Los CFDs son instrumentos complejos y conllevan un alto riesgo de perder dinero rápidamente debido al apalancamiento. El 80% de las cuentas de inversores minoristas pierden dinero al operar CFDs con este proveedor. Debes considerar si comprendes cómo funcionan los CFDs y si puedes permitirte asumir el alto riesgo de perder tu dinero.

- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

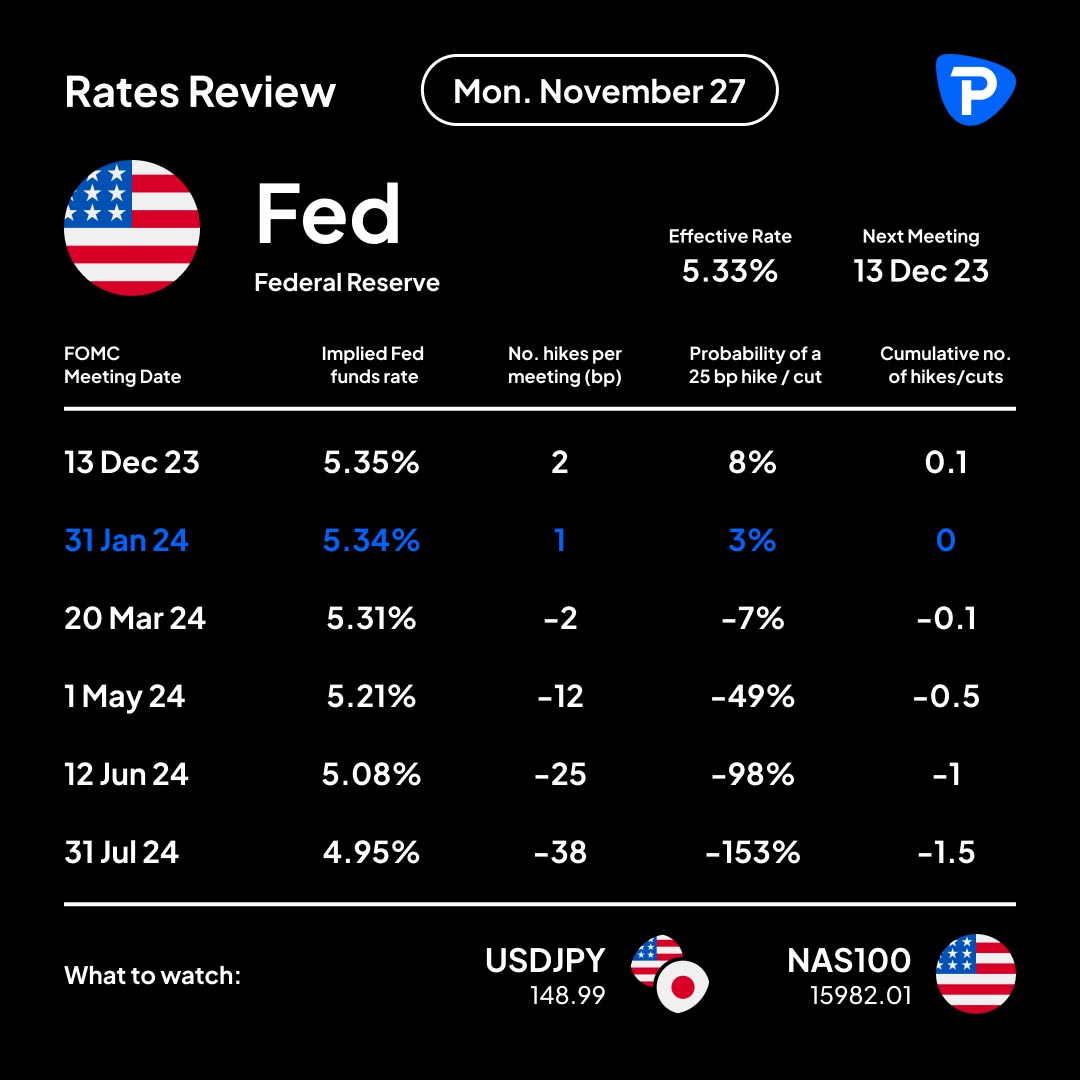

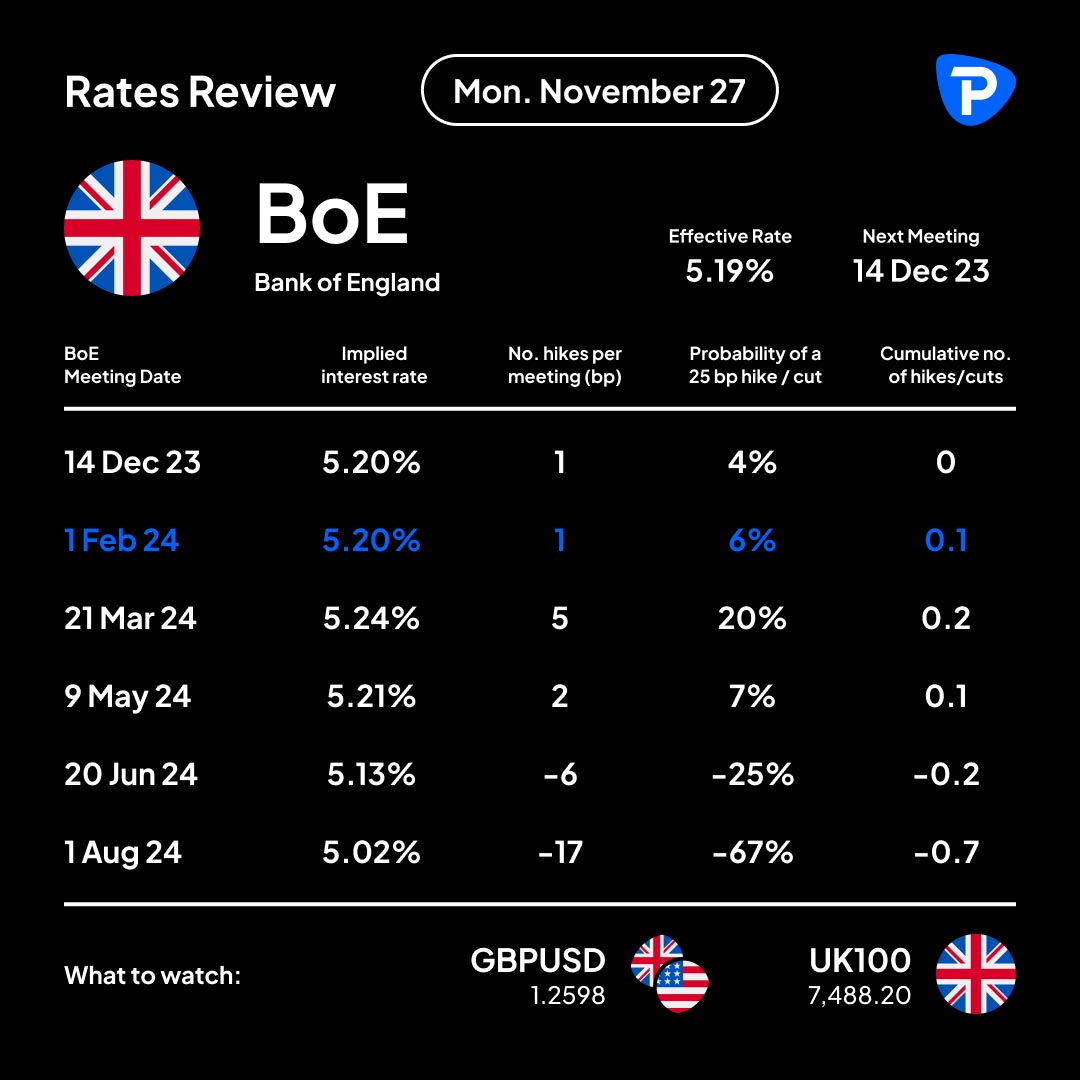

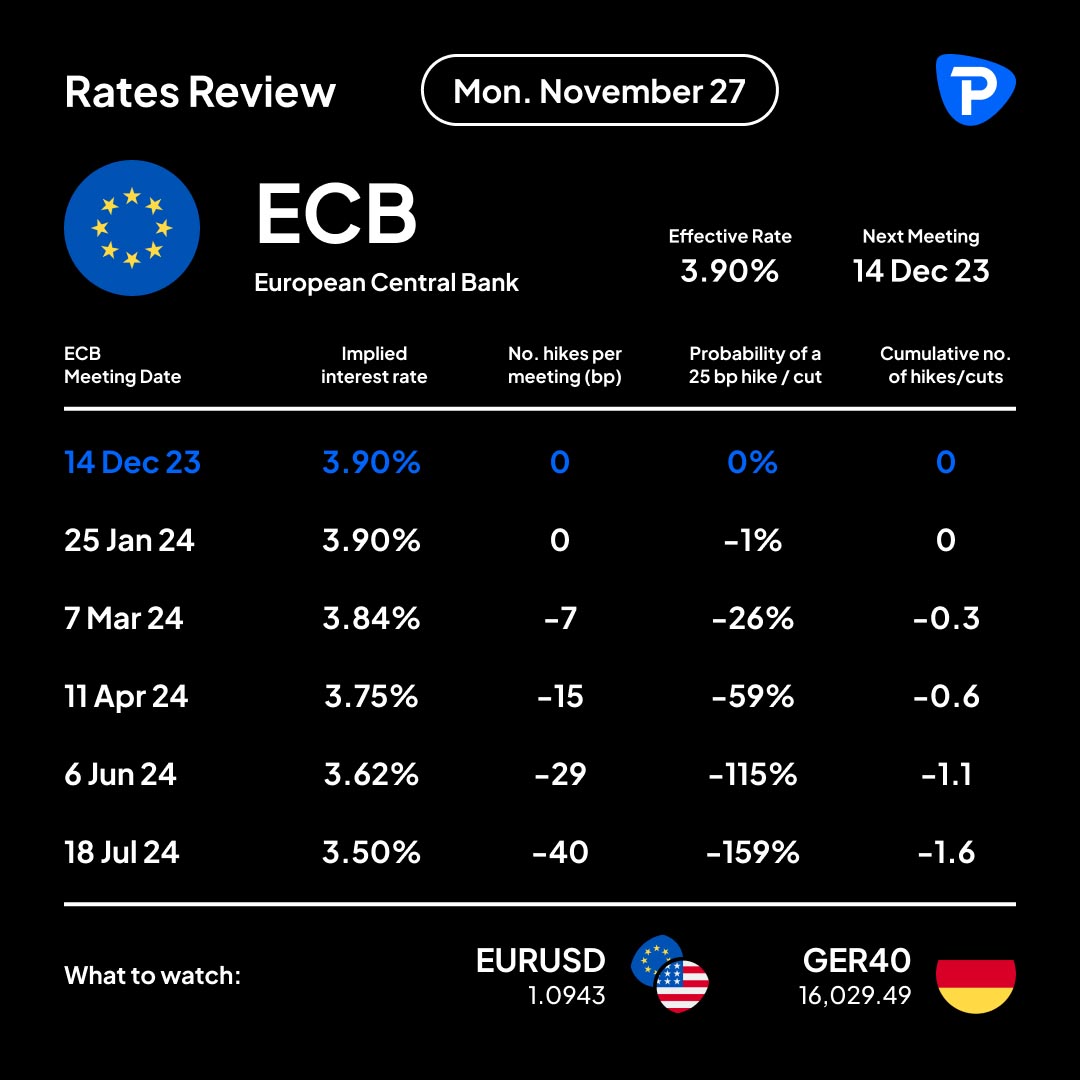

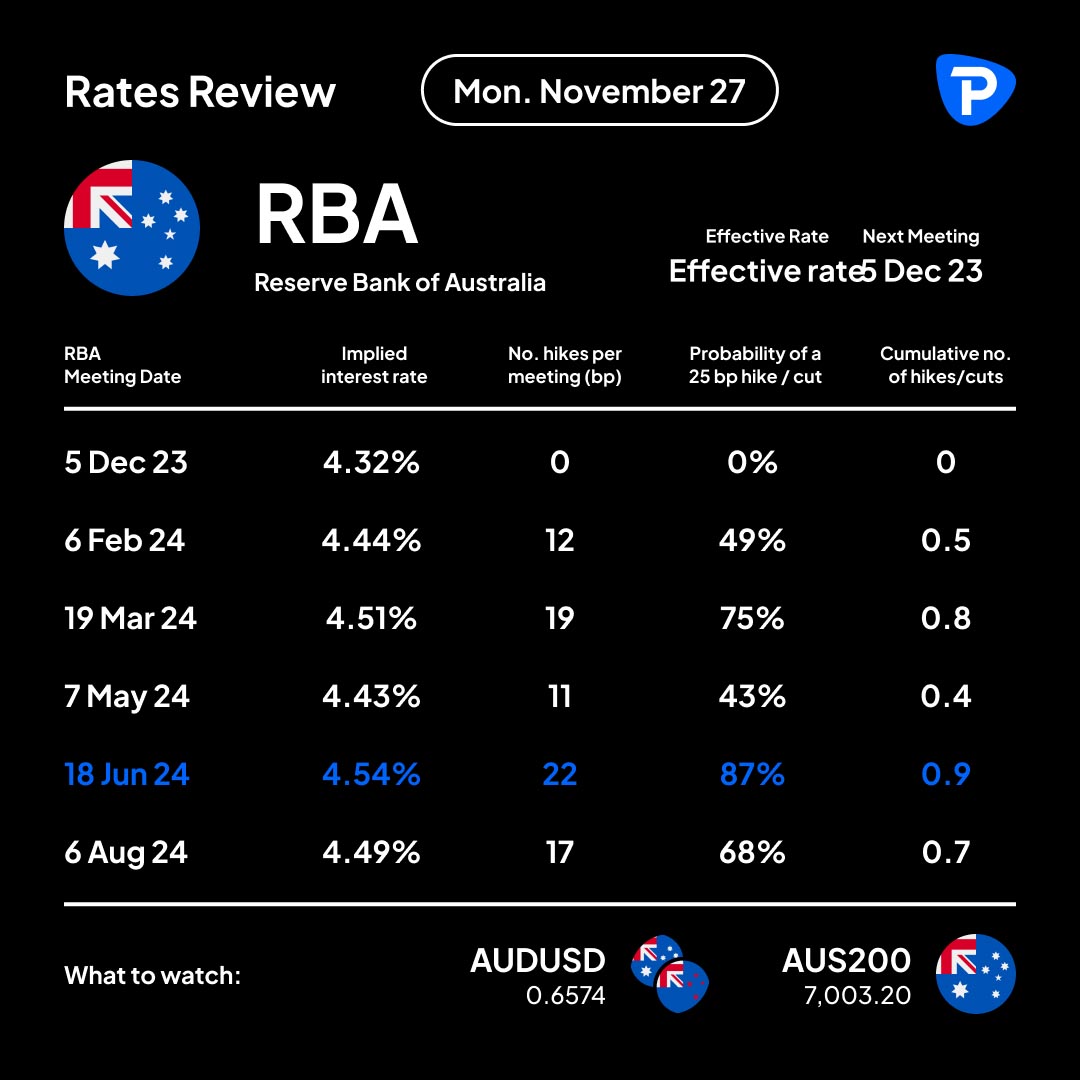

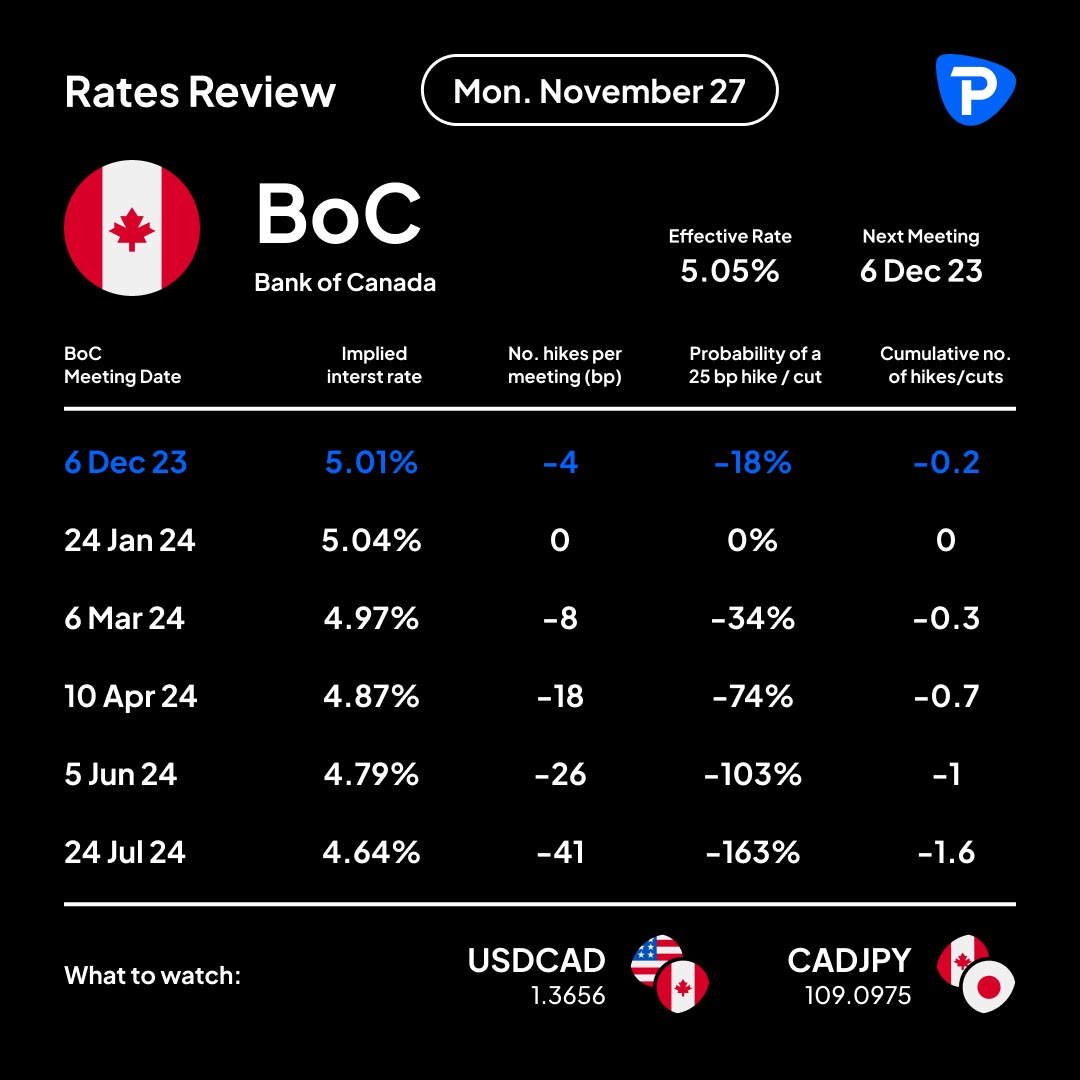

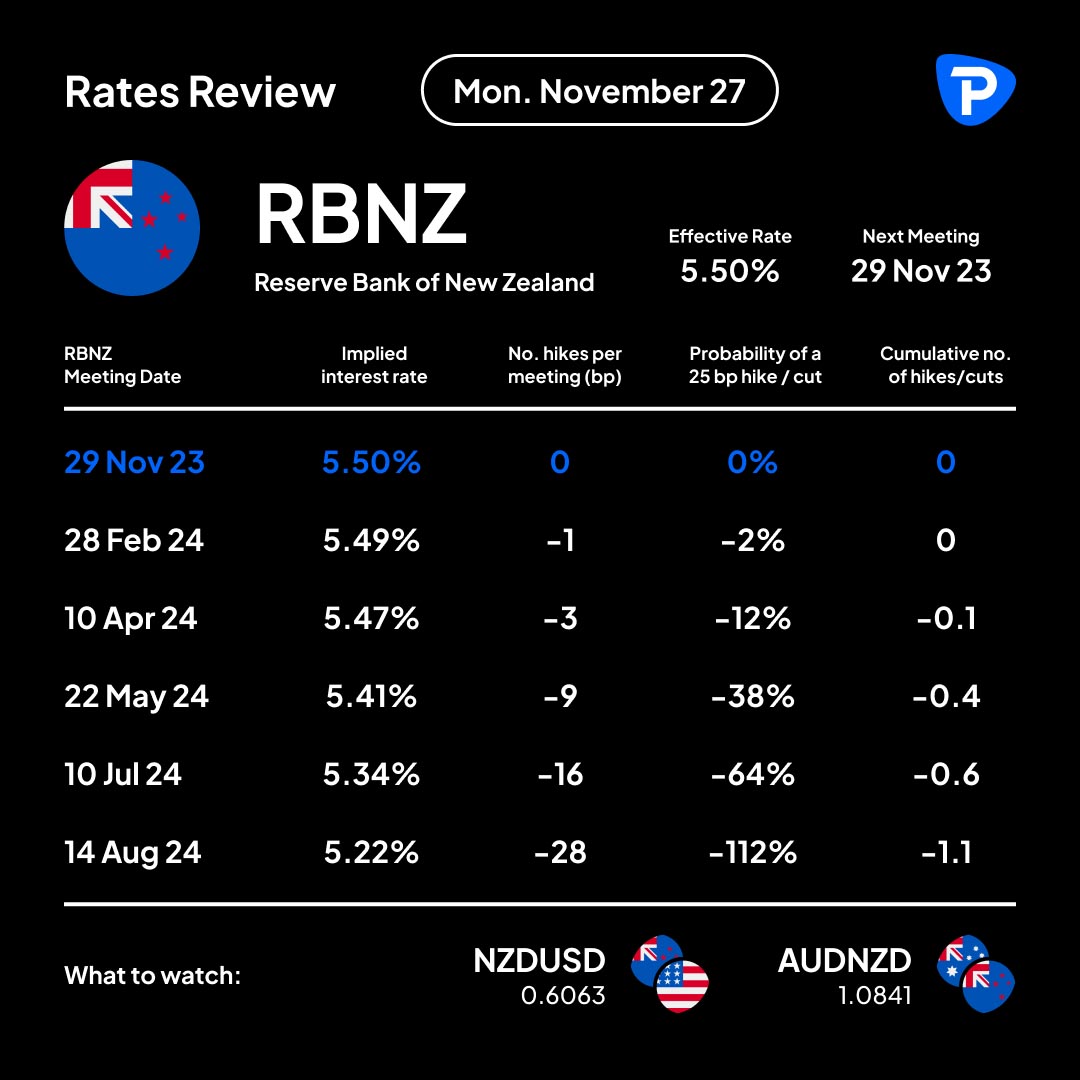

Upcoming central bank meetings

We monitor (daily) market expectations for upcoming central bank meetings.

*See below for a thorough guide to understand the interest rates tables

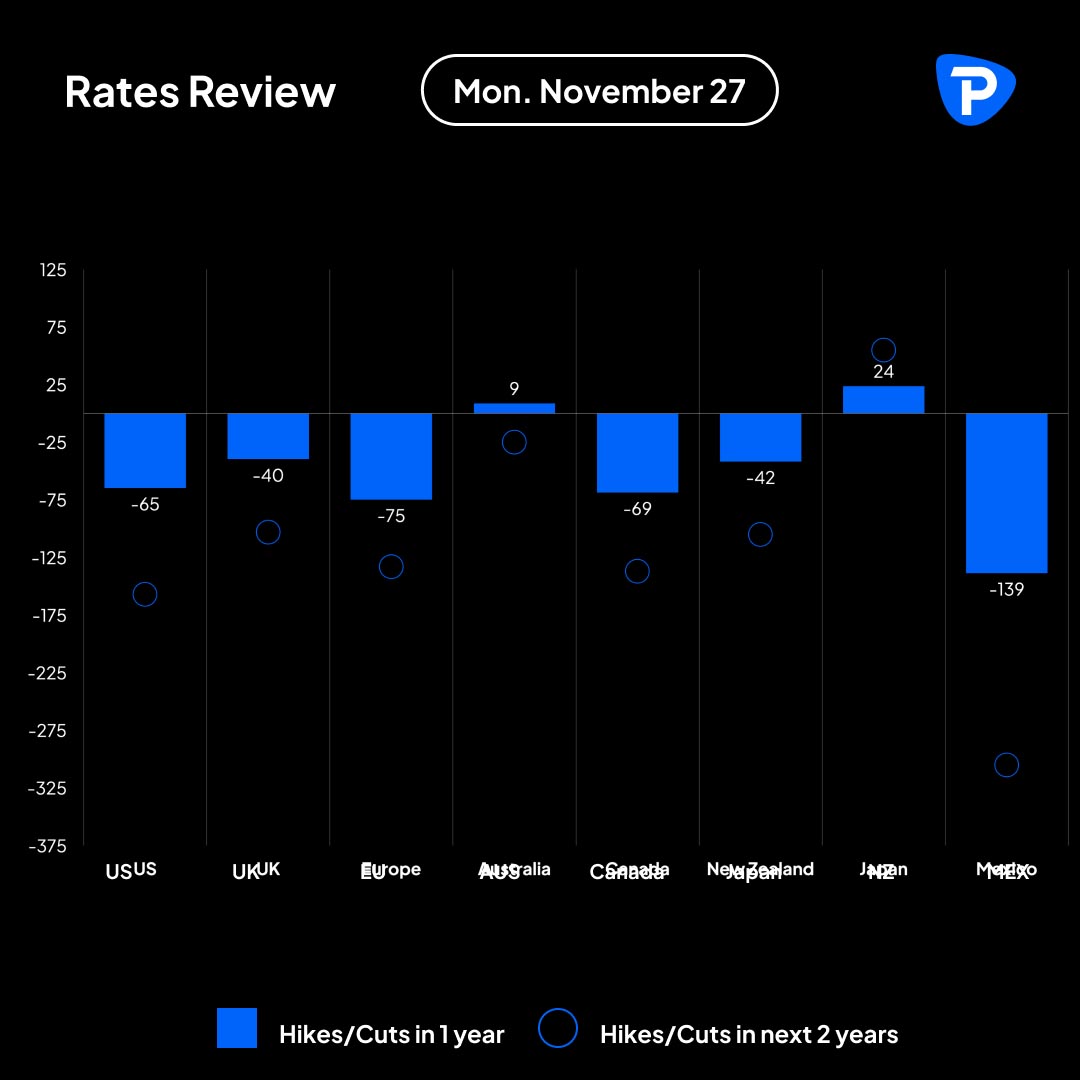

Future interest rate expectations

We look at forward interest rate expectations and ‘what is priced in’ over the coming 12 months. Here we take the difference between the 1-year forward implied interest rate – again, set by market pricing – and the effective rate.

This can offer traders a guide on future interest expectations, which can be influential on currency, commodity, and equity markets.

Reading the interest rate table – Upcoming central bank meetings

How can this benefit CFD traders? The table can offer a guide as to ‘what’s priced in’, and quantifies expectations expressed in the tradeable interest rate or interest rate swaps markets.

It can be helpful to gauge market expectations and the degree of policy tightening/easing expressed for each upcoming central bank meeting. Potentially heightening a trader’s approach to risk management over a central bank meeting, helping traders understand the potential reaction in a market.

Example 1) “A surprise hike”

If the market is pricing 5bp of hikes for the upcoming RBA meeting – representing a 20% chance of a hike, and the RBA hike by 25bp, in theory, the AUD should initially rally on the news.

Example 2) “It’s all priced in”

If the market prices 25bp of hikes for the upcoming BoE meeting and the BoE hike as expected by 25bp. In theory, while the tone of the statement and the outlook could be a catalyst, GBPUSD should not rally on the hike in isolation.

Effective rate = the average interest rate transacted on overnight loans between financial institutions. The effective rate is guided by the central bank's ‘target’ rate which is set at the central bank meetings.

A basis point (or ‘bp’) is every 0.01% change in an interest rate. For example, 3 basis points (bp) is the same as 0.03%, while 10 basis points can also be expressed as 0.10%. The blue highlighted line represents the peak/trough implied interest rate or what is known as the ‘terminal’ rate.

In order of columns:

- The central bank meeting date – central bank meeting dates are known well in advance. The frequency can vary between central banks, and as you can see, they don’t meet every month.

- The implied interest rate - this is the average value for all open interest rate/swap transactions. It represents the interest rate that market participants feel is probable for that central bank meeting. It is dynamic and traders can express a view if that rate is too high/low given all incoming data and news.

- The number of hikes/cuts – the difference between the implied interest rate for that central bank meeting and the implied interest rate for the prior central bank meeting. This is often called the ‘step’ up or down.

- Probability of a hike/cut – The number of hikes/cuts (in basis points) for that meeting divided by 25. We assume central banks move their target or benchmark interest rate in 25bp (or 0.25%) increments.

- The cumulative number of hikes/cuts – the difference between the implied interest rate for that specific central bank meeting and the effective rate.

*While prices and expectations are freely traded and move in real-time, our tables are updated daily with the snapshot taken at 09:00 AEST.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.