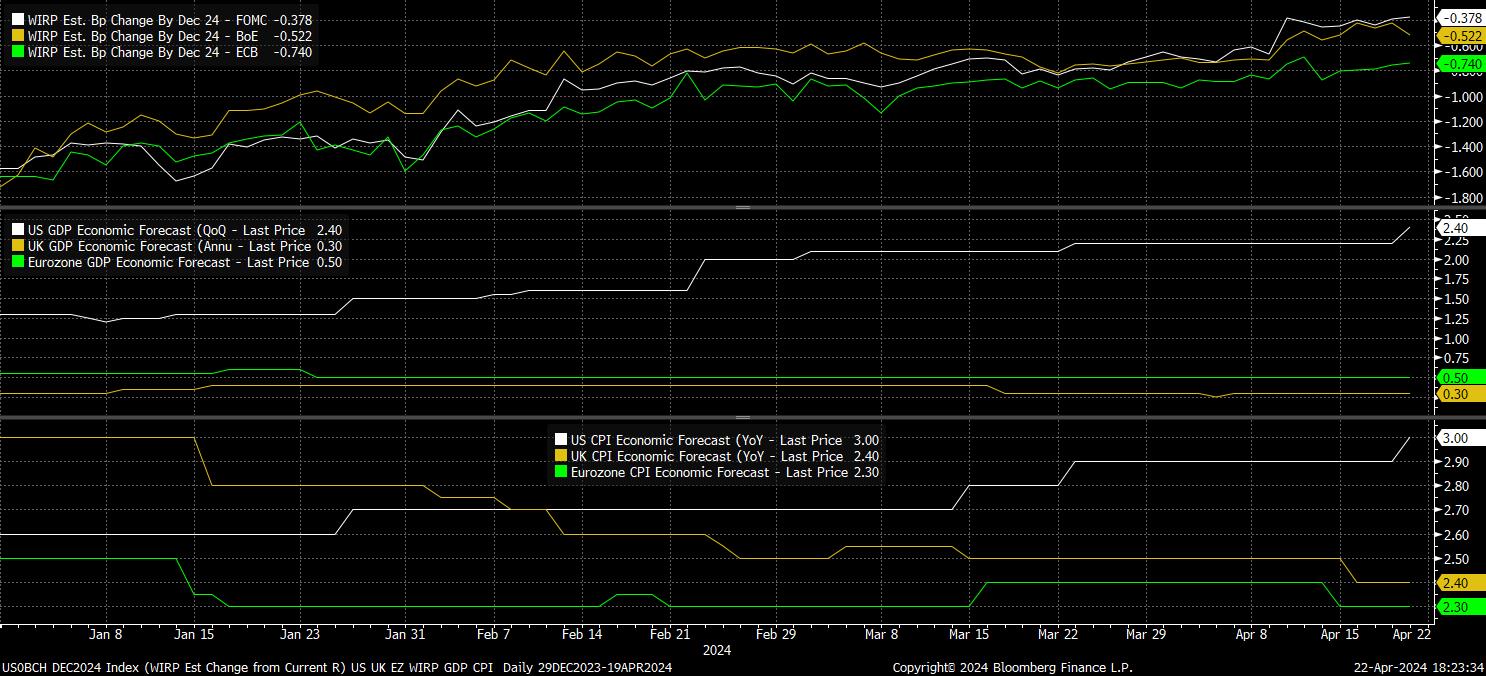

From a monetary policy perspective, swaps price an outlook broadly in line with that priced for the FOMC – seeing just over two 25bp rate cuts from the ‘Old Lady’ this year, only marginally more dovish than the policy path priced across the Atlantic.

However, from an economic perspective, the outlook – according to both incoming economic data, and sell-side consensus expectations – appears much more akin to that of the eurozone, with growth set to remain relatively anaemic, and inflation set to fall towards the 2% target in much more rapid fashion.

This raises a few interesting points.

Firstly, at a basic level, is it the market, or is it economists, that are likely to be proven right?

- At a glance, incoming evidence would argue that the economist community probably have this one spot on at the moment; inflation is rapidly on its way towards 2%, and should achieve said target in the spring by virtue of the feed-through of falling energy prices, while unemployment ticked up to a six-month high in the three months to February, as the labour market continues to gradually loosen.

- In addition, typically hawkish BoE Deputy Governor Dave Ramsden noted last week that the balance of risks to the inflation outlook now “tilts to the downside”, while also being “more confident” that inflation persistence is easing. Given that, particularly internal, MPC members speak rarely compared to their peers at the Fed or ECB, these comments seem both deliberate, and significant, in laying the groundwork for a rate cut as soon as the June MPC meeting. Mention of policy remaining restrictive, even when rate cuts begin, in the March MPC minutes, serves to further reinforce this view.

- Were a cut to be delivered in June, it seems likely that the MPC would want to proceed beyond that point at a relatively cautious pace. Quarterly cuts seems a logical pace, albeit this would mean delivering said cuts at meetings following the release of a Monetary Policy Report, rather than in conjunction with each forecast round, as we are likely to see with the ECB. In any case, quarterly cuts from June would take us to 75bp of cuts to Bank Rate by year-end.

But, how could the market be right?

- Thankfully, the MPC have been relatively clear in explaining the factors that they are watching when determining policy shifts, namely – “indications of inflationary persistence”, tightness in the labour market, wage growth, and services price inflation

- It doesn’t, then, take a PhD to deduce that stubborn services prices (above the MPC’s most recent forecasts), elevated earnings growth and/or a renewed labour market tightening, may well delay rate cuts. Hard data, however, is not currently moving in this direction, while leading indicators show relatively little risk of it doing so.

- Alternatively, perhaps the market could be right if one views the UK economy through a different lens – one where potential growth is substantially lower than in the US, as the labour force increasingly shrinks, but one where inflation is structurally higher than in other DMs, not helped by the longer-term trend of GBP weakness importing further price pressures. Naturally, folk would rush to scream ‘stagflation’ in such a scenario, which is far from the base case.

What if neither the market, nor economists, are correct?

- This would likely only be the case were some sort of financial, or geopolitical, accident to occur. In the former situation, cuts would likely be much deeper, and much quicker, than currently priced – with central banks, including the BoE, having this option in their ‘back pocket’ were it to be required, with inflation, essentially, back to target.

- Geopolitical flare-ups would likely be much more difficult to contend with, though policymakers have, and likely would again, look through the temporary inflationary impacts of any potential surge in oil prices.

Lastly, what does this all mean for the GBP?

- In the base case, markets are priced too hawkishly compared to what the MPC are likely to deliver, with the GBP OIS curve seeing just a 60% chance of a June cut, and pricing just a one-in-three chance of 3x 25bp cuts this year.

- A dovish repricing would, naturally, apply further downward pressure to the GBP, particularly as Fed policy risks tilt increasingly hawkish at the same time.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。