- Italiano

- English

- Español

- Français

June 2024 FOMC Review: Cuts Still Coming Despite Hawkish Dots

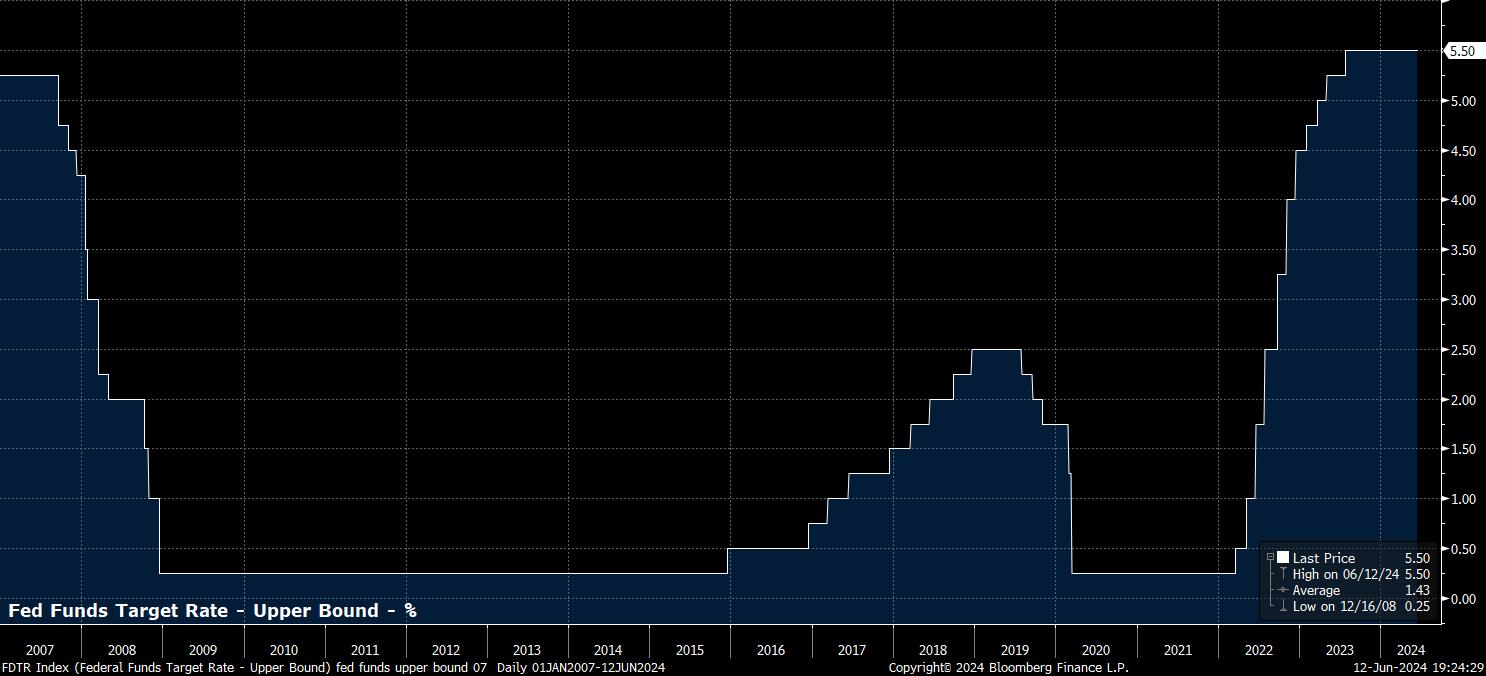

As had been entirely expected, the FOMC voted unanimously to maintain the target range for the fed funds rate at 5.25% - 5.50% at the conclusion of the June policy meeting, marking the 8th consecutive meeting at which rates have remained unchanged, 11 months on from rates having reached their terminal level, after a final hike last summer. Of course, this is a somewhat longer period than the median 8 month duration between the last hike, and the first cut, over the last 40 years.

With markets having fully discounted the FOMC standing pat in advance of the meeting, focus naturally fell on other areas of the confab – namely, policy guidance; the latest SEP, including the updated ‘dot plot’; and Chair Powell’s press conference.

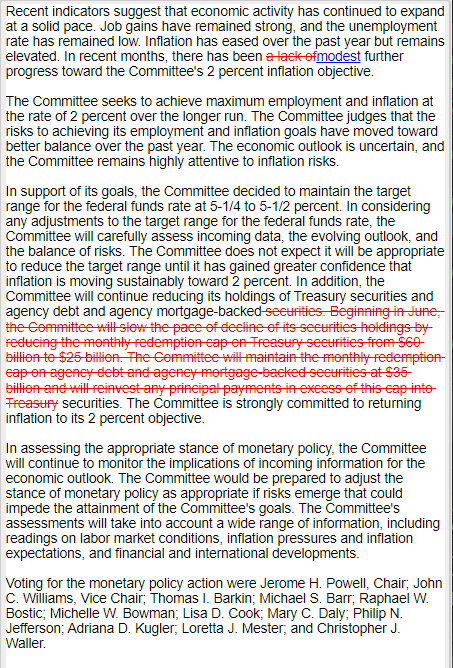

Starting with the policy guidance, there were again few surprises, as the statement by and large represented a ‘copy and paste’ of that issued after the previous meeting. Once again, the Committee flagged that they continue to seek “greater confidence” in inflation returning “sustainably towards” 2% before beginning to cut rates. Of course, this continued inclusion of “towards” implies that the price target need not be precisely achieved before the easing cycle begins, just that policymakers must be sufficiently sure it will be achieved in order to begin normalising policy.

Elsewhere in the statement, the FOMC again noted that the economy is expanding at a “solid pace”, with job gains having remained “strong”. On inflation, the Committee reiterated that price pressures have “eased” but remain “elevated”, with a “modest further progress” towards target having been made in recent months. Language on the balance sheet, after announcing a taper to QT in May, remained unchanged.

Besides the statement, the FOMC also released the latest update to the quarterly Summary of Economic Projections (SEP).

The FOMC’s latest GDP growth projections were identical to those issued at the March gathering, with real growth of 2.1% foreseen this year, followed by 2% growth in the remaining 2 years of the forecast horizon.

There were, however, slightly more significant changes to the unemployment and inflation forecasts, with said metrics ‘marked to market’ given the outturns in data seen during the first five months of the year. Unemployment, while still seen at 4.0% this year, is now seen rising to a peak of 4.2% in 2025, before pulling back a touch to 4.1% in 2026. Meanwhile, core PCE – the FOMC’s preferred inflation gauge – is now seen ending this year 0.2pp higher at 2.8%, before a fall to 2.3% in 2025, and finally the achievement of the 2% target continuing to be pencilled in in 2026.

As a result of these amended projections, and the hotter-than-expected inflation data seen during the first quarter, the latest dot plot was significantly more hawkish than that issued three months ago, and than markets had expected in advance of the decision.

Having previously pencilled in 75bp of cuts this year, the FOMC’s median expectation now points to just 25bp of easing by the end of 2024. This median expectation, however, is relatively finely balanced, with 8 of the 19 policymakers continuing to foresee two 25bp cuts before the year is out. Looking ahead, 100bp of easing is now pencilled in for 2025, compared to the 75bp that had previously been signalled, while the longer-run fed funds rate estimate – a proxy for the neutral rate – now sits at 2.8%, compared to the prior 2.6%, though some may argue that this remains too low.

Money markets, however, were relatively unperturbed by this hawkish revision to the dot plot, continuing to price around a 70% chance that the FOMC would indeed deliver two cuts this year, in the aftermath of the cooler-than-expected May CPI figures released earlier on Wednesday. The OIS curve continues to fully price the first 25bp cut for November, albeit seeing around a two-thirds chance that such a move instead comes at the September gathering.

With the excitement of the more hawkish dots out of the way, focus rapidly shifted to Chair Powell’s post-meeting press conference.

At said presser, Powell largely stuck to the script that has been heavily used of late. While noting that recent inflation data has “eased somewhat”, Powell reiterated that the Committee need to see “more good data” in order to “bolster” confidence that inflation is indeed returning towards target, in order to cut rates. Furthermore, Powell again reiterated a preparedness to respond were the labour market to “unexpectedly”, in addition to repeating that rates will be held “where they are for as long as needed”, in order to bring inflation back to target. Furthermore, as if it wasn’t already clear enough, Powell explicitly noted that “everyone” on the Committee agrees that policy remains “very data dependent”.

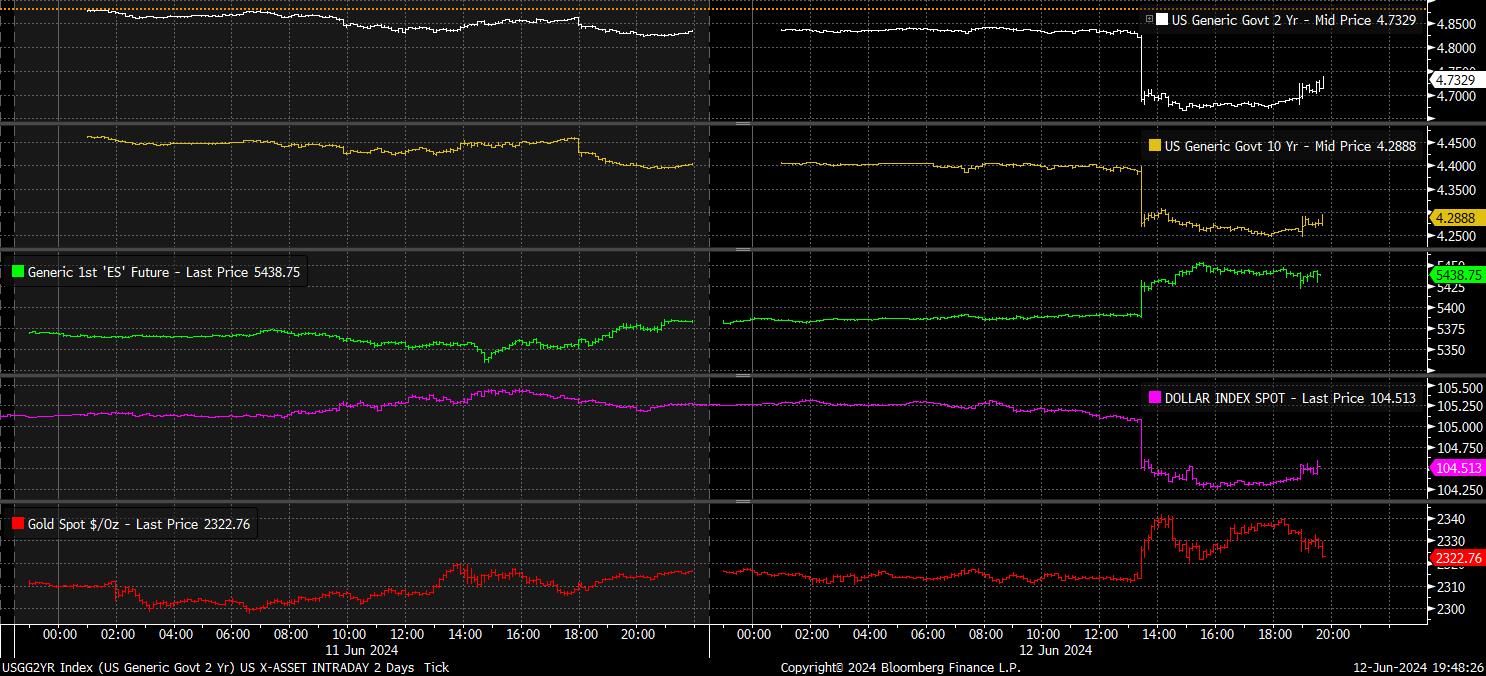

Rather remarkably, and to your scribe’s surprise, markets took all of this in their stride, perhaps having become somewhat exhausted after the violent dovish reaction to the CPI figures released earlier in the day. Equities, effectively, traded flat over the FOMC decision, while Treasuries ticked just a touch lower at the front-end, but by and large held on to the significant gains chalked up earlier in the day. The dollar was similarly unmoved, gaining around 25 pips against most G10s – a move hardly worth writing home about – with gold also largely treading water.

On the whole, the June FOMC changes little in terms of the broader policy outlook. While the dots were revised in a hawkish direction, the Committee clearly maintain a strong desire to begin to normalise policy, despite an upward revision to both this year’s and next year’s core PCE projections. This, incidentally, provides further evidence that policymakers are increasingly targeting an inflation range, with 2% as the floor, as opposed to seeking a return to 2% outright.

In any case, with a rate cut remaining the FOMC’s most likely next move, and the committee’s broader bias, appears to be towards looser policy, with the question remaining not one of ‘if’ said cuts are delivered, but ‘when’. The flexible, and forceful, ‘fed put’ hence remains intact, leaving the path of least resistance for risk assets continuing to point to the upside, with dips in equities likely to remain relatively shallow for some time to come.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.