- English

18 - 22 Oct - a traders guide to US earnings in the week ahead

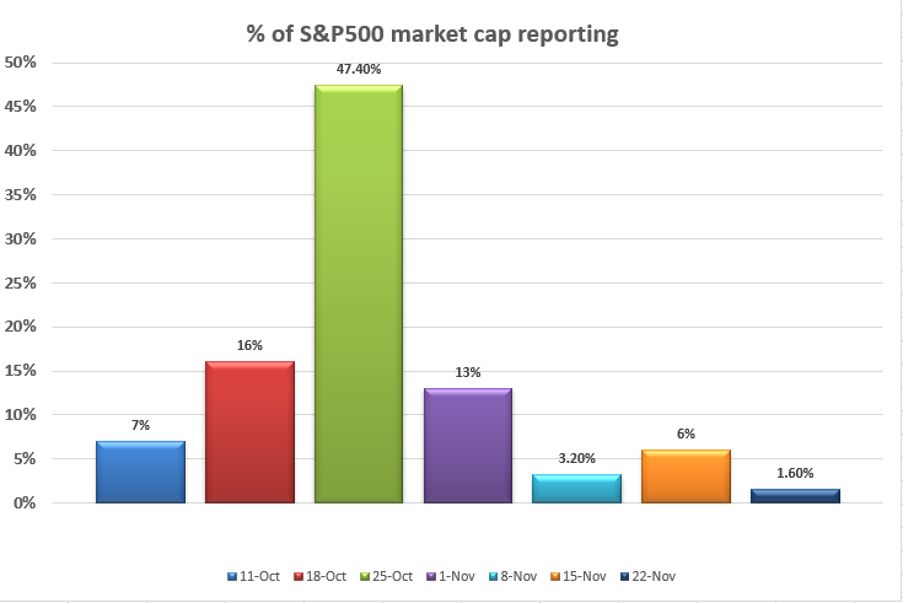

This equates to 16% of the market capitalisation of the S&P 500, which means if the earnings numbers that come out do promote a sizeable reaction in the individual stocks, we could start seeing greater movement and volatility at an index level too.

As you can see this coming weeks earnings do increase in their influence (on market cap) but will be significantly superseded by the earnings that come through the 25 October, where nearly 50% of the US500 market cap report in that week alone. That will be a week to watch out for, as volatility at a single stock and index could rise.

(Source: Pepperstone - Past performance is not indicative of future performance)

While we should see some interest in traders looking at names like Johnson & Johnson (19 Oct), Halliburton (19 Oct), Procter & Gamble (19 Oct) and Freeport-McMoRan (21 Oct), these opportunities will likely get less attention than the marquee names due to report. Notably, the big names where we should see most interest, as will be the case in the wider market, will be Netflix, IBM, Tesla and American Express.

Tesla

Tesla (report after market on Wednesday) is the retail trader favourite above all others and if you haven’t read our preview here, please feel free to do so here.

Netflix

Netflix report after Tuesday’s US close on Tuesday (20 October at 7 am AEDT). We’ve seen the share price rallying 24% into earnings and is currently eyeing a test of the all-time high of $646.84, so expectations of solid numbers and a compelling outlook have risen.

The implied move (derived from options pricing) on the day of earnings is 6%, which is in line with the average (absolute) move we’ve seen (on the day earnings) over the prior past 8 quarters - so if the options market is correct, some could be arguing Netflix is destined for $700.

(Source: Tradingview - Past performance is not indicative of future performance)

By way of numbers, the market is expecting:

- Q3 EPS of $2.63

- Q3 sales $7.48b

- Gross margins (GM) 41.65%

- Global net additions of users of 3.5m in Q3 and guidance for 8.5m in Q4.

- Average global downloads -10% QoQ

- Content updates of upcoming shows for Q4

IBM

IBM report Q3 numbers after the market close on Wednesday and with the implied move at 4.5% on the day of earnings, this could be another fairly volatile stock. In theory, IBM could be testing the 200-day MA ($136.35) or above the 4 October swing high of $146 on earnings.

IBM doesn’t have the greatest track record at earnings closing higher in two of the last six quarters, although things are looking more promising of late, with shares closing higher in the last consecutive quarters by an average of 2.7%.

The market will be watching for:

- Q3 EPS of $2.53 (Q4 consensus expectation are $4.15)

- Q3 revenue $17.82b (Q4 consensus expectation are $3.18b)

- GM 49.59%

- Free cash flow of $1.56b

American Express (AMEX)

(Source: Tradingview - Past performance is not indicative of future performance)

AMEX report Q3 earnings pre-market (22:00 AEDT) on Friday 22 October. Going into earnings AMEX has found sellers into $180, where we see a double top in play, with the neckline at $157.33 – a break of $157.33 targets $133. At this point price is supported at the 50- and 100-day MA, so the bulls will be hoping this will set the platform for a renewed tilt at this highs.

The implied move on the day of earnings is 3.5%, so we are expecting some volatility, although perhaps not to the same extent as Netflix. AMEX have a reasonable pedigree around earnings having beaten 6 of the past 8 quarter on EPS and 4 of the last 8 on sales, but aside for a 1.3% rally last quarter, shares had fallen for the past 5 quarters in a row.

The market will be watching for:

- Q3 EPS of $1.75 (Q4 consensus expectation are $1.60)

- Q3 revenue $10.58b (Q4 consensus expectation are $11.13b)

- Dividend $0.453

Trade Netflix, Tesla, American Express and IBM on both MT4 and MT5 with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.