- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

With the ‘value’ parts of the market really getting clobbered and the VIX closing above 20%, St Louis Fed president Jamie Bullard added fuel to the volatility fire, where he talked up the idea of hiking in 2022 and ending mortgage buying sooner.

(Source: Tradingview)

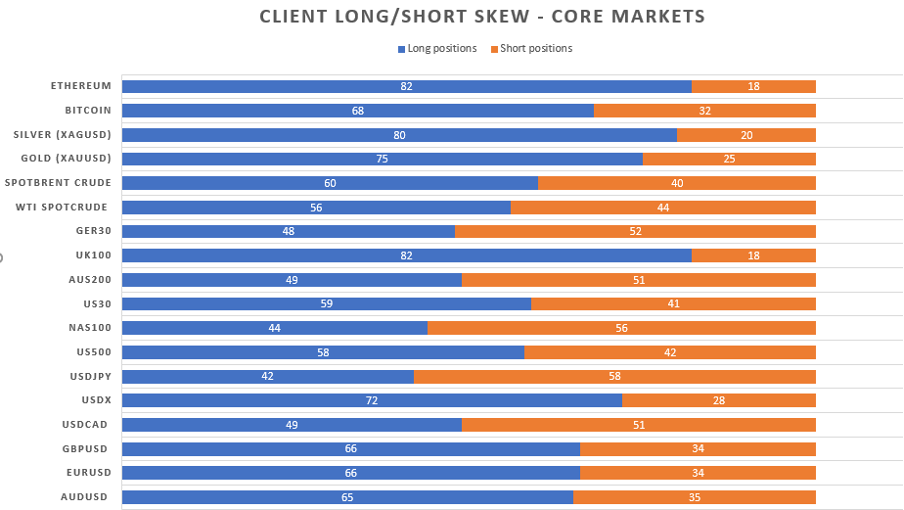

Like many, I had expected the 61.8 Fibo (of the April sell-off) in the USDX to hold for a bit after the move from 89.50 and at least see some consolidation. That wasn’t to be and it seems technical resistance means very little when this type of re-positioning event plays out. EURUSD has driven the USDX, with price moving into 1.1847 and entering the most oversold conditions since Feb 2020 – it genuinely has been a brutal move from 1.2150 and it’s not hard to see why clients are now so skewed short of USD’s, especially when their timeframes are typically hours, not days.

Client long and short positioning skew in our core markets

AUDUSD looks horrible and another pair where the 5-day RSI has moved into single figures – the liquidation of longs has been swift, with the market rapidly reducing inflation trades, the AUD and NZD have been two expressions of this theme in FX markets. AUDUSD is another pair I would be leaning into strength to short given the diverging policy settings between the Fed and RBA, but how cute can you be with the rallies is the question – the macro world are talking 70c as a medium-term target.

NZDUSD also gets the focus as we’ve closed below the March swing low of 0.6943 and again while oversold, these things can remain oversold for a while.

USDCHF has worked beautifully and is pushing the March swing and another pair that deserves attention – can the March highs of 0.9450 come into play at some stage in the next couple of weeks?

Gold is another that clients are long and expecting a technical bounce – I too shared some expectations on Friday of consolidation, but the clear horizontal support into $1764 gave way, and rallies will be sold in the near term.

(Source: Bloomberg)

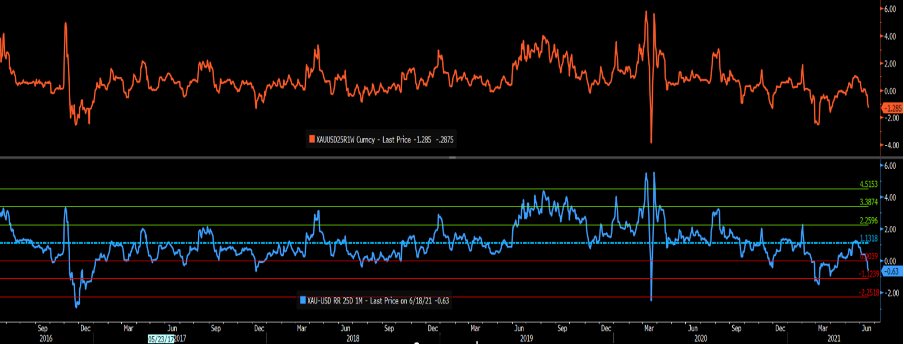

Technicals aside, if I look at the options market I can look at the skew in implied volatility which remains my preferred sentiment guide and see this is clearly bearish, but not at extremes – in the middle pane we see 1-week ‘risk reversals’ (RR) and in the lower pane 1-month RR – this effectively shows 1-month Gold put volatility trading at a 0.63 vol premium to calls. So, the market is bidding up downside options on a relative basis, but they are not at extreme readings yet.

The middle pane shows the skew of 1-week call vol minus put vol – this sits at -1.285 (so a premium demanded for puts), and if this goes to -2, I’d have far greater conviction that sentiment had swung far too bearish on gold.

What message is the US bond market portraying?

While the USD move is front and centre among clients, moves in the US bond market have really been the discussion point in the institutional world. Firstly, inflation expectations are pushing lower with 10yr inflation expectations falling from a recent high of around 2.50% to 2.24% - this is thematic of a lot of the over-owned/over loved inflation bets have been taken off rapidly in the last few days.

It’s also hard to go past the moves in the yield curve – and while perhaps not a factor many retail traders look at, the bond market offers incredible context on how the collective see the future of economics and act far in advance of realised inflation prints.

US 5yr v 30yr Treasury curve

(Source: Tradingview)

The yield spread between 5yr Treasuries and 30yr Treasuries has really caught the market's attention, collapsing 26bp in three days, which for the stats heads out there is a 5 standard deviation event. The world has shut up shop on 30yr Treasury shorts and covered in earnest causing an incredibly aggressive flattening of the curve. This will always hurt US financials and if this continues this week then shorting US banks will work out well. However, positioning aside some have questioned if the shape of the curve is telling us that the median estimate of two hikes in 2023 would constitute a clear policy error. Could they be saying if the Fed taper its bond purchases and guide to a higher fed funds rate that the US economy will simply not absorb that causing an economic downturn? It seems logical.

The week ahead

Although the pace will decline - It feels that the pain trade is for further strength in the USD, higher real rates, and a flatter Treasury curve, with the market continuing to see the reflation trades unwound. This means selling banks, select commodities, AUD, NZD, and emerging markets on rallies. In equities short Russell 2k and long NAS100 could work well.

So, what changes this dynamic this week?

When volatility kicks up, it always comes back to the Fed and this week the calendar is riddled with speakers. The two speakers that could arrest the moves and what traders should watch closely are speeches from NY Fed president Williams (Tuesday 05:00 AEST) and Chair Powell (4 am AEST), who testifies to Congress. Williams is likely one who sits in the no hike in 2023 camp and one of the more prominent ‘doves’. So, given the flattening in the curve and the broad tightening of financial conditions, USD sellers will want both key Fed officials to suggest the market has put a bit too much emphasis on the dots and push back on the near-term tightening.

USD bulls and equity shorts will be keen to see speeches from Mester, Daly, Bostic, and Bowman. Certainly, Mester and Bostic would be two, who like Bullard would be calling for rates hikes next year. Mester is likely calling for several hikes in 2023. Ready to trade the opportunity?

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.