- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

Having delivered 500bps worth of hikes since the tightening cycle began last March, and with inflationary pressures at long last showing signs of abating, policymakers – on the whole – have begun to adopt a slightly more cautious stance, seeking to assess the lagged effects of the significant amount of tightening already delivered on an economy which, in parts, particularly industry, appears rather fragile.

Many had thought that, after the May FOMC, when the statement guidance was altered in a dovish manner, removing the reference to additional tightening, making further hikes contingent on incoming data, the Fed would then hold rates at 5.00% - 5.25%.

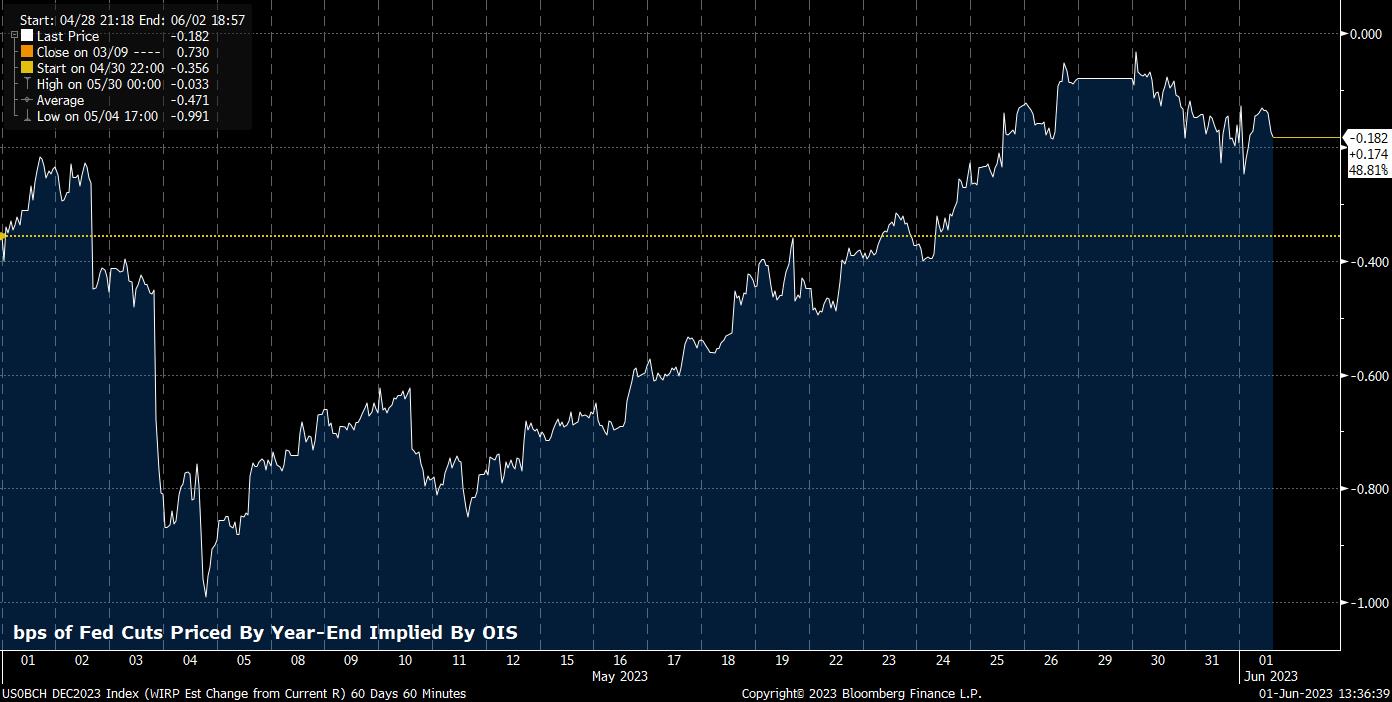

Initially, markets were reluctant to take the FOMC’s implicit guidance that rates would remain at that level for the remainder of the year at face value, pricing between two and three cuts for much of May. Since, however, as the regional banking tumult has appeared to subside, the labour market remained solid, and the services sector resilient, markets have begun to have second thoughts.

Now, markets price less than 10bps worth of cuts between now and the end of 2023 – having once priced a pivot, markets now expect a pause.

This brings us to the next stage of the debate, the idea of a skip. As noted above, with the FOMC now in data-dependent mode, policymakers are seeking to gauge the impact of already-delivered tightening, before deciding on their next move. Skipping a meeting – leaving rates unchanged in June, before hiking once more in July – would allow an extra six weeks or so to assess how the economy is evolving, with the gap seeing the release of another set of labour market and inflation data, as well as possibly giving the FOMC advance sight of Q2’s GDP figures.

The idea of skipping a meeting appears to be gathering some traction on the FOMC; voting Philadelphia Fed President Harker has flagged that the Fed need not raise rates at every meeting, while explicitly stating that they should “skip a hike at the June meeting”. Furthermore, Governor Jefferson has endorsed a similar idea, noting that a pause at one meeting need not mean that rates have peaked, while also remarking that skipping a hike would allow more time to assess incoming data.

Unsurprisingly, markets have rather aggressively downgraded the chances of a June move, while subsequently upgrading the chances of a 25bps hike in July – a move, incidentally, mirrored by a string of sell-side forecast revisions.

Where does all this leave markets? In some respects, we are back to the ‘higher for longer’ mantra that dominated the narrative for much of last year.

This hawkish repricing has fuelled a notable rally in the dollar, which advanced just shy of 3% against a basket of peers last month, the best May performance for the greenback since 2016. Whether the rally can continue will depend on two related factors – the ability of the US economy to remain resilient as the lagged effects of prior tightening are felt, and the degree to which markets price additional Fed tightening, with the terminal rate still seen at just 5.28%.

_D_2023-06-01_13-38-05.jpg)

From a technical standpoint, the DXY’s rally has stalled out a little, having spent much of the week consolidating in a tight 104-104.5 range. An upside break would open the door to return to the highs seen in mid-March in the high 105s, while support lurks closely below on a downside break, with losses likely limited to around 103.50.

Higher front-end yields would clearly support the buck if Treasuries were to resume their recent sell-off, though bonds have rallied this week after the agreement of a deal to resolve the US debt ceiling issue. Nevertheless, assuming the market does continue to reprice in a hawkish direction, bond bears should reassert control relatively easily – bad news for gold if so.

It is, perhaps, the equity market that is the most perplexing amid all this, given the deftness with which investors have managed to shrug off the significant hawkish repricing which has taken place. The S&P 500 notched its third straight monthly advance in May, the first such run since summer 2021, while the tech-heavy Nasdaq 100 continued to outperform, jumping over 7%, continuing the strong run YTD.

_Daily_2023-06-01_13-38-53.jpg)

While concerns persist over narrow market leadership, the ease with which the market has been able to climb an ever-growing ‘wall of worry’ of late has been impressive, and speaks volumes about the resilience of US equities, which seems set to continue.

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.