In fact, we can see S&P500 futures are 0.3% lower from the close of Asia, with Aussie SPI futures following in appreciation.

There have been limited moves in fixed income, with German bunds -1bp to -26bp, while UST 2s and 10s are also -1bp a piece and HY credit is little changed. Iron ore futures are holding in with a gain of 0.5%, but fodder for the bears comes elsewhere in the commodities space, with copper -0.9%, while crude is getting a real working over, lower by 2.8%, as traders focused on the impact coronavirus could have on demand, notably from the impact of lower jet fuel demand. Unsurprisingly the S&P500 energy sector is -0.8% and we can expect a similar reaction in Asian energy names.

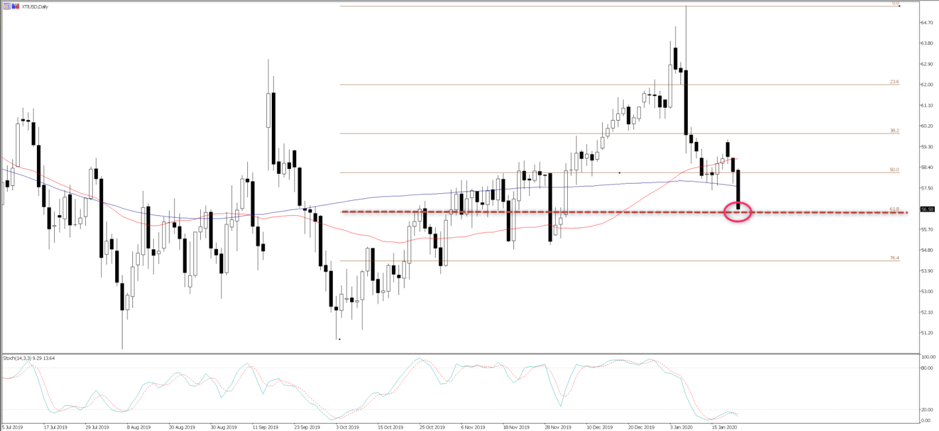

XTIUSD has hit the 61.8% Fibo of the Oct-Jan rally

So, we look to be giving some back on the open and I would hold off from buying the open as we’ll be taking our leads from China and sentiment on the ground, with traders massaging positions in Chinese equities ahead of Chinese NY. There was certainly an element of uplift yesterday from China showing a defiant stance with regards to its containment plans and the market feels one of the key differences with 2003 (SARS) is the greater transparency on display. That said, with 550 confirmed cases of the coronavirus and with Wuhan announcing the closure of transport links and the effective quarantine of 11m people, the market will still have a beady eye on developments here.

USDCNH remains a solid guide, and I see risks as we see the cross push into 6.9150, having found a platform off 6.9000, with a belief that the Chinese authorities will stimulate should economics be threatened. We have already seen China’s credit impulse moving higher of late, and we look to the January manufacturing PMI data (31 January) to see if the credit extension will support here. USDKRW also saw solid selling yesterday, and along with AUDJPY is a good proxy of sentiment in Asia, so I have an eye on price action in these pairs today.

Aussie jobs a key event risk for FX traders

AUDJPY will also take its direction from Aussie December jobs today (11:30 AEDT), and this will be a key event risk for AUD and rates traders more broadly. The reaction in the ASX200 is less assured, and textbook theory would suggest solid employment numbers would lift any equity index, but as we have come to see, textbook theory no longer applies when yield and liquidity are the dominant drivers. The consensus guesstimate is for 10,000 net jobs to be created, with the unemployment rate staying firm at 5.2%. My preference is to focus on trends, and here we see the 12-month average net job creation at 21,700, while the six-month average is 19,800, so the probability is for job creation, but it’s finger in the air time.

Current expectations for a 25bp cut from the RBA on 4 February sit at 56%, and we need to assess the outcomes in the jobs report that genuinely affects pricing here and the perception of a cut. To me, the unemployment rate is the more important consideration for the RBA and subsequently if we get 5.3%, or above, then rates move above 65% and we head to next week’s Aussie Q4 CPI knowing that the chances of inflation pushing above 2% are slim, thus missing the RBA’s 2-3% target for 19 of 21 quarters. One suspects we’ll see AUDUSD into 0.6800 in an environment of a higher unemployment rate, although the round number should support here.

What takes rates pricing below 45%? I guess we’d need to see the unemployment rate come down to 5.1%, with above-average job creation. Here we see AUDUSD into yesterday’s high of 0.6884, although the conviction to push the pair through the figure would be limited by the fact we have CPI print next week.

Staying on the FX vibe, and we’ve seen some good two-way interest in EURUSD, and EUR crosses, ahead of tonight’s ECB (23:45 AEDT). Implied vol in EURUSD is just so low, across any expiry, that the market feels there is just nothing that can promote a move. Given the vol structure, I would have limited concern with holding positions over tonight’s ECB meeting, and if anything, the focus will be on the level of optimism the bank shares on its outlook. Not to mention any updates on its strategic review.

Interestingly, USDCAD vols have fallen hard, with 1-week IV falling to 3.76%. The BoC has opened the door to a cut, with swaps now pricing a 22% chance of a cut at the next meet in early March. USDCAD has flown, pushing into 1.3153, and any retracement through Asia today is a buying opportunity in my opinion, for a move into 1.3180 to 1.3200.

GBP has been the superstar in G10 FX though, notably GBPCAD which has gained 1.2%, touching a higher of 1.7278, thanks largely to a huge beat/improvement in the January UK CBI business optimism report. GBPUSD pushed into 1.3153. The data has taken the probability of a BoE cut next week to 55% from 61%. To be honest, I didn’t even have this print on the event radar, but the fact is business investment will drive the GBP higher over time, and the tide is turning and is, for me, why on balance, the BoE will not cut rates. My base case, for what it is worth, is we will see three MPC members voting for a cut, six on hold, and it will be coined a dovish hold. We will need to see an awful PMI print tomorrow to alter that view.

I like GBPCAD here and feel this could be trading 1.7500 in the next week or so, but I am watching price action on this breakout.

做好交易准备了吗?

只需少量入金便可随时开始交易。我们简单的申请流程仅需几分钟便可完成申请。

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。