- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

ECB To Accelerate Rate Cuts As Disinflation Quickens

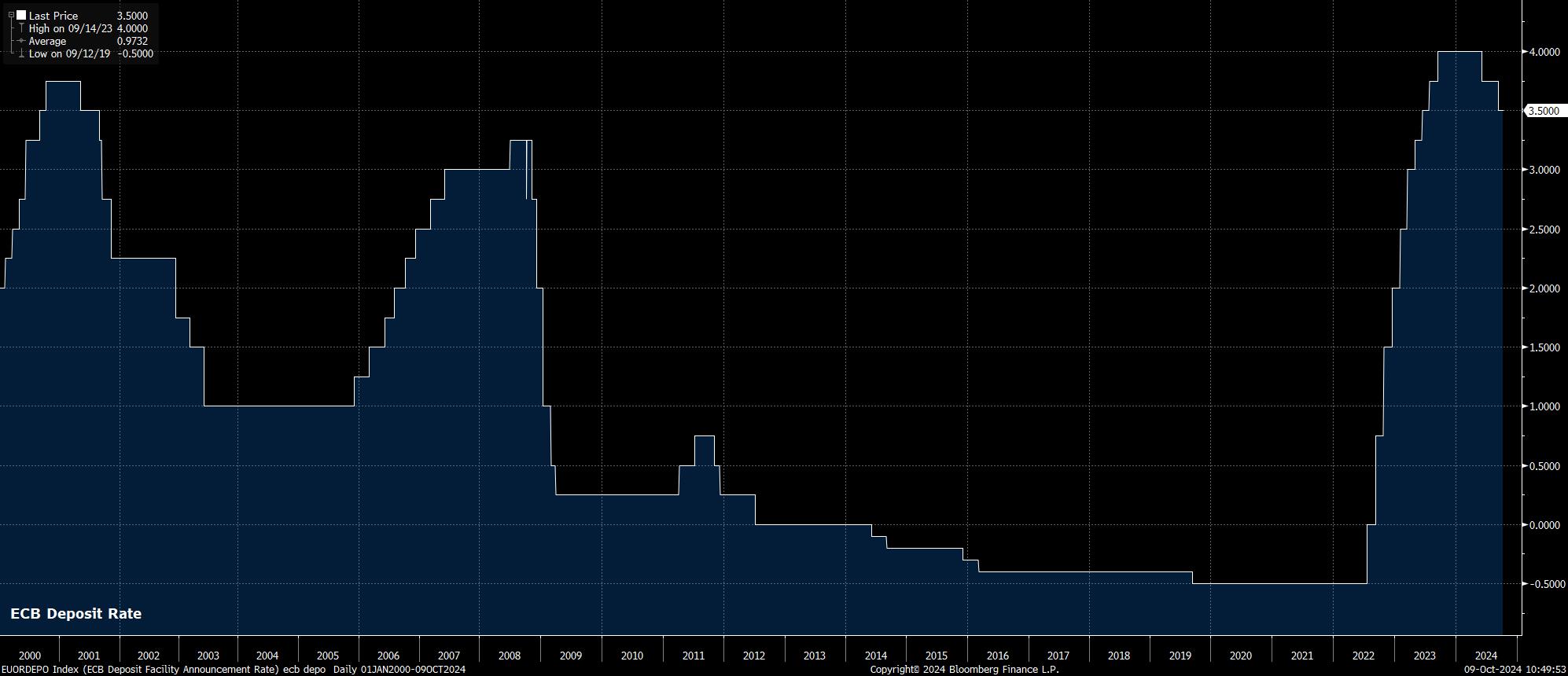

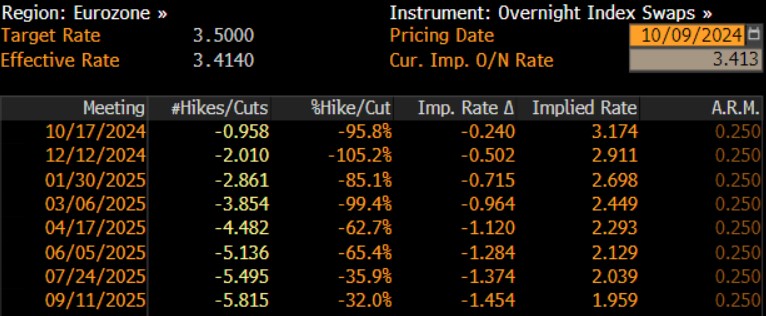

As noted, the Governing Council are set to deliver a second straight 25bp rate cut at the culmination of the October confab, taking the deposit rate to 3.25%. Such a cut is, as near as makes no difference, fully discounted by the EUR OIS curve, which implies around a 96% chance of such action, while also fully pricing another 25bp cut at the December meeting.

Accompanying such a cut, which could be considered a surprise given President Lagarde’s comments at the post-meeting press conference just a few weeks ago gave little by way of hints towards such a move.

Nevertheless, the Governing Council’s long-held data-dependent stance has, rather rapidly, made back-to-back 25bp cuts the base case, for two primary reasons.

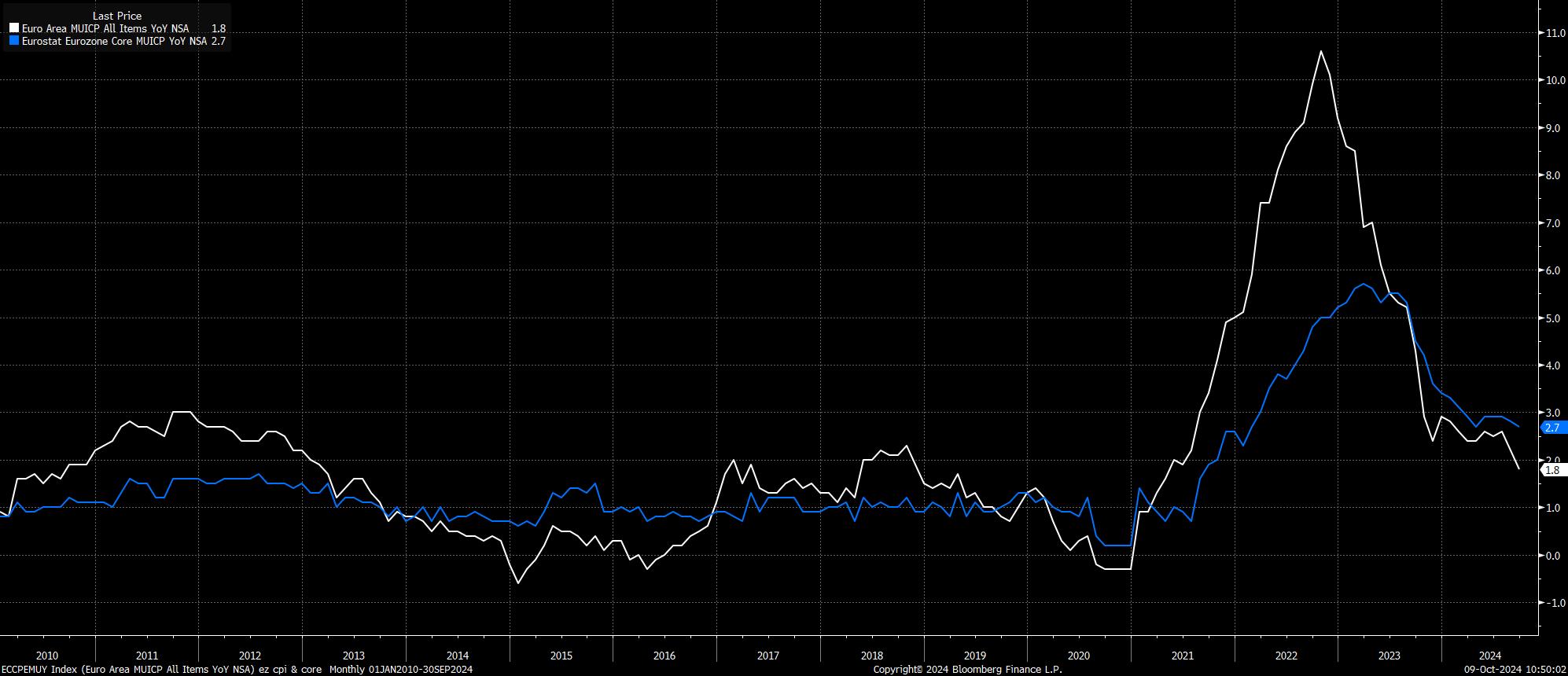

Firstly, progress on disinflation has come around quicker than expected. Per the ‘flash’ September data, headline CPI rose by 1.8% YoY, below the ECB’s 2% target for the first time in over three years, and the slowest annual increase since April 2021. Though a substantial degree of this decline was driven by a fall in energy prices, measures of underlying inflation also point to an easing in price pressures – core CPI rose 2.7% YoY, the slowest pace since April, while services inflation rose by 4.0% YoY, erasing the temporary spike higher seen in August.

It now seems increasingly likely that headline inflation will achieve the target on a sustainable basis much sooner than the Q4 25 that the latest staff macroeconomic projections outlined, with the risks of undershooting the inflation aim beginning to grow.

Furthermore, downside economic risks have also intensified. While some of these risks continue to stem from outside the bloc, namely ongoing geopolitical events in both Ukraine and the Middle East, coupled with the still-dismal Chinese economic outlook, plenty of domestically-generated risks are also increasing.

While focus, here, naturally falls on Germany, where the economy is now set to contract this year, other eurozone economies are facing headwinds of their own, particularly with both France and Italy having recently outlined plans for substantial tax hikes, and spending cuts, in an attempt to rein in out of control budget deficits.

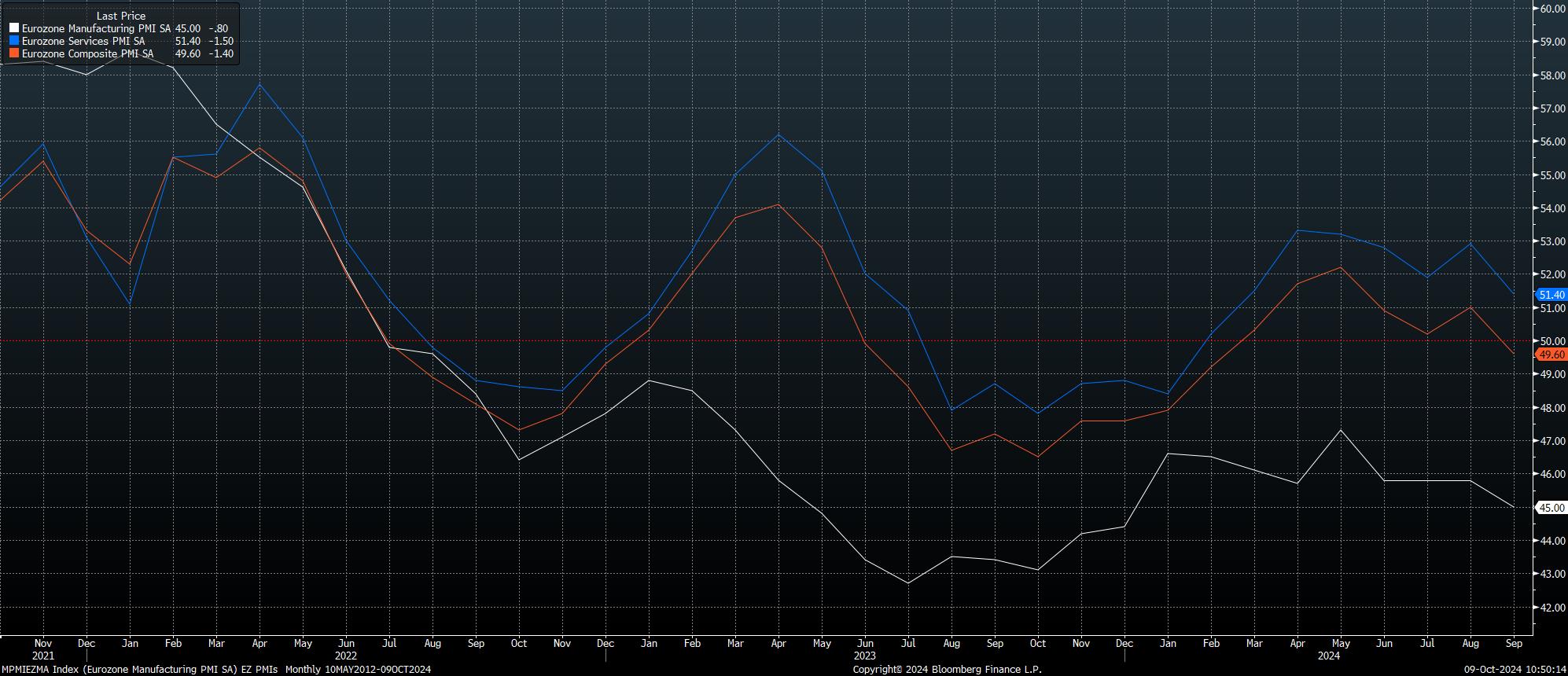

Overall, per the latest PMI surveys, eurozone economic contracted last month for the first time since February. Said slowdown has been broad-based across the economy, with the same PMI surveys showing the manufacturing sector having contracted at its fastest pace in 9 months, while the equivalent services index fell to a 7-month low.

Against this backdrop, with risks to the economic outlook also continuing to tilt to the downside, it would be relatively tough not to deliver a cut at the October meeting, particularly with policymakers having, on numerous occasions, stressed their commitment to the principle of data-dependency.

On that note, the Governing Council are unlikely to alter the guidance accompanying their policy decisions this time around. Consequently, the policy statement is set to reiterate that the Governing Council will continue following a “data-dependent…meeting-by-meeting approach” to setting policy, while also reiterating that there is no ‘pre-commitment’ being made to a particular policy path. President Lagarde’s post-meeting press conference is also likely to, broadly, follow these lines.

In practice, though, given the aforementioned outlook, there is likely to be little to deter policymakers from another 25bp cut at the December meeting, delivered in conjunction with the latest round of staff macroeconomic projections, with a regular cadence of 25bp cuts likely to then be followed at each meeting until the deposit rate reaches its neutral level, around 2%, next summer.

For financial markets, despite the Governing Council quickening the pace of rate reductions, the impact on the EUR is likely to be relatively limited.

This owes not only to the market curve already fully discounting the rate path outlined above, but also due to the pace of policy normalisation proving to be relatively synchronised across G10. That said, EUR rallies are likely to be sold into in relatively short order, particularly given the aforementioned downside growth risks, which are much more pervasive than elsewhere.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.