- English

Going into the weekend, and at the open, the market was so well hedged against a major tail-risk event to play out…the actions and the dialogue we’ve seen highlight that the tail risks have not and will highly unlikely materialize. In fact, traders are now firmly of the belief that the risk of a supply shock is now firmly in the rear-view mirror.

The crude options market tells the real story

The crude options market is key to everything that has gone down today, as it’s here that we can truly see just how well-hedged participants were against the extreme tail risks. The catalyst in the news was Iran’s response and subsequently Trump’s follow-on announcements leading into headlines of an Iran-Israel ceasefire. Iran’s counter was defiant in tone, but lightweight in actual impact. US air bases in Qatar and Iraq sustained minimal damage, and no military personnel were lost. Iran’s own oil export facilities remained untouched, and the Strait of Hormuz still operates efficiently.

With Donald Trump having lent a hand in brokering a peaceful resolution, the prospect of a prolonged conflict with US involvement has been repriced, giving the green light to add risk and pare back well-owned tail-risk hedges.

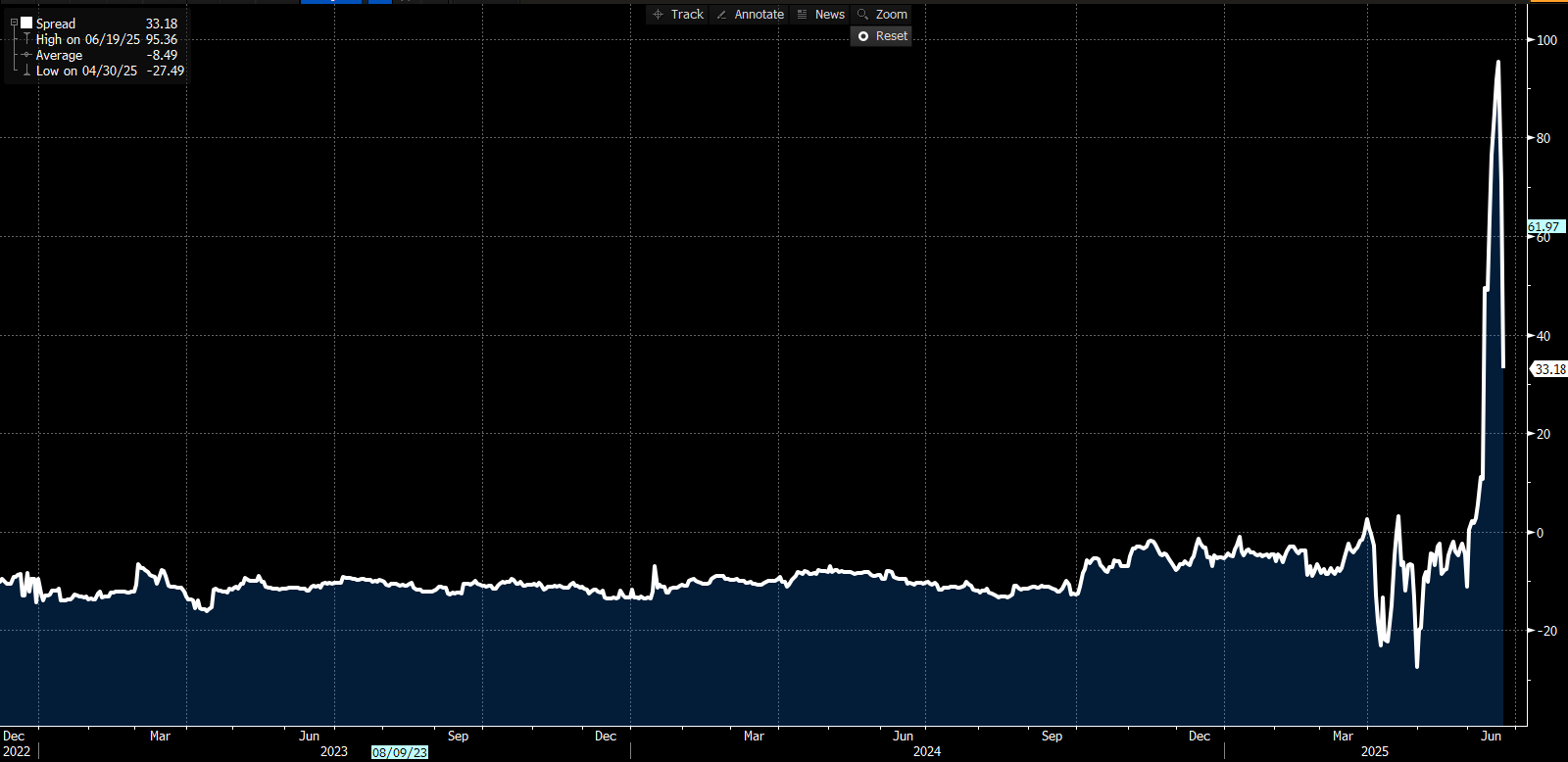

Going into the weekend’s news flow, Brent crude futures deep-out-of-money (5-delta) 1-month implied call volatility was set at an extreme 95 volatility premium to put volatility—for context, the 12-month average is -8.3 vols—this underscores the extreme skew traders had paid up for in the event of a loss of Iran’s 1.5Mbpd crude exports, and/or the closure of the Strait of Hormuz.

The oil VIX (OVX) spiked to 74% last week—the highest since 2022—but is now down to 53%. We can also see Brent at-the-money 1-month implied vol opening yesterday at an impressive 92% before the volatility sellers stepped in, driving implied vol back to 54%. Amid a backdrop of traders running long crude positions into the US attack on Iran’s three nuclear enrichment facilities, this easing of implied vol has significantly helped push the underlying crude price back to $70.

Reviewing the chain of events on the day

Brent futures initially rallied 6% to $81.40 on the Monday futures open, but that level was not sustained for long, and the market swiftly pushed it back below $80. That reversal breathed stability into Asian equities and triggered a selloff in gold—with the yellow metal trading from $3395 down to $3334.70—before the buyers stepped in with gold finding better form. This was a major red flag to me that the market was sensing the probabilities of the distribution changing.

Throughout the session, crude has been the dominant independent variable and has been so influential in driving such an empathic rejection of the lows in S&P500 and NAS100 futures. Headlines of an Iranian response on US bases in Qatar and Iraq sent futures down to 5,993, but as the broad collective learned the measures lacked the impetus to further deteriorate the situation and with the response avoiding targeting its own infrastructure the market structure evolved. We can look back at the intraday tape of SPX500 futures and see the volume spike at 5993 representing a clear capitulation move, with the algo’s sensing that the street had put its foot down further selling crude vol, selling crude futures and buying equity and FX risk – and from there it became a one-way march into the close.

That reversal in risk appetite rippled across risk FX and crypto. The DXY rallied to its 50-day moving average before being sold off from that pivot, with EUR/USD enjoying a solid reversal off 1.1460 with the spot rate now looking set to extend gains beyond 1.1600.

S&P futures ultimately broke out of their consolidation zone to close above 6,050, naturally elevating the risk of an impending challenge of the all-time highs. Breadth was impressive—nearly 80% of S&P-500 components finished higher, led by consumer discretionary, REITs, staples, industrials, financials, and tech. I’m particularly constructive on financials—JPMorgan and Citigroup stand out—and I see the recent regulatory developments and an uptick in deal-making activity as further tailwinds for further equity appreciation. Energy was the only sector in the red (–2.5%), which is no surprise given today’s crude reversal.

Looking ahead to Asia: we expect the ASX 200 and Nikkei to outperform, while moves in the Hang Seng and Chinese equity markets may be more muted. We’ll keep a close eye on Middle East developments, but sensitivity to geopolitical headlines has clearly diminished. As Trump himself has signalled, it’s time for markets to refocus on the key themes: economics, inflation, tariffs…and the passing of the “One Big, Beautiful Bill.”

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.