- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

I, for one, would have liked more from the Fed. To really challenge behaviours and drive animal spirits. But, as detailed in my prior note if the Fed didn’t win the credibility battle then they would see a tighter financial backdrop. Which is the case, where we’ve seen a steeper yield curve, a slightly stronger USD and equities have been sold.

I have put more detailed thoughts into this video (see above), which I hope best portrays what's a big subject but needless to say, I'm left with a number of questions. Consider the overriding statement that the Fed will maintain the current policy target range “until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.”

I, like many, want to understand:

- What constitutes a “moderate” overshoot? 2.5% perhaps

- How will the Fed assess the duration of ‘sometime'? 3 months, 6 months... longer?

- Why, when the Fed is pro-actively driving inflation above 2% do the inflation projections (in the set of forecasts) not reflect this?

- Could we not have had more colour on future asset purchases (QE) – size, scope and composition are important to bond traders, which could be why we saw 10-year Treasuries sell-off and subsequently the NAS100 finding sellers.

- This policy regime is an outcomes-based approach, but how flexible are they on their outcomes?

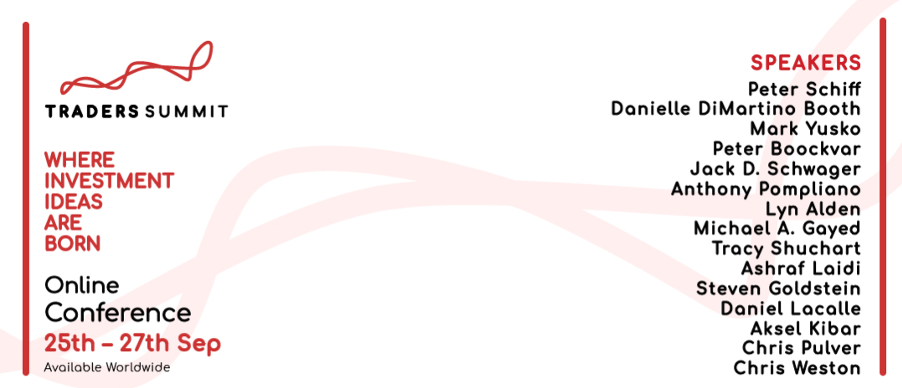

I also want to give you the heads up on Trader Summit, an event I will be speaking on the 27th on the Fed’s new policy regime and how to trade it. The line-up (perhaps yours excluded) is as good as you will see in any event and promises to be an incredible event. Get involved, it's free.

Related articles

Artículos más leídos

¿Listo para operar?

Comenzar es fácil y rápido – incluso con un depósito pequeño. Aplique en minutos con nuestro simple proceso de solicitud.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.