- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

The Daily Fix: New all-time highs in sight for US equity markets

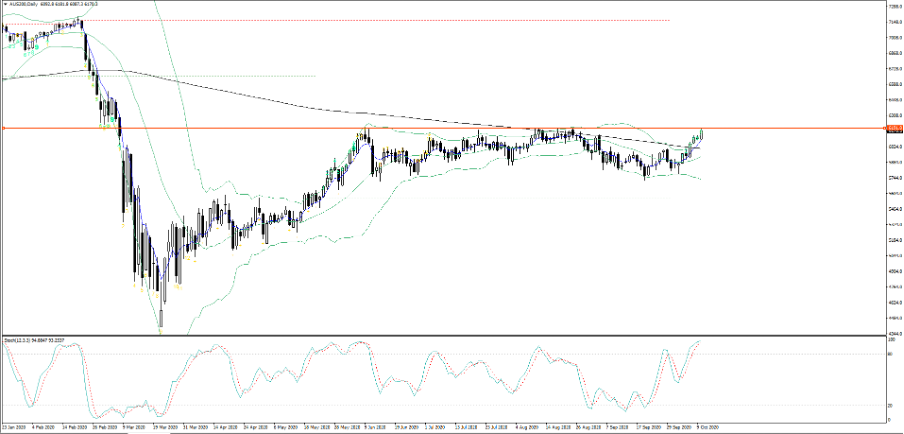

The notion of new all-time highs is there in US markets and we’re also looking at a test of the top of the range in Japan and Australia. Although, news that China has suspended purchases of Aussie coal is not going to aid sentiment Down Under.

(AUS200 daily)

I can look across the S&P 500 options structure and see that the term structure of 25-delta S&P 500 puts show higher implied volatility post the US election, which is the clear hedge against an ugly contested scenario. However, future implied volatility has come down sharply from this time last week. Can we say this portrays some easing of concerns around a contested scenario? Perhaps, but this scenario is still very real and very hard to model, but the market is still reasonably well hedged for this. We can see this in the VIX index too, which sits at 25% and implies daily moves of 1.6% in the S&P 500.

Maybe the market has bought into the notion of a DEM clean sweep but hedged themselves through options and gold to an extent – go long stocks and hedge with gold as a ‘barbell strategy’ some will employ, given the reasonably low correlation between the two variables.

The idea that this was an election play is questionable given we see the NAS100 +3.1% with tech flying, yet materials are lower and the Russell 2000 was only up 0.7% - these are both markets that are supposed to do well should we see a DEM clean sweep. Seems an odd election-focused trade to put on, especially if the DEMs may go after tech to an extent.

Consider that we have Q3 US earnings starting today with JPM starting preceding (at 21:45 AEDT), so perhaps traders are putting on risk and front-running that, despite calls that earnings are due to fall 21% YoY. Digging into tech specifically and expectations around earnings could certainly explain the moves in the mega-cap names as earnings in the ‘big five’ – Amazon, Google, FB, Apple, and Microsoft - are expected to grow 1%, with sales +13%.

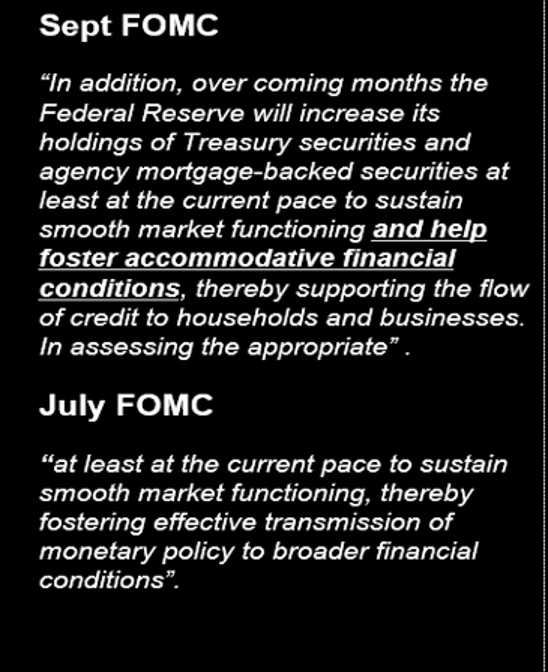

Of course, we revisit the Fed put and the recent change to the Fed’s mandate to an Average Inflation Targeting regime. I’ve included a passage from the statement which I think is absolutely key and the idea that the Fed will use policy to help foster accommodative financial conditions.

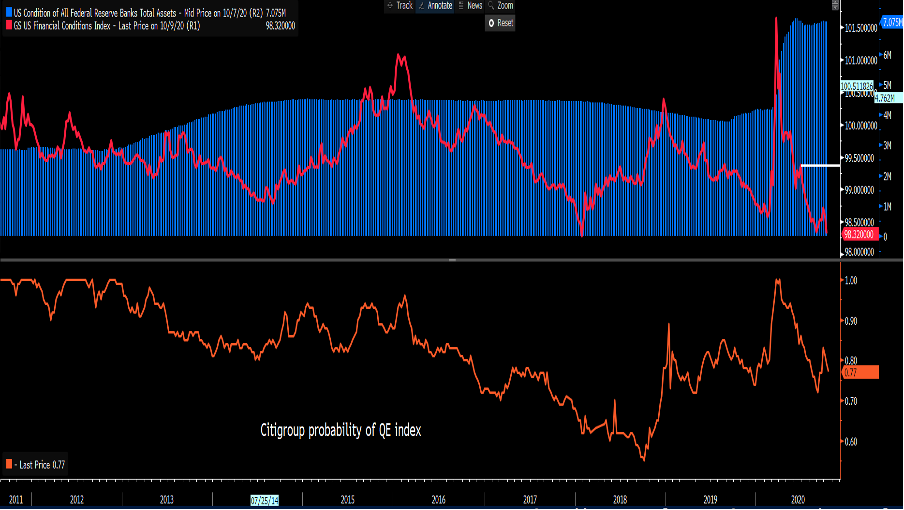

If we look at the chart below, we see:

- Top pane – Goldman Sachs financial conditions index (red) and the Fed’s balance sheet (blue histogram)

- Lower pane – Citigroup prospect of QE index. This currently stands at 77%

(Source: Bloomberg)

(Source: Bloomberg)The crux of this is that financial conditions which aggregate a blend of equity, credit spreads, money markets, volatility, and other market variables sit at multi-year lows – meaning financial conditions are incredibly accommodative. However, the market knows that if threatened then the bar for the Fed to come in with some sort of liquidity intervention is far lower than prior cycles, and that was low. Not only is the Fed unlikely to hike until late 2024 or early 2025 but they will support as and when needed. Liquidity may not create inflation, in fact, asset purchases seem to be disinflationary but they bring future returns in the equity market forward.

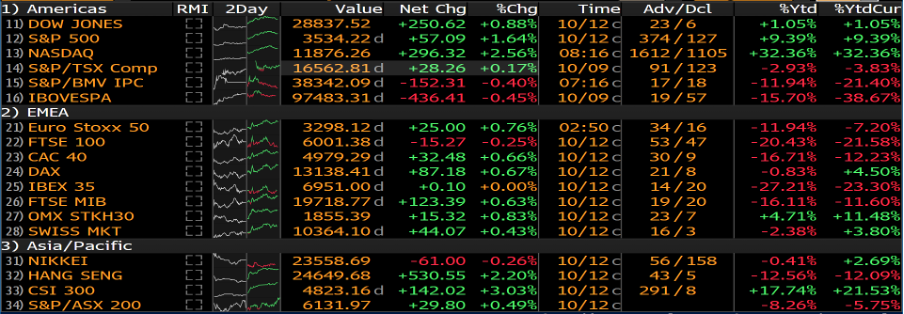

Also consider flow-based factors with trend-following and systematic players piling into the market. While the 20-day realised volatility of the S&P 500 is breaking 20% and that encourage volatility-targeting funds to add more equity exposure. We can probably add some solid participation from retail too. But when it comes to active management the notion of FOMO is absolutely there, but so is FOMU – Fear of Meaningfully Underperforming. If we look at the performance of US equities this year relative to most other global equities, even if we price all markets in USD terms (far right column) the US has blown everything, with the exception of China, out of the park.

(Source: Bloomberg)

Can this continue? It feels like there is more juice in the tank, especially for those who like long and short strategies, where long US and short FTSE is a juggernaut, even priced in GBP.

Related articles

Artículos más leídos

¿Listo para operar?

Comenzar es fácil y rápido – incluso con un depósito pequeño. Aplique en minutos con nuestro simple proceso de solicitud.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.