Resilient Retail Sales Pose Latest Risk To Dovish Fed Outlook

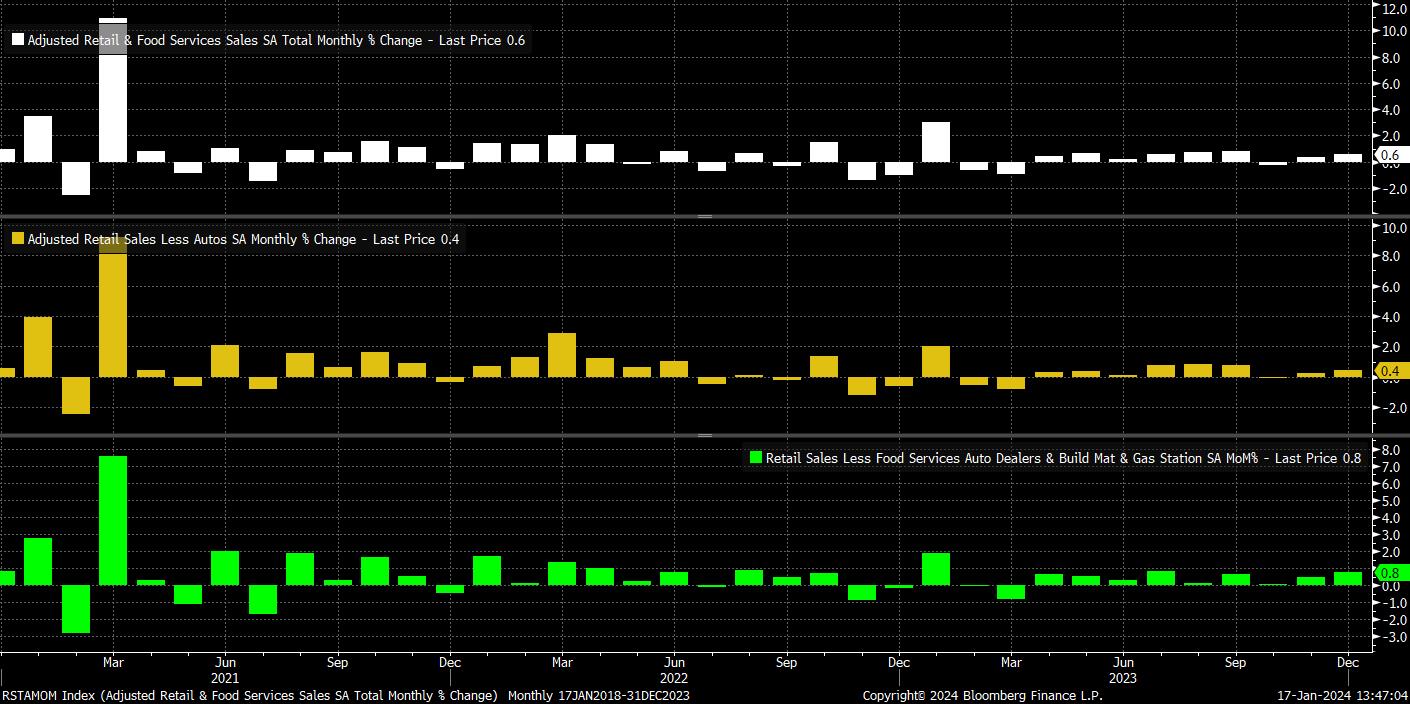

At a headline level, sales rose 0.6% MoM in December, double the 0.3% pace seen a month prior, and the fastest monthly increase in four months, while beating consensus for the sixth straight month.

The ‘core’ measures of the sales report were also promising, and surprised to the upside. Excluding autos, sales rose 0.4% MoM, again double the pace seen in the prior month, and also the most rapid rise since last September. Of more importance, as usual, is the ‘control group’ sales measure, which is used as the basket of goods that feeds directly into the GDP report. Control group sales rose 0.8% on the month, four times more than consensus had expected, and the fastest pace since last July, posing an upside risk to current forecasts for Q4 23 GDP growth, which is currently seen at an annualised pace of around 2%.

Digging further into the data, one can see that the sharp rise in sales was broad-based, with only gasoline and personal health sales acting as a drag on the overall figure, and the decline in gasoline sales being half that seen in the November data.

This modest decrease in gasoline sales speaks to a quirk of the retail sales report in its entirety, in that the data measures nominal spending, not being adjusted for inflation. Consequently, the decrease in gasoline spending likely speaks more to the continued fall in fuel prices over the back end of 2023.

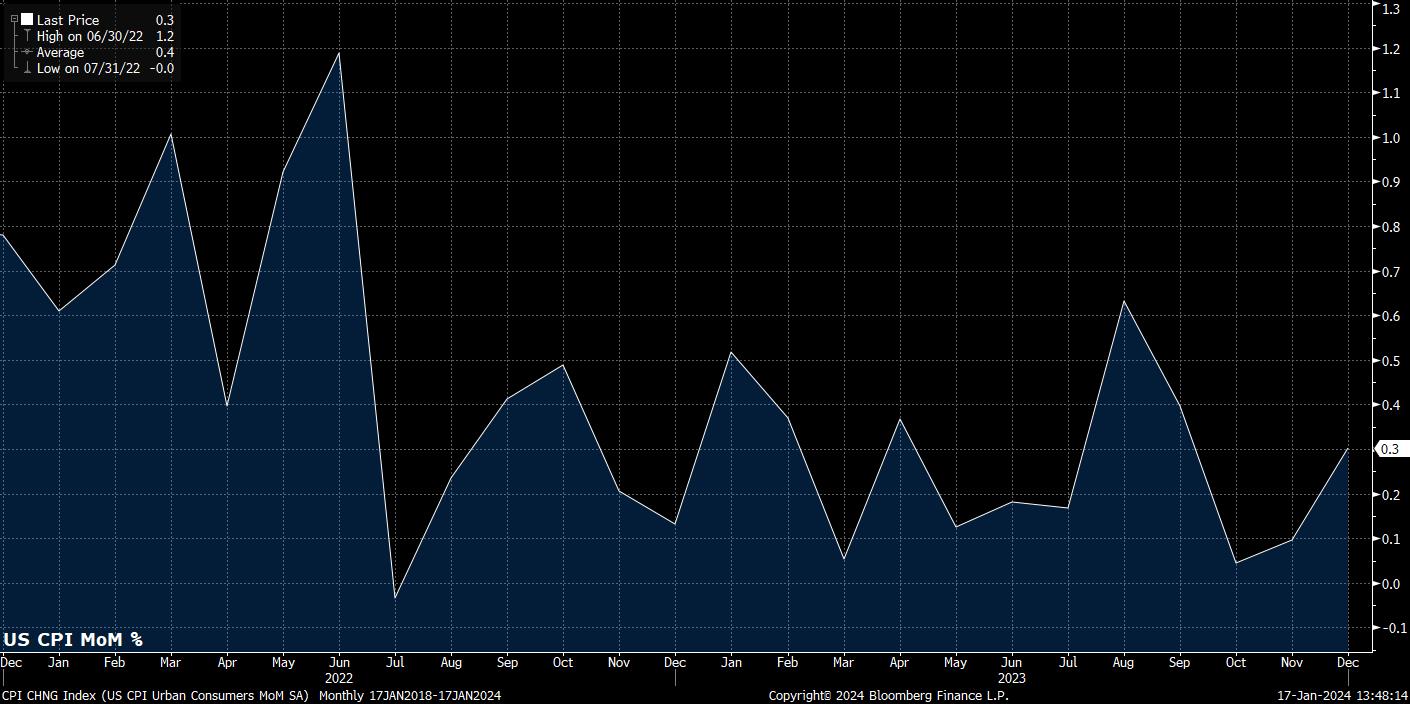

Those of a ‘glass half full’ disposition may say that the opposite is true for the headline sales beat, in that much of the increased spending was driven by the modest uptick in CPI in the month of December, where headline inflation ticked up to a 3.4% annual rate, rising 0.3% MoM, the biggest such increase since September.

It seems, however, over-the-top to pin the entire sales beat on inflationary factors, with the data significantly more likely to be speaking to the ongoing resilience and strength of the US consumer, which continues to benefit from the incredibly tight labour market, having largely weathered the storm of the Fed’s tightening cycle thus far.

On the subject of the Fed, the strong sales report should serve as another reminder that markets have become rather too aggressive in terms of pricing near-term rate cuts, following December’s impressive labour market report, continued disinflation in core CPI, and Governor Waller’s recent remarks which, implicitly, pushed back on the idea of rates being cut as soon as two months’ time.

While the data did result in a modest hawkish repricing of policy expectations, with around 5bp of cuts priced out over the course of the year ahead, and the chances of a March cut having slipped from 62% pre-release, to just under 60% now, the market still appears priced too dovishly for what policymakers are likely to deliver.

Of course, incoming releases will continue to be closely watched as markets continue to second-guess the policy outlook, with the next top-tier print coming in the form of the first estimate of fourth quarter GDP in just over a week’s time. Were that to also beat expectations, one would expect a further hawkish repricing to take place, posing an upside risk to the greenback, and a further downside risk to both equities and Treasuries – though, the long-end is soon likely to begin to offer increasing value, particularly once the easing cycle has begun, and if economic momentum does eventually begin to wane.

_d_2024-01-17_13-49-01.jpg)

Related articles

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。