- English

Trader thoughts - on guard for an imminent invasion of Ukraine

Although the NAS100 is outperforming – the double top neckline in the US500 has been breached and we can now eye a target of 4280 – backing this is the poor breadth in US500 cash (18% of stocks are higher) and volume in line with the 30-day average.

Volatility has pushed higher again with the VIX above 30% with good buying in 1-month S&P 500 put volatility – we see safe havens are outperforming in FX markets, with the JPY and CHF getting some love, notably vs the NZD and SEK – the USD is holding in well, and likely finding some form from the sell-off in rates with US 2yr Treasuries +9bp to 1.588% - St Louis Fed President James Bullard maintaining his hawkish stance and calling for 100bp of hikes by July. EURUSD is trading -0.5% and sits just below the 1.13 figure with price through its 50-day MA and the middle of the recent 1.1500 to 1.1100 range – perhaps weighed a touch by a further 4bp widening of Italian/German bond spreads.

XAUEUR daily chart

(Source: Tradingview - Past performance is not indicative of future performance.)

We see Gold working well, and in all currencies – certainly, XAUEUR looks strong and is breaking out to the highest levels since Sept 2020 – this is true of XAUJPY which is up by a lesser per cent due to JPY strength on the day – as always if taking long positions one can maximise the P&L effect by taking longs in the weakest currency, or shorts in the strongest currency.

XAUUSD continues to work as well, with traders eyeing a further move higher and away from the August 2020 downtrend and now eyes the 16 Nov swing high of 1877 - we can look into the options world and see 1-week implied volatility rising to 14.2% - the highest since mid-Dec and implying a move of $32 – good to see some life in the gold market after such sleepy conditions through 2021.

Gold 1-week and 1-month risk reversals (call option volatility minus put vol) are now positive for the first time this year- the market is effectively betting that if we’re to see a move then it may be more pronounced on an upside rip than a downside one. Clients remain sceptical with 72% of open positions held short, although this is one snapshot of time, and combines scalp positions and longer-term swing and position traders.

SpotCrude has found buyers through US trade and breached $95 for the first time since 2014 – clients are weighing into a small net short position here, which is understandable given the 52% rally since December - however, this is a trending market and has real momentum behind it and traders are using crude as the clear hedge against a potential invasion of Ukraine – of course, it really depends on the strategy – obvious if one is employing a momentum or trend strategy this can will only be traded long.

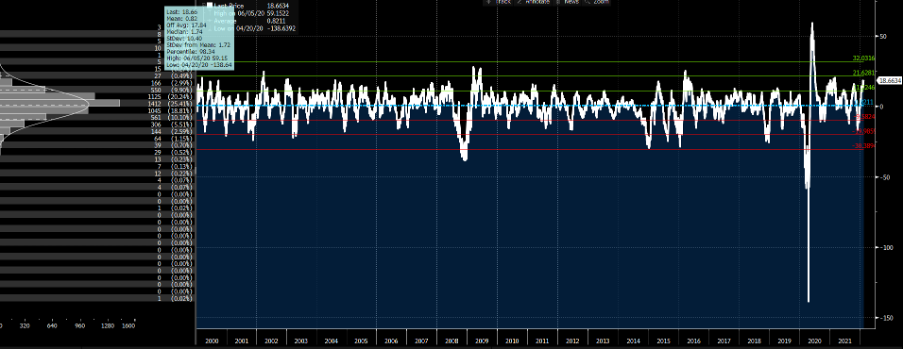

Crude futures premium/discount to the 50-day MA

(Source: Bloomberg - Past performance is not indicative of future performance.)

I will add crude is trading 18% above its 50-day MA and using a sample back to 2000 it's rare that this premium goes above 21% - in fact, a 21% premium (to the 50-day MA) is 2 standard deviations above the long-run average - If running a mean reversion strategy, I’d be looking here for a greater probability of a snapback upon this development.

We watch proceedings and the news flow with the Ukraine President saying Wednesday “will be the day Russia attacks”. Putin has been trying to show a calmer face on televised meetings with his foreign and defence ministers portraying scenes of emphasised de-escalations, but this is incredibly hard for traders to price risk around - so when in doubt buy crude and Gold – it’s somewhat surprising to see wheat and palladium not doing better. USDRUB is down 0.5% and remains a solid proxy of how traders are seeing things.

We continue to watch this space and try and get some sort of edge in our understanding.

Crypto has not really participated with tidy ranges in BTC and ETH – outside periods seen in both instruments sets the range for traders to lean against or trade the breakout – one for the radar, but the movement is subdued for now and traders are seeing more immediate opportunity.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.