- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

Analisis

There are two areas to consider when it comes to real estate – residential, and commercial. The latter remains under considerable pressure, not only from tighter monetary policy, but also as the broader macroeconomy continues to adjust to working habits in the post-covid world, with remote/hybrid working continuing to depress office occupancy rates, while also exerting pressure on city centre businesses reliant on worker traffic, such as restaurants and cafés.

It is, however, the residential real estate market that is more likely to prove a tradeable theme, particularly in the FX space. Several G10 economies display similar characteristics, whereby house prices have rapidly increased in recent years, a mortgage cliff (where fixed rate deals are being refinanced at rates double, or more, than the original loan) is rapidly approaching, and where the risk of both substantial delinquencies and a sharp fall in house prices is high. Australia, Sweden, and the UK would be the primary economies falling into this camp.

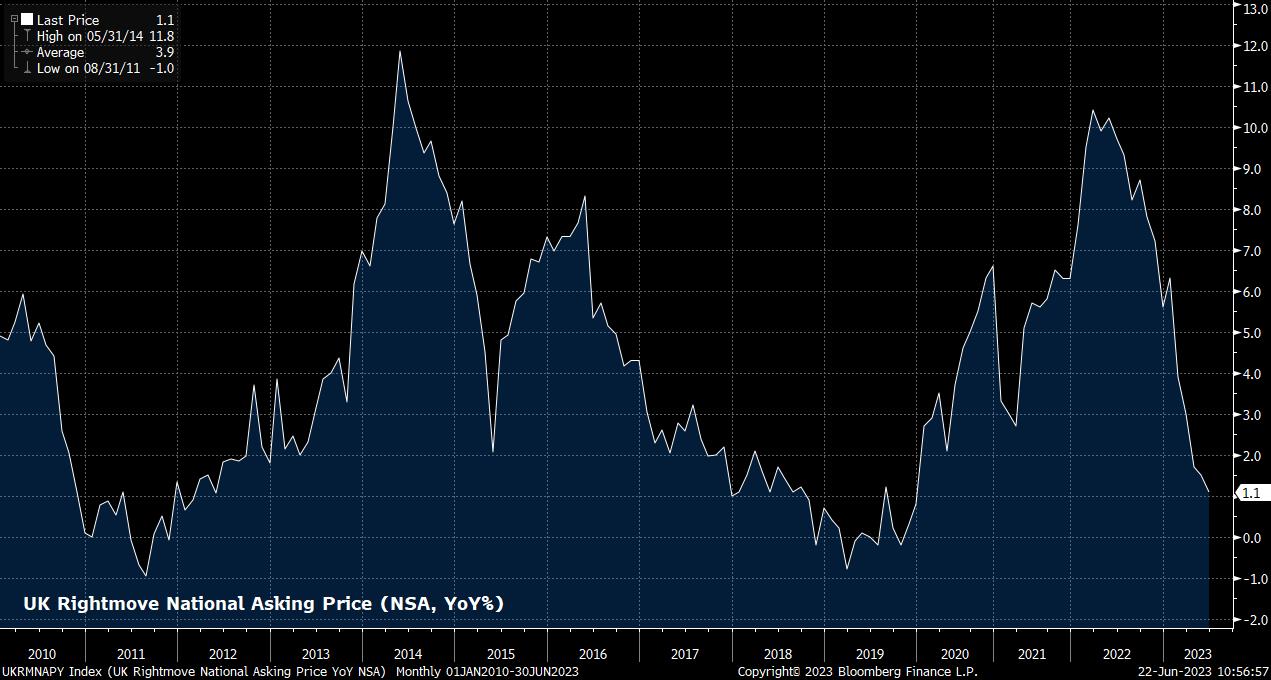

In the case of the UK, the situation is particularly stark, and a good example of both how lagged the effects of policy tightening can be, and what may develop in other developed economies. Around 2mln fixed rate mortgages, with rates below 2.5%, will roll off between now and the end of 2024; with the current 2-year fix averaging north of 6%, many of these borrowers will see interest costs treble overnight. The rate rise itself, however, has not been overnight, with the BoE having been tightening policy since December 2021, though it is only now that the impact of said hikes is feeding through into the economy.

Perhaps more importantly, not only has the impact of tightening been delayed, it is also likely to be more prolonged, given the increasing tendency to fix mortgage rates for a longer period of time – the majority of fixed rate loans extended YTD have been for a tenor of at least 5 years. This, consequently, will mean that when the BoE eventually begin to loosen policy – at some point in the future – the impact of said cuts will not be immediately felt, thus leading to the present level of rates acting as an economic drag for some time to come.

This makes a structural bull case for the GBP rather tough to come by, especially considering that the bulk of this mortgage refinancing will come later this year, leading to a significant drop in disposable income, likely denting discretionary spending, as consumers tighten their belts. While this will, hopefully, have a much-needed disinflationary impact on the economy, it will likely serve to deepen the stagnation that already plagues the UK.

_2023-06-22_11-05-08.jpg)

A similar trend is likely to be seen in other economies, and currencies, with similar characteristics – such as the SEK and the AUD, where it is noticeable that both central banks have been almost as reluctant as the Bank of England to tighten policy, lest it have a significant detrimental impact on their respective real estate markets.

Outside of the FX space, there are other ways for traders to gain exposure to the broader real estate theme. The iShares US Real Estate ETF is one that could be considered, and a fund which exhibits broader investor angst over the state of the sector, given its considerable underperformance compared to the broader S&P 500 YTD.

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.