- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

A Trader’s Guide to the December FOMC Meeting: What Markets Are Pricing and What to Expect

USD interest-rate swaps price a 25bp cut as a near certainty, even though the vote split may be close, potentially 7 Fed members voting to cut and 5 voting to hold. No changes are expected to the Fed’s updated economic projections or to the 2026-2028 dot plot.

The statement should confirm that the Fed’s “recalibration” phase is now complete and that the fed funds rate is close to neutral. Chair Powell is likely to stress that the Fed remains open to further cuts if the incoming data justifies it, but that the bar to ease policy further is now higher. The meeting minutes (released 30 December) should shed more light on the internal division within the FOMC. On balance-sheet policy, the Fed halted its QT program this month. While there are risks the Fed's balance sheet will rise in 2026, no such decision is expected at this meeting.

For a deep dive into the fundamental aspects of the FOMC meeting, see my colleague in Research Michael Brown’s FOMC preview.

Interest Rate Pricing

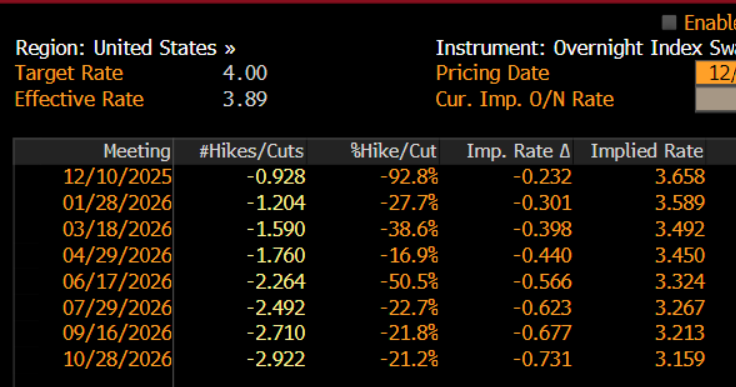

Traders will compare the statement and Powell’s press conference against what is already priced into USD interest-rate swaps - effectively, the market’s implied forward path for the Fed.

Currently:

• 25bp cut at this meeting: ~93% priced

• January 2026 cut: ~20% probability

• March 2026: a “live” meeting with a 59% chance of another cut

• By October 2026: ~92% probability of at least one further cut

While the Fed is unlikely to endorse this full path explicitly, if Powell signals a willingness to guide rates toward 3% if the data warrants it, that may be enough to keep volatility contained.

The broad USD (DXY) has been trapped in a 100.30-96.50 range since July, largely reflecting relative rate pricing. The USDX currently oscillates around the 99.02 double-top neckline; a break below could point toward 97.50. Conversely, if markets interpret the meeting as hawkish and USD shorts get covered, the range highs could come into play - and a closing break would be a meaningful technical development.

Positioning: How Traders Are Positioned Going Into the FOMC Meeting

While Pepperstone clients are skewed long USD, the broader FX market - particularly leveraged funds - heads into the meeting heavily short USD, especially vs JPY, SEK, and AUD. CAD has attracted fresh longs after the strong Canadian jobs report. Leveraged funds (and many Pepperstone traders) are also:

• Long of XAUUSD

• Modestly net long US500 and NAS100

This skew does not mean the USD cannot fall further on a dovish read - but it does suggest that any USD rally sparked by a hawkish Fed surprise could be sharper and more violent than any downside move.

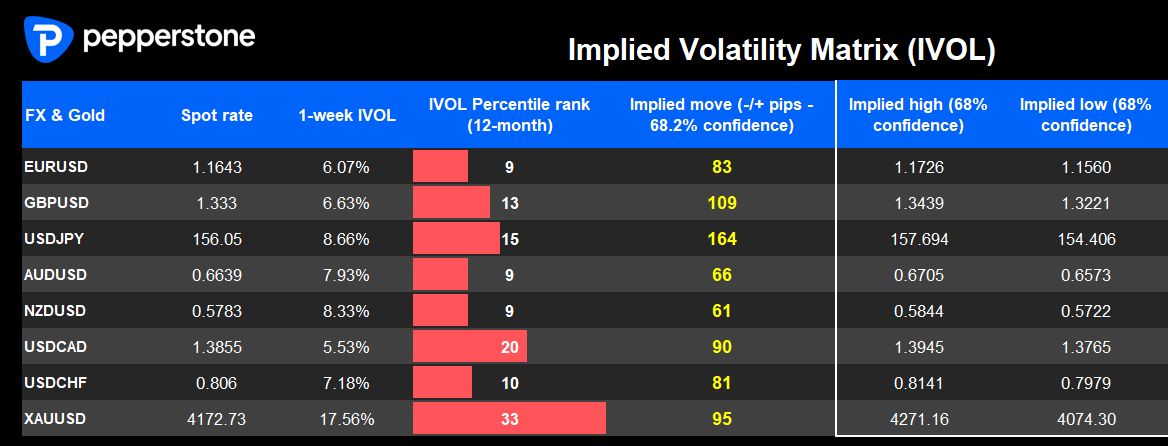

Options Implied Volatility and the Expected Movement in Markets

Implied volatility across G10 FX 1-week options is low, with nearly all pairs (excluding XAUUSD) sitting below the 20th percentile of their 12-month volatility range. This reflects the persistently small daily close-to-close percentage changes and the low realised volatility across FX.

This tells us that options traders are not expecting significant volatility this week in USD pairs.

For US Equity Indices:

• S&P 500: options imply a ±0.8% move on Fed day (slightly above the 0.7% average move over the past eight FOMC meetings)

• US2000 (Russell 2000): implied ±1.5% move, making it the more volatile index

A key wildcard is Oracle’s earnings release after the close, around one hour after Powell’s presser. While Oracle’s weight in the S&P 500 is small, the company is viewed as a proxy for OpenAI, and any commentary on capex or financing could influence the broader AI trade.

Summary

Volatility markets suggest the risk of a Fed surprise is low, with traders more focused on next week’s US nonfarm payrolls and CPI data to set the tone into year-end. Still, the Fed’s guidance remains a crucial catalyst - one that will shape FX, rates, gold, and index flows in the final weeks of 2025.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.