- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

A carry trade is one where a trader borrows funds in a low interest currency (which they are short), to purchase a higher-yielding one (which they are, in turn, long), in the expectation of pocketing the differential – or carry – as profit. This is, however, considerably more complex than that explanation would make it seem, primarily due to the impact of market volatility; say, the carry on offer were 3%, a market move of this, or a greater degree, would wipe out any return the carry could provide. Furthermore, such trades are seldom hedged, as use of, for example, a forward contract, would negate any positive carry on offer, thus defeating the object of the trade.

With this in mind, one of the key market characteristics required for carry trades to come back into vogue is low volatility. That is exactly the sort of environment that now presents itself, with G10 FX largely moving sideways rather than in any sort of defined trend, and with implied vols having fallen steeply across the board, to their lowest level since Russia invaded Ukraine, as shown by an index compiled by JPMorgan below.

Given the time of year, with markets traditionally quieting down significantly over the summer months, and the ease with which markets have shrugged off the most recent round of G10 central bank decisions, it appears that the present low vol environment may persist for some time to come.

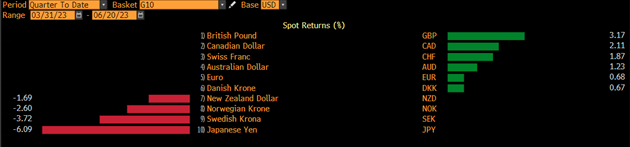

With that in mind, it’s worth considering which currencies may benefit from such an environment, and which may struggle. Before doing so, however, one must recognise that we have already seen the carry trade start to pan out during Q2, with higher yielders such as the GBP and CAD rising towards the top of the G10 leaderboard, while the JPY languishes towards the bottom, having lost at least 3% against each of its major peers over the last three months.

Taking that into account, one can extrapolate what may continue to work well over the summer, though of course past performance is not a reliable indicator of future results.

When considering carry positions, it is not only volatility that must be factored in, but also a currency’s valuation. A significantly overvalued currency may not be the ideal contender for a carry trade, given the potential risk of a downside correction; under-valuation is less of a concern, given that a rally in the currency bought to take advantage of the carry would move the trade further into the black. This rules out some of the more obvious higher-yielding contenders such as the MXN, AUD, and BRL.

Furthermore, and as explained above, volatility must be a key consideration. Higher volatility brings higher risk into the trade, thus leading to the potential for any carry returns to be eliminated by market movement – leverage, of course, would only amplify this risk. Consequently, it is lower vol G10s that one would tend towards if carry trading, such as the GBP, NZD, and CAD.

Lastly, one must ask how to fund such a trade. Short JPY is the obvious answer here, given the continued ultra-easy policies of the BoJ, and the apparent reluctant nature of the central bank to tighten policy any time soon. Long GBP/JPY, NZD/JPY, and CAD/JPY are, therefore, potential options on the table. If it is going to be the summer of the carry trade, it looks set to be a bruising one for the JPY.

_2023-06-20_14-41-37.jpg)

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.