- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

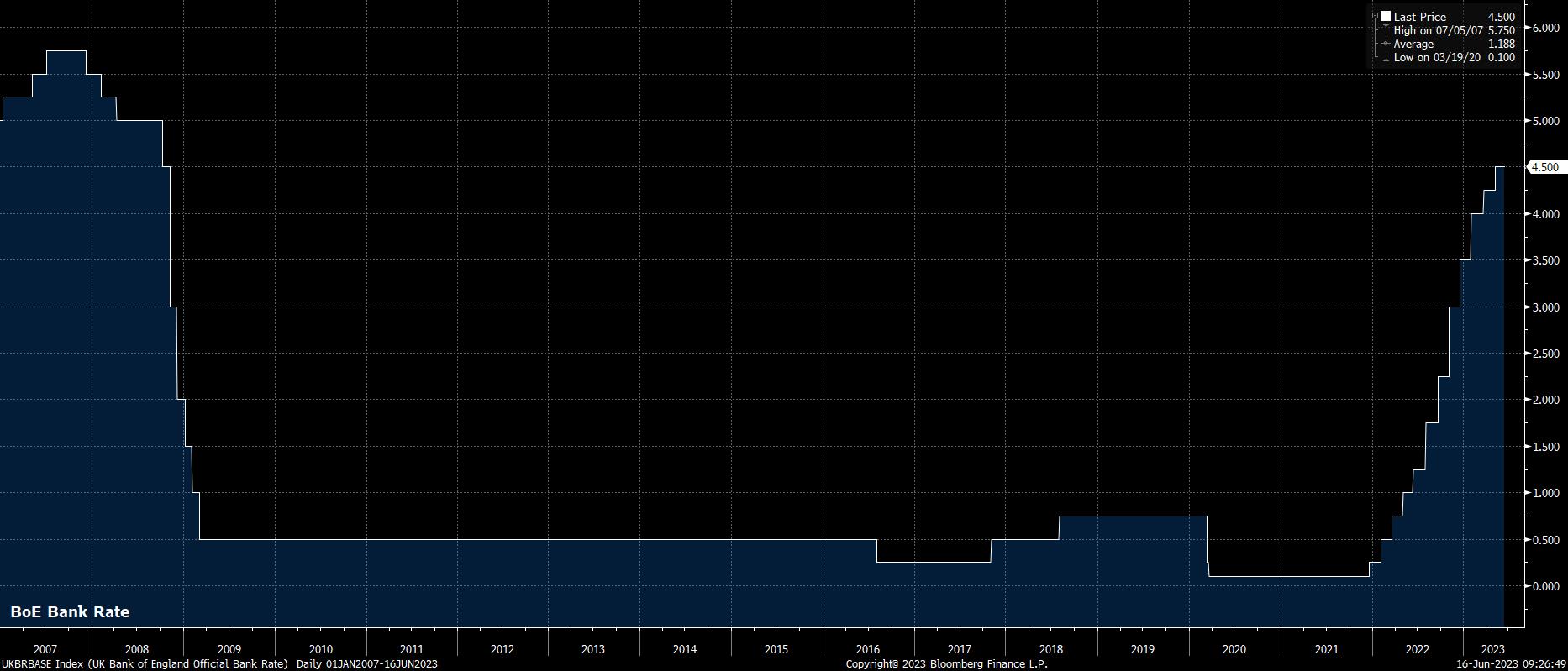

While a 6% terminal rate feels punchy, to say the least, the aggressive hawkish repricing has been driven by the ‘stagflationary’ backdrop continuing to face the UK economy, with few signs of relief, in terms of inflation, on the horizon.

Nevertheless, focusing on the June decision, the MPC are set to vote in favour of a 25bps rate hike, bringing Bank Rate to 4.75%, equal to the highest level since mid-2008. In keeping with recent decisions, the MPC’s vote is unlikely to be unanimous, with external member Dhingra set to vote to keep rates unchanged, along with fellow external member Tenreyro; that said, with this meeting being the latter’s last, there is a chance that she may throw ‘caution to the wind’ and vote for the rate cut that the Argentine has long been discussing.

It seems highly unlikely that a June hike will be the last of this cycle. The Old Lady’s own guidance is likely to allude to this, with a repetition of the prior guidance to tighten policy further “if there were to be evidence of more persistent [inflationary] pressures”. As noted above, markets price a significant degree of further tightening, expecting at least a 25bp move at every meeting between now and year-end, with the terminal rate seen just above 5.75%.

This pace seems too aggressive, given how lacklustre economic momentum already is, how much further growth is set to slow over the remainder of the year, the lagged impact of the cumulative tightening already delivered, and the ‘mortgage cliff’ facing UK borrowers coming off fixed rate deals often with rates below 2.5%. As a result, and given the MPC’s tendency to take a cautious stance of late, the bar for a hawkish surprise is a high one; even if the conditionality around the BoE’s tightening bias were to be dropped, this would simply move guidance more in line with the current market curve, rather than sparking any sort of repricing.

.png)

Although substantial guidance changes are unlikely, it is undeniable that there are increasing signs of persistent inflation within the UK economy. While headline inflation has, finally, retreated back into single digits, rising by 8.7% YoY in April, underlying inflationary pressures remain intense, with core CPI jumping 6.8% YoY in the same month, the fastest pace in 30 years.

Headline CPI should continue to decline as the year progresses, though this will largely be a mechanical function of both falling energy prices (the impact of which has been delayed by the UK’s energy price cap mechanism), and by the base effect from last year’s price surge once more distorting the annual comparisons. Once those impacts are removed, however, it’s clear that underlying inflationary pressures remain intense, and show few signs of abating. Even if, as the MPC expect, headline CPI were to fade to almost a whole 1% below the BoE’s price target by mid-2025, it appears unlikely that the core measure will decline to the same degree.

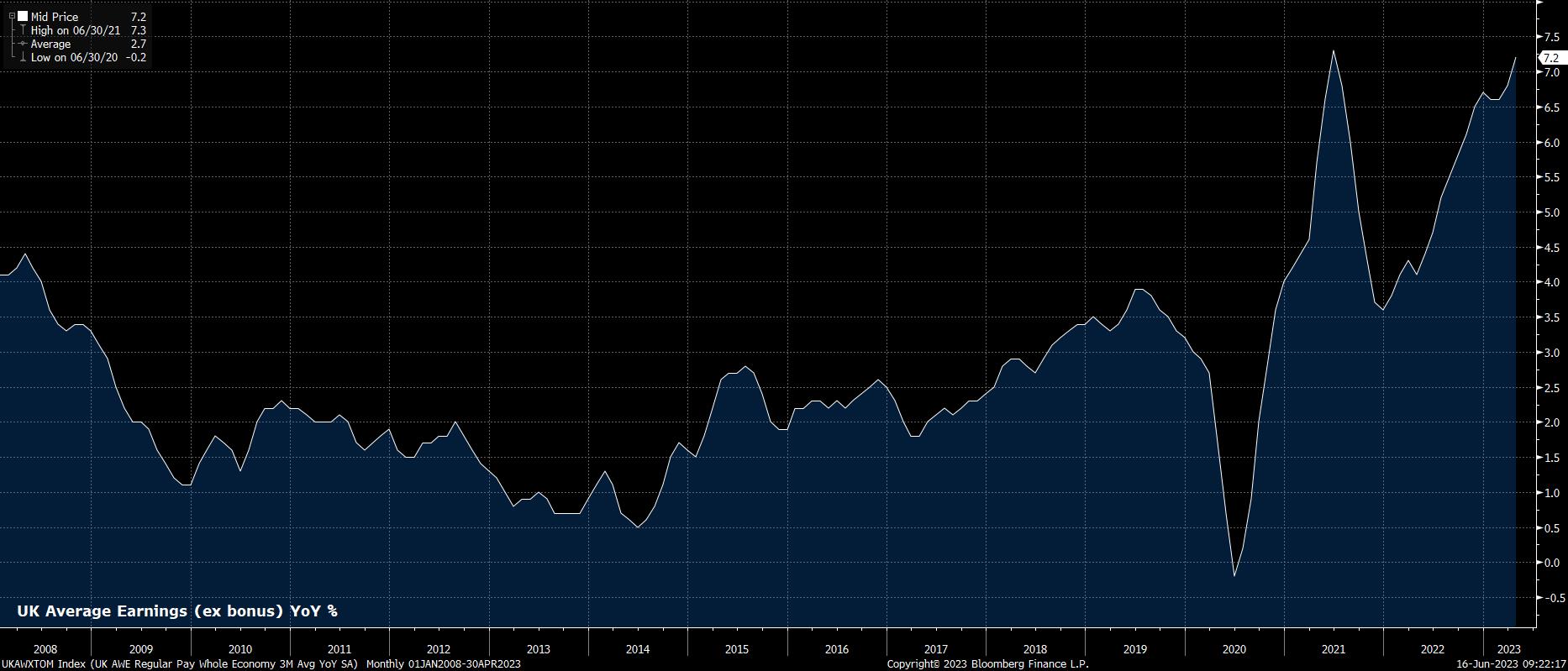

Incredible labour market tightness, as shown by an unexpected decline in unemployment to 3.8% in the three months to April, continues to fuel inflation, while also fanning concerns over a potential wage-price spiral.

Average earnings rose 7.2% YoY in the latest labour market report, the fastest pace on record, outside of the distortions caused by the pandemic; given the expected further decline in headline prices, real wage growth is a distinct possibility in the second half of the year, fuelling further concern over the persistence of price pressures. With this in mind, the MPC is again likely to outline that risks to the inflation outlook remain “skewed significantly to the upside”.

Things look little better from a growth perspective, although the UK – unlike the eurozone – did manage to avoid a technical recession over the winter. Nevertheless, GDP growth remains anaemic at best, having been as near as makes no difference flat on a monthly basis for the last 18 months; May’s additional bank holiday should erase much of the modest bounce seen in April.

Leading indicators also look rather soggy, with the most recent PMI surveys showing manufacturing output at a 4-month low; while the services sector is faring better, expanding at close to its fastest pace in a year, much of this growth appears to be propped up by tourism spending, rather than domestic demand.

In terms of markets, as noted, there is a relatively high bar for the BoE to surprise in a hawkish direction, with markets appearing to have become too aggressive in pricing the future rate path; albeit, explicit pushback on this from the MPC seems unlikely.

For the pound, with spot having now broken above longstanding resistance at both 1.25, and 1.2670, there are few, if any, noteworthy technical levels until the 1.30 handle, a point which hasn’t been breached since April 2022. That said, it does appear that the balance of risks is tilted to the downside for the quid, with the aforementioned 1.2670 level standing as key support.

_2023-06-16_09-20-38.jpg)

As for other UK assets, gilts come into the meeting having suffered a significant bout of selling, with 2-year yields touching their highest levels since 2008 at 5%, above the peak seen in the aftermath of the ‘mini budget’ last year (though, of course, Bank Rate is 250bps higher now than it was then).

UK equities have also been pressured, with London’s FTSE 100 certainly not enjoying the risk-on rally seen elsewhere, such as in Japan and on Wall Street. Of course, the recent strength in sterling will be playing a role in this, though the bulls can take some solace from price trading above the 200-day moving average at 7,540, with the 50- and 100-day MAs around 7730/40 the next upside target.

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.