- English

US non-farm payrolls preview - another huge month of job gains expected

US non-farm payrolls (23:30 AEDT / 13:30 BST) – consensus expectations:

- 490,000 jobs created

- 3.7% unemployment rate

- 5.5% average hourly earnings

ISM manufacturing (01:00 AEDT / 15:00 BST)

- 59.0 (from 58.6)

When the core macro thematic is inflation and how aggressive central banks need to be to get inflation to cool, we must ask how the US payrolls print becomes a volatility event in markets?

Given the inflation thematic, it certainly suggests we should focus on the inflationary aspect of the report and that being average hourly earnings (AHE) – here, the market expects 5.5% (from 5.2% in Feb), which aside from a rapid spike in April 2020 is an extreme pace of wage pressures. The unemployment rate (U/E) is also an important factor and is expected to tick down to 3.7% (from 3.8%) and closer to the Fed’s projection of 3.5% for end-2022.

Of course, the participation rate will drive the U/E and if this remains close to 62.3% and we get a solid lift in job creation then we should see the unemployment rate tick lower – this should cement expectations that the US labour market is good shape and that workers can demand higher wages, the backbone of good inflation.

So, we watch AHE and the U/E closely, but with a 76% chance of a 50bp hike in the May FOMC meeting and over 8 hikes priced for the full year, we need to ask what is the level that really affects these expectations. I think we’d need to see wage growth closer to 6% to push the implied chance of 50bp to 90% - A scenario that would initially be a USD positive, notably vs the JPY, CHF, and EUR, and we should see US real rates higher which may negatively impact gold.

EURUSD is one to watch, not just because of the impact US rates pricing has on the USD, but we’re still getting to grips with Putin’s decree for payment of Russian gas in RUB. We’ve seen a bearish engulfing on the EURUSD daily, so follow-through would see 1.0950 targeted.

A number on AHE closer to 5% muddies the waters somewhat but shouldn’t derail expectations too intently, as the big event risk remains the March US CPI print (12 April), which could grow at an alarming 1.1% MoM clip. A rise in the unemployment rate could lead to USD selling, especially if married with weaker-than-expected wages – again hypothetical and one for the playbook of outcomes, but some believe that for the Fed to really bring down inflation they need to engineer a situation where the unemployment rate rises over time. A 2H22 story potentially.

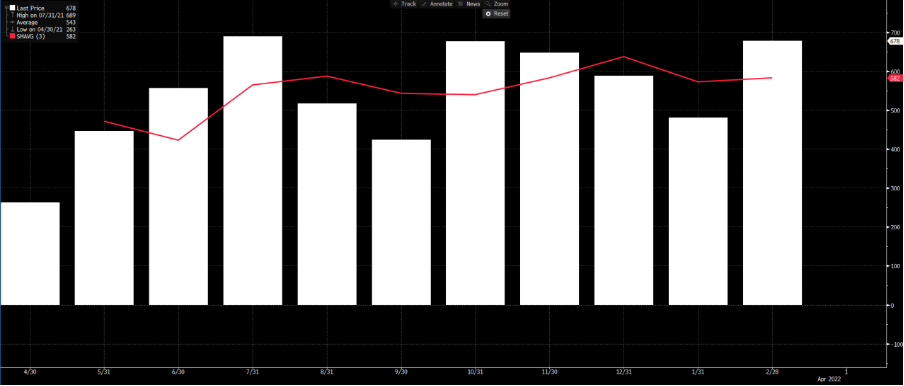

Month net jobs created

(Source: Bloomberg - Past performance is not indicative of future performance.)

In terms of the headline jobs print, the market expects 490,000 jobs to have been created in March which is a very healthy level of job gains. The economist’s range is +700,000 to zero. For context, the most accurate economist (Avery Shenfeld at CIBC) holds 490,000 as her call, while the 3-month average is 582k. Instinctively, I think if we see net job gains anywhere between 570k and 360k (1 standard deviation of the average) and this should be seen as solid job creation regardless of the 490k median estimate.

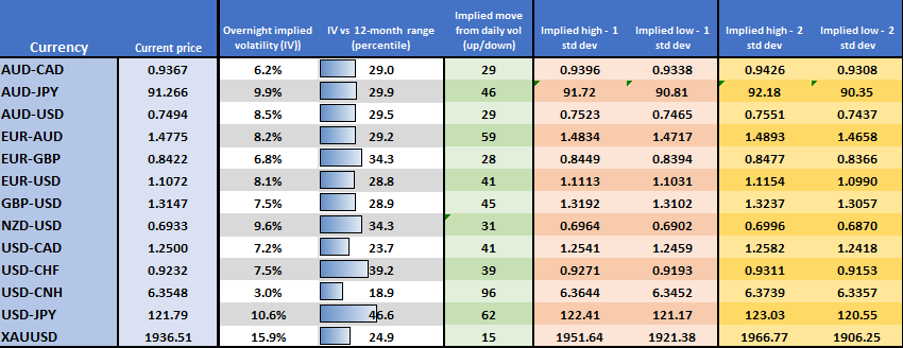

Overnight implied volatility – with expected moves on the day

(Source: Pepperstone - Past performance is not indicative of future performance.)

Looking at the options markets we can see overnight implied volatility is not overly high at this stage, it may push higher into London trade – but the volatility markets are not screaming out that payrolls or US ISM manufacturing will cause wild gyrations at this point.

To conclude, any aspects that fuel the inflation argument should promote a need to get the fed funds rate up rapidly – in turn this should be USD positive. However, given what’s already priced in it's going to need to big surprise to truly jolt the market.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.