分析

JPN225 – 市场中最热门的标的

自1月10日以来,JPN225指数的急剧上涨一直吸引着客户的广泛关注,该指数已突破了36,000点大关。快钱玩家纷纷追高该指数,主要是由于疲软的经济数据使得日本银行(BoJ)几乎没有理由放弃其超宽松的政策立场。日本和美国股市之间存在着均值回归交易,在6月至10月期间,JPN225(无论是以日元还是美元计价)表现不佳,美国基金转而看多JPN225,认为其相对表现不佳的程度过头了。从战术角度来看,问题在于是在这里平掉空头头寸以期快速下跌,还是保持观望,等待弱势出现时再买入。在这些水平上建立多头头寸很困难,因为市场走势明显过热,但我们生活在有趣的时代,需要对可能导致市场再次上涨的资金流保持开放态度。

EURCHF – 欧洲央行的反击为欧元带来上行空间

欧元近期表现稳健,相对瑞典克朗(SEK)、日元(JPY)、澳元(AUD)、瑞士法郎(CHF)和加元(CAD)均有显著上涨。推动欧元升值的一个因素是,欧洲央行(ECB)官员组成的协调小组对2024年整年在欧盟掉期市场中定价的降息幅度感到不满。然而,利率市场对欧洲央行的反对尚未进行根本性的重新定价,我们仍然看到市场定价中的共识是欧洲央行将在4月份降息。话虽如此,我们看到欧盟政府债券在相对基础上表现不佳,因此相对收益率差距在收紧,有利于欧元上行。同时考虑到瑞士国家银行(SNB)的外汇储备政策,我们看到CHF在过去5天内是较弱势的货币之一,采取将强势(EUR)与弱势(CHF)结合的动量策略往往是有效的。在0.9270筑底后,我们看到价格形成了一个看涨的外包日 - 多头希望看到价格在0.9375以上继续买入,这将打开通往0.9400/03甚至0.9511的上行空间。尽管本周还有更多欧洲央行发言人出场,但在接下来的交易时段(AEDT 20:00)我们将获得欧洲央行1年和3年的消费者物价指数(CPI)预期,这可能对欧元头寸构成适度风险。

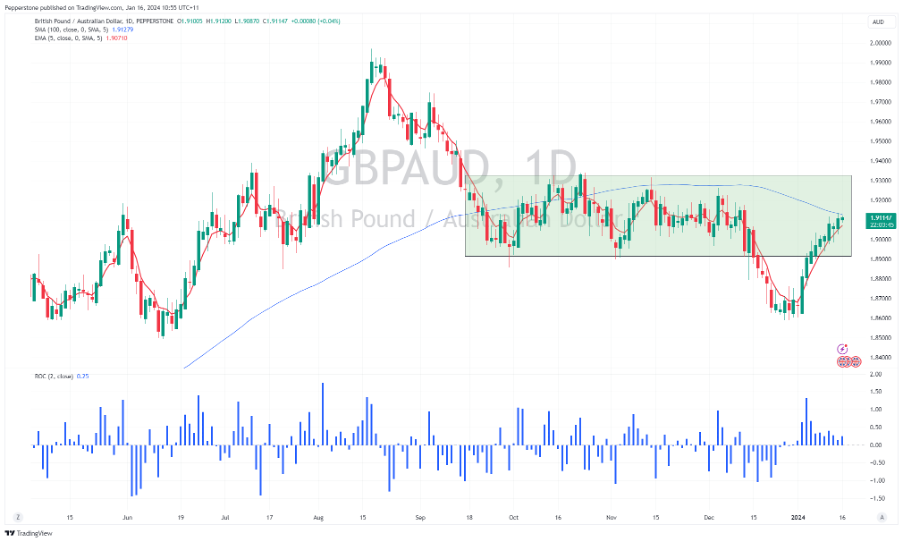

GBPAUD – 满屏上涨

英镑在今年开年表现良好,目前是表现最佳的G10货币。GBPJPY是变动较大货币对,并在各种账户中交易活跃,而日元令许多原本期待日本银行开始正常化进程的人感到沮丧。GBPAUD 也引起了人们的关注,因为我们看到该货币对在过去 11 个交易日中有 9 个交易日收高,并且已回到 10月至12月之间的密集交易区域。目前100天移动平均线正在限制涨势,但一旦突破,我会期待其上涨到之前区间的顶部1.9300附近。英国的就业和工资数据(预计在18:00 AEDT发布)可能对接下来的GBP头寸构成风险,预期周收入增长为6.8%(从7.3%)。明天英国CPI数据也将发布(同样在18:00 AEDT),市场预计核心CPI将为6.1%(从6.3%)。这两组数据会影响英国央行的利率预期,目前市场预计首次25个基点降息将在5月进行,到2024年12月总共降息5次 - 考虑到我们还会在接下来的交易时段听到英国央行行长Bailey的讲话,我们将寻找对英国利率定价的反对迹象。

XAUUSD – 关注美联储理事 Waller

由于马丁·路德·金纪念日美国现金债券市场休市,黄金和外汇市场缺乏方向性,但这将在接下来的交易时段发生变化,届时圣路易斯联储行长Waller将就美国经济展望和货币政策发表讲话(AEDT 03:00)。回想一下,Waller在推动美国股市上涨方面发挥了重要作用,他在11月28日提出了一条明确的路径,联储可能在通胀按预期运行的情况下降低联邦基金利率。我们知道Waller关注的是6个月年化通胀率,鉴于美国核心CPI在3.2%水平,核心PCE通胀率在2%左右,Waller应该会保持这样的观点,即如果这一趋势持续,联储可能会放松政策。对于做多黄金和NAS100/做空美元来说,风险在于他可能对市场就3月降息的定价表示反对,并显示出缺乏政策正常化的紧迫性。也可能有人期待他进一步讨论调整其量化紧缩(QT)计划的时间表。这就是说,如果他甚至在一定程度上确认市场定价,那么我们应该看到美国2年期国债收益率进一步下降,美元可能走低,黄金则可能回到12月28日的2088美元高点。当然,随着下降趋势的打破和动量研究转向看涨,目前的布局对黄金多头来说更为有利。

NAS100 – 它会朝哪个方向突破?

在期待美联储理事Waller关于政策和经济的讲话之际,我们还注意到恐慌指数(VIX)、股指和个股期权在本周到期。由期权到期(OPEX)引发的资金流动可能会导致美国股市出现高波动性,特别是一旦市场中的大量gamma被清除后,市场将能够在没有此类交易商对冲流的情况下自由波动。从短期日线时间框架来看,我们看到连续两个内包线 - 这暗示着迎来突破,并跟随后续走势通过16909和16612。它会朝哪个方向突破?显然,没有人知道,虽然我看到它向上突破的风险较高,但对突破的反应至关重要 - 因此我正在等待市场揭晓答案,并据资金流进行交易。

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。