- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

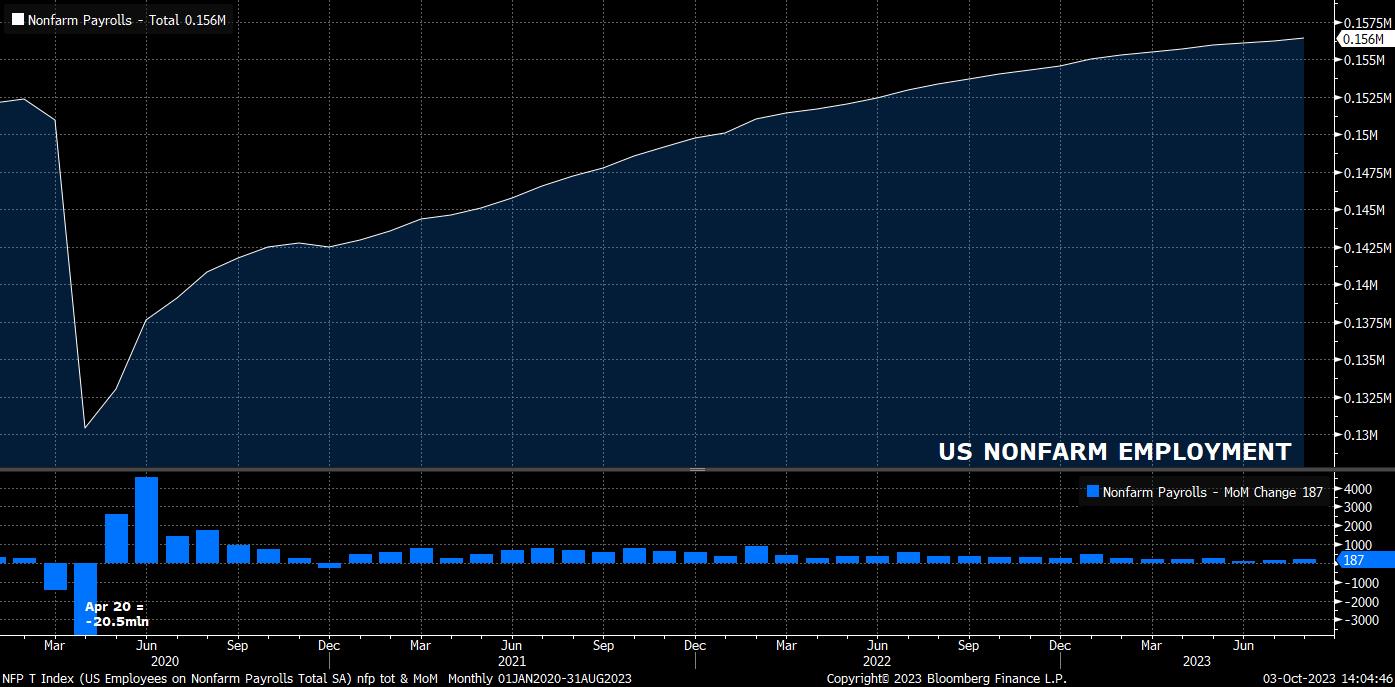

Headline nonfarm payrolls are set to have risen by 170k last month, a modest slowdown from the 187k (subject to revision) pace seen in August. As always, the range of estimates is vast, between +90k and +250k, though the usual rule of thumb that anything within around 30-40k of the median estimate can be considered ‘in line’ once again applies.

Furthermore, while such a pace of payrolls growth would represent a further slowing in job creation, it would remain above the 100-120k required to keep up with population growth, while also providing further reinforcement to the ‘soft landing’ narrative.

Leading indicators for the payrolls figure paint a somewhat mixed picture, at the time of writing.

While initial jobless claims fell 19k week-on-week to a 9-month low 202k in the survey week, continuing unemployment claims ticked moderately higher, though remain just shy of 1.7mln. Elsewhere, the employment sub-index of the ISM manufacturing PMI survey rose back above the 50 mark in September to its highest level since May, though the much more impactful services gauge has yet to be released, likewise the ADP employment survey, though the latter has proved – at best – an unreliable predictor of the official payrolls print.

A final point worth mentioning here is the ongoing autoworkers strikes, led by the UAW union. Said strikes, involving over 25,000 workers withdrawing labour thus far, began on 15th September, after the survey period for the September jobs report. Therefore, any drag on payrolls caused by strikes will feed through into the October report (due 3rd November, after the next FOMC decision), provided that the situation is not resolved prior to the October survey week (w/c 9 Oct).

Other areas of the jobs report are also likely to point to continued resilience, arguably signalling a labour market that is tighter, and more imbalanced, than the FOMC would desire to see at this stage of the economic cycle.

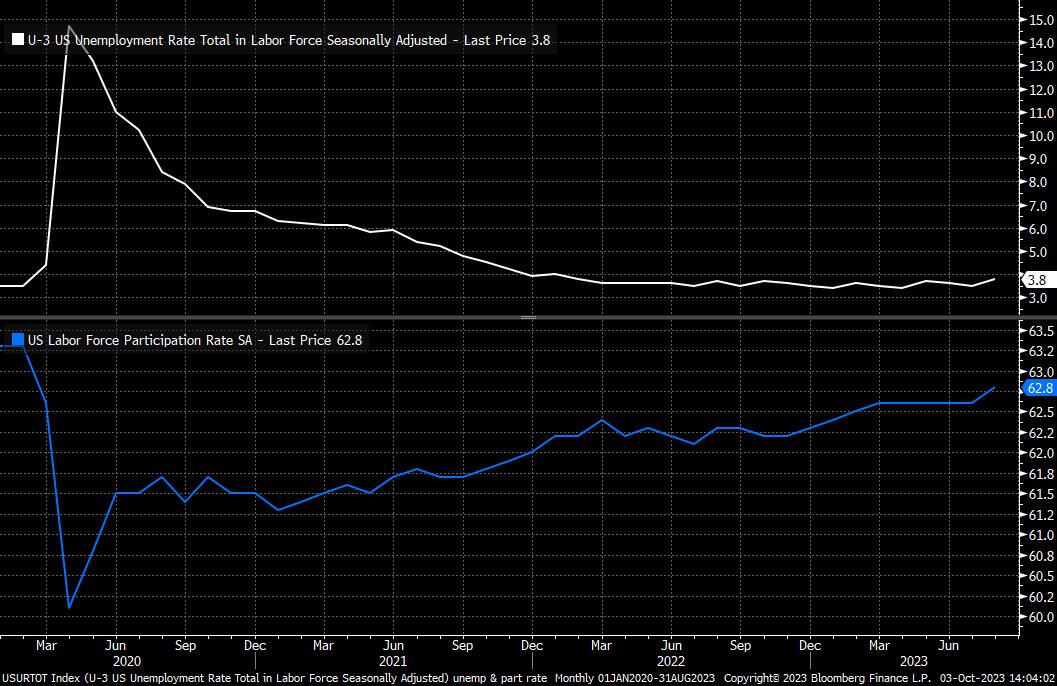

Unemployment is expected to tick 0.1pp lower to 3.7% in September, erasing a chunk of the unexpected 0.3pp rise to 3.8%, the highest level since January 2022, seen in August.

That rise, however, should be seen in a positive light, since it was driven not by joblessness, but by a surge in labour force participation, to a new cycle high 62.8%. The participation rate is set to have remained at this level in September, with close attention also likely to fall on prime age (25-55 years old) participation, which also printed a cycle, and two-decade, high 83.5% in August. These figures are of particular importance for the FOMC, given the desire to ensure late-cycle labour market progress is spread across as broad a proportion of the economy as possible.

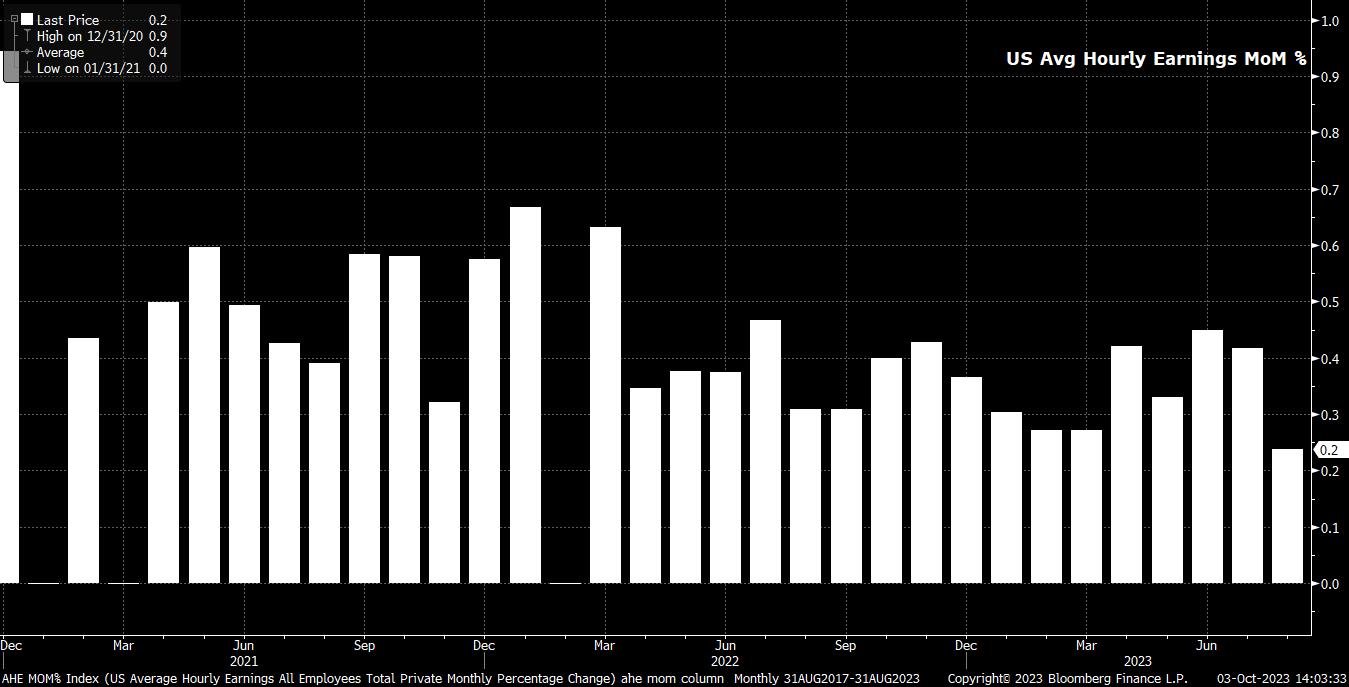

Finally, on earnings, average hourly earnings are set to have risen 0.3% MoM, a modest quickening from the 0.2% MoM pace seen in August, though such a rise should see the annual rate remain at 4.3% YoY. While such a pace would represent solid real earnings growth, it is unlikely to cause too much consternation just yet, and does not represent significant risk of a wage-price spiral developing at this stage.

Of course, the jobs report will be viewed through the lens of its policy implications, though some may contend that next Thursday’s (12th Oct) CPI print may be more impactful here.

There are two aspects that must be considered in terms of Fed pricing – the matter of whether or not the FOMC deliver another 25bp hike this year, as implied in the September ‘dot plot’; and, when markets expect the first rate cut to be delivered. At present, OIS assigns a roughly 30% chance to a 25bp hike in November, while seeing a hike by year-end as around an even chance. Looking further out, markets fully price a 25bp cut from the FOMC by next September, with 20bp of cuts priced by the July 2024 meeting.

A softer than expected report would likely spark a dovish repricing, lowering the chances of the further 25bp hike signalled in the ‘dot plot’ being delivered, while likely also bringing forward the pricing of the first 25bp cut to next summer. The opposite is, unsurprisingly, true on a hotter than expected print.

The balance of risks, however, appears tilted to a more significant market reaction on a miss compared to consensus, than on a beat. This stems from how crowded the dominant market view at present – long USD, short Treasuries – has become of late, leaving positions vulnerable to an unwind en masse were the ‘US exceptionalism’ view to come under some threat.

For the greenback, per the DXY, 107.20 stands out as the key level to watch, being the 50% retracement of the Oct 22 – Jul 23 declines; a break above here, and perhaps even the top of the ascending channel that’s been running the show since summer. Bulls will be targeting the 109 figure as a medium-term upside target (though this would likely put cable under 1.20, the EUR in the mid-1.03s, and USDJPY considerably north of 150).

_D_2023-10-03_13-57-36.jpg)

To the downside, any dips are likely to be bought into quickly, with initial support sitting at the prior YTD high 105.90, before more influential support at the 105 figure below. Short- and medium-run moving averages are too far below spot to worry about at present.

As for equities, the S&P 500 remains in something of a no man’s land around the 4,300 figure, though selling pressure has remained intense as Treasuries continue to print cycle high yields across the curve.

A move back above the 4,400 handle (and 100-day moving average) might provide the bulls with the upper hand, though seems punchy to expect over NFP itself. To the downside, few are likely to want to buy into weakness until a test, and hold, of the 200-day MA at 4,225.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.