- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

A trader’s week ahead playbook: playing defence into quarter-end

To set a platform for the week ahead – The USD rallied on 4 of the past 5 days (gaining 0.6%), while it was a rolling sea of red in our core equity indices last week - the HK50 (-4.7%) and GER40 (-3.2%) faring worst on a weekly percentage basis. US equity indices are grinding lower into quarter-end, but it’s the US small-cap plays that need to be on the radar with the US2000 the weakest index – US regional banks once again in the spotlight and finding sellers easy to come by, and the KRE ETF now targets $36.00.

Key highlights for traders to navigate:

• Month-, quarter-end positioning flows

• ECB Forum at Sintra - Fed’s Powell, ECB’s Lagarde, BoJ Ueda, and BoE Bailey speaks

• US core PCE inflation

• China manufacturing/services PMI

• Inflation reads in Australia, Europe, Canada, and Japan (Tokyo CPI)

• UK Nationwide house prices and mortgage approvals

• Liquidity dynamics – increased US bond issuance, QT increase, and ECB TLTRO loan repayments

• Swedish Riksbank central bank meeting (a 25bp hike expected)

Tactical play of the week: selling rallies in AUDCAD into 0.8890.

Rearview alpha plays:

G10 and EM FX play of last week: short AUDCAD (-3.1% last week), long USDTRY (+6.4%)

Equity indices play of last week: short HK50 (-4.7%)

Commodity play of last week – short XAGUSD (-7.3%)

Banks take a central focus

US Treasury Sectary Yellen’s comments that she expects further consolidation within the banks, while the higher cost of deposits is impacting bank profitability, have put these institutions back on traders’ radar - we subsequently mark the Q2 US earning calendar on the map once again when JPM kick off proceedings on 14 July.

We can cast our net outside of the US and see banks on a global basis remain key shorting candidates. Notably in the UK and Australia, where Lloyds and NatWest are in freefall, and many are questioning the asset quality and lofty ROE guidance of these institutions amid the unfolding UK mortgage and rental crisis. For AUS200 traders, BoQ and ANZ look particularly vulnerable to further downside, although tactically, I would consider long CBA/short ANZ as a pairs trade.

Will the GBP be impacted by reduced growth expectations?

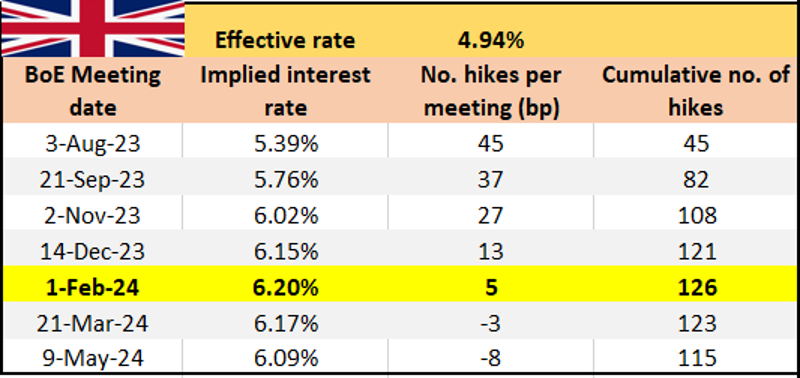

With UK banks in focus, on the data side, there will be focus on the Nationwide house price data (-4% YoY decline expected) and mortgage approvals (+49k in May) this coming week – the market has priced another 50bp hike from the BoE on 3 August, with a peak bank rate of 6.2% by February 2024. However, despite calls that the GBP should now face headwinds as the currency morphs from carry to a relative growth play, we’re not seeing that play out in the price action.

UK swaps pricing – expectations for the upcoming BOE meetings

Granted, the UK gilt curve has collapsed, but GBPAUD, GBPNOK, and GBPNZD all look like they’ve got further upside here. I’d be looking for GBPUSD to test 1.2680, where this could run into buyers here.

In the US, we’re seeing signs of reduced system liquidity, with bank reserves falling $102b last week and starting to do more of the heavy lifting in supporting the massive US Treasury TGA rebuild. We get further significant US T-bill and bond issuance this week, and we should see an increased decline in the Fed’s US Treasury holdings, but with rebalancing flows a key factor, let's see if this issuance has any impact on risk assets.

US data to navigate

The US economic data is mostly tier 2 releases – durable goods, regional manufacturing, new home sales, and consumer confidence. Core PCE is the highlight (due Friday at 22:30 AEST), and the market sees an unchanged read at 4.7% - again, this could affect pricing for the 26 July FOMC meeting, where the market prices 18bp of hikes here. Those hoping for a pause in July would want to see a number that offers real belief that the Fed’s projection of 3.9% (by year-end) is too high.

The USD has found signs of form, with the DXY pushing 103. The USD bid is a function of falling growth momentum in China and Europe, so the US data points, EU consumer confidence and inflation, and China’s manufacturing/services PMI data (Friday 11:30 AEST) need close attention.

It seems the market just can't get enthused by China’s current range of stimulus measures and we see USDCNH another FX cross-rate that has become a trend-followers dream and trades north of 7.2100 – let's see if the PBoC starts to push back on the move this week (through its daily CNY fix), as higher levels should accelerate USD buying vs the AUD and the EUR.

Staying long USDJPY, for now

USDJPY remains well traded by clients and eyes a move into 144.00 and, as we posted last week, is coming ever closer to potential jawboning from the BoJ/MoF – traders have pointed to the elevated RSI’s; however, this is not a major concern for me, as it’s the rate of change that the MoF look at more closely. We also see the price at a 4.3% premium to the 50-day MA, which is not wholly extended, and where a 5%-7% premium (to the 50-day MA) would be where I’d have a higher conviction of mean reversion trades playing out.

Aussie CPI to influence the July RBA pricing

In Australia, we get monthly CPI and retail sales this week – the market prices a 40% chance of the RBA hiking by 25bp on 4 July, so this data could easily influence that pricing. There will be a concerted groan from households if we see CPI (due Wed at 11:30 AEST) fail to come down to the consensus call of 6.1% (from 6.8%). If we look at the economist’s range of estimates, we see the distribution ranging from 6.9% to 5.6%, which is incredibly well dispersed. A 5-handle should see hikes priced out of the July RBA meeting and see the AUD under pressure.

(Distribution of economists calls for Aussie monthly CPI)

_.png)

On the central bank speeches, there will be focus placed on the Sintra Conference where Powell, Lagarde, Ueda and Bailley will be speaking.

The Case for gold upside

Commodities get a close look, too – my preference for gold is to place sell-stop orders below $1912, with the aim to play bearish momentum into and below the figure. Gold bulls will want a close back above $1938, and if the growth concerns that we saw late last week extend into the new week, then gold should benefit as a hedge, but we’d also need to see inflationary pressure ease.

Crude found buyers into the range lows of $67.00 – huge support and one that should be on all radars, especially those who want to scalp off big levels.

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.