- Français

- English

- Español

- Italiano

Tech Gears Up For A Year-End Rally

The message from recent price action is coming through loud and clear; that the bulls are firmly in control of proceedings, and wrestling a greater degree of control on an almost daily basis. Last week’s cooler than expected US CPI figures cemented the idea that the Fed’s tightening cycle is at an end in the market’s mind, benefitting the rate-sensitive tech sector, forcing the Nasdaq back above both the 50- and 100-day moving averages, and to its best levels in almost two years.

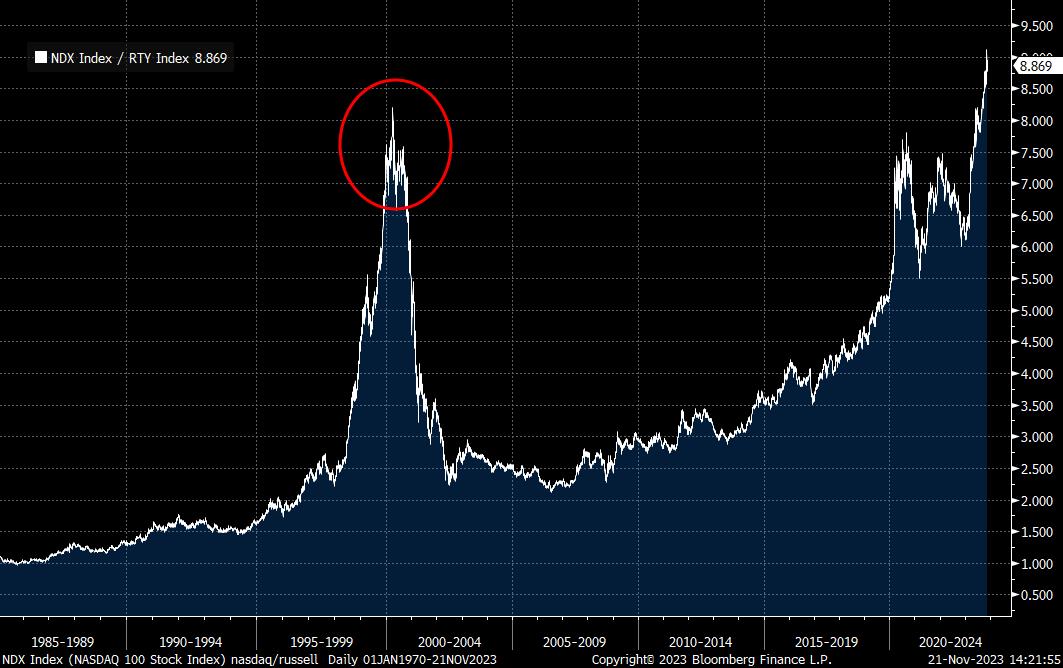

This tech strength, however, is not evident solely by looking at the headline level at which the Nasdaq trades. On a relative basis, compared to small caps, tech is currently outperforming by, as near as makes no difference, the biggest margin ever, considerably above the level of outperformance seen during the ‘dotcom bubble’ at the turn of the millennium.

Of course, this should not be particularly surprising, given how well-documented the stellar performance of the ‘magnificent seven’ has been this year.

Nevertheless, there are some signs that market breadth is beginning to improve, which bodes well for gains to continue as the end of 2023 approaches. The percentage of S&P 500 members trading above their 200-day moving average, for instance, now sits at its highest since August, implying gains are beginning to be spread more widely among index members.

In addition to this, the list of bullish equity catalysts continues to grow – Treasuries continue to rally, particularly at the long-end, with bond bulls now back in command, and the market absorbing recent auctions without a hitch; emerging markets are finding demand as the Fed’s tightening cycle comes to a conclusion; China continue to deliver stimulus which, while falling short of expectations, is injecting liquidity nonetheless; and, hopes of a US soft landing continue to grow.

This long list should be coupled with seasonality, which is typically favourable in the final weeks of the year, along with the usual year-end ‘window dressing’ that typically takes place, where fund managers feel the need to purchase well-performing, and in vogue, names, in order to avoid the need to justify not owning them in year-end investment letters.

Of course, there are risks that remain for the equity space. Despite markets having reduced their focus on the middle east of late, amid increasing signs that the Israel-Gaza conflict’s impact on the energy complex will be minimal, there remains a risk that tensions do resurge, and that a regional escalation of the conflict does occur. Furthermore, while the FOMC’s hiking cycle does look to be over, the market does appear to be pricing too aggressive a pace of rate cuts, with over 100bp of easing priced by the end of next year.

For now, the price action speaks for itself, with risk bulls well and truly off to the races in the final stretch of 2023. Though the case for further upside is solid, risks remain, and with the sell-side’s average end-2024 S&P price target sitting bang in line with the index’s current level, longstanding bulls may be inclined to lock in profits before holiday-thinned trading conditions prevail.

Related articles

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.