On the week we learnt that the UK and Japan are in a technical recession, although this meant little to markets and perhaps the bigger issue in Japan was the steady stream of pushback from key Japanese officials on recent JPY weakness.

US retail sales fell 0.80% in Jan, a sinister turn when both US CPI and PPI were far hotter than expected, putting us on notice that the US core PCE print (due on 29 Feb) could be above 0.4% MoM - which if seen a year ago would have been a trigger for the Fed to hike by 25bp. The February CPI print (due 12 March) will get huge attention, and while some way off is a key date for the diary.

Among a barrage of ASX200 companies reporting last week, we also saw a poor Aussie employment report, which now puts great emphasis on the February employment report (due on 21 March) given economists (and the ABS) expect a solid snapback in hiring in this data series. The ASX200 eyes new ATHs, and key earnings from the likes of BHP, RIO, QAN and WOW this week could take us there.

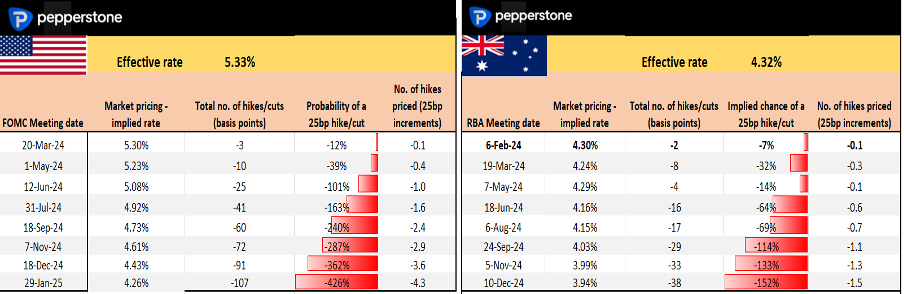

In markets, the USD gained for a sixth straight week, although a 0.2% week-on-week (Wow) gain was more of a stealth grind higher than an impulsive one-way tear. Assisting USD flows was a reduction in US swaps pricing, where we started the week with 113bp of cuts priced by December 2024, and finished with 91bp (or 3.6 cuts), which helped lift the US 2YR Treasury to 4.64% (+16bp on the week). If the market hadn’t already amassed a sizeable USD position, then one could argue the USD move would have been higher.

The EURUSD weekly shows indecision to push the pair lower and a move above 1.0805 (last week's high) and should take the pair through 1.0828 (200-day MA) and onto 1.0865, which would be a level I’d be looking to fade longs on the week.

While we saw the US500 0.4% lower on the week, we saw the prior week's low of 4918 (and the 5-week EMA) holding firm, with traders selling the VIX index above 15%. While US cash equity will be closed Monday for Presidents Day, I’m expecting choppy trade through to Thursday - so the intraday environment for day traders could get a little messy and it will pay to be nimble.

The NAS100 was the underperformer last week but should attract good attention from clients this week with Nvidia’s number due out on Wednesday (after the cash close), and where the market eyes some punchy in reaction to the headlines, which could spill out into AI names more broadly.

The Year of the Dragon got off to a solid start for China equity outperformed, notably in the small-cap space (the CSI500 closed +10% WoW) and we see the CN50 index looking compelling for further upside, and I see 12,000 coming into play. While National Team flows and PBoC liquidity have supported China/HK equity, economics do matter, so put the China Prime rate decision and new home sales data on the radar to potentially influence this week.

On the China proxy theme, Copper etched out a solid move on the week although we have seen selling interest into $3.80. Crude is also getting attention from traders, with price gaining 3.4% WoW and testing the 29 Jan pivot high. Moving in a bullish channel we see upper trend resistance into $80.50 – a level to put on the radar.

Staying in the commodity theme, silver (XAGUSD) has found good buying interest off $22 and has closed above the double bottom neckline and the 200-day MA – upside into $24.00/50 looks possible. On the ag’s, cocoa and wheat come on the radar as short set-ups, while corn has seen a solid bear trend since October but indecision in Friday's price action, suggests traders are on notice for a small reversal this week.

The marquee event risks for traders to navigate:

Monday

US cash equity and bonds are offline for Presidents Day – futures will be open but will close early.

Tuesday

China 1 & 5-year Prime Rate (12:20 AEDT) – The market sees the 5-year Prime rate lowered by 10bp to 4.1%, while the 1-yr rate is expected to remain at 3.45%. The Prime rate is the benchmark rate by which households can borrow from Commercial banks. We may see some disappointment in China's equity markets if the PBoC refrain from easing, which has been the trend of late. This time may be different, so conversely, a deeper-than-expected cut across both tenors may see traders adding to an early long position in the CN50 index.

Wednesday

Canada Jan CPI (00:30 AEDT) – The consensus is we see Canadian headline CPI coming in at 3.2% (from 3.4%) and core CPI unchanged at 3.6%. The CAD swaps market sees the first cut from the BoC occurring at either the June or July meeting. A core print above 3.6% should see good CAD inflows, while below 3.4% should interest CAD sellers. The GBPCAD (daily) setup is on the radar, where a closing break of 1.6950 would inspire short positions for 1.6800/1.6750.

Australia Q4 Wage Price Index (11:30 AEDT) – the median estimate from economists is for Q4 wages to increase 0.9% QoQ & 4.1% YoY (from 4%). The AUD may see a small move on this data point, but it will naturally be dependent on the extent of the outcome vs expectations. A wage print above 4.3% would be a big surprise and get some attention from Aussie rates traders who see the first cut (from the RBA) at the August meeting.

Nvidia Q424 earnings (after-market) – as noted in the Nvidia preview the options market prices a substantial -/+11% move on earnings. Naturally this sort of reaction – if it plays out - has the potential to cause big volatility in the NAS100 and US500 after the cash market close, so it is a clear event risk.

Thursday

FOMC meeting minutes (06:00 AEDT) – the January FOMC minutes should be a non-event given it predates last week’s stronger US CPI and PPI print. Any colour on an early end to QT may get some focus though.

EU HCOB (flash) manufacturing & services PMI (20:00 AEDT) - the market looks for the EU manufacturing index to print at 47.0 (from 46.6) and services at 48.8 (from 48.4). If these median expectations prove to be correct, then we would see a slight improvement in the pace of decline, which is modestly EUR positive. Seems unlikely we see a sizeable reaction in the EUR unless we see services above 50.0.

UK S&P (flash) global manufacturing & services PMI (20:30 AEDT) - the market looks for the UK manufacturing index to print at 47.5 (47.0) and services at 54.5 (from 54.3). So, a slight improvement is expected in both metrics. A service PMI print above 55 could see increased movement in the GBP and cement expectations the BoE will look to cut rates from August. GBPUSD needs a catalyst as it tracks a tight sideways range, while I hold a preference for GBPNOK lower, with GBPCAD shorts a potential trade I’m looking at.

Friday

S&P Global US Manufacturing & Services PMI (01:45 AEDT) – the market looks for manufacturing index to print at 50.5 (from 50.7) and services at 52.1 (from 52.5). Any reading above 50 shows expansion from the prior month, so if the consensus proves to be correct then both metrics will show expansion but at a slower pace. Hard to see a pronounced move in the USD or US equity unless we see a sizeable beat/miss.

China New Home Prices (12:30 AEDT) – China’s new home prices have fallen every month since May 2023, so further falls seem likely in the January series. China equity may find sellers if we see the pace of decline increases from the December outcome of -0.45%. Any improvement in the pace of decline could be taken well by the CN50 and HK50 Index which are already seeing tailwinds courtesy of National Team buying.

ECB 1 & 3-year CPI expectations (20:00 AEDT) – there is no consensus by which to price risk for the EUR, but consider the last estimate was 3.2% and 2.5% respectively. Any impact on the EUR will come from the extent of the revisions. June remains the likely forum for the ECB to start a cutting cycle. Biased long of EURJPY given the bullish momentum for 163.

US Politics – The South Carolina REP Primary is held on Saturday – will this be the stage for Nikki Haley to formally exit the REP Nominee race?

Marquee corporate earnings reports

- US corporate earnings – Home Depot (Before-market 20 Feb), Walmart (Before-market 20 Feb), Nvidia (After-market 21 Feb)

- ASX200 Corp earnings – COH (19 Feb), BHP (20 Feb), WOW (21 Feb), RIO (21 Feb), QAN (22 Feb), FMG (22 Feb)

- HK Corp earnings – HSBC (21 Feb)

Fed speakers

US & Aus Interest rate pricing – what’s priced into markets?

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。