Clearly, a lot has happened in this cycle; before continuing this note, I’ll just submit that statement as a contender for the ‘understatement of the year’ award.

However, when taking a ‘big picture’ view, it’s worth pondering what the biggest and most significant of these events may be. In fact, events may be the wrong word, suggesting one specific moment in time. Instead, it is the biggest theme or trend that should be the focus of our ruminations.

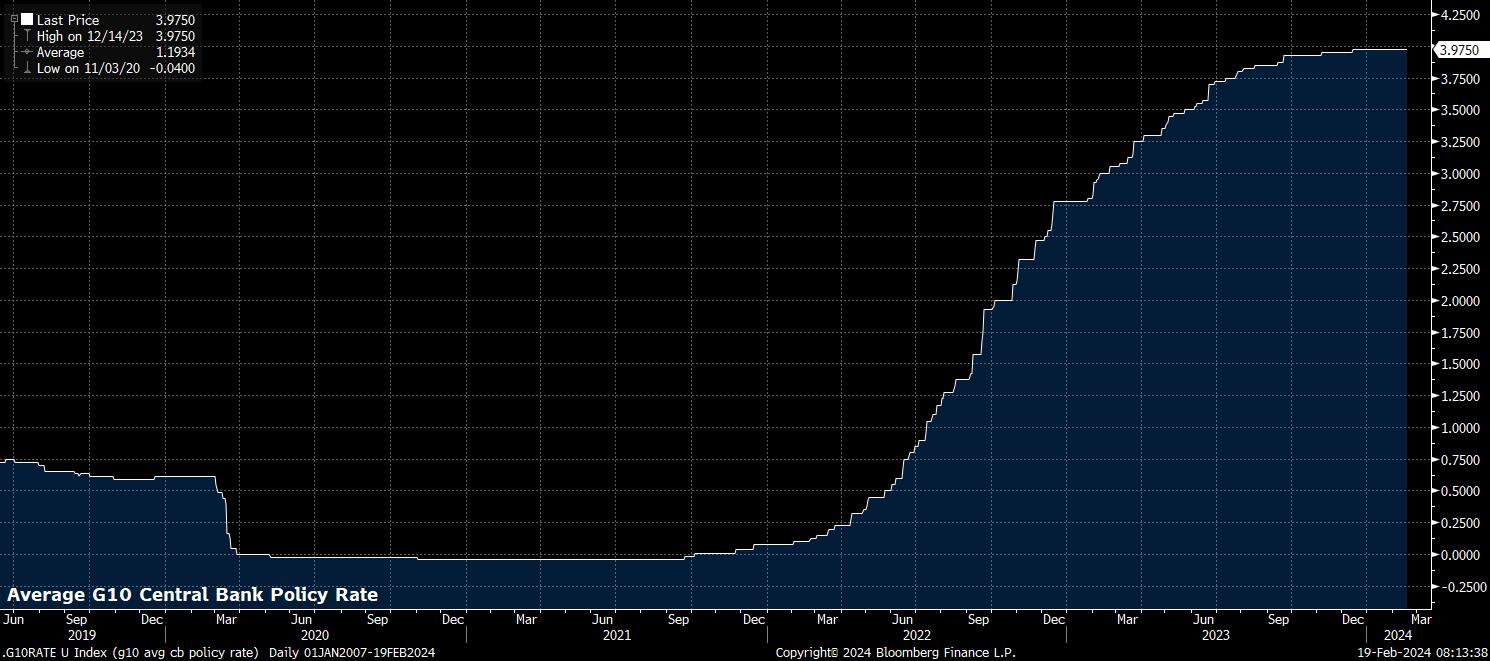

Here, I’d like to suggest, as I have in these pages previously, that the most significant conclusion to be drawn from the last couple of years lies, unsurprisingly, in the realm of monetary policy. Put simply, it is the way in which central banks have managed to separate the two primary tools in their toolboxes - interest rates, and the balance sheet - in order to restore price stability, while also preventing significant financial instability, and ensuring that a financial accident has not occurred, despite the most rapid rate hiking cycle in four decades having wrapped up last year.

I say that price stability has been restored as, though we have not yet got to precisely 2% CPI in the majority of DM economies, we are clearly close to the end of the road back to that target level, even if the ‘last mile’ of said road will be bumpier than the journey we have already travelled, as last week’s US CPI data proved, and the PCE figures due later this month will likely reinforce.

Nevertheless, it seems a question of ‘when’ rather than ‘if’ 2% inflation will be achieved. The answer to that question, however, matters little in terms of timing the first rate cut, with G10 policymakers simply seeking ‘confidence’ that inflation will return to that yardstick before beginning to move to a less restrictive stance.

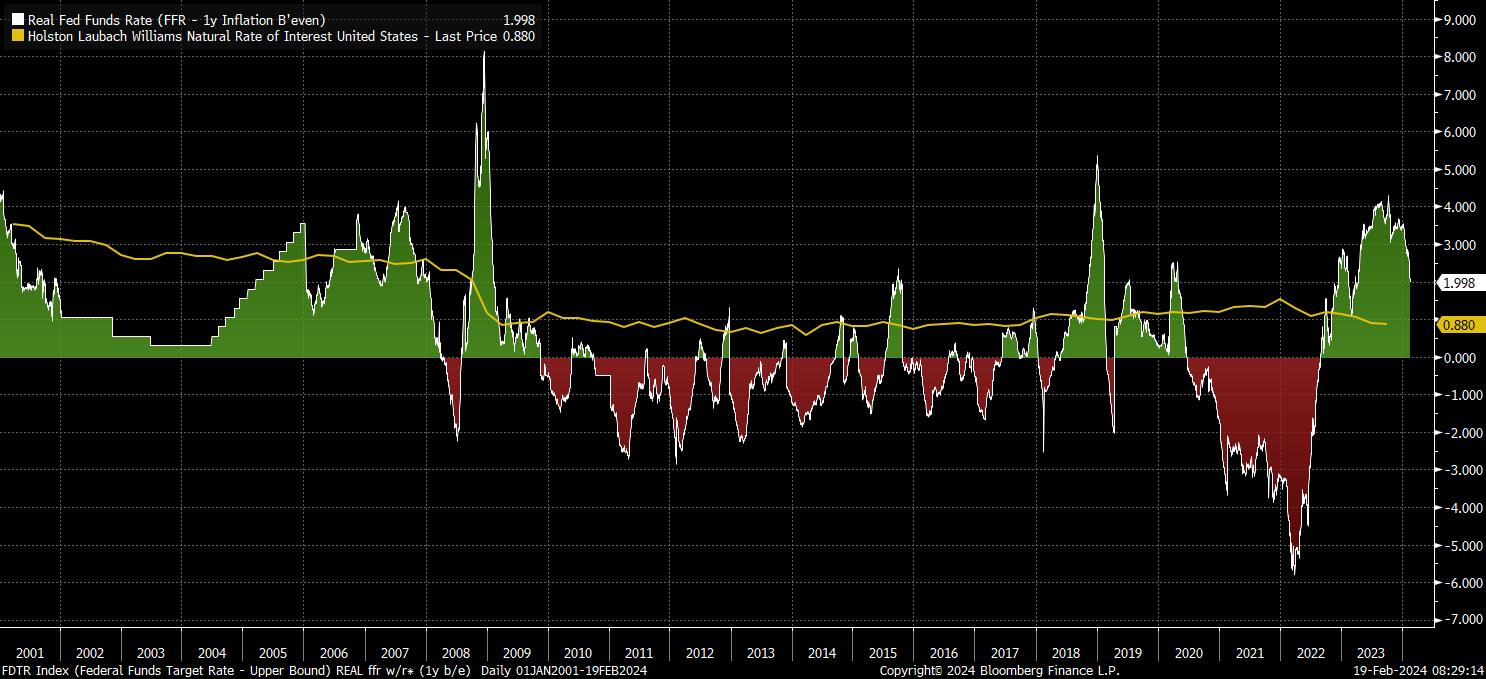

The reason for this is simple. As was harped on about during the hiking cycle, monetary policy works with ‘long and variable lags’. These lags that were present in the hiking cycle, are still present when rates are reduced. Waiting for 2% on the nose to be achieved would likely end with policy running too tight for too long, and a subsequent undershoot of the inflation target.

Those lags, however, do continue to pose a risk, particularly to rate sensitive sectors of the economy where 500bp of base rate hikes continue to feed through the system at large. Commercial real estate is one such area, which is grabbing significant attention - and taking up a seemingly inordinate number of column inches - at present.

It is here that the separation of interest rate and balance sheet policy becomes critically important to comprehend.

Targeted liquidity injections have become the modus operandi for the central bank put, in the way that a rate reduction, or even blanket QE, was in the past. The BoE led the way on this in Q3 22, delivering a targeted intervention in the gilt market after the Truss/Kwarteng ‘mini-budget’, while continuing to raise Bank Rate in an attempt to tamp down on double-digit inflation. The Fed then followed suit, almost a year ago, with the BTFP programme to support regional banks facing liquidity issues with large HTM portfolios, again while continuing to raise the fed funds rate. Credit for these innovative, and forceful, interventions must be duly given.

_2024-02-19_07-49-47.jpg)

While separation of the policy toolkit is one takeaway, the other is one of flexibility. The current environment is no longer one where policymakers will simply tweak the blunt tool of benchmark rates once every 6 weeks or so, and do little else. Instead, it is one where significant liquidity will be targeted to where it is needed, while the over-arching aim of restoring price stability remains the priority.

This all has significant implications for the year to come.

As noted, the next move in rates in almost all DM economies - Japan excluded - will be a cut. Whether this cut comes in the early spring, or the late summer, is largely immaterial besides those seeking short-term opportunities in the FX space. (For those readers, short the EUR and CHF, long the USD, GBP, and AUD seem attractive ways to position oneself.)

With that in mind, we should all be safe in the knowledge that, as the year progresses, policy will steadily become less restrictive, and likely move back to a neutral level some time in H1 25 (though r* is, obviously, near impossible to measure).

When this knowledge is then coupled with the well-demonstrated desire of central banks to ensure that liquidity remains provisioned where it is needed, when it is needed, it is clear that the overall policy stance will continue to ease.

There are a couple of implications to this.

One is that vol should remain relatively subdued, being capped by the reassurance that the central bank put is alive and well, and more flexible than before.

Another is that risk should remain resilient. Though countless columns have been written on the over-concentration of equity markets among the ‘magnificent seven’, it will likely be tough to bet against equities over the medium-term when Powell & Co are ready and waiting on the sidelines. Particularly when a return of inflation to target likely allows policy to provide more aggressive support than 12-18 months ago.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。