- English

- The main events this week for traders to navigate

- French election concerns likely persist until 7 July, if not longer

- Will the gains in the CHF force the SNB hand?

- Gold finding better buyers on haven demand

- US equity risk this week – US2000 is the better short

- The RBA to leave interest rates on hold

- UK CPI is the main event for GBP traders

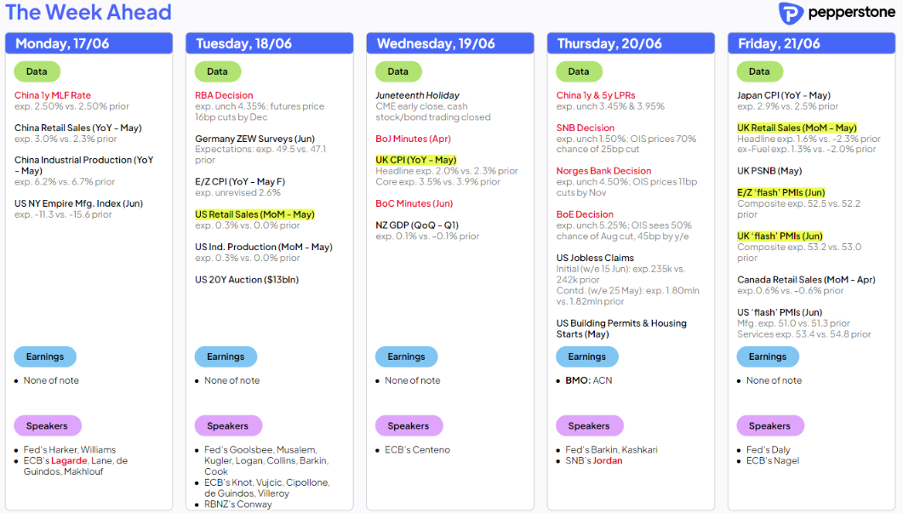

We also see key inflation prints in the UK, Europe (a final revision) and Japan. At the same time, we see retail sales in the US, PMIs in Europe, the UK and the US, and China home prices, and property investment.

For those who really want to get deep into the weeds, we hear 16 Fed speeches, 13 ECB speakers, as well as speeches from the SNB, and RBNZ. I wouldn’t be overly concerned with holding exposures over any of the respective dialogues.

French election angst to persist this week

The evolving theme in French politics continues to see market players attempting to price risk and uncertainty around the future French fiscal position and what this could mean for France’s credit rating, and the cost to fund a wider deficit.

The CAC40 (and EUStoxx50) is in freefall, led by the banks, with traders being guided on perceived risk through the aggressive widening of yield premium seen in the French 10-year bond yield over the German 10-year bund - which has blown out 29bp since 7 June. EURCHF has been another guide on political/fiscal risk, with the pair in a strong bear trend and eyeing a move into 0.9500.

We wrote about trading the French election in depth here, but with the left-wing parties forging an alliance, this just adds a new level of uncertainty into the mix and increases the chance of an outcome that could see a move away from the agreed €20b spending cuts, with increases to the deficit that adds uncertainty in French and peripheral EU bond markets.

With traders wanting certainty, this may not come until after the second-round vote (7 July), so the prospect of further downside in French and EU markets is real.

The SNB meeting is a line ball call

The uncertainty in Europe suggests the Swiss National Bank (SNB) meeting (Thursday at 17:30 AEST) is a lineball call on whether the SNB cut rates by a further 25bp. I would have sat in the camp that the SNB hold rates this week, but with the market seeing safe-haven demand for the CHF – as is the way when the macro concerns centre on Europe – the recent bout of CHF strength sways the odds modestly in favour of a cut. Still, the SNB can cut rates, but if the FRA-GE yield spread continues to blow out, then CHF safe-haven demand will likely trump a possible SNB rate cut.

Another factor being discussed is whether traders are warming to gold as a hedge against French and (to a lesser extent) German political concerns. Certainly, being long XAUEUR has caught attention, with traders looking at the 10 June highs of €2191 as a big pivot to take out for a possible trend move to play out. A close above $2341.6 in XAUUSD would be an obvious positive for long positions, which would suggest the yellow metal could squeeze towards $2375 – a level we should see cap the weekly range highs unless EU volatility really comes live.

US equity hanging in – US2000 shorts preferred

Price action and the technical set-up in US equity indices will also be front and centre. If it hadn’t been for the rise and rise of Nvidia, Microsoft and Apple, then the US500 and NAS100 would have attracted far greater rewards for those positioned short. Market breadth in the S&P500 is clearly deteriorating, and the index is hanging in by a thread, and that is throwing up greater short opportunities in single stock names, but such is the influence these three behemoth names have on both indices.

For those wanting to express a more bearish short-term view, then Europe is where to look, or in the US, the Russell 2000 (US2000) is the vehicle of choice, with the index not getting the same support seen from these mega-cap names, with the small-cap index printing lower highs and lows.

US data this week needs to hit the sweet spot, with the bulls wanting to see improvement in retail sales (consensus 0.3%), jobless claims and S&P Global manufacturing and services PMIs (consensus - 51.0 & 53.4 respectively). Weakness in these data points may negatively impact sentiment, and I would also consider expressing this through long NAS100 / short US2000 exposures.

NAS100/US2000 (expressed as a ratio on TradingView)

The RBA to leave rates unchanged

The RBA meeting will almost certainly see rates on hold at 4.35% and we should see the statement largely unchanged. AUDUSD may be good for -/+20-30 pips through the meeting but should quickly revert to following other external factors such as equity risk and commodity markets. On the week I’d be playing a 0.6680 to 0.6550 range, and leaning into these levels for a possible reversal, should they get there.

GBP eyeing the UK CPI print

In the UK the highlight of the week will be the May CPI print (Wednesday at 16:00 AEST), with UK core CPI expected to fall to 3.5% y/y (from 3.9%), and headline CPI to 2% y/y (2.3%). Core services inflation is eyed to fall to 5.5% (from 5.9%), still high in absolute terms, but well off the levels of 7.4% seen in May 2023. The BoE will then leave rates on hold at 5.25%, but a downside surprise in the CPI print could influence the tone of the BoE meeting statement, potentially showing some increased appetite for a 25bp cut in the August meeting. For now, GBPUSD holds the 1.2800 to 1.2690 range lows, where a downside break could see the pair targeting 1.2580.

The final say….

The markets evolve as always, and it pays to know the market sensitivities and the news flow which could feed the beast. The risk in markets does seem to be building, and I see an increased conviction to play defence this week, with uncertainty mounting – we shall see, and price action is, as always, the true guide on the aggregation of all behaviours and beliefs.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.