- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

Analisis

At this stage and as always in trading, it’s wise to hold an open mind to all possibilities. However, I favour the former and acknowledge that there's a large membership in the other camp that feel this move has genuine legs. The movement hasn’t been confined to equity, where crude and energy more broadly has been given a solid working over. I find it hard to see the Fed achieving its new Average inflation Targeting regime, if crude prices are headed back to $30. It also makes me think it's a matter of time before OPEC start to jawbone this move to try and support prices.

The NAS100 move has been well traded and remains the talk of the town, with the March uptrend firmly giving way. As has the 50-day MA with the index having pulled back 11% from the 12,439 high. News that the Oxford and AstraZeneca COVID-19 vaccine trial has been put on hold due to a person undergoing a ‘serious adverse reaction’ has seen equity futures fall after the cash market close and could keep the buyers away in Asia. Especially as this was one (along with the Pfizer and BioNTech) that was inspiring hope for near-term preliminary Phase 3 trials.

Trend breaks have played out in the US500 too, where we see turnover 31% above the 30-day average and 90% of stocks lower. Trend breaks don’t necessarily mean impending bear markets, but a set of behaviours have changed and we could at the least see sideways choppy trade for a period. Or, we could see the more doomsday situation play out. However, when I look at the flexibility of central banks, the improvement in economic data and the willingness from key players to put money to work, then I don’t see the collapse scenario. Either way, we trade price and respect what the tape does and if there's more to liquidate, then it's not out of the realms of possibility we could be facing another 5%-10% downside.

Asia is unsurprisingly going to open on a negative vibe, with the ASX200 likely to open 2% lower and the 6k level didn’t hold for very long. We see the ASX200 unwinding into 5890 and it will be interesting to see if the market can build on that, as the prospect of a buyer’s strike is elevated. There has been good support into 5850 of late, so a bit more downside and that level could be tested again and from here we watch price action.

On the subject of corrections, the USDX pushed up a sizeable 0.8% and is on a merry march to the 50-day MA, and could be ready to break above 93.48. On the day we’ve seen some big selling currencies such as the NOK, GBP, ZAR. The JPY has worked as has the CHF and USD, as you’d expect and I like the set-up in USDCAD, which has broken clean through the July bear channel and into 5 August low - a break here and 1.3310 is the target.

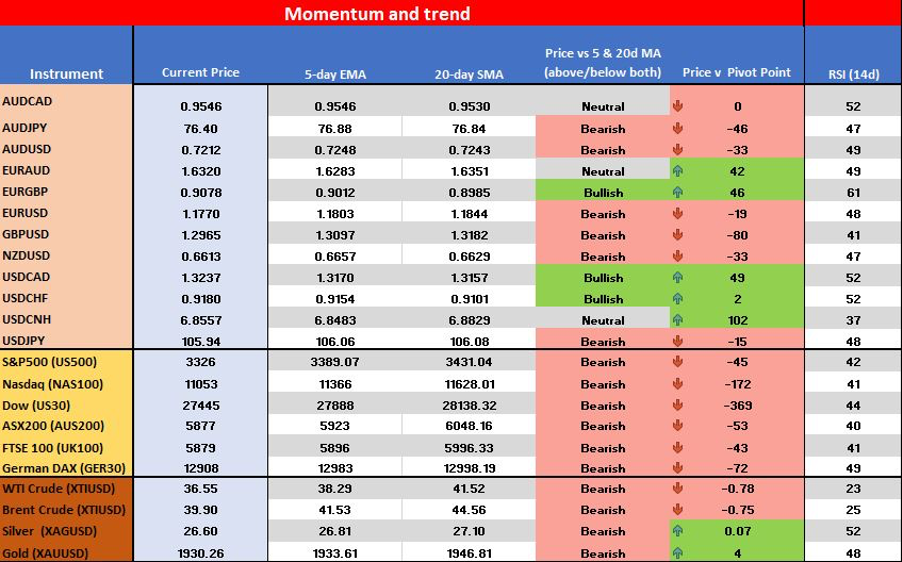

My ST trend monitor is looking like a sea of red today and that won't surprise given the moves, but for now the flow of capital is aimed at more defensive plays and this will not sit well with central banks. If the Fed is truly pro-active, they will get in front of this move and that makes the 18 Sept FOMC just that much more important.

Related articles

Artículos más leídos

¿Listo para operar?

Comenzar es fácil y rápido – incluso con un depósito pequeño. Aplique en minutos con nuestro simple proceso de solicitud.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.