- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

This won’t be known until sometime in upcoming US trade and would take Biden to the required 270 seats. What has resonated is the split in Congress and the subsequent repricing of tax hikes, regulation, and a somewhat lower growth environment for 2021, which just means the Fed will have to do more of the heavy lifting. Lower and stable bond yields make everything ok, especially if we get news of a vaccine soon which is boosting the ‘hope’ aspect of markets.

Either way, risk is again firmly on the front foot and there are signs of FOMO in the markets as active managers chase and systematic players follow the momentum and trend in equity futures, which are flying. As a result the USD has been offered.

The FOMC meeting (6:00am AEDT) gave us nothing new which won’t surprise and markets were unmoved on both the statement and Powell’s presser. However, I do feel the Fed will need to pull a rabbit out of a hat in the December meeting if they're to be believed and deemed credible in its quest to drive inflation above 2% on a sustained basis. This will require lower real yields and a weaker USD.

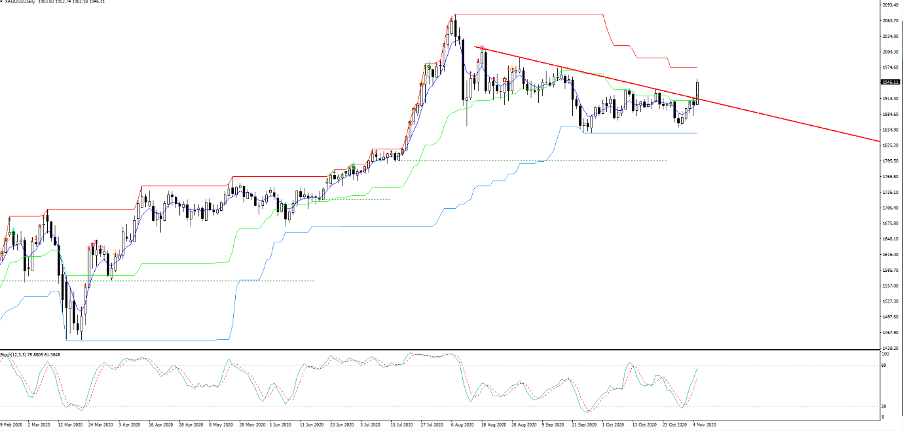

Gold, Silver and Bitcoin have worked like a dream in the weak USD environment and has attracted huge client interest. XAUUSD has broken the August downtrend and is eyeing a move into the 40-day high at 1973 – we didn’t even see a move in US real rates with the bond market silent, but Gold loves higher equities.

NAS100 eyes the 13 October highs of 12,256 having smashed through the recent downtrend and drawdowns are likely to be bought into the 5-day EMA in this environment. We’re even seeing the US2000 up 2.8% which suggests this is more than just a low bond yield equals buy tech trade and something more cyclical. A weaker USD has boosted materials stocks and the sector gained 4.1% within the various S&P 500 sectors.

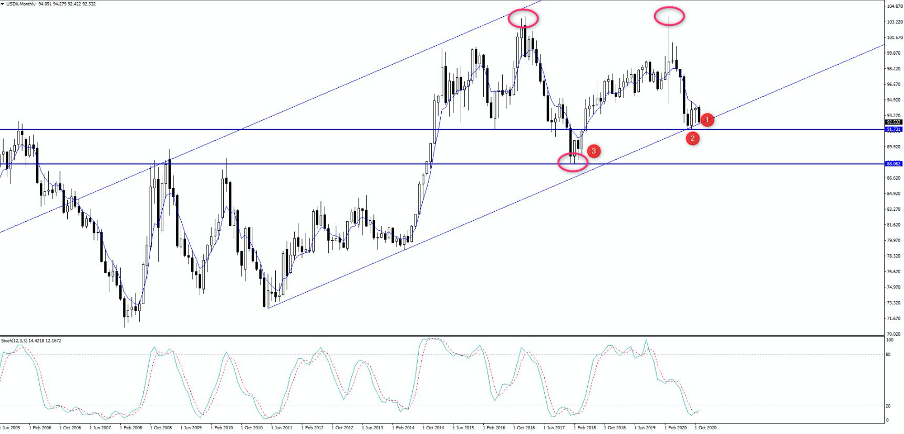

A couple of USD charts that catch my eye today.

Firstly, one that defines my longer-term macro framework and that is the USDX. Granted, it's 57% weighted towards the EUR and who wants to buy the EUR with any conviction at this juncture? I’ve gone out to the monthly for a guide as this gives solid oversight on the rhythm and feel of the flow. In this chart we see the USD still rising in a bullish channel.

A close through here would turn my view on the USD from neutral to ‘high watch’. My fundamental view is that the Fed need to bring down real yields if they're to have any success in achieving its objectives. A breakthrough horizontal support (number 2) and the technicals would be turning structurally bearish and offer conviction to my fundamental view. I would be looking at working short USD trades and taking an even more constructive view on Gold and Bitcoin, with a view to ramp up the conviction on a close through the neckline of the double top at 88.13 (no.3). EM assets will work well in this environment.

But as far as a macro oversight given the importance of the USD, this will be a key chart and I will be taking down the timeframes and trading in and out of certain assets accordingly.

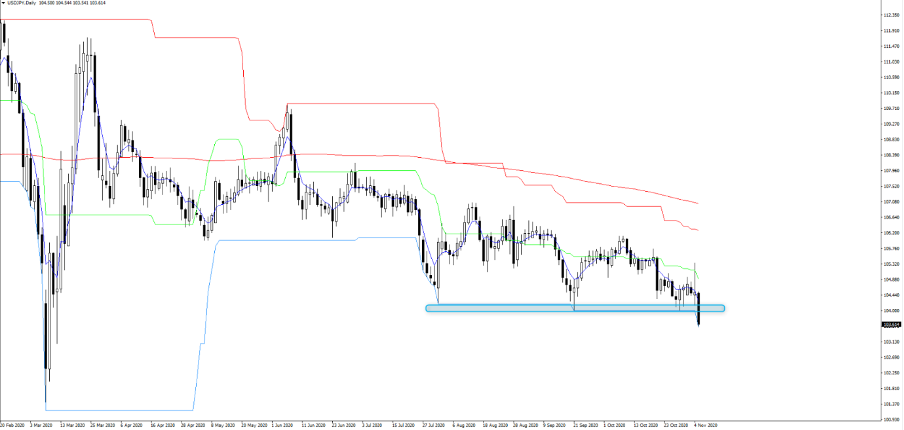

USDJPY – price smashed through the series of lows seen between 140.20 to 104.00. The BoJ will likely be out on the wires today talking about one-sided movement and that they're watching markets. Like everyone else the BoJ are almost powerless to stop a USD move. A rally back to 103.98 would be interesting to see if traders confirmed this breakout zone as now resistance. While we watch for confirmation of the US election result and whether talk of litigation impacts risk at all. We also have US payrolls (00:30 AEDT) in US trade – the market is looking for 593,000 jobs (unemployment rate at 7.6%, participation rate 61.5%). I don’t see payrolls as a hugely significant event risk for traders, in so much as becoming a volatility event. Unless of course it’s a complete disaster.

AUDUSD vs S&P 500 futures – Just like the BoJ, the RBA can try and limit the appeal to buy the AUD by staying in step with the Fed, However, when the AUD is considered a cyclical currency and a vehicle to trade risk sentiment, there's little the RBA can do. The rally in US equities has hit the USD, so our job is simply to find the best currency to do that against and that could be the NOK, NZD or AUD.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.