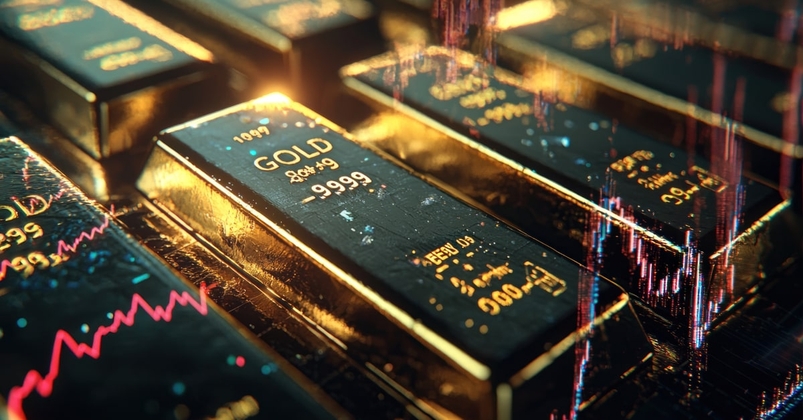

分析

市場分析

關註我們覆蓋全球的市場分析,不要錯過重要的交易機會、專家評論、視頻分享和更多其他內容

做好交易準備了嗎?

只需少量入金便可隨時開始交易。我們簡單的申請流程僅需幾分鐘便可完成申請。

Pepperstone並不表示此處提供的材料是準確的,最新的或完整的,因此不應以此為依據。此處提供的信息,無論是否來自第三方,都不應視為推薦信息;或買賣要約;或要求購買或出售任何證券,金融產品或工具的要約;或參與任何特定的交易策略。我們建議該內容的任何讀者尋求自己的建議。未經Pepperstone同意,不得複製或再分發此信息。

.png?height=420)

.jpg)