- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

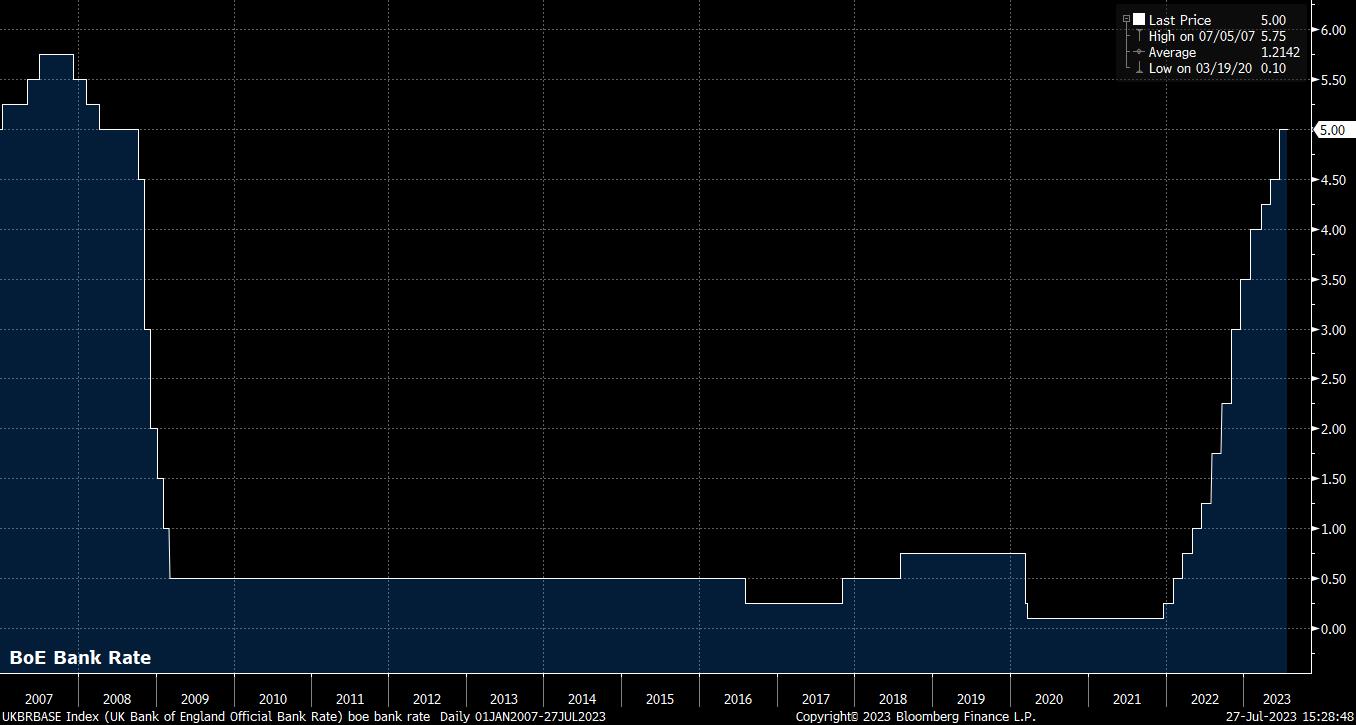

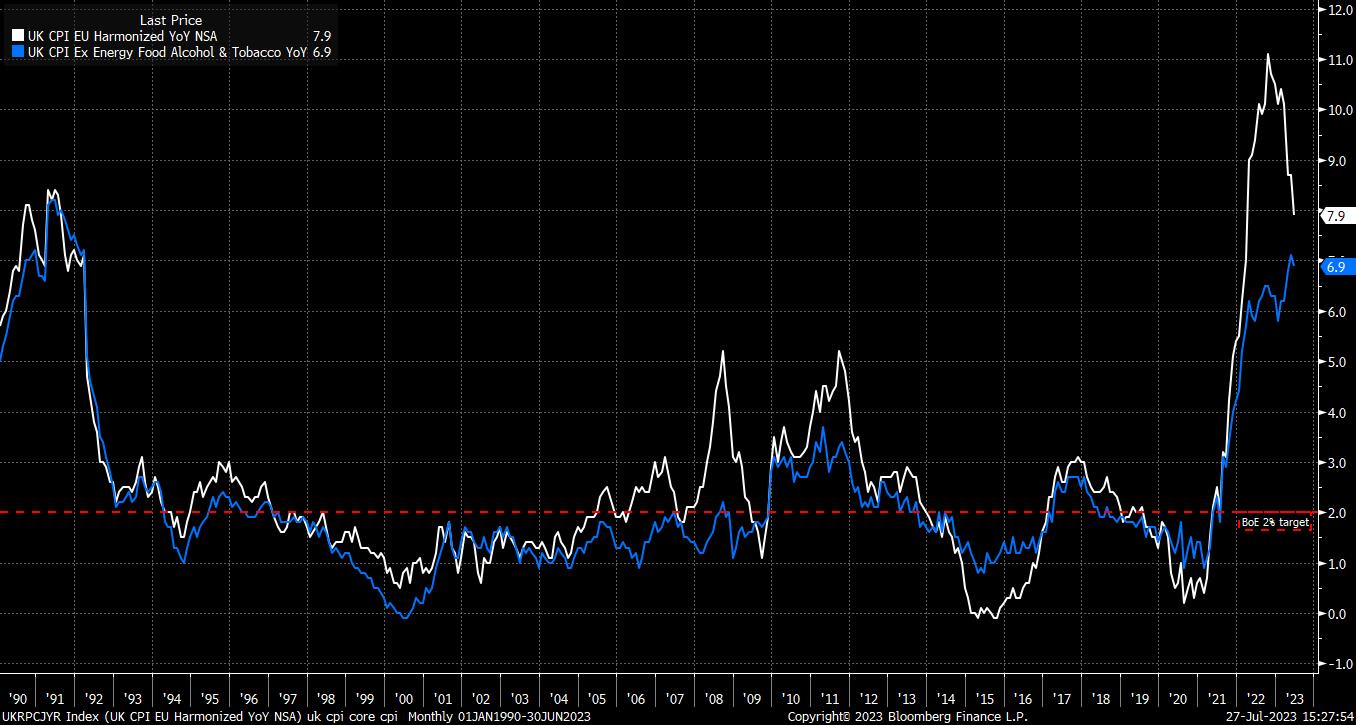

As mentioned, a 25bp Bank Rate hike, to 5.25%, appears like the most likely outcome from the August decision. However, it remains an incredibly close call between that, and a larger 50bp move as delivered at the June meeting, in what was then a knee-jerk reaction to the worrying, and surprising, surge in core inflation above the 7% mark.

Though a close call, it seems unlikely that a majority of MPC members will vote in favour of another outsized Bank Rate increase. That said, the August decision is again unlikely to be unanimous, with arch dove Dhingra, an external member, set to favour rates remaining unchanged, while external member Mann may favour a larger 50bp move, as might new Committee member Megan Greene. Still, the majority are likely to favour stepping back down to a 25bp increment.

Markets, however, are not entirely of this view. Around 33bp of tightening is priced for the August decision, implying around a one-in-three chance that the BoE do decide to move in a larger increment.

In terms of forward guidance, the MPC are again unlikely to pre-commit to a rate path, a common theme since last year’s ‘mini-budget’ crisis, where the Bank did explicitly push back against OIS pricing. Instead, the most that is likely to be provided is simply a repetition of the line that has now been used for some time, in that “further tightening in monetary policy would be required” if signs of more persistent inflationary pressures were to emerge.

The Bank have also tended to use their inflation forecasts as an implicit signalling mechanism in the past, though this again is unlikely to provide as much signal as in days gone by, given the well-documented lack of faith that policymakers currently have in the models used to compute said projections. Consequently, while headline CPI, based on the market rate path, is again likely to be projected well below the 2% target in 18-24 months’ time – usually a signal that market pricing is too aggressive – there is likely to be little emphasis placed on this by policymakers.

Meanwhile, the other forecasts released in the August Monetary Policy Report are also likely to be little changed from those issued in May.

Back then, the BoE forecast a rather sluggish pace of GDP growth over the forecast horizon, though did scrap their call for the UK to dip into recession. Economic growth is likely to remain relatively anaemic for the foreseeable future, though any downward revisions to the expected inflation path are likely to provide a modest booth to the growth side of the equation.

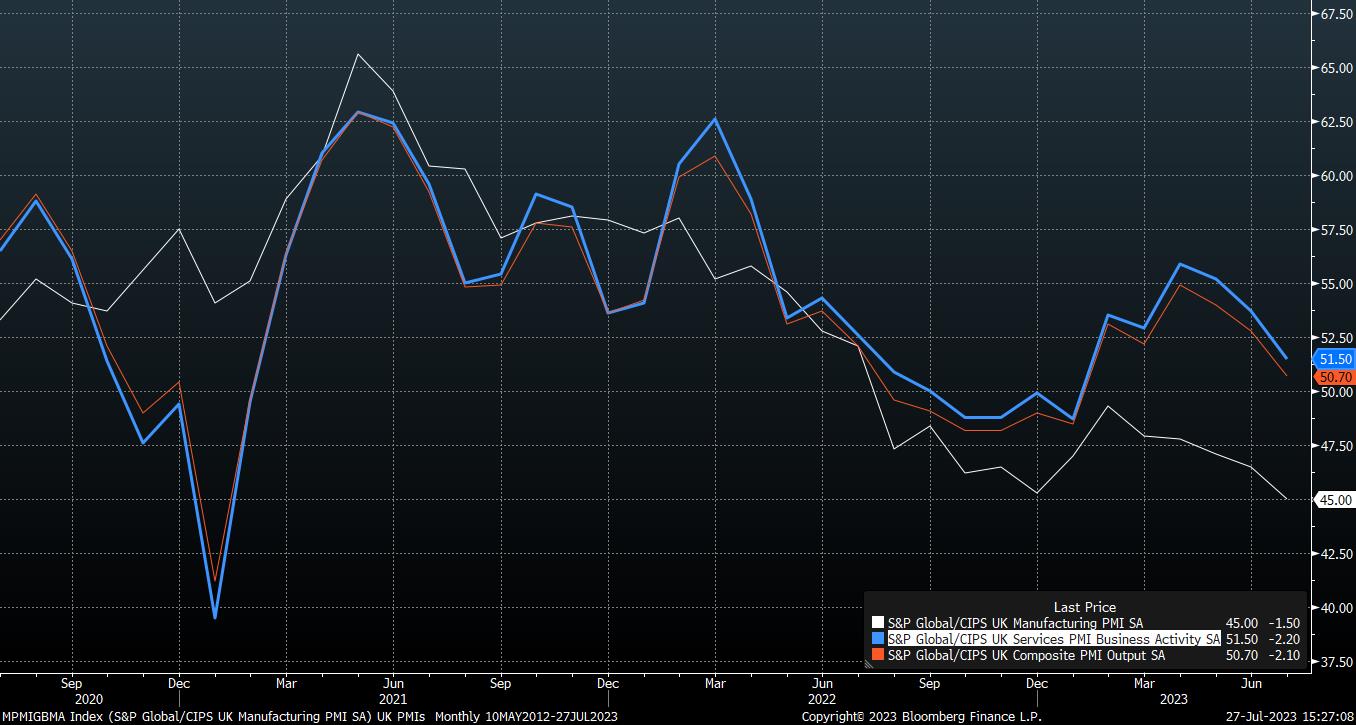

Nevertheless, incoming economic data is starting to show worrying signs of softness. Recent PMIs point to a further waning of economic momentum, with output in the manufacturing sector shrinking at its fastest rate in over three years, while the composite and services output gauges slumped to their lowest levels since the start of the year. With this in mind, and taking into account the upcoming ‘mortgage cliff’ likely to be hit in H2, risks to this outlook remain tilted to the downside.

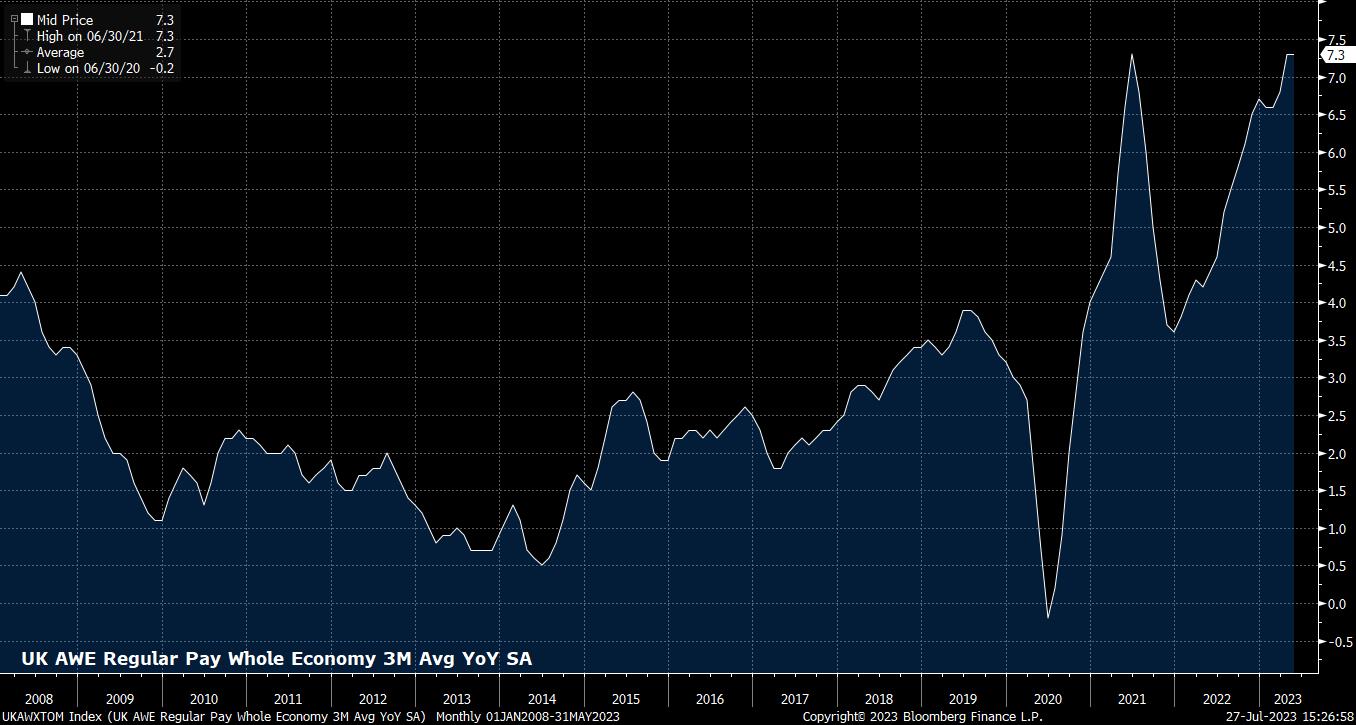

In a relatively similar uninspiring vein, the Bank’s forecasts for the labour market are likely to remain broadly in line with prior expectations; namely, a slow, but steady, rise in joblessness to 4.5% by the end of the forecast horizon. Recent jobs data has been a mixed bag from a policy perspective, with a rise in participation pleasing, but a record pace of regular pay growth likely to provoke some concern.

This is particularly true as inflation fades over the remainder of the year, meaning that the present nominal earnings growth is likely to soon turn into positive real wage growth, presenting some risk of a wage-price spiral.

As for the post-meeting press conference, which will be the first time we’ve heard Governor Bailey speak on monetary policy in almost a month, there is similarly unlikely to be any explicit guidance on future policy shifts. In common with the recent FOMC and ECB decisions, the Governor is likely to try and give the Bank as much optionality as possible in terms of the outlook, while also maintaining a distinct tightening bias, with the full lagged effects of policy tightening yet to be felt.

There may, however, be relatively limited opportunity for question of this ilk, given the media’s likely focus on the rising cost of living, particularly the impact that rising mortgage rates are having on the consumer.

_2023-07-27_15-25-43.jpg)

Turning to financial markets, it would appear that the risks to the GBP are tilted to the downside into the August MPC meeting. Not only do markets price more than the 25bp of tightening likely to be delivered by the BoE in August, OIS also prices around three further 25bp hikes before the end of the year. This seems, particularly with downside economic risks mounting, and the full lagged effects of tightening yet to be felt, over-the-top.

Consequently, with this tightening likely needing to be priced out, and with the FOMC remaining likely to hike rates once more this year, probably in November, the path of least resistance seems to point lower for cable.

Having made a cycle high at 1.3140, and retreated rapidly, 1.2850 is now the key level to watch, with a closing break below likely leaving the bears to target the 1.2670-2690 region, where horizontal support, and the 50-dma both lurk.

_2023-07-27_15-24-19.jpg)

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.