Upside CPI Surprise Not Necessarily A Boon For The Quid

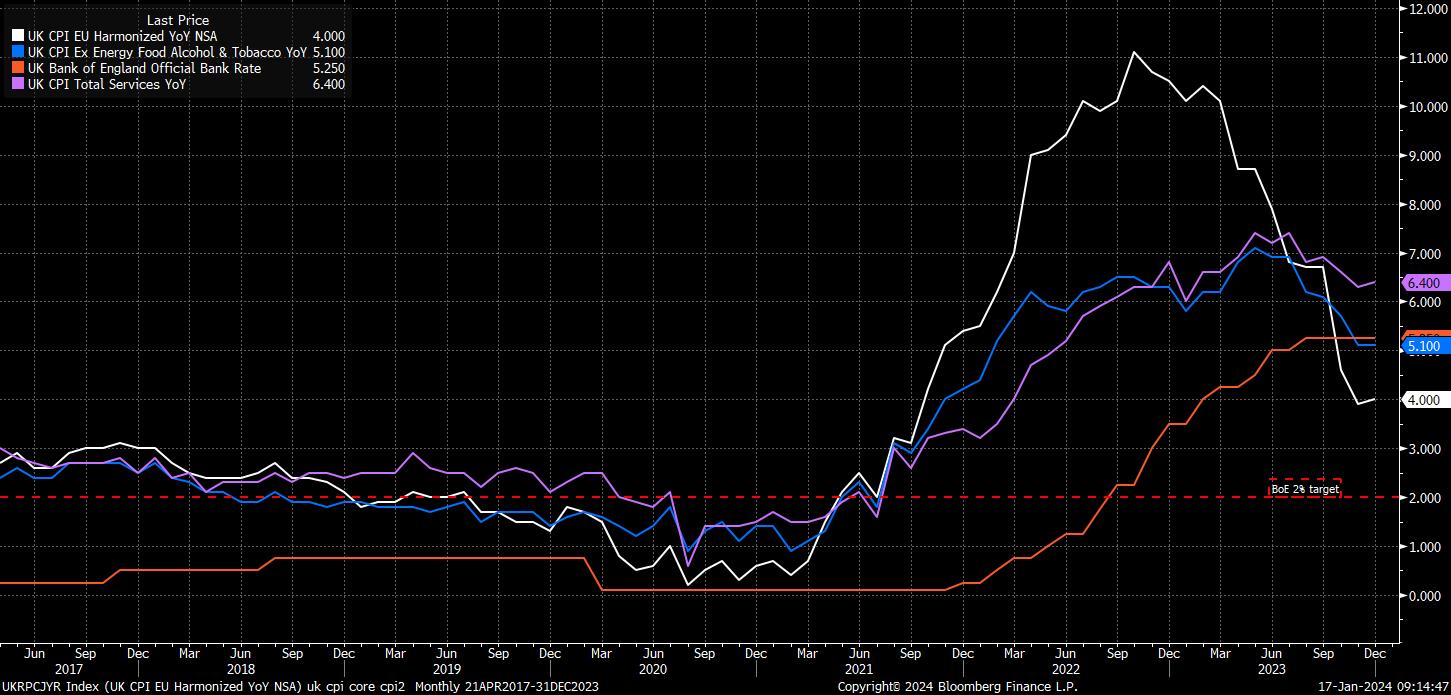

Taking the figures in turn, headline CPI rose 4.0% YoY in December, 0.2pp above consensus, the first hotter than expected print since the September data released at the start of Q4 24. Stripping out the volatile food and energy components puts core CPI at 5.1% YoY, unchanged from a month prior, and still just over 2.5x above the MPC’s 2% price target.

Much of the uptick in headline inflation at the tail end of last year was driven by a rise in both tobacco and alcohol prices, the former in particular representing the previously announced rise in duty on tobacco products that had been announced in the Autumn Statement, with said rise then exacerbated by a base effect from last year.

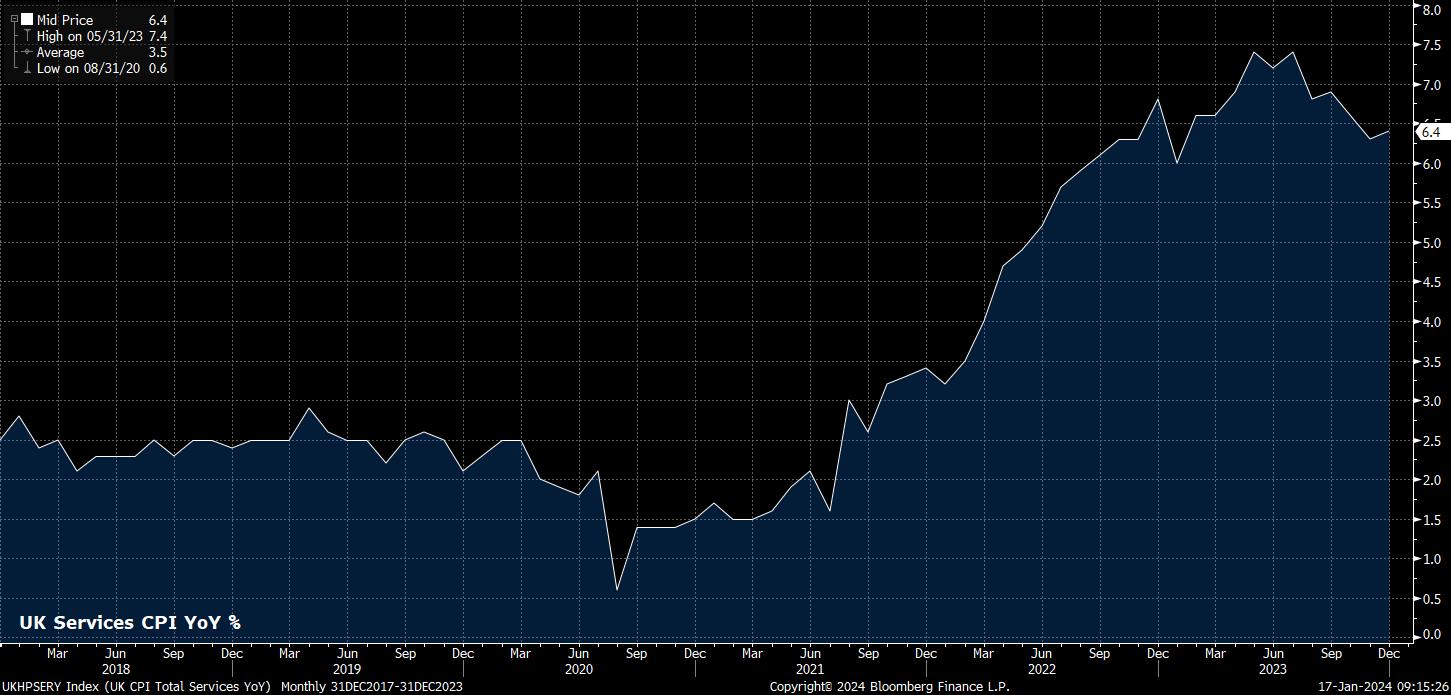

However, despite this, it is not entirely possible to explain the rise in inflation by one-off, or ‘transitory’, factors. Services inflation remains a particular concern, having ticked marginally higher to 6.4% YoY in December, and having now remained north of the 6% handle in every month since September 2022.

This ‘sticky’ services inflation, while being just a touch below the MPC’s latest forecasts, is of concern, and likely stems from the continued tightness being demonstrated by the UK labour market, with unemployment having held steady at 4.2% per the most recent data referencing November, and earnings continuing to rise at a clip of just over 6%.

Companies hoarding workers due to ongoing labour supply constraints and skills shortages is likely a significant contributing factor to this tightness, meaning that any weakness could well spiral rapidly were the jobs market to begin softening as the lagged impact of the MPC’s tightening cycle continues to be felt.

Despite that, some glimmers of more promising news may well be starting to emerge. Sticky services in the prices of airline tickets and package holidays continue to underpin services prices, factors which the Old Lady itself has noted are “not reliable” indicators of inflation persistence. Persistence which, judging from recent remarks, will be the key determinant of both when, and by how much, Bank Rate is reduced over the year ahead.

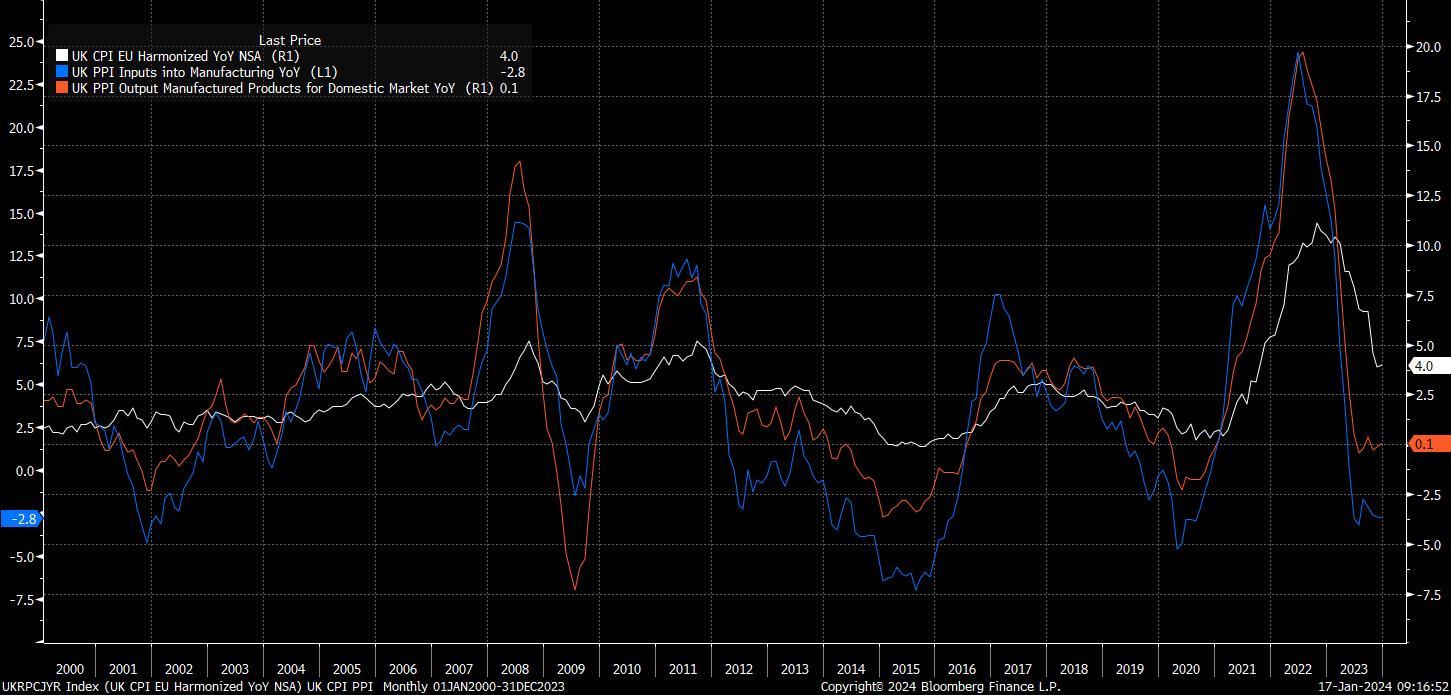

Furthermore, the goods side of the economy displays much more cause for optimism, with both input and output PPI measures now deep in deflationary territory. One would expect this to feed through the value chain and into the CPI basket as the year progresses, though any optimism must be tempered by the tendency of PPI to overshoot inflation on the way up, before overshooting deflation on the way down.

In any case, the upside surprise in CPI has led to a knee-jerk rally in the pound, with cable around 70 pips above pre-release levels, along with a hawkish repricing of the OIS curve, with the first cut now fully priced for June (vs May prior), and now just 117bp of cuts priced in 2024, the lowest amount this year. This does, however, still seem rather overdone.

Furthermore, it seems likely that GBP rallies will continue to be sold into, particularly as the quid has been unable of late to take advantage of its high-beta status, largely treading water despite the S&P 500 having gained ground in 10 of the last 11 weeks. With the growth outlook also remaining relatively dour, and mortgage refinancing set to continue, risks to the economy and currency continue to point to the downside.

From a technical standpoint, a break below the bottom of the current range, and the 50-day moving average, around 1.2610-15 is likely to bring more bears to the table, targeting the 200-day MA at 1.2550 initially, a closing break of which would likely open the door to a test of the 1.25 handle in relatively short order.

_2024-01-17_09-17-27.jpg)

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。