- Français

- English

- Español

- Italiano

EURUSD closed above the former rising trend (drawn from the March lows) and targets 1.0960 (the 61.8 fibo of the July-Oct sell-off), with USDCHF looking to pull below 0.8850, which would keep the bearish trend intact. GBPUSD closed above the 200-day MA, where a break of 1.2500 takes us to 1.2560. USDSEK was the big percentage mover last week, and we look ahead at the Riksbank meeting where a 25bp hike is touch and go.

USDCNH is starting to trend lower too, and eyes a break of 7.2000. The PBoC has made it clear that their preference is low volatility, and they have done a sensational job is just about killing off any pulse in the yuan - after trading a tight range since mid-August, will they now step in front of a weakening USD?

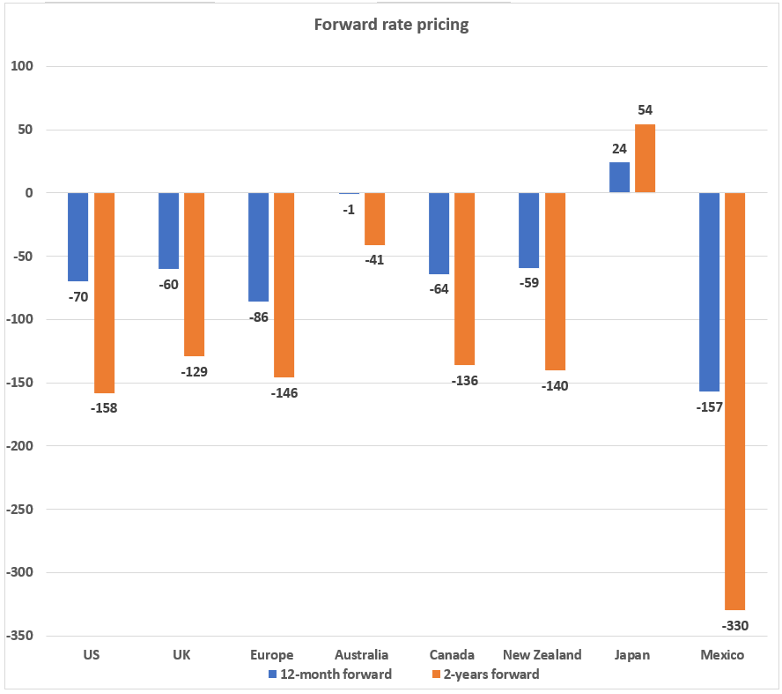

The fate of the USD resides in the data flow and Fed speakers – so far there has been limited pushback to the 100bp cuts priced for 2024, with US swaps pricing the first ‘live’ FOMC meeting for May. Many will see this as too soon and too punchy, but the market is betting against higher-for-longer, which is also the case in Europe, the UK, Canada, NZ, and others, with the market seeing the ECB kick off an easing cycle in developed economies in April.

Central bank easing is a theme that will be front of mind for 2024, with some debate as to why the markets are discounting such easing. The central thesis is that with absolute conviction inflation is heading towards target, labour markets cooling sufficiently and growth at far more subdued levels the need to take rates to a more equilibrium state and out of restrictive is the fundamental reasoning.

It’s when the market discounts front-loaded cuts that we see easing as a function of recession hedges, where a central bank would need to get policy rates below inflation.

If we look at forward rate differentials – we look at the difference between 1 or 2-year EUR forward rates and that of the US forward rates – we have seen no real skew for US rates to move more aggressively on a relative basis, which would justify the USD sell-off. However, clearly, the US CPI resonated, and the idea that the right-hand side (i.e., USD data is more exceptional than other countries) of the USD smile theory is losing USD support.

One could argue that if we work off pure central bank divergence – which has been a profitable way to capture moves in exchange rates throughout 2022 and 2023 – that 2024 could be the year of the JPY. Life is rarely that simplistic though.

In equity land, we see consolidation in US indices, and with one eye on moves in the US Treasury market as a guide, where a downside break in the 10yr of 4.37% would be helpful, we subsequently watch for an upside break of 16k in the NAS100 – Nvidia’s earnings could be key here. It’s the EU equity bourses where the momentum is right now, with the GER40, EUSTX50 and SPA35 in beast mode and swing traders will be looking for a pullback to initiate new longs into December.

I was positioned for outperformance in Chinese/HK indices but that has been a poor call and I have moved to the sidelines on that, waiting for more constructive flows to be seen.

The marquee event risks for the week ahead:

OPEC meeting (26 Nov) – the alliance meets in Vienna and with Brent crude in a steep downtrend, and having fallen 20% from the Sept highs, there have been headlines of imminent additional supply cuts to be seen at this meeting. As we head into the weekend meeting, traders with crude exposures need to consider the potential gapping risk in crude.

UK Autumn Statement (22 Nov) – Chancellor Hunt offers the autumn statement with talk the govt will focus heavily on imposing sanctions for people who claim benefits and encourage people to take up employment. It feels unlikely this will a vol event for the GBP, although traders will keep an eye out for any tangible fiscal measures that could stimulate growth.

Nvidia 3Q earnings (report 21 Nov after-market) – the market looks for another big earnings report from the best performing US stock in 2023 – the market prices Nvidia’s implied move (derived from options pricing) at 7.1% on the day. The market will go into the report positioned for an upside surprise relative to consensus, with expectations that we see data centre sales of $15b. There will be a strong focus on guidance on the impact of US restrictions on AI chips to China and how this could impact data centre sales for 2025/26. The bulls will want to see a fourth consecutive share price increase on quarterly earnings and will naturally want to see a break of $500, which has kept a lid on the share price on seven occasions.

US Thanksgiving holiday (23 Nov) – cash equities are closed, and futures have partial settlement.

Economic data to navigate:

- China 1 & 5-year Prime Rate decision (20 Nov 12:15 AEDT) – while the market is on edge for further policy easing – notably for a further cut to banks Reserve Ratio Requirements – few expect a cut to the prime rate, with the 1-year rate expected to remain unchanged at 3.45% and the 5-year rate at 4.2%.

- RBA meeting minutes (21 Nov 11:30 AEDT) - after hiking by 25bp I am not sure we’ll learn a lot of new intel from the minutes and traders are better listening to speeches from the RBA governor Bullock as the greater prospect of being an AUD vol event.

- US leading Index (21 Nov 02:00) – the consensus is we see the leading index fall 0.7% in October – some have seen this data point as a precursor to recessionary conditions, so a big downside miss may impact the USD.

- Canada CPI (22 Nov 00:30 AEDT) – the economist’s consensus is we see headline CPI at 3.1% yoy (from 3.8% yoy) and core CPI at 3.6% (3.8%). The expected drop in inflation justifies Canadian rates pricing with the first cut being priced for April 2024 and 64bp of cuts being priced over the coming 12 months.

- US FOMC minutes (22 Nov 06:00 AEDT) – after the recent Fed chatter, notably from Cleveland Fed president Loretta Mester (a known hawk), who failed to push back on market expectations for rate cuts and suggested the debate is now how long to keep rates restrictive, it’s hard to see the FOMC minutes being too much of a market mover.

- US Durable Goods (23 Nov 00:30 AEDT) – the market looks for -3.2% (from 4.6%). With US Q4 GDP running around 2.2%, a weak print here could see GDP Nowcast models being revised lower, which may see US bond yields pull lower and promote USD selling.

- UK S&P Global manufacturing and services PMI (23 Nov 20:30 AEDT) – the consensus is for manufacturing to come in at 49.9 and services PMI 50.4 – A services print below 50 may see bond yields lower, which would drag down the USD. A Services print above 51.0 would revisit calls of US exceptionalism and promote USD buyers.

- EU HCOB manufacturing and services PMI (23 Nov 20:00 AEDT) – the consensus is for manufacturing PMIs to improve modestly at 43.4 (from 43.1 in October), although that is still a woeful outcome. Services PMIs are eyed at 48.1, again a slight improvement from 47.8 – the EUR will be sensitive to the services print, where EU swaps markets price the first cut by the ECB in April and 86bp of cuts over the coming 12 months.

- Sweden’s Riksbank meeting – it’s a lineball call on whether the Swedish central bank hike to 4.25%, with swaps pricing 11bp of hikes and 50% of economists surveyed by Bloomberg calling for a 25bp hike. We could see some vol in the SEK, so watch exposures. USDSEK has been in a strong downtrend, so the market is likely positioned long of SEKs going into the meeting.

- US S&P Global manufacturing and services PMI (25 Nov 01:45 AEDT) – the market looks for the manufacturing index to come in at 49.9 (from 50.0) / and services at 50.3 (50.6) – we should see the USD, and risky assets more sensitive to the services print, and certainly if we see the index below 50.0 – the level where we see growth/decline from the prior month.

Central bank speakers

BoE – Gov Bailey speaks (21 Nov 05:45 AEDT)

ECB – 10 speakers – Schnabel (22 Nov 04:00 AEDT) and Lagarde (22 Nov 03:00) get centre focus

RBA – Gov Bullock speaks (Monday 10:00 AEDT & Tuesday 19:35)

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.