- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

On Friday we saw the S&P 500 launching 1.5% in the final couple of hours of trade and this may spill over into a strong Asian open, notably in Japan. On the day, we also saw crude gaining 4% on the day, long-end Treasury yields moved higher and risk FX worked well.

The week ahead

Looking ahead though and the week ahead promises to hold several event risks that traders should be cognizant of and factor into their risk management approach. Firstly, US President Biden, will (on Wednesday) offer greater clarity around his “economic vision” and layout the framework for the much speculated $3t infrastructure program. A percentage of this will be paid in taxes so any colour as to the extent of this is welcomed, while the bulk paid for in deficit spending. Any insights into whether the spending will be front-loaded is useful for clarity too.

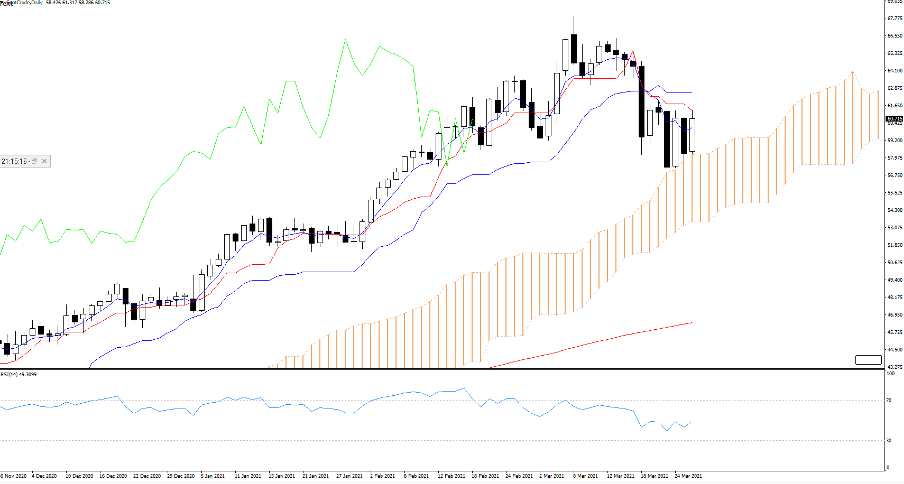

(USDJPY daily)

(Source: Bloomberg)

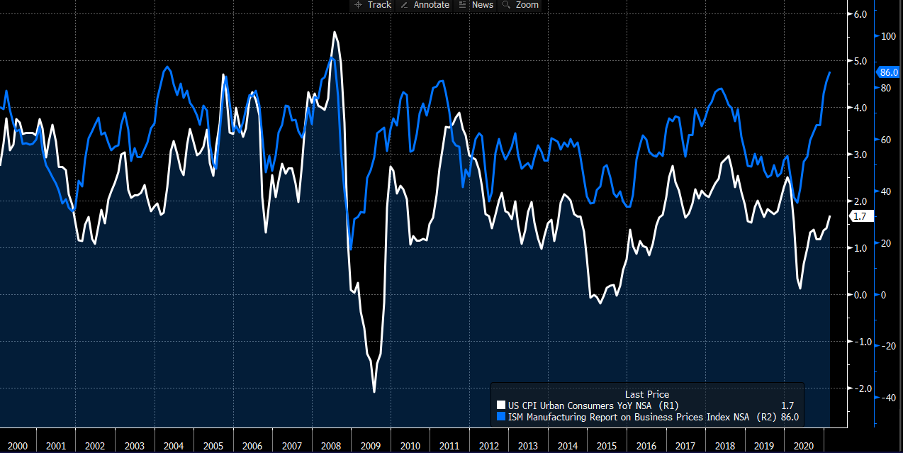

Staying in the US and we get March consumer confidence (Wed 01:00 AEDT) with calls this improves to 96.8 (from 91.3). Later in the week, we see the March ISM manufacturing report (1 April at 01:00 AEDT), with the consensus seeing this print come in at 61.4 (from 60.8), which would represent a solid rate of expansion from the February print. All eyes on the ‘prices paid’ sub-component, which is seen as a key proxy of inflation.

(Blue - ISM prices paid, white – US CPI YoY change)

(Source: Bloomberg)

US non-farm payrolls (NFP) a clear highlight

Then on Friday (23:30 AEDT) we get the US payrolls report, which I see as the big economic risk of the week. Consensus is for a solid 643k jobs to be created in March, further improving from the 379k gain we saw in February. The distribution of forecasts range from 460k to 1m, where the whisper number sits at the top end of the range. 1m jobs would set the reflation trades alight, with the S&P 500 outperforming, led by cyclicals (energy and banks) and cause a solid sell-off in bond yields taking USDJPY and USDCHF higher. EURUSD should push through last weeks lows of 1.1761 and towards 1.1690.

The US unemployment rate is expected to tick down 20bp to 6% and if the household survey runs hot then we’ll see a sub 6% print here. The market will key off this rate intently. Hourly earnings are expected to gain 4.5% YoY, with a small tick up to 34.7 in hours worked.

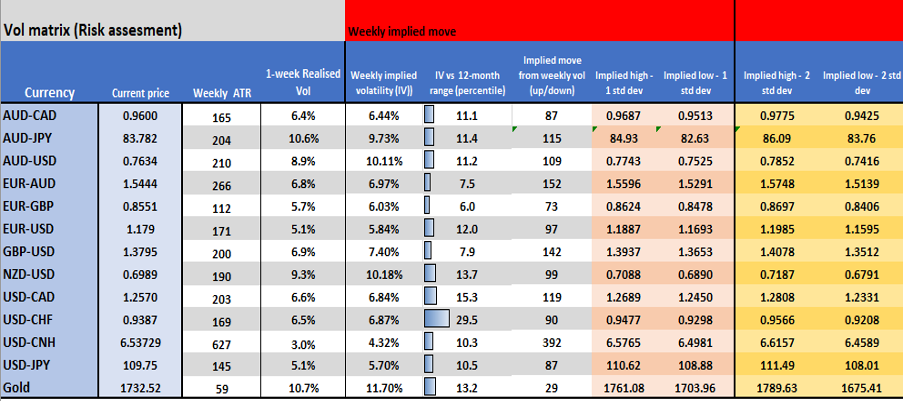

Looking at the reaction in markets to a beat in NFPs over the past year and we see the S&P 500 tends to perform favourably – good news is not bad news with the Fed demanding credibility to its new Average Inflation Targeting policy mandate. USDJPY is one of the cleaner vehicles to trade payrolls and should follow US 5yr Treasury yields closely, which are holding a triangle pattern and if the 5yr yields clear 86-90bp then USDJPY should follow. USDJPY’s pedigree hasn’t been great with the pair falling in the hour after payrolls for the past 4 prints. Watch the June 2020 spike high here at 109.85, as a break should see 110.60/70 come into play – USDJPY weekly implied vol sits a lowly 5.7%, suggesting an 87-pip move in the week (with a 68.2% level of confidence).

(Weekly implied volatility matrix)

Conversely, if we see buying in US bonds and the 5yr heads through 73bp, portraying that interest hikes are also being priced out, then USDJPY should head towards 109. Gold will find form in an environment of falling bond yields and gold’s form over payrolls has been consistent relative to the outcome of the data – good jobs sees gold trade lower and vice versa.

Eyes on the OPEC meeting

Crude volatility has ramped up of late and takes centre stage as well with OPEC meeting on Thursday. Lockdowns in Europe and the Suez Canal blockage which has delayed shipments from the Persian Gulf to Europe and have added to the variance in crude’s moves. It would, therefore, ‘surprise’ if OPEC increased production given the weaker demand outlook, so should the group take up output then we’ll see crude finding sellers easy to come by. As it is that seems unlikely, and the bulls will want to clear $61.75 for a move into $64.40. For those who watch the Ichimoku cloud, price is holding the top of the cloud (in our SpotCrude) but seems to be contained below the conversion line – use this to guide.

Watch CAD and NOK exposures over the OPEC meeting too, notably with CAD rates pricing quite rich now, with expectations of a more active BoC elevated in the years ahead. I have closed out my AUDCAD short idea and while Jobkeepers support rolls off in Australia this week and data is light (watch house price index on Thursday at 10:00 AEDT), if AUDCAD can squeeze through 0.9610 then it may have legs into the 0.9680/90.

In China, the highlight will be the March manufacturing print, which is expected to increase to 51.2 (from 50.6). An improvement would not shock in any way and as we see Chinese manufacturing has improved in March for the past 15 years. Will this signal a turn in a more sustained turn in sentiment towards Chinese equities?

In Europe, we get Eurozone initial CPI prints on Wednesday (20:00 AEDT) and final manufacturing reads – while EURUSD will get strong focus, the equity markets look interesting, and I’d expect focus on the GER30 for a break to new highs.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.