- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

Analisis

Gyrations in the US (and DM) bond markets have started to impact equity sentiment, especially US 5-year real rates (DFII5 on TradingView) rising to the highest levels since 2008, at a time when the G4 central bank balance sheet is falling. We continue to watch this dynamic, while micro factors may start to play a role with Q2 earnings rolling in.

Commentaries from CEOs on expected demand, input prices and how the cost of capital is impacting are a few themes to focus on. The US500 rests on 4400, with the shorts eyeing a test of the 26 June low of 4329 – a break here, especially if it coincides with the VIX index rising above 18%, should get traders in front of the screens and taking down the timeframes.

We also saw the return on the JPY, with shorts squaring as the carry trade was partly unwound - higher G3 bond and rates volatility a clear consideration here, with the MOVE index pushing to 130. We also saw Japan's data flow come in hot, notably in the TANKAN report, which showed Japanese corporates expect inflation (in 5 years) to exceed 2% for the fourth quarter in a row. We see Japan's 10yr swaps rising to 60bp, and 10yr JGBs to 42.8bp, and the fact that funds are shorting Japanese bonds could be telling ahead of the BoJ meeting on 28 July.

Japan takes centre focus – if the market genuinely believed the BoJ were to tweak its uber-dovish monetary policy setting, it could cause real gyrations through markets.

We watch China data ahead of the July Politburo meeting, although, with elevated expectations of stimulus to be announced during this key event, one could easily feel that bad data could easily be forgiven.

Central bank meetings in NZ and Canada may get some attention – although it’s the BoC meeting which looks the far livelier affair.

Rearview alpha plays- what worked best:

• G10 and EM FX play of last week: short CADJPY (-1.5% last week), short USDHUF (-2.6% on the week)

• Equity indices play of last week: Short FRA40 (-3.9%), short EU Stoxx 50 (-3.7%)

• Commodity plays of last week – Long SpotCrude (+4.6%), short XAUGBP (-0.8% on the week) – lower for four consecutive weeks.

• Equity plays for the radar – CSL (AU) – shares have fallen in 9 of 10 trading sessions. RIVN (Rivian Auto US) – shares have gained in 8 consecutive trading sessions. JP Morgan – commence the US Q2 corp. earnings on Friday.

Marquee events for traders to navigate:

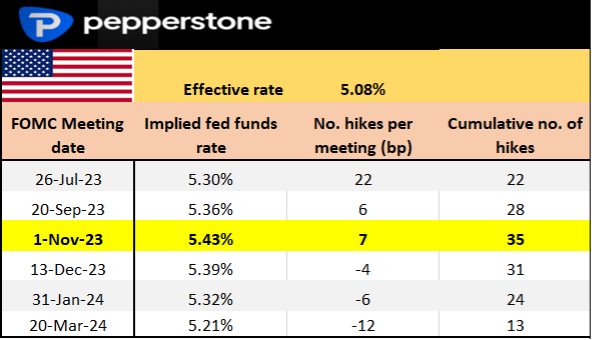

US Core CPI inflation (Wed 22:30 AEST) – the marquee event risk of the week. The consensus is weighted towards core CPI at 0.3% MoM / 5% YoY (from 5.3%), with the economist’s range of estimates seen between 5.1% to 4.8%. Headline CPI is expected to come in at 0.3% MoM / 3.1% YoY (from 4%). The Cleveland Fed Nowcast model sees core CPI running at 5.1% YoY. With risky assets sensitive to moves in US bond yields, a core CPI print at/above 5.3% is the ‘pain trade’ and would likely see US bond yields rise further and risk taken down.

While it may lower the prospect of a hike from the Fed in the July FOMC meeting, it would take a truly weak number to see market pricing for a 25bp hike fall below 50%.

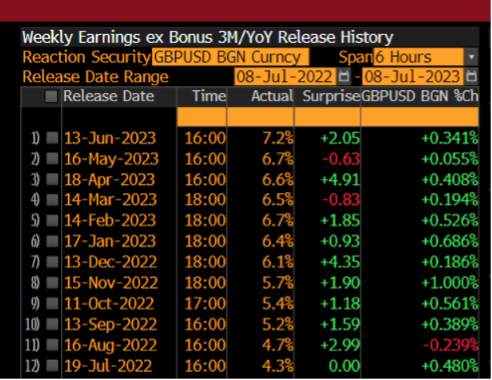

UK jobs and wages report (Tues 16:00 AEST) – traders will recall the red-hot April wage data which contributed to the BoE hiking rates by 50bp (in the June BoE meeting), so GBP and UK100 traders will be watching this data point closely. The market expects weekly earnings (ex-bonus) 3M/YoY to come in at 7.1% (from 7.2%). Rates markets have priced a 76% chance of a 50bp hike at the 3 Aug BoE meeting, with peak bank rate expectations at 6.41%. We also see that GBPUSD has rallied in the last 10 consecutive wage reports.

US 2Q corporate earnings – JPM, J&J, Citi and Wells Fargo get us going with earnings on Friday (14 July), with JPM’s numbers getting the full attention of traders – the implied move on the day of earnings for JPM (derived from options) is 1.3%, with the bulls looking for a firm break of the range highs of $147. While we watch the price action in the US big US money centres, keep an eye on the small end of town and the regional banks – the KRE ETF is a good proxy here.

Bank of Canada meeting (Thurs 00:00 AEST) – this is a ‘live’ meeting that could result in some sharp movement in the CAD – after the recent Canadian jobs report, retail sales and core CPI report, the market is skewed to a 25bp hike to take rates to 5%, with the market pricing a hike at 68% chance. We also see 16 of 24 economists calling for the hike. CAD longs preferred, with USDCAD targeting 1.3200.

RBA gov Lowe speaks (13:10 AEST) – there is little Aussie tier 1 data to trouble traders this week, so RBA gov Lowe and China data get the attention. Rates markets price a 62% chance of a 25bp hike at the 1 August RBA meeting, so Gov Lowe’s outlook may influence that pricing. The Aussie jobs report (20 July), and Q2 CPI (26 July) remain the big event risks for AUD traders that could decide a hike on 1 Aug.

China June CPI/PPI (Mon 11:30 AEST) – the market sees CPI at +0.2% and PPI inflation at -5% (from --4.6%). USDCNH looks to consolidate between 7.2800 and 7.2185, where a break could influence G10 FX pairs, with a higher USDCNH likely acting as a headwind for AUD and NZD.

China June trade data (Thurs no set time) – China’s trade data is hard to consider for one’s risk management as there is no set time, and typically has a low initial impact on Chinese equity markets or the yuan. As we look for more stimulus to be announced at the July Politburo it feels as though the market will limit the reaction. The current consensus is for China’s June exports to fall -10%, while imports are called down -4.4%.

We also get China new yuan loans/aggregate financing through the week (no set time or date), and while closely watched, it is unlikely a market mover.

US PPI inflation (Thurs 22:30 AEST) – the market looks for 0.4% YoY on headline PPI and 2.6% YoY on core PPI – it’s hard to see this being a big market mover unless we get an outlier print (vs consensus). The PPI print should shape our understanding of the important core PCE deflator (released 28 July).

RBNZ meeting (Wed 12:00 AEST) – the market sees this as a low-risk event, with all 15 economists (surveyed by Bloomberg) seeing NZ interest rates on hold, with the NZD swaps market pricing just 3bps. AUDNZD gets attention and looks to have put in a short-term bottom, with longs preferred for a move to the 200-day MA at 1.0850.

University of Michigan sentiment – the market expects the sentiment survey to increase to 65.5 (from 64.4). We also look at the respondents’ views on US 1-year inflation expectations, with the consensus eyeing 3.1% (from 3.3%), while the 5-10-year inflation expectations are eyed to be unchanged at 3%.

Fed speakers – Daly, Mester, Bostic, Barkin, Kashkari, Waller

BoE speakers – Bailey (Tues 01:00 AEST and Wed 18:00 AEST)

RBA speakers – Gov Lowe speaks (Wed 13:10 AEST)

ECB speakers – Villeroy, de Cos, Vujcic, Lane

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.

.jpg?height=420)

.jpg?height=420)

.jpg?height=420)

.jpg?height=420)

.jpg?height=420)