Trading equity indices

In reaction to ever-changing trading trends from clients, Pepperstone has been increasing its equity indices offering. Expanding on its core US, Europe and Asian equity index range to a more complete suite of global indices. If you’ve not looked at trading equity indices before, or have traded before and want further perspective, this guide may be of interest:

What is an equity index?

Benjamin Graham (the architect of value investing) - “in the short-run, the market is like a voting machine, but in the long run it is a weighing machine”

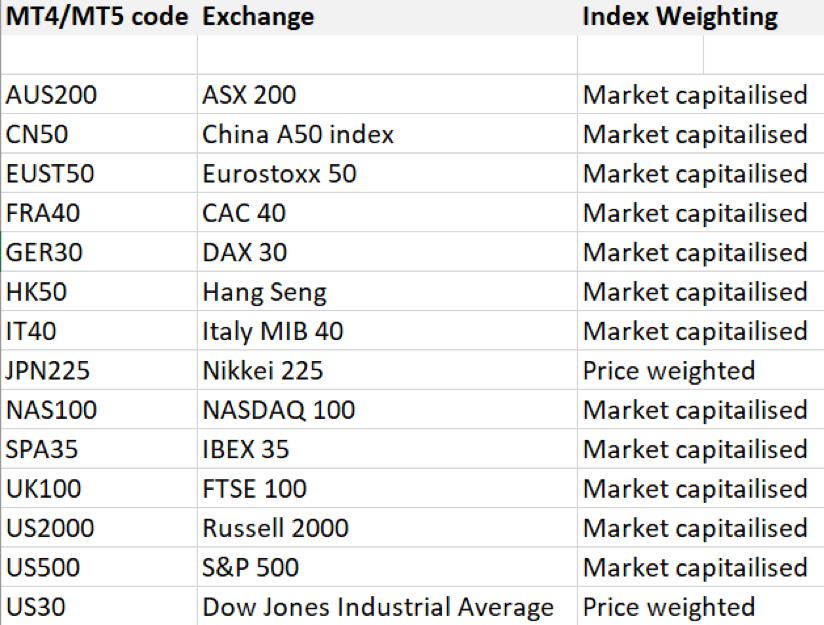

An equity index is comprised of a set number of listed companies, or ‘equities’, each of which has its own variable weighting on the index. Which, in turn, is defined by its market capitalisation (cap) or its absolute level of its price.

Market capitalisation is calculated by multiplying the current share price by the number of shares outstanding, or that are freely tradeable.

Why is market cap important?

A company with a high market cap (or price) will have a higher weighting on the overall index and will, therefore, have a far greater impact to the changes in the index level than a company with a smaller weighting.

So, even if the two companies have an identical percentage move in the share price over a period, the larger cap (or priced) stock will contribute, or subtract, more index points than the small-cap company.

This is an important consideration for traders, especially around events such as corporate earnings, where a company with a sizeable index weight, radically misses or beats expectations, undergoes a rapid move in price, and subsequently causes a sharp move in the index.

An equity index represents the real-time aggregated performance of all the companies in that basket and portrays a level of supply and demand from traders and investors.

In most cases, the companies listed on a nation’s index will also be domiciled there, but that is not always the case. For example, Chinese consumer-focused giant Baidu has its primary listing on the NASDAQ 100.

However, in most cases, companies will choose to list on their native exchange and therefore, while financial markets are incredibly interconnected, moves in an index are seen as a confidence barometer to hold the equity of corporations in that specific country or region.

Why are traders attracted to index trading?

The fact that each equity index comprises of many different companies, sourcing revenue streams from different variables and economic factors, increases diversification.

An index blends stocks with cyclical and defensive qualities. Stocks which pay high dividends, those that are considered as ‘quality’, with a strong balance sheet, low debt and high cash flow, and those which investors may consider to be ‘value’, where the investment case falls on valuation.

Despite these many factors, and despite the numerous market themes all playing out at any one time, the attraction is that an index blends all these qualities into one tradable price.

Aside from the diversification indices offer relative to individual equities, another key attraction, similar to the forex market, is the reduction in gapping risk.

With Pepperstone offering prices for clients to trade on many global indices 24 hours (or almost 24 hours a day), 5 days a week, it lowers the probability for markets to ‘gap’ higher or lower after a period of closing – such, as is the case, for say, an Australian energy company would on the re-open of the equity market if WTI crude fell 5% during US trade, or a German auto company if the Chinese CN50 index fell 3%, amid poor Chinese economic data.

Reducing gapping risk in our trading offers traders greater control, especially around key economic data points or other volatility-creating event risks.

What are core attractions for index traders?

- Indices are a great way of expressing a trading thematic while offering incredible geographical reach. If you want to trade a view on China, trade an index that focuses on China, such as the CN50 or HK50. If you think the US will outperform, chose between the US30, US500, TECH100 or US2000, as your weapon of choice. If you think European equities face sizeable downside, take a short position on a complete range of European indices as your trading vehicle (see PS diverse range here).

- Take advantage of any situation – when trading an index, you can go ‘long’ or ‘short’ and trade the markets whether they are going up or down.

- It’s not just about speculation, use an index CFD as an effective hedging tool - if you’re worried about a sell-off or drawdown in a market, it can be far more cost-effective to ‘hedge’ a diversified portfolio of physical stocks using an index CFD, and maximise the portfolio’s performance, than going to cash, with a view to buying back those stocks at a later date.

- Trade like a hedge fund – with the ability to go long one equity index, and short another, you can trade a long/short (or ‘pairs’ trade) strategy and trade the relative performance of the two markets, just as a hedge fund would.

- Information advantage – sourcing news, views and insights on global equity indices has never been easier. In fact, the hardest consideration many face is who or what to follow to receive reliable and accurate news. However, sourcing relevant news, so you can make informed decisions to manage exposures, has never been more efficient. – (follow Pepperstone on Twitter).

- One size doesn’t fit all - While market volatility changes all the time, equity indices offer differing degrees of volatility and risk. For example, if your strategy prefers higher volatility or greater range expansion, the HK50 might be one to look at. While in Australia, the AUS200 might be an index to focus on if your strategy works best in less volatile markets. Understanding the typical trading range and volatility in an index can be incredibly beneficial, especially when we consider risk and correct position sizing.

- While spreads do vary depending on the time of day, index CFDs are highly liquid, especially when the underlying cash session is open.

What do traders need to know?

Consider the contributions from each sector’s (such as energy, staples, or financials) weight on the index, as they differ quite markedly depending on the index.

For example, the ASX 200 financial sector commands a 32% weighing on the broader ASX200, while the energy sector holds a mere 7%. Clearly, if there are elevated concerns around the demand for credit and housing in Australia, yet oil rallies 3%, the index will likely fall.

Another example is the Tech100, which is largely comprised of US high growth, high valuation tech firms, with limited exposure of staples, energy or REIT. So, if we want to express a trading view on tech, where best to go than the US Tech 100.

Of course, if the world gets concerned that we’re seeing an accelerating global economic slowdown, tech may face strong headwinds and the Tech100 may underperform and attract increased interest from short-sellers.

In Japan, a reasonable percentage of the index weight comes from exporters – hence when USDJPY goes lower, we see the JPN225 moving higher in appreciation, as the world perceives US importers to gain purchasing power, with Japanese goods becoming cheaper.

The dynamic of sector weighting and an index’s sensitivity towards each individual sector, changes from index to index, so it’s certainly something to be aware of.

How do dividends affect index trading?

When a company pays out a dividend, the share price, all things being equal, will fall by an equivalent amount, as the equity reflects the fact that the company is now trading ex-cash.

This phenonium has implications for index traders too. Unlike an index future, where dividend and interest payments are rolled into the initial spread you pay. If you buy an index (long) as a CFD, you are entitled to the dividends paid out by the companies on that specific date

If we aggregate all stocks paying dividends on a specific day, we can then understand the expected fall in the index, which we achieve by calculating the size of the dividend and the stock's weight on the index.

It is important to understand that when the index falls by the aggregated dividend total, it will affect the profit and loss on any open position, dependent on whether the client is long or short the index.

Pepperstone will subsequently cash adjust the account by the same amount. So, if you’re long an index, the index will fall, but the trading account will have a cash credit to the account, and vice versa. In effect, it is a zero-sum game.

The goal of trading equity indices

The goal of trading equity indices is to have a strategy which you have genuine confidence in, that provides you with a positive expectancy, and that when you are in front of the trading screen it is just you and the markets, everything else is noise.

Trading equity indices allows you to directly take advantage of the opportunities that global equities markets offer, and provides diversified trading strategies across uncorrelated instruments.

Learn more about trading equity indices with Pepperstone, or stay informed with weekly global market news, insights and up-to-the-minute economic outlooks from our team of experts.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information provided here, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.