Chinese Equities: A Short-Lived Bounce, Or The Start Of A Turnaround?

This catalyst comes in the form of increased government intervention – aka, panic – and greater state attempts to try and prop up the market; the latest of which being President Xi receiving a briefing from officials on plans to stem the stock market bleeding.

While headlines confirming such a meeting sparked a chunky rally, the CSI 300 gaining more than 3% on Tuesday in its best day since 2022, and small caps vaulting higher by almost double that magnitude, it’s worth noting that we have been here many times before of late, as investors attempt to ‘catch a falling knife’, and turn a ‘dead cat bounce’ into a more durable rally.

We’ve also been here many times before in terms of Government attempts to prop up the market. A plethora of (frankly futile) short-selling bans have already been implemented, as have a host of relatively small, targeted fiscal stimulus programmes, mainly focused on the property sector. Furthermore, the PBoC have cut the required reserve ratio (RRR) by 50bp, an attempt to release around 1tln CNY in capital, while also flagging space for further monetary easing in the near-term if required. As the above shows, none of this really worked.

Now, it would appear that efforts to stabilise proceedings have stepped up a gear, not only with Xi receiving the aforementioned briefing, but also with China’s sovereign wealth fund announced a pledge to increase holdings of equity ETFs, for the first time since October. Accompanying this was an announcement from China’s securities regulator noting that it would make ‘greater efforts’ to ‘guide’ long-term funds to enter the equity market. Put in simple terms, all of this is Chinese policymakers trying to engineer a state-mandated bull market.

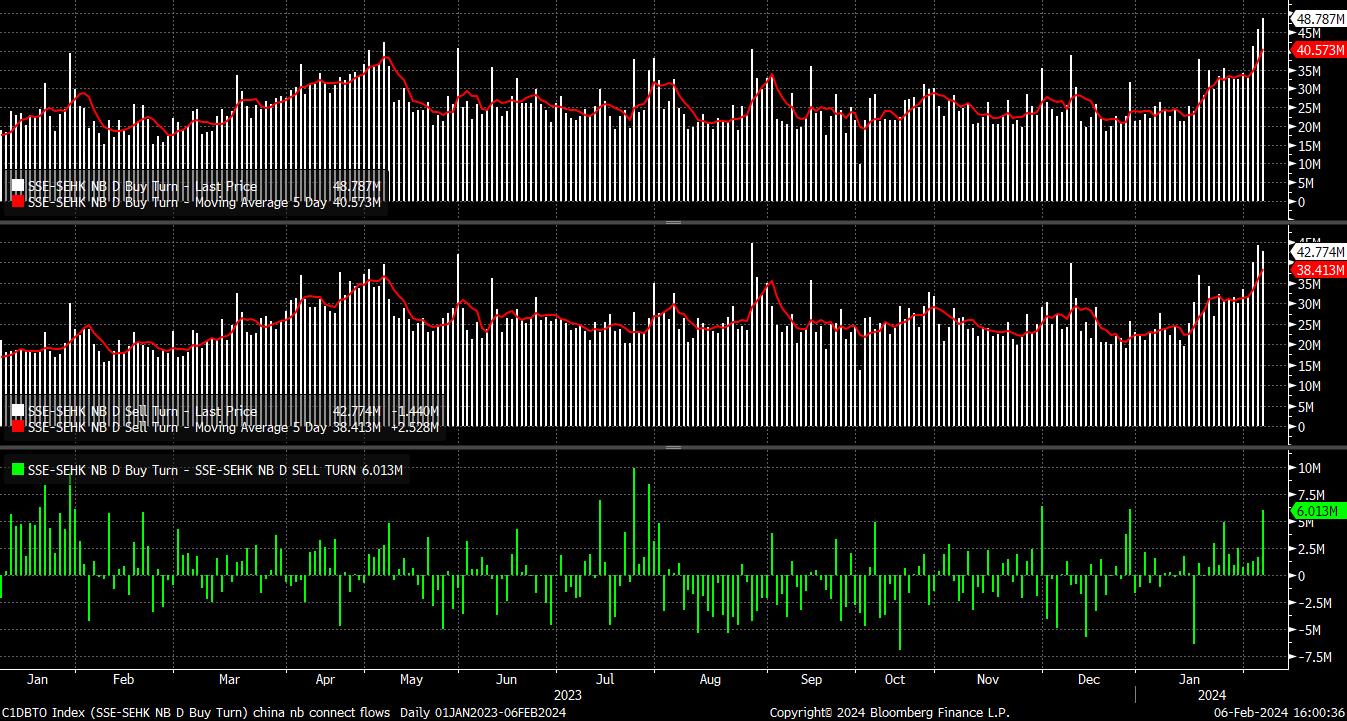

It is, clearly, far too early to say whether or not those efforts have – or will – work. However, Tuesday’s trade showed some early signs of increased confidence, with net inflows via the ‘northbound connect’ rising to the highest level this year.

Perhaps the most significant question among all this is why authorities are going to such lengths to try and prop up the market.

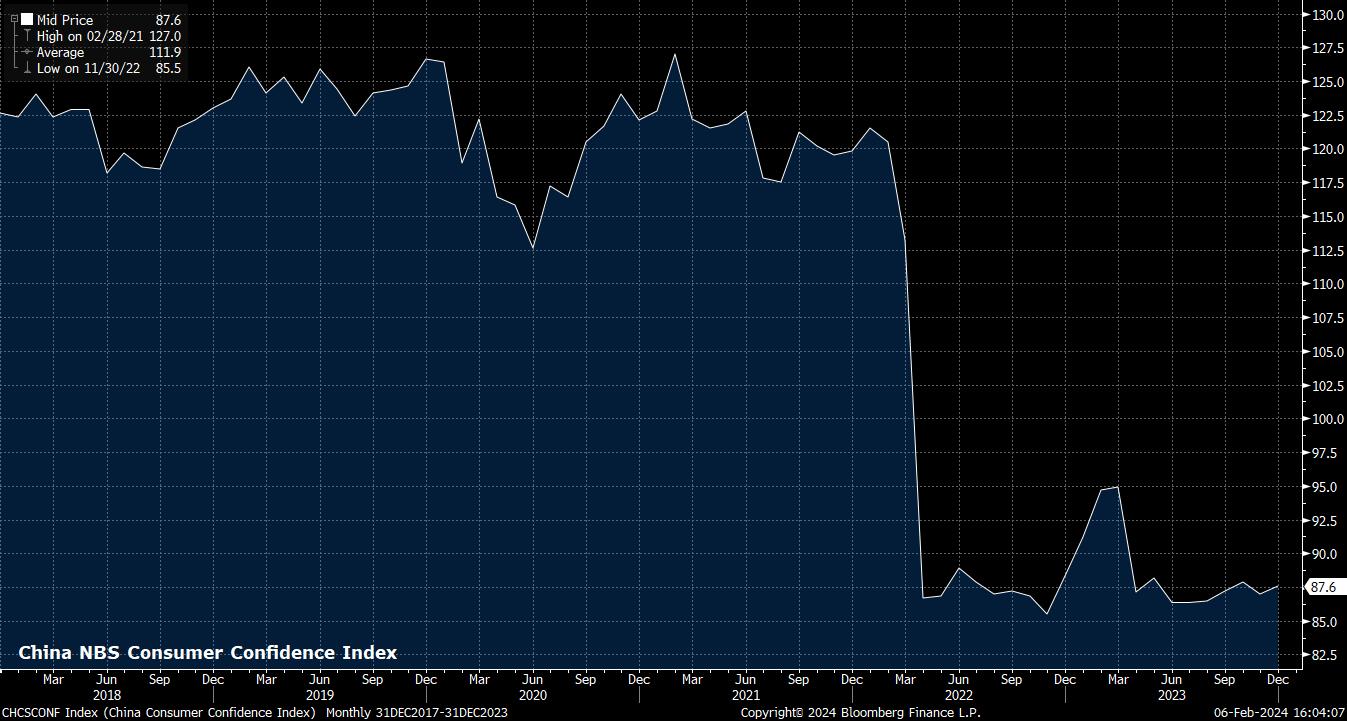

The most obvious answer lies in the impact of recent declines on consumer confidence. Per official sentiment data from the National Bureau of Statistics (NBS), confidence has fallen off a cliff faster than equity markets have; restoring some degree of optimism is likely a key government priority ahead of the Lunar New Year holiday, typically a pivotal period for consumer spending, and thus economic growth more broadly.

Restoring consumer confidence is one thing, yet restoring investor confidence is likely to be an entirely different matter.

Sentiment has, unsurprisingly, taken a pummelling over the last 18 months or so, as sweeping government crackdowns escalate, and President Xi attempts to exert an ever-increasing degree of control over private enterprise within the country. Macroeconomic concerns also persist, with the lack of any significant or sustained recovery from the pandemic continuing to exert significant pressure.

Against that backdrop, it should come as no shock whatsoever that the Hang Seng and CSI 300 stand as two of the worst performing major equity markets since the start of 2023, with recent gains barely being visible over such a time horizon.

_stock_2024-02-06_16-14-53.jpg)

The resolution of those macroeconomic woes, or at the very least a perception that authorities have enough of a grip on the situation (likely by virtue of having thrown enough stimulus at the issue) for a recovery to begin, likely holds the key to unlocking a more durable recovery in sentiment, and equities more broadly.

However, as the most recent PMI surveys show, such a recovery could still be some way off.

Of course, it is not only a rather dismal growth outlook that Chinese markets must contend with. Deflation remains a significant risk, even if CPI is likely to move back into positive territory over the LNY period, leaving the potential for a prolonged debt-deflation spiral elevated. Furthermore, the property sector’s woes persist, and are by this stage well-documented, and exports remain incredibly weak, while Sino-US relations look set to worsen further into, and likely after, November’s presidential election.

On top of all this, international investors – as noted above – remain highly wary of venturing into the market, particularly when other nearby markets offer exposure to Asia, without many of the numerous downsides involved with allocating to China.

While India and Vietnam both stand to benefit as supply chains and production are increasingly moved away from China, it is perhaps Japan that is the most likely to outperform in the region, particularly owing to Tokyo’s ongoing stock market reforms, geared towards boosting valuations, ensuring more efficient use of capital, and return of capital to shareholders, whose proposals are now likely to be listened to by firms in a much more proactive manner.

In summary, the balance of risks points to further downside in Chinese equities over the medium-term. While ongoing efforts to engineer a state-mandated bull market may provide some stability in the short-run, deeply-engrained structural issues, and plentiful downside macro risks, all point to stiff headwinds persisting for some time to come.

Related articles

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。